A pairs trading strategy is a market-neutral trading approach where a trader buys one asset and sells another correlated asset at the same time. The goal is to profit from the price relationship between the two, rather than overall market direction, using statistical arbitrage principles.

Key Takeaways

- The pairs trading strategy focuses on correlated assets trading.

- It is a form of statistical arbitrage.

- Market-neutral trading reduces exposure to overall market moves.

- A long-short trading strategy is used to capture price divergence.

- Proper risk management is essential for consistent results.

What Is Pairs Trading?

Pairs trading is a long-short trading strategy where you take two related assets and trade them against each other. One position is long (buy), and the other is short (sell).

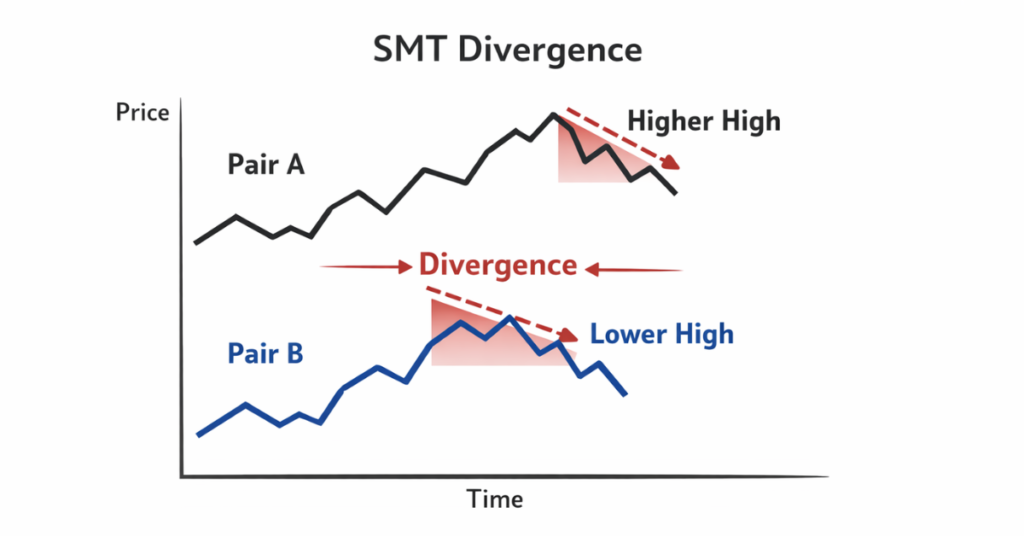

Instead of predicting whether the market will go up or down, you focus on the relationship between two assets. If the spread between them widens unusually, you trade, expecting it to return to its historical average.

This approach is considered market-neutral trading because it aims to reduce exposure to overall market trends.

For example, if the entire stock market falls, both assets may drop. But if they move differently from their usual relationship, profit can still be made from that difference.

How Statistical Arbitrage Works in Pairs Trading

Statistical arbitrage is the foundation of most pairs trading strategies. It relies on historical data and mathematical models to identify relationships between assets.

Traders analyze:

- Historical correlation

- Price spread

- Mean reversion behavior

When two assets have historically moved together but suddenly diverge, the strategy assumes they will eventually converge again.

The trade profits from the convergence.

This makes statistical arbitrage a data-driven approach rather than an emotional one.

What Do We Mean by Correlated Assets Trading

Correlated assets trading means selecting two instruments that typically move together due to economic, sector, or structural relationships.

Common examples include

- Two banks within the same country

- Oil companies affected by crude prices

- EUR/USD and GBP/USD in forex

Correlation is usually measured between -1 and +1:

- +1 means perfect positive correlation

- 0 means no relationship

- -1 means opposite movement

A strong positive correlation above 0.7 is often preferred in pairs trading strategy setups.

Pairs Trade Examples (Stocks & Forex)

Below is a simple comparison table showing potential pairs trade examples:

| Market | Asset A (Long) | Asset B (Short) | Reason for Pair |

| Stocks | Coca-Cola | PepsiCo | Same industry, similar demand drivers |

| Stocks | Visa | Mastercard | Similar business model |

| Forex | EUR/USD | GBP/USD | Strong historical correlation |

| Forex | AUD/USD | NZD/USD | Commodity-linked currencies |

In each example, the trader expects temporary divergence followed by convergence.

Step-by-Step Pairs Trading Strategy

A structured pairs trading strategy follows several stages.

- First, identify two correlated assets using historical data.

- Second, calculate their price spread.

- Third, measure how far the spread deviates from its historical mean.

When divergence exceeds a certain threshold, enter a long-short trading strategy:

- Buy the undervalued asset

- Sell the overvalued asset

The goal is for the spread to narrow again.

Exit occurs when the spread returns to its average.

This systematic approach makes it popular among hedge funds using statistical arbitrage.

Why Pairs Trading Is Market-Neutral

Market-neutral trading attempts to reduce exposure to broad market movements.

If the market crashes:

- The long position may lose value

- The short position may gain value

These effects offset each other.

This balance makes pairs trading attractive during volatile market conditions.

However, market-neutral does not mean risk-free. Unexpected changes in correlation can create losses.

Want to practice market-neutral strategies in live conditions? Use a Defcofx that allows fast execution and flexible leverage to manage both legs of a pairs trade efficiently.

Open AccountRisk Factors in Pairs Trading

While statistical arbitrage sounds safe, risks still exist.

One major risk is correlation breakdown. Two assets that moved together historically may suddenly behave differently due to:

- Company-specific news

- Policy changes

- Economic shifts

Liquidity risk is another factor. If one asset moves faster than expected, exiting both positions at desired levels may become difficult.

Proper position sizing and stop-loss planning remain essential.

More About Correlated Assets Trading

More advanced traders use statistical models like

- Z-score calculations

- Cointegration testing

- Regression analysis

Z-score measures how far the spread deviates from the mean in standard deviations. A high absolute Z-score signals potential entry.

Cointegration testing ensures the long-term relationship between assets is stable.

These tools make statistical arbitrage more precise.

Practical Forex Pairs Trade Example

Imagine EUR/USD and GBP/USD historically moving together. Suddenly, EUR/USD rises sharply while GBP/USD remains stable.

If divergence exceeds the normal range:

- Trader may short EUR/USD

- The trader may go long GBP/USD

If the relationship returns to normal, profit is generated from convergence.

This long-short trading strategy focuses on relative movement, not absolute direction.

Executing forex pairs trading requires tight spreads and quick order placement on both positions. Choose a Defcofx trading platform designed for precision and fast response during divergence setups.

Open AccountPsychology of Market-Neutral Trading

Unlike trend trading, pairs trading removes directional bias. This reduces emotional decision-making.

You are not betting on market growth or decline. You are betting on relationship stability.

This structured mindset aligns with disciplined trading frameworks.

Pairs Trading in Real Conditions

Many modern brokers provide tools that allow traders to execute long-short trading strategies efficiently. Tight spreads and fast execution become important when managing two positions simultaneously.

Traders looking to implement market-neutral trading in forex markets often seek platforms offering flexible leverage, competitive spreads, and efficient order execution.

For example, brokers like Defcofx provide high leverage options, low spreads, and fast withdrawal processing, which can help traders react quickly when correlated assets diverge unexpectedly. This can be particularly useful when managing statistical arbitrage setups that require precision and timing.

Defcofx for Pairs & Market-Neutral Trading

Why Defcofx Fits Pairs Trading & Statistical Arbitrage Strategies

Executing a pairs trading strategy requires more than just analysis. Since traders manage two positions simultaneously, broker infrastructure plays a critical role in execution quality, cost control, and risk management.

Defcofx offers trading conditions that align well with market-neutral and statistical arbitrage approaches:

- High Leverage up to 1:2000: Allows traders to balance long and short positions efficiently without excessive capital lock-up.

- Low Spreads from 0.3 Pips: Tight spreads are especially important in pairs trading, where profits often come from small price convergence.

- No Commissions or Swap Fees: Reduces friction when holding paired positions for mean reversion without unexpected overnight costs.

- Fast Withdrawals (Within 4 Business Hours): Including weekends, supporting active traders who prioritize liquidity access.

- Global Access & Multi-Language Support: Suitable for traders worldwide looking to implement forex and CFD pairs strategies.

For traders applying statistical arbitrage in forex markets, Defcofx’s execution speed and flexible trading environment can help manage divergence and convergence opportunities more precisely.

Final Thoughts on Pairs Trading

Pairs trading is a structured market-neutral trading method built on statistical arbitrage principles. By identifying correlated assets and trading opportunities and applying a disciplined long-short trading strategy, traders aim to profit from price convergence rather than market direction.

While powerful, it requires careful monitoring of correlations, proper risk management, and a clear entry and exit framework. When executed correctly, pairs trade examples demonstrate how relative value movements can create consistent opportunities across both stocks and forex markets.

Frequently Asked Questions

What is a pairs trading strategy?

A pairs trading strategy involves buying one asset and selling another correlated asset at the same time. The goal is to profit from the change in price relationship between them rather than overall market direction.

Is pairs trading considered statistical arbitrage?

Yes, pairs trading is a form of statistical arbitrage because it relies on historical price relationships and mathematical models to identify divergence and convergence opportunities between correlated assets.

How does market-neutral trading reduce risk?

Market-neutral trading reduces exposure to overall market direction by balancing long and short positions. If the market moves strongly in one direction, gains on one side may offset losses on the other.

What are common pairs trade examples?

Common pairs trade examples include two companies in the same industry, like Visa and Mastercard, or correlated forex pairs such as EUR/USD and GBP/USD. The key is strong historical correlation.

What is the biggest risk in correlated asset trading?

The biggest risk in correlated asset trading is correlation breakdown. If the relationship between two assets changes permanently, the expected convergence may not occur, leading to losses.

Discover More Trading Guides by Defcofx

- Good Stocks to Invest in for Beginners

- Best Currency Pairs to Trade during Sydney Session

- How Do Exchange Rates Impact International Trade?

- Best Currency Pairs to Trade During the Tokyo Session

- Is Day Trading Profitable?

- How to Read Stock Candlesticks

- What is an Expert Advisor | Automated Trading Guide