The 7-3-2 rule is a money and risk management guideline used in trading that limits overall exposure. It typically means allocating no more than 7% of capital to one market, 3% to a single trade, and risking only 2% of the account on any one position to control losses and protect capital.

Key Takeaways

- The 7-3-2 rule is designed to control risk and protect trading capital through strict exposure limits.

- It helps traders avoid overexposure to a single market or trade.

- The rule is commonly applied in forex and leveraged trading environments.

- It promotes consistency, discipline, and long-term account survival rather than short-term gains.

- Beginners and experienced traders use it as a framework for risk and money management, not as a trading strategy itself.

What Is the 7-3-2 Rule in Trading?

In trading, the 7-3-2 rule is a structured approach to managing capital and risk rather than a method for entering or exiting trades. It sets clear boundaries on how much of your account can be exposed at any given time, helping traders stay disciplined even during volatile market conditions.

The rule focuses on three layers of control. First, it limits how much capital is allocated to a single market, reducing concentration risk. Second, it restricts the size of any individual trade so that one decision cannot significantly impact the entire account. Third, it caps the actual risk per trade, ensuring losses remain manageable and predictable. Together, these limits help traders maintain consistency and avoid emotionally driven decisions.

By using the 7-3-2 rule, traders prioritize capital preservation over aggressive growth, which is especially important in markets like forex where leverage can quickly magnify both gains and losses.

How the 7-3-2 Rule Works

The 7-3-2 rule works by breaking risk control into three practical limits that guide how traders allocate and protect their capital. Each number represents a specific restriction designed to prevent overtrading and excessive exposure.

The 7% limit refers to overall exposure to a single market or asset. This means a trader should not allocate more than 7% of their total account balance to one market at a time, helping avoid concentration risk if that market moves unexpectedly.

The 3% limit applies to individual trades. Even within the same market, no single trade should represent more than 3% of the total account value. This ensures that one poorly timed entry does not dominate the account’s exposure.

The 2% limit defines the maximum risk per trade. It represents the amount a trader is willing to lose if the trade hits the stop loss. By capping risk at 2%, traders can absorb multiple losses without severely damaging their account, allowing them to stay active and disciplined over the long term.

7-3-2 Rule Explained With a Practical Example

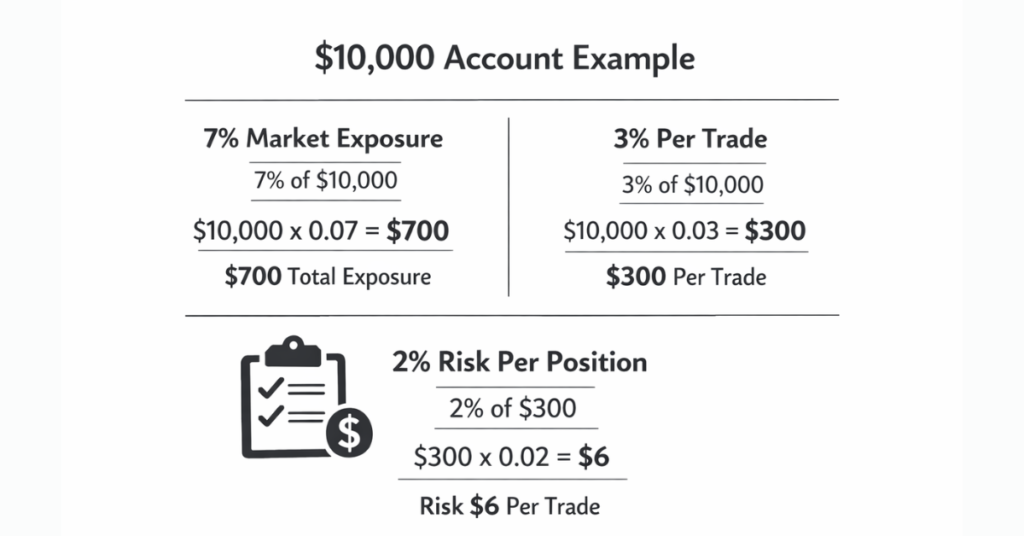

To better understand the 7-3-2 rule, consider a trading account with $10,000. Here’s how the rule applies step by step:

- 7% Market Exposure: The trader should not allocate more than $700 to a single market, such as EUR/USD. This prevents overexposure if the market moves against them.

- 3% Per Trade: Within that market, no single trade should exceed $300. Even if multiple trades are open, each remains within a safe limit.

- 2% Risk Per Trade: For each trade, the trader sets a stop loss so that they risk no more than $200 on that position. This ensures that even a losing trade does not heavily impact the overall account.

By following this structure, traders can take multiple positions while keeping losses controlled and capital protected. The example illustrates how consistent application of the rule helps manage risk, even during high volatility.

Why the 7-3-2 Rule Is Used in Forex Trading

The 7-3-2 rule is especially valuable in forex trading, where markets are highly leveraged and volatile. By limiting exposure, it ensures traders do not risk more than they can afford to lose, helping maintain consistent performance over time.

- High Leverage Options: Forex brokers like Defcofx offer up to 1:2000 leverage, which can amplify both gains and losses. Applying the 7-3-2 rule ensures traders manage this leverage responsibly.

- No Commissions or Swap Fees: With low spreads starting from 0.3 pips and no hidden costs, traders can implement the 7-3-2 rule without additional trading expenses eroding profits.

- Fast Support and Withdrawals: Platforms that provide withdrawals within 4 business hours allow traders to efficiently manage risk and adjust positions in line with the rule.

The rule encourages disciplined trading, helping traders avoid over-leveraging and maintain long-term capital preservation. It is suitable for both beginners and experienced traders who want structured risk management in a fast-moving market.

Open a Live Trading Account7-3-2 Rule and Risk Management

The 7-3-2 rule is fundamentally a risk management framework. By limiting overall market exposure, trade size, and risk per position, it ensures that no single trade or market movement can cause catastrophic losses. This structured approach is critical in leveraged markets like forex, where high volatility can quickly erode capital.

Applying the rule allows traders to:

- Maintain consistent position sizing, avoiding impulsive overtrading.

- Protect their account from unexpected market swings.

- Make rational, emotion-free decisions based on predefined risk limits.

By combining this rule with reliable trading platforms that offer fast execution and withdrawals within 4 business hours, traders can stay disciplined and focused, mitigating unnecessary risk while capitalizing on opportunities.

7-3-2 Rule and Leverage Considerations

Leverage is a double-edged sword in trading; it can magnify profits but also losses. This is why understanding how the 7-3-2 rule interacts with leverage is crucial, especially in forex and CFD trading, where brokers like Defcofx offer up to 1:2000 leverage. Without structured risk limits, high leverage can turn a small losing trade into a significant account drawdown.

The 7-3-2 rule provides a safety framework within leveraged environments:

- 7% Market Exposure: Even if a trader uses maximum leverage, the rule ensures that total exposure to any single market never exceeds 7% of the account. For example, on a $10,000 account, a trader would only risk $700 in a market, regardless of leverage. This prevents catastrophic losses if the leveraged position moves against them.

- 3% Per Trade: Traders can open multiple positions in the same market, but no individual trade should exceed 3% of the total account. This ensures that a single misjudged trade, amplified by leverage, does not jeopardize the account.

- 2% Risk Per Trade: The 2% limit defines the absolute loss per trade based on stop-loss placement. In leveraged trading, the notional exposure may be larger, but the maximum loss remains capped. This allows traders to take advantage of leverage responsibly without risking excessive capital.

Additionally, brokers with fast support and withdrawals like Defcofx allow traders to react quickly to market changes, reinforcing disciplined application of the 7-3-2 rule. Using a platform with no commissions or swap fees ensures that applying these risk limits does not come at the cost of unnecessary trading expenses, allowing for cleaner, more predictable outcomes.

The combination of structured risk management and responsible leverage application creates a robust trading approach that balances opportunity with capital protection, helping traders avoid emotional decision-making and long-term account drawdowns.

Is the 7-3-2 Rule Safe for Beginners?

Yes, the 7-3-2 rule is particularly beneficial for beginner traders, as it provides a clear and structured framework for managing risk, position size, and overall market exposure. Many newcomers struggle with emotional decision-making and over-leveraging, which can quickly deplete trading capital. By following the rule, beginners can focus on learning the markets without taking excessive risks.

Why it works for beginners:

- Structured Risk Limits: With maximum exposure set at 7% per market, 3% per trade, and 2% risk per position, beginners are naturally guided to make smaller, more controlled trades.

- Emotional Discipline: The clear limits reduce impulsive decisions and prevent panic-driven trades when markets move against them.

- Consistent Learning: Limiting losses allows beginners to experience trades in real market conditions while preserving enough capital to continue practicing and learning.

- Application With High Leverage: Even on platforms offering up to 1:2000 leverage, beginners can safely participate without risking their entire account, provided they follow the rule consistently.

When applied on trading platforms with fast support and withdrawals, such as Defcofx, beginners also gain the confidence to manage trades efficiently. Additionally, low-cost trading conditions like spreads starting from 0.3 pips with no commissions or swap fees allow small accounts to implement the rule effectively without excessive trading costs.

Pros and Limitations of the 7-3-2 Rule

The 7-3-2 rule offers a balanced approach to risk management, making it a widely respected guideline among traders. However, like any framework, it has both advantages and limitations. Understanding both sides ensures traders can apply it effectively and avoid common pitfalls.

Pros:

- Controlled Risk: By limiting exposure to 7% per market, 3% per trade, and 2% per position, traders can preserve capital during market volatility.

- Discipline and Consistency: The rule encourages structured trading habits, helping traders stick to a plan instead of making impulsive decisions.

- Adaptable Across Markets: While commonly used in forex, it can be applied to stocks, commodities, and indices, making it versatile.

- Supports Leverage Management: High-leverage platforms like Defcofx (up to 1:2000) can be used safely if the rule is followed, preventing catastrophic losses.

- Cost-Effective Trading: On platforms with low spreads from 0.3 pips and no commissions or swap fees, applying the rule does not incur additional expenses, maximizing efficiency.

Limitations:

- Does Not Guarantee Profits: The rule manages risk but does not influence market outcomes or trading strategy success.

- Requires Strict Discipline: Traders must consistently apply the limits, or the rule loses its effectiveness.

- May Restrict Aggressive Traders: Those seeking high-risk, high-reward trades might find the limits too conservative.

- Dependent on Platform Reliability: Fast support and withdrawals (like Defcofx’s 4-hour processing) are important to manage trades efficiently, especially in volatile markets.

7-3-2 Rule vs Other Money Management Rules

The 7-3-2 rule is one of several money management strategies traders use to protect capital and manage risk. Comparing it with other common rules highlights its strengths and unique approach.

Comparison with Popular Rules:

- 2% Rule: This rule limits risk per trade to 2% of the account, similar to the 7-3-2 rule’s risk per trade. However, the 7-3-2 rule adds market and trade size limits (7% and 3%), providing a broader risk management framework.

- 5-5-5 Rule: Some traders use a 5-5-5 approach, limiting exposure to 5% per market, 5% per trade, and 5% risk per position. While slightly more aggressive, it does not emphasize conservative risk scaling like 7-3-2, which is more beginner-friendly.

- Fixed Lot Sizing: Traders using fixed lot sizes focus solely on position size without adjusting for market or account exposure. The 7-3-2 rule offers a multi-layered risk strategy, ensuring trades remain proportional to account size and market risk.

Key Advantage Over Other Rules:

- Combines capital allocation, trade sizing, and risk per trade into one framework.

- Encourages consistent discipline, which is essential for long-term trading success.

- Works seamlessly on platforms offering high leverage, low-cost trading, and global reach, such as Defcofx, allowing traders to implement risk management effectively across various instruments.

When the 7-3-2 Rule Works Best

The 7-3-2 rule works most effectively in trading environments where capital preservation and disciplined risk management are critical. It is especially useful in volatile markets, leveraged trading, and for traders who want to maintain long-term consistency rather than chasing short-term gains.

Optimal Conditions for Applying the Rule:

- High-Volatility Markets: Forex pairs, cryptocurrencies, and commodities can move quickly. Applying the 7-3-2 rule limits exposure and helps traders avoid large drawdowns.

- Leveraged Trading Platforms: Brokers like Defcofx offering up to 1:2000 leverage require strict risk controls. The rule ensures traders can benefit from leverage without risking disproportionate losses.

- Accounts of All Sizes: Whether managing a small or large account, the proportional limits (7%, 3%, 2%) make the rule adaptable and scalable.

- Consistent Trading Strategies: Traders following a defined plan benefit more because the rule enforces discipline and prevents overtrading.

- Platforms with Fast Withdrawals: Using brokers with 4-hour withdrawal processing, traders can quickly manage funds and adjust positions, enhancing the practical effectiveness of the rule.

Common Mistakes Traders Make Using the 7-3-2 Rule

Even though the 7-3-2 rule is simple and effective, traders often make mistakes that reduce its benefits. Recognizing these pitfalls is essential for applying the rule correctly and protecting capital.

Common Mistakes:

- Ignoring Stop-Loss Discipline: Some traders set trades but fail to adhere to the 2% risk limit per position, exposing their account to larger losses.

- Overleveraging: Using maximum leverage without considering the rule’s limits can amplify losses despite the framework. High-leverage brokers like Defcofx require strict adherence to the rule for safety.

- Exceeding Market Exposure: Allocating more than 7% to a single market or instrument increases concentration risk, undermining the rule’s protective purpose.

- Inconsistent Application: Skipping steps or applying the limits selectively defeats the purpose of the rule and can result in unpredictable losses.

- Neglecting Account Costs: Not factoring in spreads, commissions, or swap fees can subtly increase risk. Platforms like Defcofx, with spreads starting from 0.3 pips and no hidden fees, help mitigate this issue.

By avoiding these mistakes and combining the rule with fast support and withdrawals, traders can maintain control and maximize the effectiveness of their risk management strategy.

How Traders Apply the 7-3-2 Rule in Modern Trading Platforms

Modern trading platforms make it easier to implement the 7-3-2 rule effectively, providing tools that allow traders to manage risk, monitor exposure, and execute trades efficiently. Platforms like Defcofx, with global access, multiple asset classes, and advanced trading tools, support disciplined trading and seamless rule application.

Practical Application:

- Position Sizing Tools: Traders can calculate trade sizes according to the 3% per trade and 2% risk limits, ensuring consistent application of the rule.

- Stop-Loss and Take-Profit Features: These allow precise control of potential losses and gains, critical for adhering to the 2% risk per trade guideline.

- Real-Time Monitoring: Modern platforms provide dashboards to track total market exposure, helping traders stay within the 7% market limit.

- Fast Deposits and Withdrawals: With platforms like Defcofx offering withdrawals within 4 business hours, traders can quickly adjust capital allocations if needed.

- Low-Cost Trading Conditions: Spreads starting at 0.3 pips and no commissions or swap fees make it cost-effective to implement strict money management rules without eating into profits.

Final Thoughts on What is the 7 3 2 rule?

The 7-3-2 rule is a powerful and practical framework for managing risk and protecting trading capital. By limiting overall market exposure, individual trade size, and risk per position, it helps traders from beginners to experienced maintain discipline, reduce emotional decision-making, and navigate volatile markets effectively. While it does not guarantee profits, consistent application ensures long-term sustainability and controlled growth.

Traders using platforms like Defcofx benefit further from high leverage up to 1:2000, fast support and withdrawals within 4 hours, low spreads from 0.3 pips, and no hidden fees, making it easier to apply the rule efficiently and safely across multiple instruments and markets worldwide.

Open a Live Trading AccountFAQs

The 7-3-2 rule is a risk management guideline that limits capital exposure: 7% per market, 3% per trade, and 2% risk per position. It helps forex traders manage leverage, protect their accounts, and maintain consistent trading discipline.

Yes, when applied consistently, it reduces the risk of large losses and promotes long-term capital preservation. However, it does not guarantee profits, as market outcomes are still subject to volatility.

Absolutely. The rule provides clear, structured limits that help beginners avoid overtrading and manage risk, making it easier to learn market behavior without risking significant capital.

Yes. Traders on platforms like Defcofx, offering up to 1:2000 leverage, can safely use the rule to control exposure, ensuring losses remain manageable despite larger position sizes.

It enforces market, trade, and per-position limits, helping traders maintain capital, avoid over-concentration, and trade consistently, even in volatile markets.

Yes. The rule’s proportional limits (7%, 3%, 2%) make it scalable for accounts of any size, allowing traders to participate responsibly regardless of capital.

Ignoring stop-loss rules, overleveraging, exceeding market exposure, inconsistent application, and neglecting trading costs are the most common pitfalls.