Monday’s forex session kicked off the week with high drama across major pairs. A sudden plunge in oil prices sent the Canadian dollar reeling, while a wave of risk aversion put the safe-haven yen back in vogue. At the same time, sterling attempted a cautious rebound as traders parsed divergent central bank signals. Below we recap the action in USD/JPY, GBP/USD, and USD/CAD, distilling what drove the moves and what they signal for the days ahead.

USD/JPY

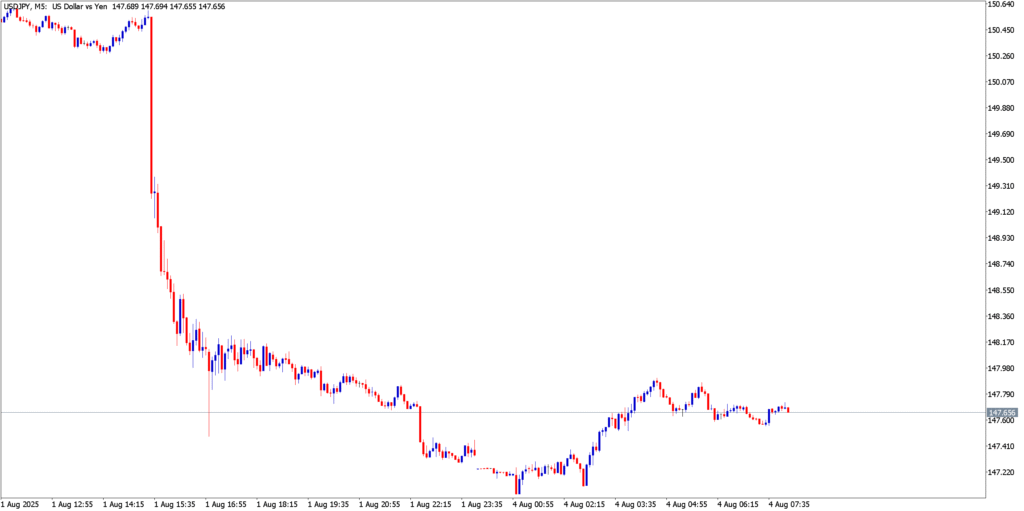

The Japanese yen flexed its safe-haven muscle to start the week as global growth jitters sparked a defensive mood. Fresh signs of a slowdown in China and a sharp drop in oil prices rattled investors, sending them scurrying into traditional safety plays like the yen. “Clearly the Japanese yen is a beloved safe-haven asset when the globe seems to be in chaos,” notes one strategist. Supporting the yen’s bid, Friday’s soft U.S. payrolls data fueled bets that the Federal Reserve may pause or even cut rates soon, undercutting U.S. yields and the dollar. Meanwhile in Tokyo, speculation is swirling that the Bank of Japan could further tweak its yield-curve policy after hints of rising inflation, adding another tailwind to the yen. This mix of risk-off sentiment and policy expectations set the tone for USD/JPY’s drop.

The pair extended Friday’s steep decline before finding support around the ¥147.00 level and staging a modest rebound. The technical picture turned bearish after last week’s plunge from the 150 area. In overnight trading, USD/JPY extended its slide to a low near ¥147.00, a region that acted as interim support. Notably, sellers failed to push the pair below this psychological ¥147 barrier, and downside momentum began to wane as morning liquidity picked up. Short-term indicators on the 5-minute chart showed oversold conditions, and price action formed a tentative base in the mid-147s. The subsequent bounce saw the pair reclaim the ¥147.50 level and probe toward ¥148.00, but the recovery stalled under a lower high, reflecting that the bears still held the upper hand. Immediate resistance emerges around ¥148.0 – a level that capped intraday upticks – while the prior support at ¥147 (now twice tested) anchors the downside.

Market Outlook

Caution prevails for the next session as traders gauge whether risk aversion will intensify or ease. If global risk-off sentiment deepens, USD/JPY could resume its descent; a decisive break below ¥147.00 would expose the next support in the mid-146s (with ¥145.00 as a deeper target on a sustained yen rally). However, should calm return to equity and commodity markets, the pair may consolidate or even creep higher. A close back above ¥148.50 (near Friday’s post-plunge bounce high) is needed to relieve the immediate bearish pressure and signal a larger recovery toward ¥150.00. With Japanese officials on alert after recent yen strength, traders will also watch for any verbal intervention as USD/JPY approaches the key 150.00 zone. In the near term, the bias leans slightly bearish in favor of the yen, unless a reversal in risk mood or a hawkish Fed surprise revives dollar demand.

GBP/USD

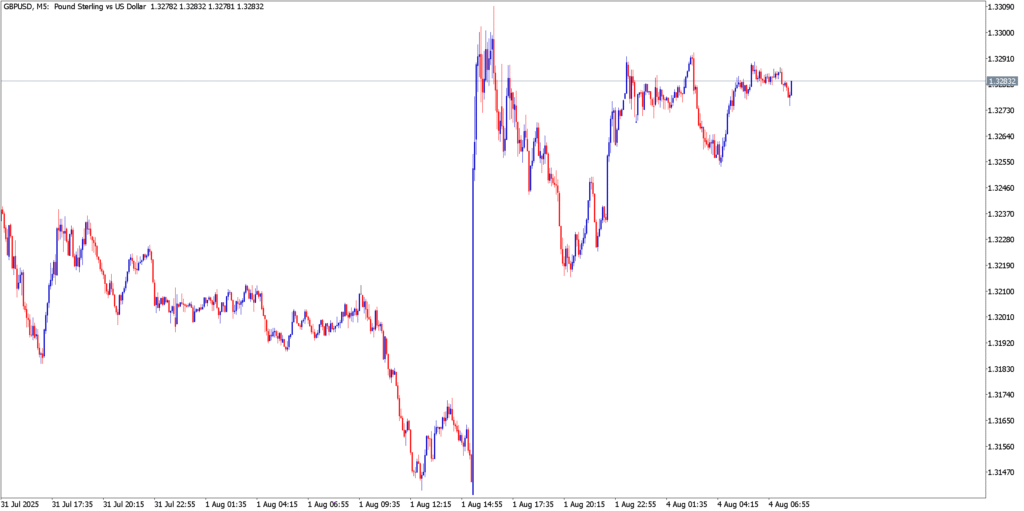

The British pound started the week trying to claw back losses, riding on the coattails of a weaker dollar after last Friday’s data shock. Sterling’s relief rally comes despite a cloudy fundamental backdrop: just last week the Bank of England surprised markets with a rate cut to 4.00%, aiming to support a sputtering UK economy. In contrast, the U.S. Federal Reserve held its rates steady around 4.25–4.50%, underscoring a growing policy divergence that typically favors the dollar. This divergence – BoE easing vs. Fed on hold – had pushed GBP/USD to multi-year lows near 1.3150. However, the pair got a boost when U.S. nonfarm payrolls surprised to the downside, denting the dollar broadly. The weak jobs report eased Fed tightening fears and gave the pound room to breathe. On the political front, relatively stable Brexit headlines and a lack of new UK-specific risks kept traders focused on the macro picture. In short, sterling’s modest strength on Monday was driven more by USD softness and improved risk appetite than by UK optimism, highlighting the delicate balancing act between central bank expectations.

The pair rebounded off last week’s lows, but encountered intraday resistance in the mid-$1.33s amid a still-cautious overall downtrend. Technically, GBP/USD showed a corrective bounce within its broader downtrend. After bottoming out around $1.315 in the wake of the BoE’s move, the pair has been grinding higher, establishing a series of higher lows on the intraday charts. On Monday, sterling extended its rebound, with the pair climbing to an early-session high near $1.333. Notably, bulls struggled twice to clear the mid-1.33 zone, which aligns with last Friday’s post-NFP spike high and now forms a short-term ceiling. This double-top formation around $1.333 signaled fading momentum. The 5-minute candlesticks also show narrowing ranges into the European session, hinting at consolidation. Key support has formed around the $1.3250 area – roughly where pullbacks found buyers overnight. As long as that floor holds, the intraday bias remains mildly upward. Yet the larger structure (visible on higher time frames) remains bearish; the pair is still well below its 50-day moving average and trapped under a descending trendline from mid-July’s highs. In essence, the recent uptick looks like a relief rally within a prevailing downtrend, unless buyers can muster a break above $1.3350 to flip the short-term structure bullish.

Market Outlook

The pound enters the next session with a tentative positive tone, but traders are wary. To build on its comeback, GBP/USD will need follow-through catalysts – perhaps upbeat UK data or further signs of U.S. dollar weakness. Absent that, sterling could stall and slip back as the weight of central bank divergence reasserts itself. A move above $1.3350 would open the door toward $1.3400 and signal that sterling’s recovery has legs. Conversely, a drop back below $1.3250 would hint that the bounce is petering out; in that case, focus returns to the major support around $1.3150 (the recent multi-year low). With the BoE now in easing mode and the Fed taking a pause, any fresh commentary from officials will be scrutinized – hawkish pushback from the Fed or a dovish tone from the BoE could quickly reignite the downside for GBP/USD. For now, cautious optimism prevails, but the pound’s path is likely to remain choppy, tracking each twist in rate expectations and overall risk sentiment.

USD/CAD

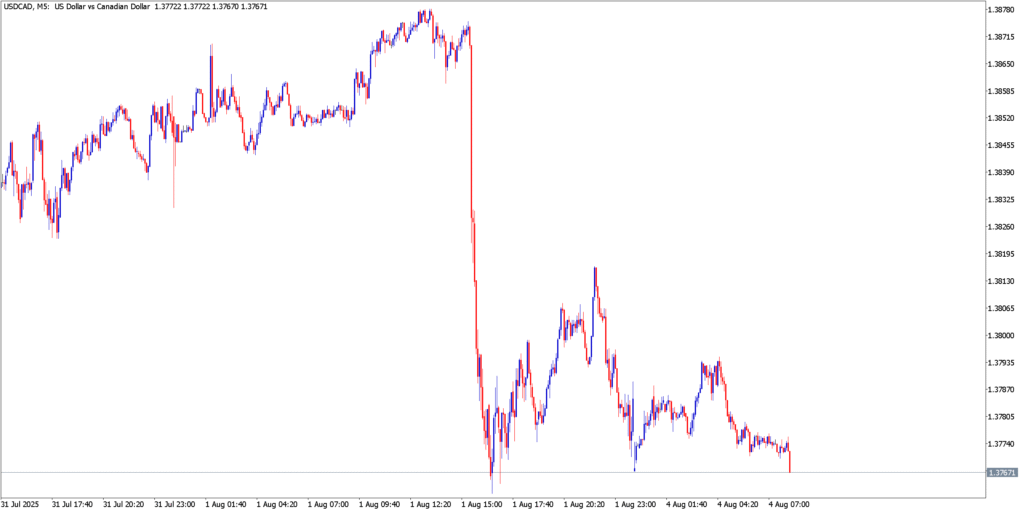

Oil shock was the buzzword of the day for the Canadian dollar, as a sudden crude oil price tumble sent the commodity-linked currency sharply lower. Over the weekend, reports emerged of an unexpected OPEC+ supply boost just as data showed weakening Chinese demand, a one-two punch that knocked oil prices down by over 4%. The Canadian dollar – affectionately known as the loonie – felt the pain almost immediately. As an oil exporter’s currency, the CAD often fluctuates with the price of crude, so the slide in oil triggered a selloff in CAD assets. By Monday, traders were also digesting last Friday’s news that Canada’s monthly GDP contracted, which adds pressure on the Bank of Canada to maintain an accommodative stance. Meanwhile, the U.S. dollar found some footing on safe-haven flows amid the commodity rout. This combination of falling oil and a cautious BoC outlook made USD/CAD a standout mover, with the pair reversing higher after an initial dip. In short, the loonie was caught in a perfect storm: sinking oil revenues, a hint of domestic economic strain, and a mildly resurgent USD – a recipe for near-term weakness.

The pair initially extended its decline to test support near C$1.3750, then bounced as oil prices collapsed, reflecting the Canadian dollar’s sensitivity to commodity shocks. The technical story for USD/CAD on Monday was one of two halves. In the Asian session, the pair actually continued the downtrend that began late last week – dipping from the mid-1.38s and testing the 1.3750 support level by early Europe. This zone roughly coincides with Friday’s low, making it a pivotal line in the sand. Indeed, buyers stepped in around C$1.375, preventing a breakdown. As news of oil’s slide hit the wires, the tide shifted: USD/CAD swiftly bounced off its lows and started climbing. The 5-minute candles turned decisively bullish heading into the North American morning, with the pair breaching initial resistance at 1.3820 (the overnight high). The rally picked up steam, suggesting short-covering and fresh long positions as the oil-sensitive CAD tumbled. By midday, USD/CAD was approaching the C$1.3875 area, near the top of its recent range. Technical indicators confirm the momentum flip – the pair moved back above its intraday moving averages, and hourly MACD (not shown) tilted upward from oversold levels. Still, on the broader chart USD/CAD remains below the psychological C$1.3900 handle and the multi-month highs beyond it. In summary, intraday structure turned bullish after the oil shock, but the pair has yet to break out of its larger range (roughly 1.37–1.39).

Market Outlook

The outlook for the loonie now hinges on whether the oil selloff is a momentary blip or the start of a deeper slide. If crude prices stabilize or rebound, the Canadian dollar could find its footing again, keeping USD/CAD capped below C$1.3900. However, any further weakness in oil – or signs of risk aversion globally – may continue to pressure the CAD. A clear break above the 1.3900–1.3920 resistance zone would signal a bullish breakout, opening the door for USD/CAD to revisit the mid-1.40s. On the downside, support at 1.3750 remains crucial; a move back below that level would indicate the oil shock effect is fading and put the focus on 1.3700 and 1.3650 next. Traders should also watch for commentary from the Bank of Canada this week – officials may downplay rate hike plans given the growth wobble, which would be another headwind for the loonie. All told, near-term risks are skewed toward USD/CAD strength unless oil markets and risk sentiment swiftly recover. The loonie’s tumble on Monday is a reminder of its vulnerability to commodity swings and global macro surprises.

Key Takeaways

Monday’s price action in USD/JPY, GBP/USD, and USD/CAD offers a microcosm of broader market themes that continue to drive FX in 2025:

- Risk Sentiment on Display: Markets flipped to a risk-off stance, benefiting safe-haven currencies and hurting risk-sensitive ones. The Japanese yen’s strength and the Canadian dollar’s weakness fit the classic pattern – in times of uncertainty, investors flock to the JPY, USD, and CHF while shunning commodity-linked currencies. Traders should remain attuned to sentiment shifts: today’s moves confirm that when fear creeps in (be it from growth fears or geopolitical shocks), safe havens outperform and high-beta currencies fall out of favor.

- Central Bank Divergence Matters: The divergence in monetary policy trajectories was evident in the pound’s struggle versus the dollar. With the BoE easing and the Fed holding firm, yield differentials are tilting against GBP – a theme that kept sterling’s rally in check. Conversely, any hint of the Fed turning more dovish (like the weak jobs data implied) can quickly weaken the USD broadly. This push-and-pull underscores that FX traders are fixated on central bank signals, and even intraday, currency moves are calibrating to the expected rate path of each economy. Keep an eye on policy commentary: divergence can drive sustained trends, while convergence or surprises can spark sharp reversals.

- Market Psychology & Reaction Speed: Monday’s forex swings also highlight the market’s hypersensitivity to surprises and the speed at which narratives can shift. A single data release (disappointing payrolls) or an unexpected headline (OPEC’s oil surprise) can whipsaw currencies as traders rush to re-price expectations. This speaks to a fragile market psychology – one where conviction is low and knee-jerk reactions can overshoot. For active traders, the lesson is to stay nimble and respect technical levels; when fundamental news triggers a break (such as USD/CAD surging on oil news), it often pays to go with the momentum but with an exit plan in case the move reverses just as fast. In short, volatility is back, and with it comes opportunity for the prepared and peril for the complacent.