A buy limit in forex is a pending order placed below the current market price to buy a currency pair at a lower, pre-set level. Traders use it to enter trades at better prices during pullbacks, improving cost control and risk management.

Key Takeaways

- A buy limit order lets traders plan entries at a lower price than the current market, instead of buying instantly.

- It is mainly used during pullbacks, retracements, or near support levels.

- Buy limit orders offer price control and discipline, but they may not execute if the price never reaches the set level.

- Understanding the difference between buy limit, buy stop, and market orders is essential for correct trade execution.

What Is a Buy Limit Order in Forex Trading?

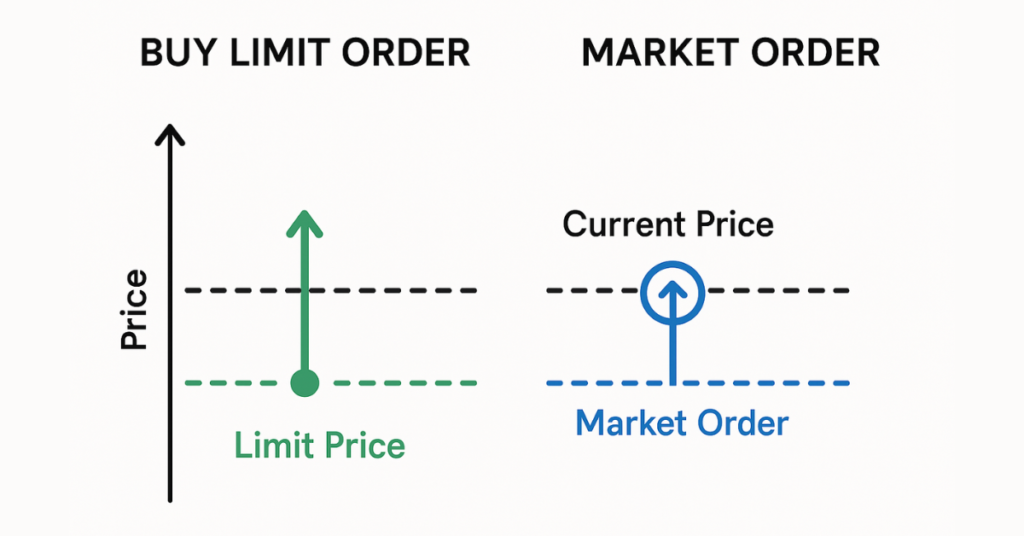

A buy limit order in forex trading is a type of pending order that instructs the broker to open a buy trade only when the market reaches a specified lower price. Unlike a market order, which executes immediately, a buy limit waits patiently for the price to retrace to a level the trader believes offers better value.

This order type is commonly used when traders expect the market to move down temporarily before continuing upward. By setting a buy limit, traders avoid chasing price and instead enter trades with a predefined plan, which supports more disciplined and consistent trading decisions.

How a Buy Limit Order Works in Forex

A buy limit order works by allowing the trader to predefine the exact price at which they want to enter a buy position. When the market price is higher than the chosen level, the order remains pending and inactive. It only triggers if the price falls to the specified level or better.

Traders typically place buy limit orders at areas where they expect temporary price weakness, such as support zones or retracement levels. Once the market touches that level, the order is automatically executed without the trader needing to monitor the chart constantly.

Buy Limit vs Market Order

| Aspect | Market Order | Buy Limit Order |

| Execution Type | Executes immediately at the current market price | Executes only when price reaches a predefined lower level |

| Entry Timing | Instant execution | Delayed until price hits the limit price |

| Price Control | No control over exact entry price | Full control over entry price |

| Slippage Risk | Higher during volatile market conditions | No slippage, but execution is not guaranteed |

| Fill Guarantee | Almost always filled | May remain unfilled if price never reaches the level |

| Best Used When | Speed and certainty of entry are required | Planning strategic entries at support or retracement levels |

| Trading Approach | Suitable for momentum or breakout trading | Preferred for technical, support-based entry planning |

| Main Risk | Less favorable entry price | Missing the trade entirely |

Buy Limit vs Buy Stop Order

| Aspect | Buy Limit Order | Buy Stop Order |

| Order Type | Pending order | Pending order |

| Placement | Placed below the current market price | Placed above the current market price |

| Market Expectation | Price will drop first, then reverse upward | Price will rise and continue upward |

| Trading Objective | Enter at a better (lower) price | Enter on momentum or breakout |

| Typical Use Case | Buying at support or during retracements | Buying after resistance breaks |

| Entry Price Control | High control over entry price | Less price advantage, focuses on confirmation |

| Execution Risk | May not be filled if price doesn’t fall | May trigger at higher prices during fast moves |

| Common Beginner Mistake | Expecting momentum instead of a pullback | Confusing it with a buy limit and overpaying |

| Best For | Strategic, planned entries | Trend-following and breakout strategies |

Real Buy Limit Order Example in Forex

Imagine the EUR/USD currency pair is currently trading at 1.1200, but technical analysis shows a strong support level at 1.1150. A trader believes the price will temporarily drop to this support before continuing upward.

Instead of buying immediately at 1.1200 (market order), the trader places a buy limit order at 1.1150. Once the market reaches this level, the order automatically executes, allowing the trader to enter at a better price.

This approach provides several advantages:

- Cost control: The trader avoids overpaying by entering at a lower level.

- Discipline: Trades are executed according to a predefined plan, reducing emotional decisions.

- Efficiency: No need to constantly monitor the charts; the order triggers automatically.

When Should You Use a Buy Limit Order?

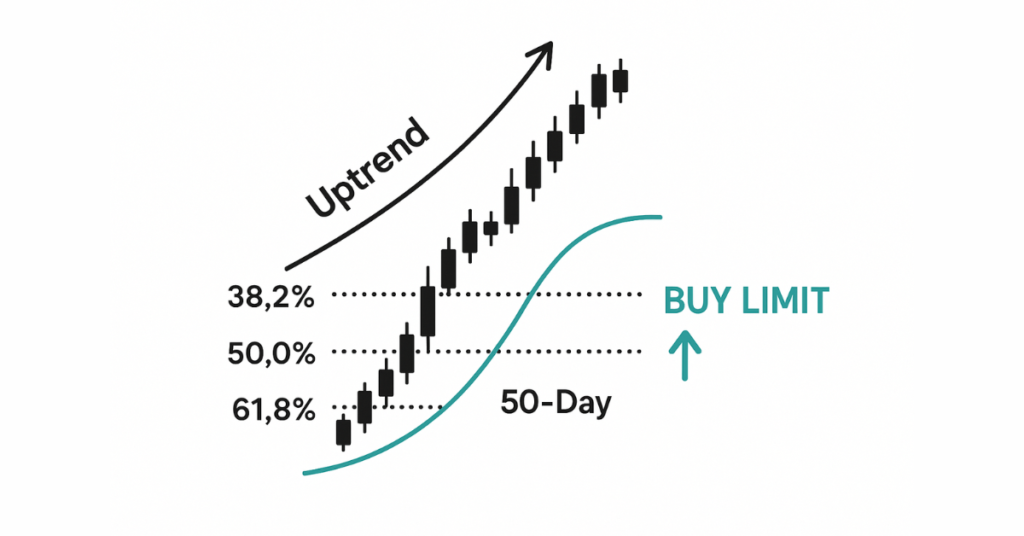

A buy limit order is most effective when traders expect the market to pull back temporarily before resuming an upward trend. Instead of chasing price movements, traders can enter positions at a predefined lower level, improving cost efficiency and risk management.

3 common scenarios for using buy limit orders include:

- At Support Levels: When technical analysis identifies strong historical support, a buy limit can capture a rebound.

- During Retracements: In trending markets, prices often pull back to key moving averages or Fibonacci levels. A buy limit allows traders to enter at these optimal points.

- Range-Bound Markets: For currencies oscillating between defined support and resistance, buy limits help traders buy near the lower range.

Success in using buy limit orders depends on analyzing market structure, identifying reliable support zones, and combining with risk management tools.

Buy Limit Trading Strategies

Using buy limit orders effectively requires strategic planning and an understanding of market behavior. Here are some of the most reliable strategies traders use:

- Support-Based Entries: Traders identify strong support zones on the chart, where the price has historically bounced. A buy limit order is placed slightly above or at the support level, anticipating a reversal. This strategy ensures better entry prices than buying at the current market rate.

- Retracement Strategy in Trending Markets: In an uptrend, prices often pull back to moving averages or Fibonacci retracement levels. Placing a buy limit at these points allows traders to enter with the trend rather than chasing a rising price.

- Range Trading Strategy: For currencies moving within a well-defined range, buy limit orders are placed near the lower boundary of the range. This strategy maximizes the probability of entering at a favorable price before the next upward move.

- Risk-Reward Focused Entries: Traders often pair buy limit orders with stop-losses slightly below support and predefined take-profit levels, ensuring disciplined risk management.

How to Place a Buy Limit Order on MT4 & MT5

Placing a buy limit order on MT4 or MT5 is straightforward and ensures traders can execute planned entries without constantly monitoring the market. Here’s a step-by-step guide:

Step 1: Open the Trading Platform

Log in to your MT4 or MT5 account (Defcofx supports both platforms with fast execution and low spreads from 0.3 pips).

Step 2: Select the Currency Pair

Choose the currency pair or asset you want to trade.

Step 3: Open the Order Window

Click on “New Order” or press F9, then select “Pending Order” from the order type dropdown menu.

Step 4: Choose Buy Limit

From the pending order types, select Buy Limit. Enter the desired price below the current market level where you want the order to execute.

Step 5: Set Volume & Stop-Loss/Take-Profit

Specify the trade volume (lot size) and add stop-loss and take-profit levels for proper risk management.

Step 6: Place the Order

Click “Place.” The buy limit order will remain pending until the market reaches your predefined price.

Advantages of Using Buy Limit Orders

Buy limit orders offer several key benefits that make them a preferred choice for disciplined forex traders:

1. Better Entry Prices: By setting a buy limit below the current market price, traders can enter at more favorable levels, maximizing potential profit compared to instant market orders.

2. Cost Control and Discipline: Buy limit orders enforce a planned entry, reducing impulsive decisions driven by market emotions. Traders avoid chasing prices, which often leads to overpaying.

3. Efficient Trading: Pending orders allow traders to automate entries, freeing them from constant chart monitoring while ensuring they don’t miss strategic price levels.

4. Integration with Risk Management: Buy limit orders can be combined with stop-loss and take-profit levels, helping manage risk and maintain consistent trading strategies.

5. Strategic Use of Market Analysis: Traders can place buy limits near support levels, Fibonacci retracements, or moving averages, applying technical analysis effectively without manual intervention.

Risks and Limitations of Buy Limit Orders

While buy limit orders offer strategic advantages, they come with certain risks and limitations that every trader should understand:

1. Order May Not Execute: If the market never reaches the buy limit price, the trade remains unfilled. This can be frustrating in fast-moving markets where prices skip support levels.

2. False Support Levels: Placing a buy limit based on a perceived support may backfire if the market breaks below that level, resulting in potential losses.

3. Missed Opportunities: In rapidly trending markets, waiting for a lower entry may mean missing the profitable move, especially if prices continue upward without retracing.

4. Overreliance on Technical Analysis: Buy limit orders rely heavily on accurate market analysis. Incorrect identification of support zones, retracements, or trends can lead to unexecuted trades or losses.

Is a Buy Limit Order Suitable for Beginners?

Buy limit orders can be suitable for beginners, but only when used with proper guidance and risk management. They encourage planned and disciplined trading by allowing traders to enter at predetermined levels rather than reacting impulsively to market movements. This helps reduce emotional decision-making, which is often a major pitfall for new traders.

However, beginners must understand that buy limit orders may not execute if the market doesn’t reach the specified level. This requires patience and realistic expectations. Combining buy limit orders with stop-loss and take-profit settings can help beginners manage risk effectively while learning how to identify support levels and retracements.

Defcofx ensures that pending orders are executed accurately, with low spreads from 0.3 pips, fast withdrawals within 4 hours, and global access, giving beginners both convenience and security while learning to trade.

Open a Live Trading AccountCommon Mistakes Traders Make with Buy Limit Orders

Even experienced traders can make errors when using buy limit orders. Understanding these common mistakes helps improve execution and profitability.

- One frequent error is placing orders without proper analysis. Setting a buy limit arbitrarily without identifying reliable support or retracement levels can lead to unfilled orders or losses if the market breaks below the chosen level.

- Another mistake is ignoring market conditions. Traders sometimes place buy limits in strong trending markets where the price is unlikely to pull back, which can result in missed opportunities.

- Overleveraging is also a risk. Using high leverage without proper risk management can amplify losses if the trade goes against expectations.

- Finally, neglecting stop-loss and take-profit settings can turn an otherwise well-planned trade into a riskier position. Traders must pair buy limit orders with these protective measures to maintain disciplined and controlled trading.

Why Trading Buy Limit Orders with the Right Broker Matters

Choosing the right broker is essential for effectively executing buy limit orders. Even with perfect analysis, a broker with slow execution, high spreads, or poor order handling can negatively impact trade outcomes.

With a broker like Defcofx, traders benefit from tight spreads starting from 0.3 pips, no commissions or swap fees, and fast order execution, ensuring buy limit orders trigger precisely at the intended price. The platform also supports high leverage up to 1:2000, giving traders flexibility in position sizing while maintaining proper risk control.

Global access and multilingual support mean traders from any country can place orders conveniently, while fast withdrawals completed within 4 business hours, including weekends, provide peace of mind for both funding and profits.

Success Tip: Using a reliable broker enhances strategy execution, especially for beginners and intermediate traders. Correctly placed buy limit orders, combined with a trustworthy broker, increase the likelihood of achieving planned trade outcomes while minimizing execution risk.

Open a Live Trading AccountFinal Thoughts on What a Buy Limit in Forex

A buy limit order is a powerful tool for traders who want to enter the market strategically at lower prices rather than chasing immediate market movements. It offers better entry points, enforces trading discipline, and allows traders to combine technical analysis with structured risk management.

While the order type provides many advantages, it also carries risks, such as unfilled trades or false support levels. Traders should always combine buy limits with stop-loss and take-profit settings to control potential losses and maximize disciplined trading.

Using a reliable broker like Defcofx further enhances trading efficiency. Traders can benefit from tight spreads from 0.3 pips, no commissions, high leverage up to 1:2000, fast support, and withdrawals within 4 hours, creating an ideal environment for executing buy limit strategies effectively.

In summary, buy limit orders are ideal for both beginner and experienced traders when applied thoughtfully, with careful market analysis and proper risk management.

Open a Live Trading AccountFAQs

A buy limit order executes only at a predefined lower price, while a market order executes immediately at the current price. Buy limits allow better entry control, whereas market orders prioritize instant execution.

Yes. If the market never reaches the specified price, the buy limit order remains unexecuted. Traders must plan levels carefully and be patient.

Buy limits are ideal during pullbacks, retracements, or near support levels, where traders anticipate the price will reverse and continue upward.

Absolutely. Defcofx supports buy limit orders on MT4 and MT5, offering tight spreads, high leverage up to 1:2000, fast execution, and global access for seamless trading.

Key risks include unfilled trades, false support levels, and missed opportunities. Combining buy limits with risk management tools mitigates these risks effectively.