Monday’s session kicks off a frenetic week of central bank news. Traders are bracing for a Fed policy meeting on Wednesday and other major announcements, and have already priced in a rate cut – pressuring the US dollar. As Reuters notes, “expectations of a rate cut from the Fed… have weighed on the dollar”. By late Asia trade on Sept 15 the dollar is slightly weaker (the EUR near $1.173, GBP ~1.356), and JPY is steady around 147.4 per dollar. Overall sentiment is cautiously bullish on risk assets (U.S. stocks at highs) and cautious on USD, setting the stage for volatility in pairs like USD/JPY, USD/CAD, and GBP/USD.

The week’s calendar is stacked: China data (Mon), U.S. jobs/retail figures (Tue), Fed, BoC and UK data (Wed), BoE (Thu), and BoJ (Fri). With Fed/BoC cuts expected, plus UK inflation and Japanese inflation/BoJ, USD crosses look set for big swings.

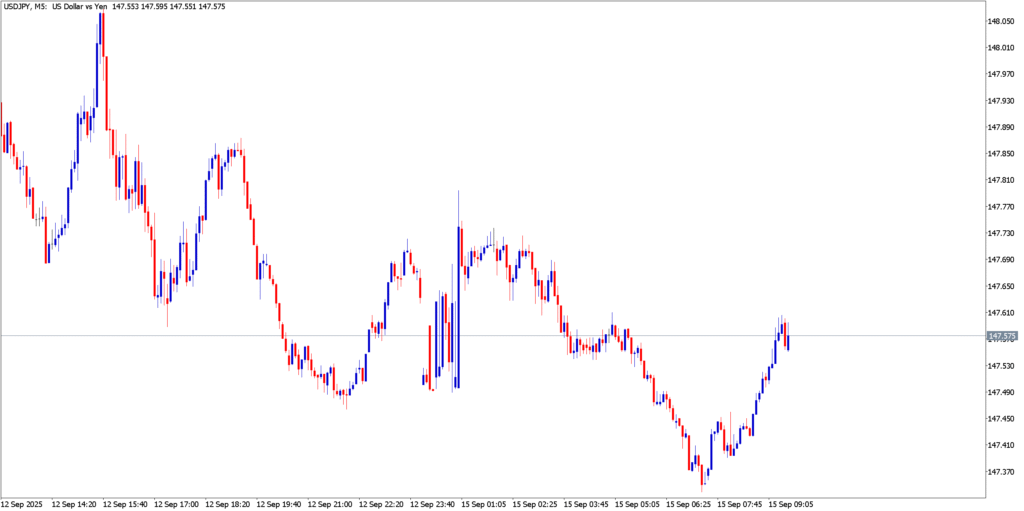

USD/JPY

On Monday the dollar slid from last week’s ~148.05 high down to a low near 147.35 before bouncing back into the 147.50s. This morning’s rebound stalled well below resistance around 148.00–148.50 (the pair was rejected at the 148.6 region on daily charts). The sharp drop likely pushed short-term RSI into oversold territory, so the ensuing bounce has lifted RSI and Stochastics off their lows; however, MACD remains tilted bearish as the downtrend persists. In short, momentum favors sellers on rallies unless USDJPY decisively breaks above ~148.50.

Technical Strategy

We have a neutral-to-bearish bias. Traders might look to sell any uptick toward the 148.00–148.50 zone, targeting the 147.00–147.20 area, with a stop above 148.80. Conversely, a break below 147.30 could expose a slide toward the 146.50 region (stop ~147.70). In all cases keep stops tight: key support lies near 147.30 and 147.00, and only a fresh break above 148.60 would flip the bias bullish.

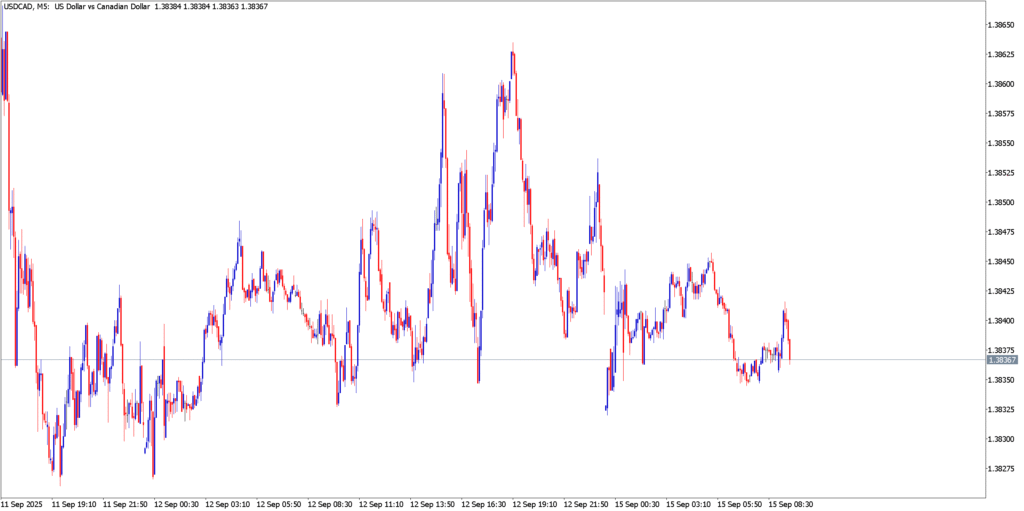

USD/CAD

USD/CAD has been choppy and range-bound. Since Friday the pair has traded between roughly 1.3820 and 1.3865. It briefly reached 1.3865 on Friday (likely on risk-driven rallies) but slid back into the low 1.38s by Asia Monday. Neither side of the range has decisively broken; RSI is stuck near mid-levels (around 50), and MACD is flat, reflecting neutral momentum. Stochastic oscillators have been flipping around neutral on the 5-min chart. Recent fundamentals (Fed and BoC easing bets) have kept CAD under slight pressure, but price action so far shows no clear trend.

Technical Strategy

A neutral stance is prudent. One plan: buy near the bottom of the range (~1.3820–1.3830) for a pop toward 1.3860–1.3870, with a stop just under 1.3800. Alternatively, consider selling a clean break above 1.3865–1.3870, aiming for 1.3820, with a stop above 1.3900. Key levels: support ~1.3820 and resistance ~1.3865. Watch Canadian data on Tuesday (CPI) – a hot print could push USD/CAD lower (CAD strength), while a soft print could fuel more USD buying ahead of the Sept 17 BoC meeting.

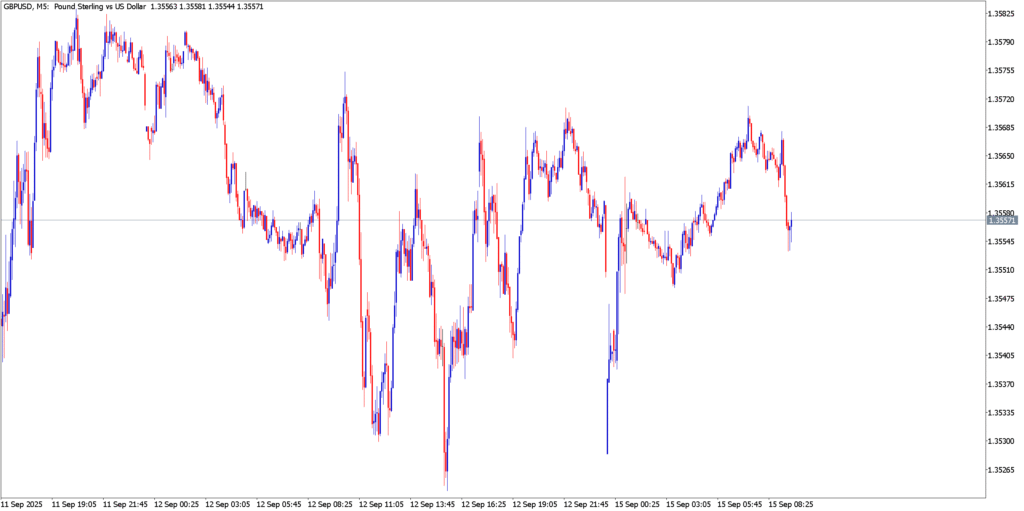

GBP/USD

GBP/USD has been grinding in a tight band in the mid-1.35s. The pair hit about 1.3583 late last week (its peak on Friday) but pulled back to the 1.3540s overnight. As of Monday AM it’s around 1.3555. On the 5-min chart this price action shows a small rally after finding support near 1.3540. The short-term RSI is roughly neutral (mid-40s to 50s), and MACD shows little directional bias, though the recent uptick suggests slight buying momentum. Stochastics gave a bullish crossover off oversold earlier, hinting at some rebound potential. Overall, the pair is still trapped below strong technical resistance in the 1.3580–1.3600 area (a multi-week high). Daily charts show GBP/USD in an up-channel, capping around 1.3595.

Technical Strategy

We lean neutral-to-bullish if the 1.3540 support holds. A reasonable trade is to buy near 1.3540–1.3550 targeting 1.3600, with a stop below 1.3530. Alternatively, a close above 1.3585 would signal strength (trend channel breakout), in which case one could add to longs targeting 1.3660 (stop ~1.3570). On the downside, a break under 1.3540 would open 1.3500–1.3480 (with stops near 1.3560). Keep an eye on UK data – any surprise CPI/inflation could quickly move this pair, and the BoE’s Sep 18 meeting (likely hold) is just ahead.

Market Outlook

Economic and central bank events will drive volatility all week. Monday’s focus is on China’s data (retail, IP) – disappointing figures could weigh on commodity FX (AUD, CAD) and ease USD demand. Tuesday brings a deluge: UK Jobs figures, German ZEW, US Retail Sales/Industrial Production, and Canada CPI (vital ahead of the BoC meeting). The big show is Wednesday: FOMC decision and press conference, when the Fed is widely expected to cut 25bps – markets will hang on Powell’s guidance for future cuts. The BoC and Brazil’s central bank also meet Wed, with the BoC strongly expected to ease 25bps. Thursday features New Zealand GDP (Q2) and the Bank of England decision; BoE rates are seen on hold, but any change in tone could shock GBP. On Friday, Japan releases August CPI and holds its BoJ meeting – no rate change is expected, but any signal of future tightening could drive USD/JPY.

In summary, this week’s policy mix (Fed/BoC cuts vs. BoE/ECB/BoJ steadiness) points to FX volatility. USD/JPY and USD/CAD are particularly sensitive to central bank turns (and carry flows), while GBP/USD will move on UK news and market positioning ahead of the BoE. Traders should watch the 147.30-148.00 zone in USD/JPY and 1.3820-1.3860 in USD/CAD for breakout clues, and 1.3540-1.3600 in GBP/USD. With so many key events, risk management is crucial: use tight stops and be prepared for sharp moves on announcements.