Forex markets start Friday cautious. Investors brace for Fed Chair Powell’s Jackson Hole speech, and the U.S. dollar has surged to fresh multi-week highs as Treasury yields rise. Risk-sensitive currencies are under pressure: the New Zealand dollar is plunging after Wednesday’s dovish RBNZ cut, taking NZD/USD to four-month lows. In Europe, surprisingly strong PMI readings give the euro some support, but with inflation around 2% and global growth tenuous, EUR/USD remains capped. Sterling is modestly stronger after UK CPI unexpectedly jumped to 3.8% YoY in July and Q2 GDP beat forecasts, suggesting the BoE will hold rates. Overall, policy uncertainty and data surprises favor USD strength, keeping other majors subdued as traders await the key speeches and data of the day.

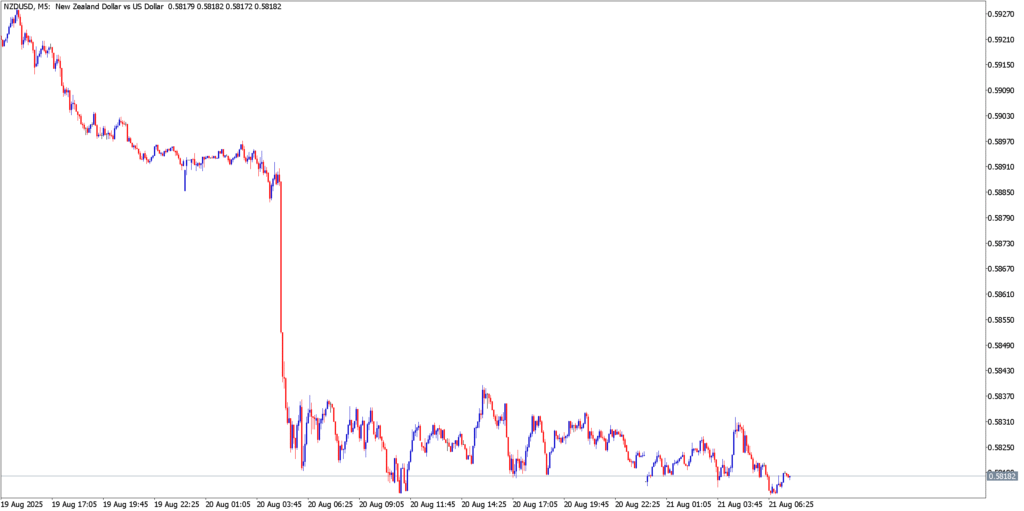

NZD/USD

Technicals in Focus

NZD/USD is in a steep downtrend after RBNZ’s 25bp cut shock. The pair plunged roughly 1.2% to $0.5817 (a four-month low) on Wednesday and continued sliding into the 0.5800 area. The M5 chart shows lower lows and tight lower-high rebounds, with previous intraday support (near 0.5860) now acting as resistance. Short-term momentum is deeply bearish: MACD would be well below zero, and RSI/Stochastic are oversold. Key levels: immediate support ~0.5800 (psychological round) and ~0.5780; resistance ~0.5860–0.5880 (last intra-session highs). The prevailing bias is down, though an extended selloff could briefly stall given oversold indicators.

Trading Strategy

- Bullish: Seek very short-term bounces. Buy around 0.5800–0.5820 (if price steadies) targeting ~0.5860 for profit-taking, with a stop below 0.5780. Only minimal counters are advised given weak momentum.

- Bearish: Trade the downtrend. Sell on any rebound toward 0.5860–0.5880 (overhead resistance) with a target back to 0.5800 (or new lows). Use a stop above 0.5900 (just above recent swing high).

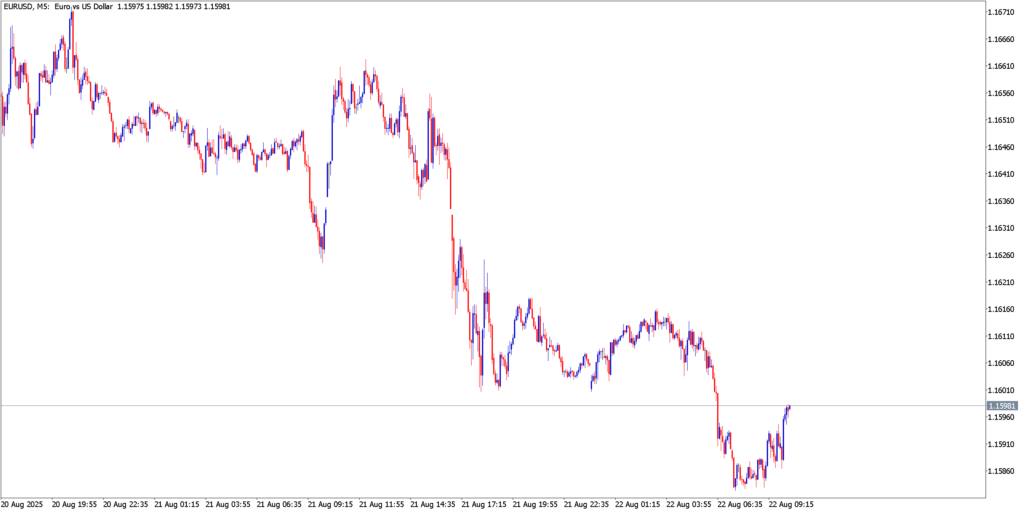

EUR/USD

Technicals in Focus

EUR/USD continued selling pressure into Friday. It broke below the key 1.1600 level (seen as support) and slipped near 1.1580. The five-minute chart shows a series of lower highs, and little conviction on rallies: gains to ~1.1620 earlier were quickly reversed. Momentum indicators are bearish: MACD is negative, and RSI/Stochastic sit in the lower reaches (near oversold). Important levels: resistance at 1.1600–1.1620 (old support turned cap) and 1.1640; support around 1.1550 (recent low) and then 1.1500. The short-term trend is clearly down as USD strength dominates; any pullback is limited.

Trading Strategy

- Bullish: Consider only if signs of stabilization appear. One plan is a buy at 1.1580–1.1600 (near current low) targeting 1.1620–1.1640 (former support), with a stop just under 1.1560. This is a shallow rebound play in an otherwise bearish market.

- Bearish: Main focus is on continued decline. Sell on rallies into 1.1620–1.1640 (failed support), aiming for 1.1550–1.1520. Place a stop above 1.1660 to guard against a counter-trend jump.

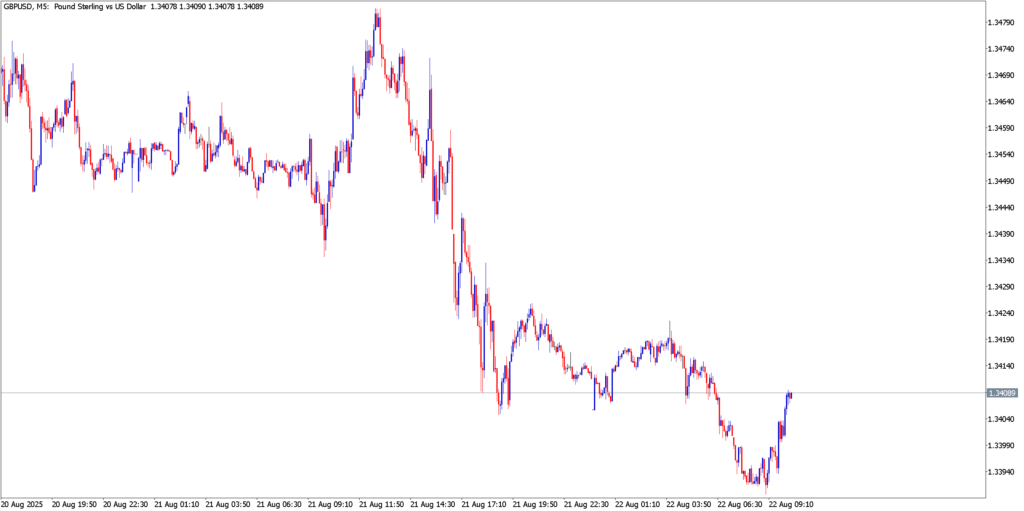

GBP/USD

Technicals in Focus

Cable is trading in a sideways-to-slightly-bullish pattern. The M5 chart shows consolidation between roughly 1.3200 and 1.3270. Price has bounced off support near 1.3200 and repeatedly stalled around 1.3270–1.3300. Indicators are neutral-to-mildly bullish: MACD is flat, RSI around the midpoint, and Stochastic not extreme. Key levels: support ~1.3200 (and psychological 1.3180); resistance ~1.3270 and then 1.3300. The trend is range-bound with a slight upside bias, reflecting the mix of resilient UK data and a broadly firm USD.

Trading Strategy

- Bullish: Buy a breakout above the top of the range. Entry on a clear move over 1.3270 (e.g. 1.3280) targeting 1.3320–1.3350, with a stop below 1.3230 (just under recent range high). Alternatively, a bounce from 1.3200 support with a tighter stop could be attempted.

- Bearish: Sell a break of range support. Entry below 1.3200 (e.g. 1.3190) targeting 1.3150–1.3120, stop above 1.3240. A failure at 1.3270 resistance is another short trigger, aiming back to support.

Market Outlook

- United States: The spotlight is on Powell’s Jackson Hole address (Fri 10:00 ET) and any Fed commentary on inflation vs employment. Current data is mixed: jobless claims have ticked up (labor easing) while PMIs remain solid. Unless Powell signals clear dovish intent, the USD should stay bid on safe-haven flows and yield advantage. Upcoming US reports (e.g. PCE inflation later this month) will further guide Fed timing, but for now markets expect the Fed to hold steady before hiking or cutting again.

- New Zealand: After this week’s 25bp cut (to 3.00%) and dovish rhetoric, expectations now hinge on inflation (still within target at 2.7%) and growth. With the RBNZ flagging further cuts likely, the NZD is on the defensive. Next key NZ data is Q3 CPI (late Sept); unless global risk appetite shifts (e.g. commodity prices), NZD/USD is likely to struggle or trend lower as rate differentials remain slim.

- United Kingdom: UK inflation surprised higher (July CPI 3.8% YoY) and growth was firmer than expected. This has firmed expectations that the BoE will hold rates at 4.25% at least into autumn. The coming week’s data (Aug. flash PMI on Thu, labour market on Tue) could test whether economic activity is cooling. In the medium term, GBP will react to any shifts in BoE guidance or major fiscal announcements ahead of the Autumn Budget, but for now policy divergence supports sterling slightly.

- Eurozone: The euro-zone outlook is broadly stable. Inflation has returned to 2.0%, and a recent Reuters poll sees the ECB pausing until at least December. The EU-US trade deal (exempting many tariffs) and German fiscal stimulus suggest steady growth ahead. EUR/USD will largely track global risk and USD moves. Key European drivers are flash PMI updates (Thu) and any ECB commentary; barring surprises, rates are expected to remain on hold, keeping EUR under modest upside constraints.