Forex markets face a data-packed Friday, with inflation and growth metrics taking center stage. The U.S. will report its closely watched core PCE inflation (Fed’s preferred gauge) alongside other UoM surveys, while Canada publishes July GDP and the UK wrestles with sticky inflation. Recent U.S. data (Q2 GDP was revised up to 3.8% and jobless claims are low) underscore economic resilience, which has bolstered the dollar. By contrast, a core PCE gain of only ~0.2% m/m is expected – a moderation that could soften the dollar if confirmed. Meanwhile, Canada’s economy is forecast to have grown roughly 0.1% in July, and persistent UK inflation risks have kept the Bank of England cautious. Together, these fundamentals – and how they compare to technical trends – set the stage for potentially volatile moves in EUR/USD, GBP/USD and USD/CAD.

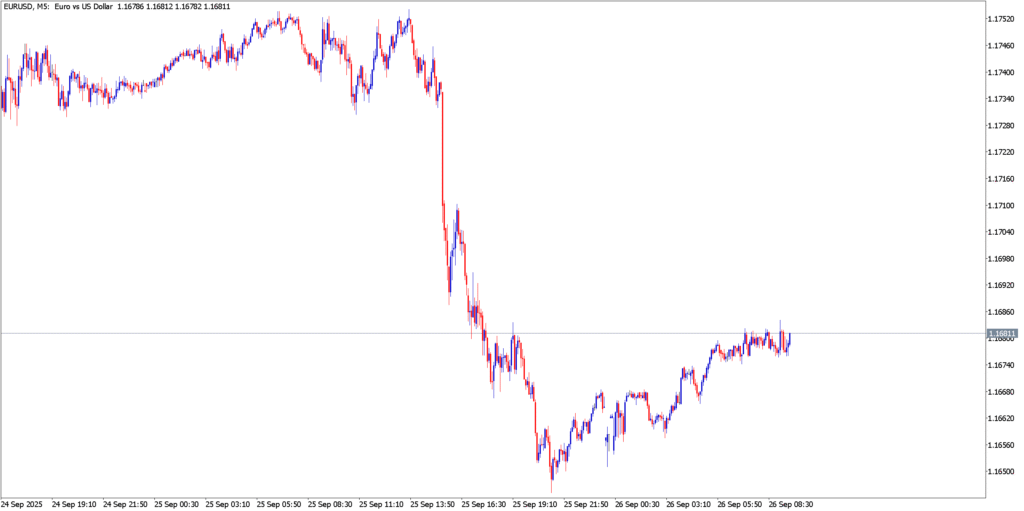

EUR/USD

EUR/USD has been grinding higher this week. After finding support in the mid-1.17s on Tuesday, the euro rallied toward the upper 1.17s and briefly touched the 1.1820 area on Wednesday before pausing. The pair is now consolidating just under resistance in the low 1.18s, with support seen around 1.1760–1.1780. Recent candles suggest indecision as traders await Friday’s U.S. inflation news and the weekend.

Technicals in Focus

EUR/USD’s rally has pushed momentum indicators to bullish extremes. The MACD histogram is positive, reflecting the recent upswing, and the RSI is likely approaching overbought levels near 70. The Stochastic Oscillator is also in its upper band. These suggest bullish bias but also warn that the rally could stall or see a pullback if the USD strengthens. On the charts, short-term moving averages (not shown) appear to be curling higher, reinforcing the uptrend. Key resistance lies just above current levels (~1.1825–1.1840), and a break there would open the 1.19 region. Conversely, support around 1.1760–1.1780 is the next downside pivot.

Trading Strategy

Traders should weigh fundamentals carefully. A softer-than-expected core PCE print (forecast ~0.2% m/m) would likely undermine the dollar and favor EUR/USD breaking higher out of its range. In that case, buying on dips toward 1.1760 with stops below could be attractive, targeting a move toward 1.1850–1.1900 if U.S. dollar sentiment sours. However, if U.S. inflation surprises to the upside, expect the dollar to firm, capping EUR/USD and possibly triggering a retreat to the 1.1760 area again. Given the RSI/Stochastic signals, traders might also play the short side in the upper 1.18s if bearish reversal patterns emerge. Overall, bias is mildly bullish, but traders should guard positions given the crowded overbought signals and upcoming data risks.

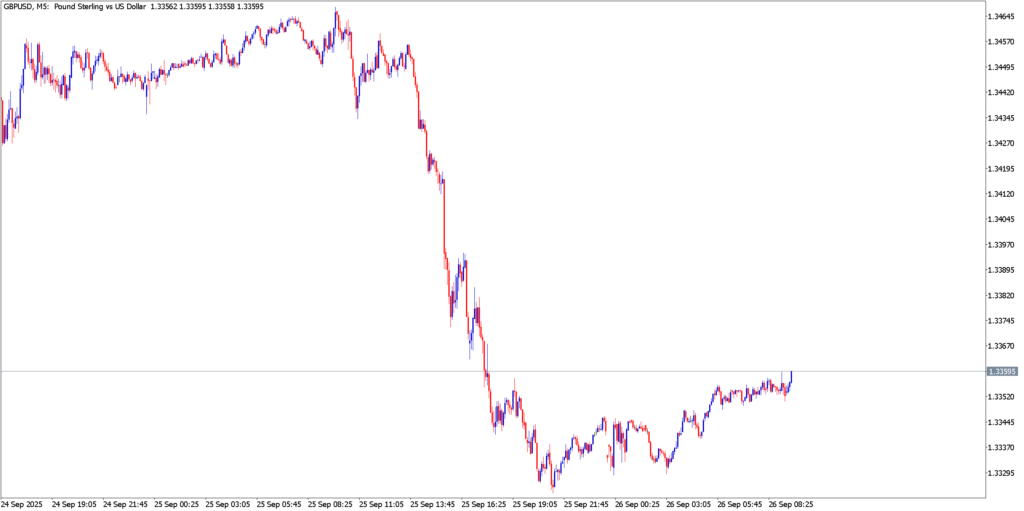

GBP/USD

GBP/USD has extended its recent slide. The pound gave up most of this week’s gains, breaking through support around 1.3530 and sliding to ~1.3460 on Thursday. Price action shows a clear downtrend: a series of lower highs and lows as traders digested weak UK data and strong U.S. figures. Yesterday’s close near the 1.3460 area marks a fresh multi-week low.

Technicals in Focus

The technical outlook for GBP/USD is bearish. The MACD is below its signal line, and momentum readings look negative. The RSI is likely in oversold territory (<30), and the Stochastic Oscillator is also stretched low. These indicators confirm strong downside momentum but also suggest the pair may be near a short-term exhaustion. Resistance now resides near the 1.3520–1.3540 zone (recent swing lows), and the next major support is around 1.3400. A break below 1.3400 would open the path toward 1.3300–1.3260 (as noted by last week’s ForexCrunch analysis), while any rally face resistance around 1.3520.

Trading Strategy

Fundamentals favor dollar strength and pound caution. UK policymakers remain wary of inflation risks, which limits expectations of near-term rate cuts and puts a lid on GBP strength. Conversely, a resilient U.S. economy and even modest U.S. inflation would keep USD bid. Thus, traders should be cautious about aggressively buying GBP here. If core PCE comes in at or above forecasts, expect GBP/USD to remain heavy. However, if PCE is surprisingly soft, a technical bounce from oversold levels is possible. In that scenario, one might try a faded rally approach: shorting any bounce into the 1.3500–1.3520 zone with tight stops, targeting 1.3400 on the downside. On the flip side, a loss of 1.3450 support could be used to add to short positions with an eye on 1.3300. In summary, momentum is down, so any longs should be small and risk-managed, while swings and pullbacks offer better shorting opportunities given the overall downtrend.

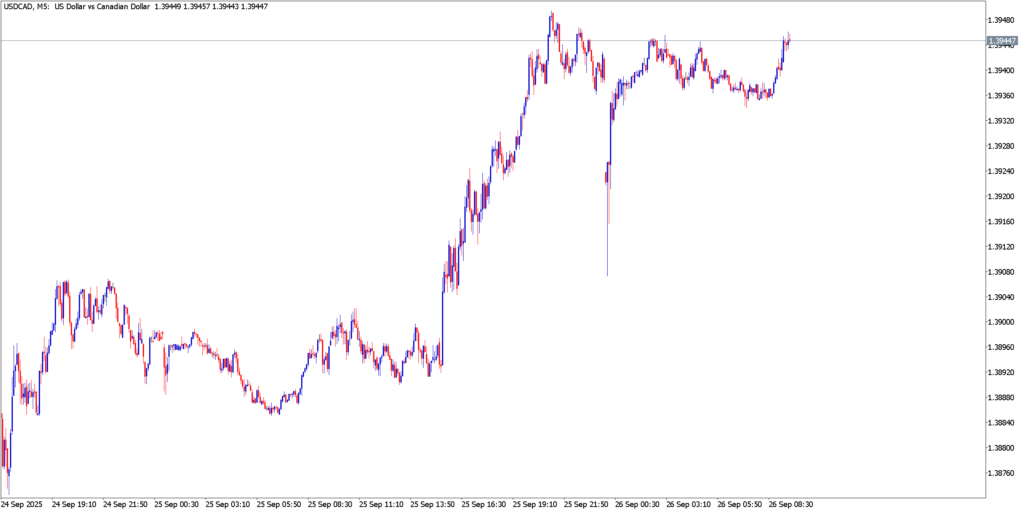

USD/CAD

USD/CAD has been climbing steadily. The pair rose from about 1.3820 early this week to reach a high of ~1.3875 by Thursday. The trend is clearly upward over the past two days, with each pullback meeting buyers. As of late Thursday U.S. trading, USD/CAD sits near the top of its recent range around 1.3870. There is little resistance overhead until 1.3900–1.3920, while support lies back at 1.3820.

Technicals in Focus

Bullish momentum dominates USD/CAD right now. The MACD is above its signal and the RSI is around 60–65 (approaching overbought territory), while the Stochastic is high. The fact that price action keeps making higher highs and higher lows suggests buyers remain in control. However, the RSI/Stoch suggest the rally is mature, so watch for any negative divergence on the short-term charts. Key levels: resistance ~1.3900 (a round number), with support near 1.3820 and then 1.3780.

Trading Strategy

Monday’s Bank of Canada hold and inflation data have already been priced in, so attention on Friday will be the July GDP report. Canada’s economy is expected to have grown ~0.1% in July. A stronger-than-expected GDP (e.g. >0.1%) would likely bolster the loonie, pressuring USD/CAD lower; in that case, traders might lighten USD longs or even sell into the overnight strength. Conversely, a disappointing GDP print or any sign of renewed U.S. risk appetite would allow USD/CAD to continue higher. On the U.S. side, a weak U.S. PCE print could also drag USD/CAD down, despite the technical uptrend. For now, a reasonable strategy is to buy on dips near technical support (e.g. 1.3820–1.3840), with tight stops in case of a sudden CAD surprise. If USD/CAD clears 1.3900 decisively, it could extend toward 1.3950. Alternatively, watch for failure around 1.3870–1.3900; a reversal there could offer a quick short to 1.3820. Overall, USD/CAD’s uptrend looks intact, but traders should balance it against the risk that Canadian data or a weak dollar scenario might intervene.

Market Outlook

In sum, Friday’s major data point to an active trading day. A softer core PCE will likely weaken the dollar and boost EUR and GBP, while a stronger figure would reinforce recent USD gains. At the same time, Canada’s GDP and UoM sentiment figures add nuance: an unexpected CAD strength would blunt USD/CAD’s rally. Technical charts across all pairs warn of possible near-term exhaustion (overbought/oversold indicators are flashing), so traders should manage risk tightly. In practice, this means watching for key breaks (EUR/USD above 1.1825 or below 1.1760, GBP/USD below 1.3400 or a pullback to 1.3520, USD/CAD beyond 1.3900 or back under 1.3820). Keep stops wide enough to weather volatility, and be prepared for choppiness around the data releases. Overall, the interplay of inflation versus growth news will likely keep FX volatility elevated. Traders should align their technical setups with the fundamental outcome: if U.S. data disappoint, look for buy-the-dip in EUR/GBP, and if data surprise on the upside, lock in profits on USD sell-offs. The coming session will reward those who marry the charts with the headlines.