A cocktail of surprise economic data and central bank drama is hitting currencies mid-week. Traders are grappling with unexpected U.S. jobs weakness and inflation surprises, fueling wild swings and speculation over central bank pivots. The US dollar’s rally has faltered as recession fears mount, while the euro and pound rebound on hints of policy relief. Meanwhile, the yen springs to life with talk of tighter Bank of Japan policy and possible intervention. In this high-volatility environment, sentiment shifts on a dime – from soaring optimism to risk-off panic – making EUR/USD, GBP/USD, and USD/JPY the center of an intense tug-of-war between data-fueled anxiety and monetary policy bets. Buckle up: Forex markets haven’t been this rattled in months, and more turbulence lies ahead.

Macro and Economic Context

Global markets are digesting a flurry of fresh macroeconomic signals released around September 10, 2025, and the picture is decidedly mixed:

United States: The world’s largest economy flashed signs of a cooldown. August Nonfarm Payrolls shocked analysts by increasing a meager 22,000 (vs. ~75,000 expected), and the unemployment rate jumped to 4.3%, a near four-year high. This weakest jobs growth in years – compounded by downward revisions showing job losses in June – “confirmed that labor market conditions were softening” and sealed the case for a Fed interest rate cut at the upcoming FOMC meeting. Treasury yields tumbled as investors rushed into bonds, convinced the Fed will pivot to easing sooner to stave off a downturn. Yet inflation remains in focus: the U.S. CPI report due tomorrow is hotly anticipated after whispers of a slight upside surprise in August headline inflation (around 2.9% YoY vs 2.7% f’cast). Core CPI is running ~3.1%, near expectations – moderating but not yet at target. The Fed thus faces a dilemma: cooling jobs and tame core prices argue for relief, but any inflation uptick could complicate the narrative. Weekly data showed initial jobless claims hovering at ~234K and continuing claims ~1.94 million, hinting at gradual labor softening. All told, Fed rate cut bets have surged – Fed Funds futures now price a high chance of a 25 bp cut in September – putting the once-mighty dollar on the defensive.

Euro Area: In Frankfurt, the European Central Bank is in a holding pattern as the euro-zone enjoys a rare bout of stability. With euro inflation hovering around the 2% target (flash estimate 2.1% in August) and unemployment at record lows, the ECB this week opted to keep interest rates unchanged. The deposit rate remains at 2.00% (main refi 2.15%), after a year of steady cuts from the pandemic highs. A Reuters poll showed 66 of 69 economists expect no change on September 11, confirming the ECB is “done cutting interest rates” for now. ECB President Lagarde’s commentary acknowledges easing price pressures and a “broadly resilient” economy, even as Germany flirts with recession. In fact, Eurozone inflation has moderated sharply – a key reason policymakers feel comfortable “leaning back and waiting it out”. Growth is sluggish but better than feared: Q2 euro-area GDP grew about 1.2% YoY, and soft landing hopes are guardedly rising. However, the ECB’s stance is tinged with caution amid exceptionally uncertain global conditions – trade disputes (notably US tariff tensions) and political rifts pose risks. Markets are now betting the ECB will hold steady into year-end, and some even push rate cut expectations to 2026, reflecting the view that inflation is tamed. The euro, which had been on its back foot for weeks, drew strength from the ECB’s steady hand and the dollar’s wobble. Still, traders remain wary of Lagarde’s press conference (scheduled tomorrow) for any hints on future easing if growth sputters.

United Kingdom: The UK economy presents a nuanced picture. Recent data shows Britain managing to avoid the worst-case slowdown despite global headwinds. Q2 GDP grew 0.3% (vs 0.1% expected), making the UK the second-fastest growing G7 economy last quarter thanks in part to government spending and inventory builds ahead of trade tariffs. This outturn was better-than-forecast and gave a brief lift to sterling. However, the momentum appears to be fading. July’s monthly GDP was flat (0.0%), and the NIESR projects only +0.2% growth for August, suggesting the UK is flirting with stagnation. Consumer spending remains weak and business investment fell, as high borrowing costs and tax hikes squeeze activity. Notably, inflation in Britain is still the highest in the G7 – July CPI was 3.8% YoY and expected to peak around 4.0% in September, double the BoE’s target. The Bank of England responded by cutting rates last month (Aug) for the fourth time since 2024, bringing Bank Rate down to 4.00%. That cut, however, was a nail-biter 5-4 vote – four MPC members voted to hold rates citing uncomfortably high inflation. This split decision underscores the BoE’s conundrum: wage growth and price pressures remain persistent, limiting how fast it can ease policy. Governor Bailey emphasized a “gradual and careful” approach to further cuts. Markets now expect the BoE to pause at 4% for the rest of 2025, and analysts note one final cut might come in November if inflation permits. For now, sterling has been relatively firm, buoyed by Britain’s better-than-feared growth and rising real rates. But clouds remain: record wage gains and anemic productivity risk embedding inflation, while looming fiscal tightening (Chancellor Reeves is eyeing tax hikes) could dampen growth ahead. In short, the UK is walking a tightrope between resilience and stagnation – and any slip could quickly shift the GBP’s trajectory.

Japan: The Japanese yen, after months of weakness, is suddenly in the spotlight. Bank of Japan officials have turned more hawkish in tone, hinting that the era of ultra-easy money may be inching toward an end. At Jackson Hole in late August, BoJ Governor Kazuo Ueda struck an optimistic note on wages, saying labor shortages are “one of our most pressing issues” and wage growth is spreading beyond big firms. He signaled that conditions for another rate hike are falling into place – reinforcing expectations that the BoJ could raise rates again by year-end. Indeed, nearly two-thirds of economists now predict a BoJ hike of 25 bps or more this year. This marks a sea change from the BoJ’s decade of dovishness. However, Ueda also cautioned that underlying inflation (ex-food/energy) is still just under 2%, so the BoJ will “go slow” and monitor data closely. In the meantime, the yen’s steep slide to multi-decade lows (USD/JPY recently neared 148–150) has authorities uneasy. Japan’s Finance Ministry has been vocal about “undesirable” FX moves, raising the specter of yen intervention if depreciation becomes disorderly. Notably, U.S. political developments added a twist: President Trump announced new 15% tariffs on all Japanese goods in a surprise move, fueling trade tension fears that paradoxically gave the yen a safe-haven bid this week. Overall, the sentiment on yen has shifted – speculation of a BoJ policy tweak and global risk jitters have triggered a yen rebound after months of carry-trade selling. Traders are now on high alert for any BoJ or MoF action if USD/JPY approaches the psychologically critical ¥150 zone.

Geopolitical and Other Factors: Broad risk sentiment is fragile. Trade disputes are back in focus – the U.S.–China tariff skirmishes and now U.S.–Japan trade friction inject uncertainty into markets. In Europe, political tremors (a “bruising” EU-U.S. trade deal backlash and leadership changes in Japan’s government) add to jitters. Energy prices are another wildcard: oil has been climbing after an OPEC+ output cut, which if sustained could complicate the inflation outlook worldwide. Finally, U.S. fiscal drama looms – investors quietly fret over a potential government shutdown fight in Washington, which could dampen risk appetite. All these elements form a complex backdrop where headline risks abound, amplifying forex volatility around key data releases.

EUR/USD

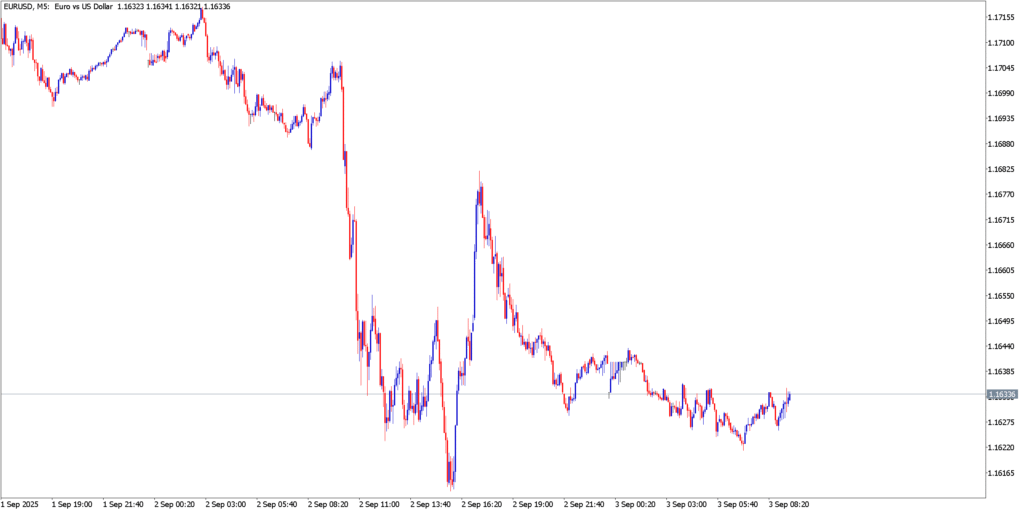

EUR/USD, 5-minute chart as of early Sept 2025. After a sharp drop on Sept 2 (strong USD on data), the euro rebounded, holding support around $1.165 and challenging the mid-$1.17s.

EUR/USD has regained an upward bias after bouncing from early-month lows. Technically, the pair is consolidating above 1.1700, retaining most of last week’s gains as the dollar retreat stalled. The 1.1650–1.1660 region has emerged as strong support, aligning with a 61.8% Fibonacci retracement of the recent rally. Bulls defended this zone on pullbacks, and as long as EUR/USD stays above ~1.1650, the short-term tone remains constructive. The euro continues to trade above its 20-day EMA (now ~1.1652), reinforcing a bullish bias in the near term. Momentum oscillators echo this view: daily MACD is tilting above the zero line and RSI, which briefly touched overbought levels when EUR/USD hit 1. XVIII, has cooled to the 50–60 range – indicating room for the rally to resume without immediate overbought stress. Should the pair hold above support, an extension towards 1.1750 is likely. A breakout above 1.1740, which is around a downward trendline from July’s highs, would unlock further upside momentum – possibly targeting the late-July peak near 1.1830 next. On the flip side, if the euro slips under 1.1650, it would negate the bullish setup and expose deeper support at 1.1600 and 1.1550. For now, trend indicators are positive: the pair’s series of higher lows since mid-August points to an intact uptrend. Stochastic oscillators on H4 charts are rising again (after a brief dip), reflecting improving momentum after the recent pause. Strategy: Consider a buy-on-dips approach – for instance, buying above $1.17 once support is confirmed, with upside targets at $1.1750 and $1.1830, and a prudent stop-loss below $1.1640 to manage downside risk. This setup capitalizes on dollar weakness while respecting key technical floors.

GBP/USD

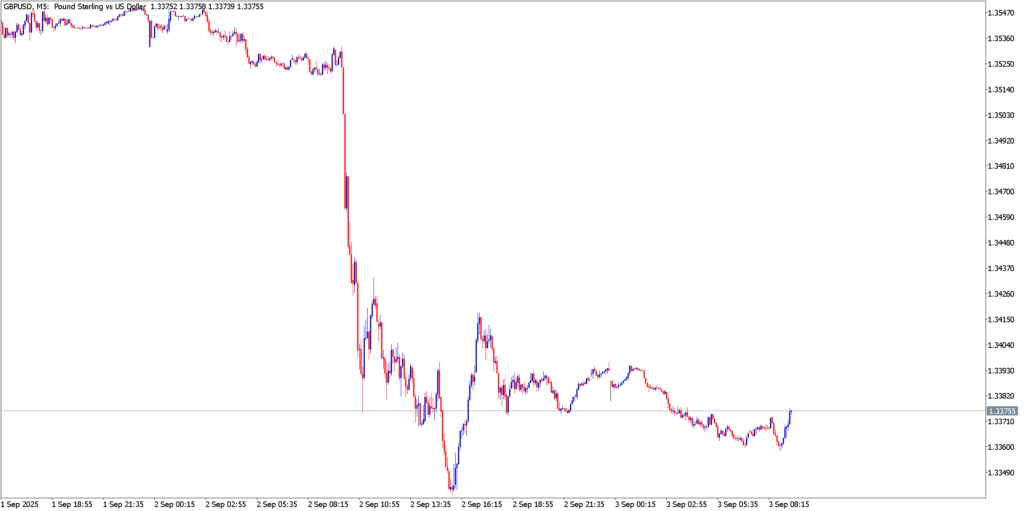

GBP/USD, 5-minute chart as of early Sept 2025. The pound plunged on Sept 2 amid risk-off sentiment, then staged a V-shaped recovery into the following week, reflecting shifting USD fortunes.

GBP/USD has rebounded impressively from its September 2 trough (near $1.335) to trade around the mid-1.35s. Technically, the pair’s bounce is encountering resistance near $1.356–1.362, an area that includes the late-August swing high and the upper Bollinger Band on the daily chart. The recent up-move has been underpinned by the middle Bollinger Band and the 50-day SMA, which provided support on the pullback. Price action formed a large bullish daily candlestick off those supports, and GBP/USD climbed back above the 12-day EMA, indicating short-term momentum has flipped positive. The Bollinger Bands are starting to widen upward, hinting at increasing volatility in favor of the bulls, though the lack of a clear upturn in longer moving averages signals some market hesitation. Momentum indicators: The daily MACD histogram is near the zero line with the MACD line and signal line in a tentative “kiss” – essentially a flat alignment that could turn into a bullish crossover if the rally extends. The RSI is around 55–58, up from oversold levels but not yet overbought. This suggests the rebound “may continue” in the near term as there is gas left in the tank before hitting overbought territory. On the weekly timeframe, GBP/USD has broken above its 12-week EMA and is retesting that breakout point (~1.3450). If this area holds as support, the longer-term uptrend could resume toward 1.38 or even 1.40. However, a failure to sustain gains and a drop back below $1.34 would indicate the recent bounce was corrective, potentially re-opening downside toward $1.31–1.30 (major support zone). For now, the pound’s correction doesn’t appear fully over – there are some lower highs visible on the weekly chart’s RSI, cautioning that upside momentum might be capped beyond the mid-1.36s. Key levels to watch: Immediate support is seen at $1.345 (broken resistance turned support), followed by $1.337 (the recent swing low). Resistance lies at $1.356 (recent peak) and $1.362, with a breakout above 1.362 needed to aim for the $1.378–1.380 area. Strategy: The bias is cautiously bullish above $1.345 – traders might go long on dips toward the mid-1.34s, targeting a move to $1.360–1.362 initially, while using a stop-loss below $1.337 to guard against a downturn. Given the mixed momentum signals, a nimble approach is warranted: bulls can ride the uptrend in the short term, but be prepared to lock in profits near 1.36 and even consider fading the rally if price action falters at those highs (as the larger corrective pattern could reassert itself).

USD/JPY

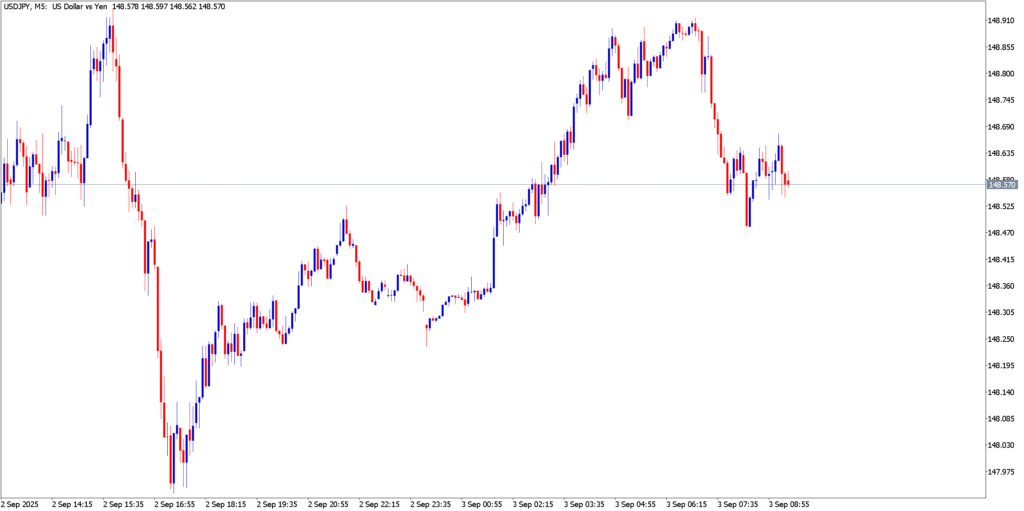

USD/JPY, 5-minute chart as of early Sept 2025. The dollar’s uptrend ran into resistance above ¥148, with a sharp reversal toward ¥147 after the weak U.S. jobs data on Sept 5 signaled a potential turning point.

USD/JPY’s relentless uptrend has hit a ceiling as shifting fundamentals breathe life into the yen. After spiking above ¥148.50 last week, the pair slumped back toward ¥147.0 amid the flurry of weak U.S. economic data and falling Treasury yields. This reversal is evident on the charts: the 50-day EMA (~¥148), which USD/JPY climbed above in late August, has now turned into resistance as the price was rejected at that EMA on the recent upswing. The short-term trend has pivoted to bearish with the pair tracking a descending trendline from the highs – the path of least resistance appears lower at the moment. Momentum indicators confirm a downshift: The RSI, which was in overbought territory when USD/JPY was making multi-month highs, has since eased dramatically – it’s now mid-40s and “has room to fall further,” indicating ample scope for additional downside momentum. The MACD on daily charts has likely rolled over (a bearish crossover is forming) reflecting waning bullish momentum. Importantly, safe-haven flows into the yen and speculation about BoJ tightening have changed the market character; dips in USD/JPY are being met with less eager buying than before. Key support to watch in the immediate term is ¥146.50. This level, just below current trading, coincides with last week’s lows – a clear break below 146.5 could accelerate the decline toward the mid-145.00s. Indeed, technicians note that a downside break would complete a small top pattern, with potential targets around ¥145.5 down to ¥145.0 (where the 100-day MA might also lend support). On the upside, any rebound is likely to struggle near ¥148.0 – only a sustained move back above ¥148.0 would invalidate the bearish setup and restore bullish confidence in the pair. Above there, the major line in the sand is the cycle high (~¥149) and then the psychological ¥150 level – which looms large as a potential intervention point for Japanese authorities. Stochastics on 4H charts are attempting to lift from oversold levels, so we could see interim bounces; however, as long as lower highs persist, the bias remains to sell rallies. Strategy: Adopt a bearish stance on USD/JPY while below ¥148. Traders might sell on recoveries toward ¥147.5–148, with a target of ¥145.0 for the next downswing and a protective stop above ¥148.50. This captures the developing downtrend while respecting the risk of a sudden spike (for example, if U.S. yields blip up on data or any surprise from the BoJ). Additionally, stay alert for any official jawboning – rapid drops toward mid-140s could prompt a response, but for now, momentum favors the yen as fundamentals erode the dollar’s yield advantage.

Market Outlook

The stage is set for an eventful back half of the week. Going into Thursday and Friday, traders will be laser-focused on two major catalysts: the ECB meeting (Sept 11) and the U.S. inflation report. Both have the potential to jolt forex markets out of their current ranges:

Central Bank Triggers: Thursday’s ECB rate decision (and Lagarde’s press conference) could spark euro volatility. While consensus expects no change in rates, any surprise shift in tone – say, hints at future easing if data worsen, or conversely a more hawkish stance on lingering core inflation – would move EUR-crosses. Similarly, Fed officials will enter their blackout period ahead of the Sept 16–17 FOMC, but not before a few more speakers hint at their leanings. Markets are currently priced for a Fed cut next week; should U.S. CPI (out Sept 11) surprise to the upside, it might challenge that dovish assumption, potentially lifting the dollar off its lows. Conversely, a benign CPI print could cement rate-cut bets and pressure the USD further. The Bank of England meets a week later (Sept 18) – speculation is growing that they will hold at 4%, so any UK data (like Friday’s monthly GDP and production figures) that alter that outlook could whipsaw GBP. Bank of Japan watchers, meanwhile, are eyeing any remarks from officials as USD/JPY flirts with levels that in the past drew intervention. BoJ Governor Ueda’s recent comments have already primed markets for a possible policy tweak; an outright hawkish hint or any unscheduled policy moves would amplify yen strength in a hurry.

Broad Market Sentiment: Beyond scheduled events, keep an eye on equity markets and risk appetite as a barometer. Stock indices have wobbled amid the growth scare – a deeper slide in equities (on recession fears) would likely benefit the yen and Swiss franc at the expense of growth-sensitive currencies (like GBP or AUD). Conversely, if dip-buyers step in and risk sentiment stabilizes, the high-beta currencies could find support. Commodity prices are another factor: oil’s continued rise has started to stoke inflation worries again; if that continues, it could complicate central bank outlooks (higher oil could boost CAD, hurt JPY due to Japan’s import costs, and put a floor under USD via higher U.S. breakevens). On the geopolitical front, any escalation or surprise (for instance, news on U.S.–China trade talks, or European political developments) can quickly shift the risk tone. Notably, U.S. political drama – from debates over Fed independence to budget battles – is lurking in the background and could erupt into a market-moving issue (a government shutdown threat in October would be one to watch).

Heading into the next sessions, the expectation is for continued choppiness. Volatility is elevated – one day the dollar is sliding to multi-week lows, the next it bounces back on position squaring. Traders should be prepared for swift sentiment reversals around each data release. EUR/USD will take cues from Lagarde and U.S. CPI – a breakout above 1.1750 or breakdown below 1.1650 likely hinges on those events. GBP/USD faces domestic data (UK GDP) and any hints from BoE speakers; its recent resilience will be tested if growth disappoints. USD/JPY is poised on a knife-edge: it could grind lower toward 145 if U.S. yields continue to sag, but any hawkish U.S. inflation surprise or a sudden rise in Treasury yields might send it rebounding – not to mention the ever-present wildcard of Tokyo’s intervention. In sum, the market mood is cautiously skittish: forex traders are bracing for big moves, but also aware that every surge or dip can reverse just as quickly in these headline-driven conditions. Risk management is paramount – the coming days could set the tone for the rest of September, and no one wants to be caught wrong-footed in this maelstrom of data and policy signals.