Global forex markets were thrown into turmoil on Monday as a one-two punch of abysmal U.S. economic data and sudden political upheaval in Japan ignited extreme volatility. The U.S. dollar plunged to its weakest level in over a year after a dismal jobs report showed only 22,000 jobs added in August vs. 75,000 expected, solidifying bets on a Federal Reserve rate cut. At the same time, an unexpected resignation by Japan’s Prime Minister Shigeru Ishiba over the weekend sent the yen on a wild ride, with USD/JPY surging above ¥148.0 before whipsawing as traders grappled with the news. Major currency pairs saw dramatic price swings in response – the euro and pound catapulted to multi-week highs against the buck, while the yen’s initial plunge gave way to a cautious rebound. Markets were left reeling by this combo of weak U.S. fundamentals and geopolitical shock, fueling a high-drama trading session to kick off the week.

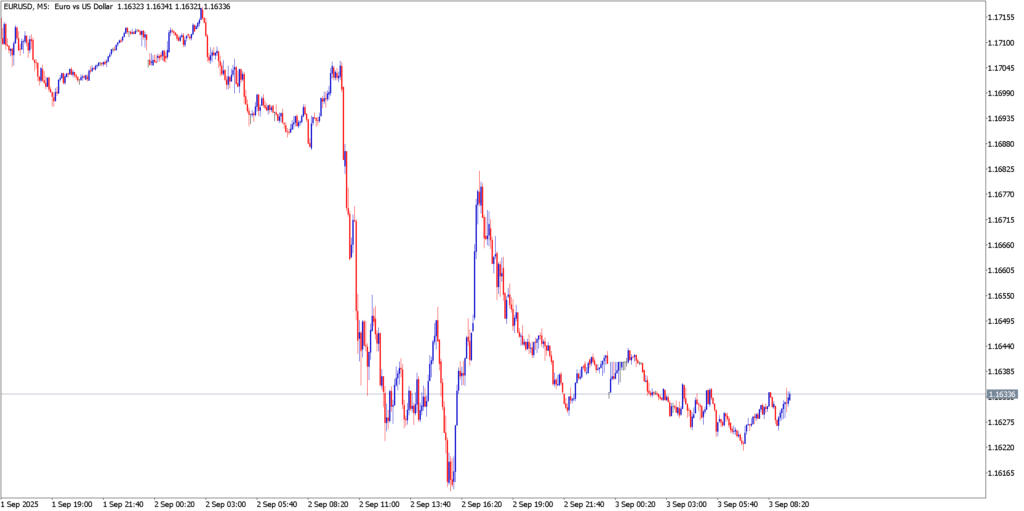

EUR/USD

The euro ripped higher, capitalizing on the dollar’s collapse. EUR/USD burst through the critical $1.1730 resistance and even notched a five-week high near $1.1750 by the end of last week. Monday saw the pair consolidating those gains above the breakout level, buoyed by a clear shift in interest rate expectations – with markets fully pricing in a Fed rate cut this month while the ECB is expected to stand pat, traders see a widening policy divergence favoring the euro. Eurozone data added tailwinds as well; reports of better-than-expected industrial output helped underpin the single currency’s strength. All told, sentiment has flipped bullish for EUR/USD as the dollar’s misery becomes the euro’s opportunity.

On the technical front, momentum favors the bulls. EUR/USD is trading comfortably above its 50-day moving average, and the 14-day RSI has climbed back above 50 after offloading earlier overbought conditions, indicating room for further upside. The MACD lines are poised for a bullish crossover – they’re “ready to move upward, awaiting a stronger catalyst”. Key resistance looms at 1.1780, followed by a formidable hurdle around 1.1830 (a 45-month high from early July). A decisive push above 1. eighteenth (1.1800) would turn the technical outlook outright bullish, opening the door to 1.1900+ targets. However, if euro-buyers fail to sustain the breakout, initial support lies at $1.1700, with deeper backstops at 1.1680 and 1.1590. Strategy: Neutral-to-Bullish – Traders may consider buying on a clear break above $1.1780 (aiming for the $1.1830 area), while a drop back below $1.1700 could invite a cautious short bias.

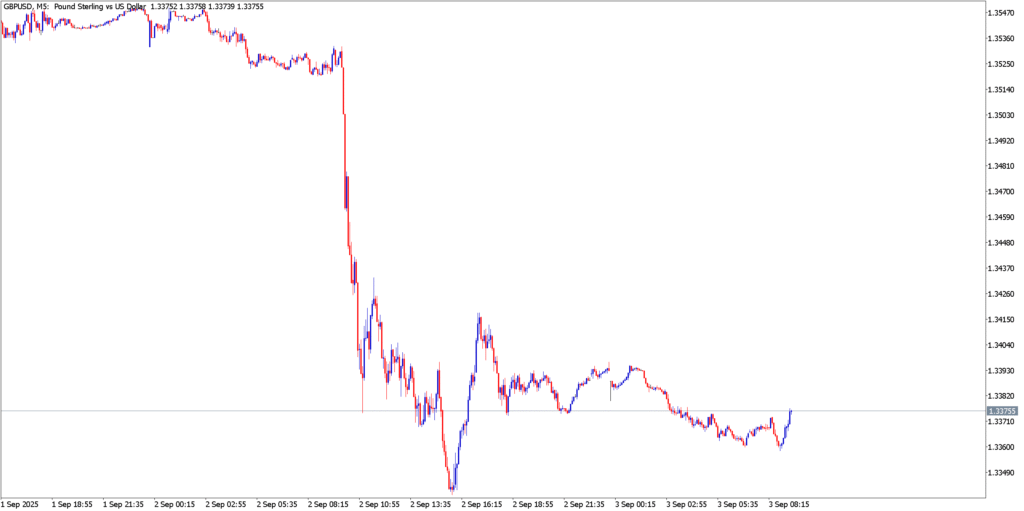

GBP/USD

The British pound surged in tandem with the euro, riding the dollar’s weakness to its own multi-month highs. GBP/USD climbed to $1.3500 in the wake of the weak U.S. jobs data, extending an impressive rebound from its August lows around $1.3140. Notably, the pair broke above the 1.3428 resistance (its highest level in a year), signaling a bullish regime shift. Sterling’s strength is further underpinned by the domestic backdrop: UK inflation remains stubbornly high at 3.8% (an 18-month peak), and the Bank of England – which delivered a surprise rate cut to 4.0% in August in a narrow 5–4 vote – is now seen unlikely to cut rates further this year amid sticky price pressures. This policy stance, combined with the Fed’s tilt toward easing, paints a supportive picture for the pound. Traders also took heart from upbeat UK retail spending data in August, suggesting consumer resilience. With Fed rate cut odds surging and the dollar index at 14-month lows, GBP/USD’s rally had plenty of fuel.

Technically, bulls are in control. The pair is trading above both its 50-day and 100-day EMAs, reflecting strong upward momentum. It has even formed an inverse head-and-shoulders pattern, a bullish reversal signal. With GBP/USD now above the key 1.3550 threshold (last year’s high), buyers are eyeing a test of 1.3600 (August high) next, which could open the path toward 1.3700 and 1.3800 (the July peak) if surpassed. The RSI hovering in the mid-50s suggests there’s further upside potential before hitting overbought extremes. On the downside, support is visible at 1.3500 (recent breakout level and round number), with the next cushion at 1.3440. A drop below 1.3350 would be a warning sign, potentially ending the pound’s uptrend and targeting the low-1.33s or worse. Strategy: Bullish – Favor buying on dips as long as prices hold above ~1.3440, with 1.3600+ as an initial target. If the pair fails and slips under 1.3440, a short-term sell bias could emerge, aiming back toward the mid-1.3300s.

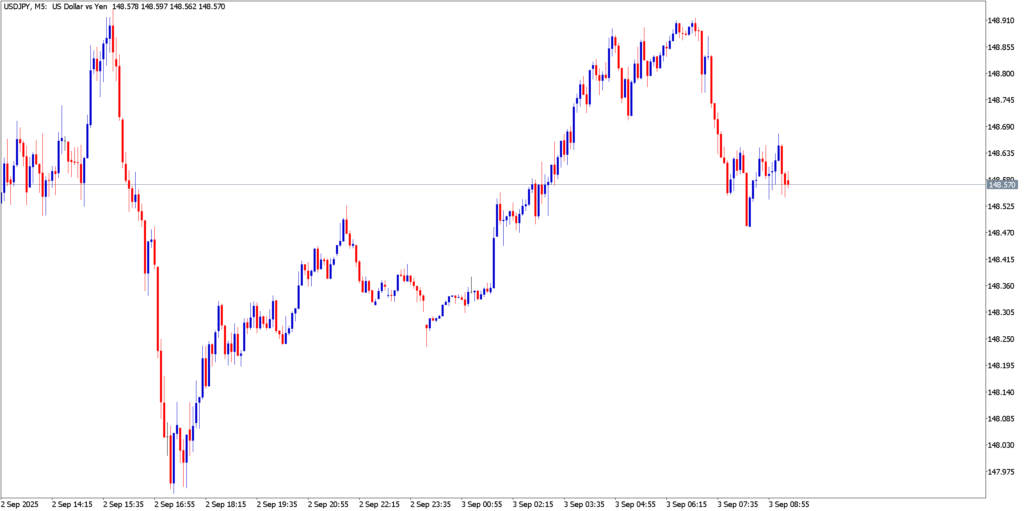

USD/JPY

High drama unfolded in USD/JPY to start the week. The shock announcement that Japan’s Prime Minister Ishiba would step down sent the yen sharply lower, as political uncertainty and the prospect of a more dovish successor spooked yen bulls. In early trading, USD/JPY spiked nearly ¥1.5 higher, surging above the ¥148.00 mark to highs around ¥148.80 as traders dumped the safe-haven yen. This yen weakness was exacerbated by traders seeking higher yields elsewhere, given that U.S. yields – while dipping on Fed cut bets – still dwarf Japan’s negative rates. However, the yen’s slide soon moderated. Fresh data showed Japan’s economy on firmer footing (Q2 GDP was revised upward, buoyed by resilient exports), which rekindled speculation that the Bank of Japan might consider tightening policy if conditions allow. Moreover, by Tuesday the dollar’s own fragility (7-week lows on the USD index) began to dominate, helping the yen recover from its worst levels. USD/JPY ultimately whipsawed off its peak, highlighting an ongoing tug-of-war between yen-specific turmoil and U.S. dollar weakness.

In technical terms, USD/JPY’s picture is mixed. The pair is straddling a shallow rising channel support in the mid-147s, and Monday’s reversal candle hints at buyer exhaustion up near ¥149. Momentum indicators are flashing caution – on the 4H chart, RSI dipped below 50 during the pullback, and the price is well under its short-term SMAs, suggesting a bearish bias within the recent channel. If yen strength resumes (USD/JPY fall), a break below ¥147.00 and especially ¥146.50 support would confirm a bearish breakout, potentially targeting the mid-¥145s or lower. On the flip side, if bulls regroup and hold the line above ¥148.0, they could make another run toward the ¥148.80 resistance and the psychological ¥149.00 level. Above ¥149, there isn’t much resistance until the ¥150 area, but that would likely require a renewed surge in U.S. yields or further risk-on sentiment. Strategy: Volatile/Range – The outlook is choppy; selling into rallies near ¥149 with tight stops could be prudent given the political uncertainty, while aggressive bulls might buy dips above ¥146.5 support in anticipation of a relief rebound. Flexibility is key amid these fast-moving headlines.

Market Outlook

The stage is set for a high-stakes week ahead after Monday’s fireworks. Traders are now laser-focused on upcoming economic catalysts that could either reinforce or reverse the dramatic moves. Top of mind is the U.S. Consumer Price Index (CPI) report for August, due Thursday morning, which will be pivotal for Fed expectations. If inflation comes in soft, it could cement the case for a Fed rate cut and keep the dollar on the defensive; but a hotter-than-expected CPI would test the market’s dovish convictions and might spark a dollar bounce amid renewed inflation anxiety. The same day, the European Central Bank meets, and while the ECB is widely expected to hold rates at 2.0%, any surprise hawkish tone (or conversely, a dovish signal) could whipsaw the euro. In the UK, traders will watch for any signs of cooling inflation or growth in upcoming data – with price pressures still elevated, the Bank of England’s stance remains critical for sterling sentiment. Over in Japan, the political saga will continue to unfold: markets will monitor who might replace the PM and whether the BoJ hints at policy adjustments in light of stronger economic data and yen volatility.

Looking further out, the U.S. Federal Reserve’s policy meeting next week (Sept 16–17) looms large; every data point until then (including benchmark revisions to U.S. jobs data and producer inflation numbers) will be parsed for clues on the Fed’s move. Volatility is likely to stay elevated as traders brace for these events. After Monday’s drama, market psychology is on a knife’s edge – any fresh surprises in data or policy rhetoric could trigger outsized moves. Forex participants should keep a close watch on economic calendars and news wires; support and resistance levels will be tested again as this high-voltage September saga continues to unfold. Stay alert – the week has only just begun, and the FX rollercoaster is far from over.