Today’s forex session unfolded as a rollercoaster driven by political and economic crosswinds. Global markets grappled with trade-war tensions, central bank pivots, and a commodity shock, producing whipsaw moves across USD/JPY, GBP/USD, and USD/CAD. Safe-haven demand buoyed the yen on renewed uncertainty, the pound tried to ride U.S. dollar weakness amid Fed rate-cut bets, and the Canadian dollar sank under collapsing oil prices. In short, Fed dovishness, tariff drama, and an oil plunge conspired to shake up intraday price action across these major pairs.

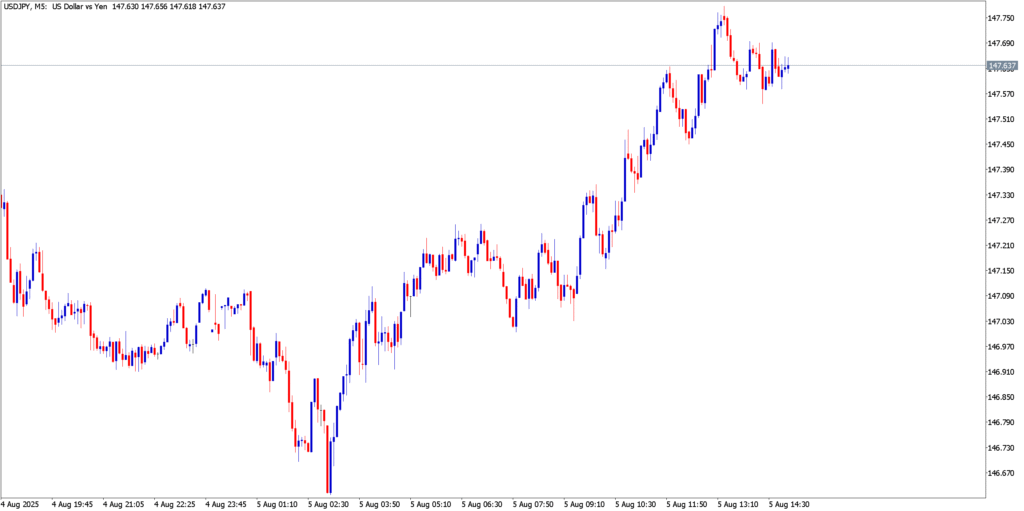

USD/JPY

The dollar-yen started Tuesday on the back foot after a steep slide late last week. A dismal U.S. jobs report on Friday (with Nonfarm Payrolls badly missing forecasts) sparked a dollar sell-off and sent USD/JPY tumbling from roughly ¥150.9 highs to about ¥146.7 by early Tuesday. That drop was exacerbated by safe-haven flows into the yen as global growth jitters flared – from a China slowdown to escalating trade-war fears. Reports that Washington raised tariffs on dozens of countries (even eyeing India over Russian oil purchases) stoked risk aversion. Meanwhile, the Fed’s tone has turned dovish: officials like Mary Daly warned not to “wait too long to lower rates” given softening labor data, reinforcing market bets on a Fed rate cut by September. This cocktail of trade angst and Fed dovishness put the U.S. dollar on the defensive, boosting the yen’s appeal.

Intraday Price Action

In overnight Asia trade, USD/JPY extended its drop, briefly probing the ¥146.70s support zone – around Friday’s post-NFP lows. Notably, sellers failed to break the psychological ¥147.00 barrier, and momentum waned as oversold signals emerged on the M5 chart. A tentative base formed in the mid-147s, and as European trading got underway, the pair staged a rebound. Price action carved out a minor double-bottom near ¥147.00 and climbed back above ¥147.50. Yen strength began to ebb once equity sentiment improved and U.S. Treasury yields ticked up off their lows, helping the dollar trim losses. Intraday rallies, however, repeatedly stalled near ¥148.00, marking that level as immediate resistance that capped the recovery. By mid-session, USD/JPY was gyrating around the mid-147s – well off its lows but still underperforming compared to last week’s highs.

Key Technical Levels

Support held firm at ¥147.00, a level tested twice in 24 hours. A breach below this floor could not materialize on Tuesday, signaling short-term exhaustion of the sell-off. On the upside, ¥148.00 emerged as intraday resistance – a lower high that the rebound failed to overcome. This aligns with the underside of the broken bullish trendline from last month, reinforcing it as a hurdle for any further bounce. Beyond ¥148, bulls would need to contend with ¥148.50 (near Friday’s initial bounce high) to regain confidence.

Market Outlook

The bias remains cautious, with the yen retaining a slight upper hand unless risk sentiment markedly shifts. If risk-off mood deepens again (e.g. more trade-war headlines or growth fears), USD/JPY could retest ¥147.00 and potentially break lower – exposing support in the mid-146s and even ¥145.00 if panic accelerates. Traders are also on watch for any Japanese official jawboning as the pair nears 150; Tokyo has intervened before to curb rapid yen weakness, so the 150.00 zone is a line in the sand. On the flip side, a continued calm or risk-on turn (perhaps if U.S. ISM Services data surprises strong or trade tensions ease) might see USD/JPY consolidate or grind higher. A daily close back above ¥148.50 would relieve immediate bearish pressure, opening the door for a larger rebound toward ¥150. In all, the intraday structure is still fragilely bearish-to-neutral, hinging on the tug-of-war between Fed-driven dollar softness and the ever-present safe-haven demand for yen.

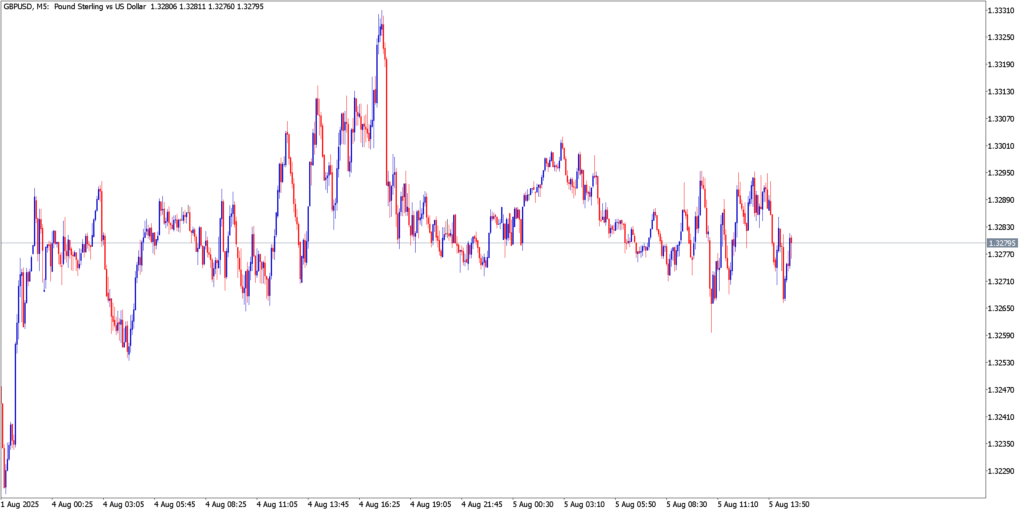

GBP/USD

The British pound has been caught between opposing forces. Late last week, sterling enjoyed a relief rally after the U.S. jobs shock eroded the dollar – GBP/USD surged on Friday but failed to hold above the $1.3300 handle. That momentum carried into Monday as the pair found a floor near $1.3250 and retested 1.3300 when the U.S. dollar remained under broad pressure. A rebound in global equities aided risk sentiment and offered support to the pound. However, sterling’s upside has been checked by domestic factors – chiefly the Bank of England’s shifting stance. Markets are bracing for a BoE interest rate cut at this week’s meeting (the first cut in years) amid signs of a sputtering UK economy. Traders are betting on a 25 bps cut to 4.00% on Thursday, a sharp dovish turn that has tempered the pound’s strength. This policy divergence – with the BoE easing just as the Fed is also tilting dovish – creates a complex push-pull. Sterling enjoys short-term boosts from U.S. dollar weakness, but fears of BoE easing keep those gains in check. Additionally, political stability in the UK (no new Brexit flare-ups or crises) means the pound’s moves are more a macro story now, tied to central bank expectations and risk sentiment rather than local headlines.

Intraday Price Action

On Tuesday, GBP/USD traded in a tight range, reflecting indecision. After Monday’s upswing fizzled at the $1.3330 area, sterling lacked fresh catalysts. In early European trade the pair hovered around $1.3290–1.3300, effectively flat on the day. The 5-minute chart showed consolidation as bulls and bears awaited the next cue – U.S. ISM data or any BoE hints. Technically, Monday’s high near $1.3330 formed a double-top pattern (sterling was repelled twice in that mid-1.33 zone). That level coincides with Friday’s post-NFP spike high, establishing a short-term ceiling for the relief rally. With upside momentum fading, intraday ranges narrowed into Tuesday, suggesting a coil spring before upcoming event risks. On the downside, support around $1.3250 held firm, roughly the area where overnight pullbacks found buyers on Monday. This ~$1.3250 zone – also near the 5-day moving average – has marked a line where dip-buyers stepped in, keeping the intraday bias mildly upward as long as it holds. By midday, GBP/USD was still gravitating near 1.3300, unable to break higher amid a modest USD bounce, but not selling off either – a stalemate ahead of news.

Key Technical Levels

Resistance is clear at $1.3330–1.3350. Sterling bulls need a breach above this band (and the 50-day MA above it) to extend the recovery. Such a move would signal that the pound’s rebound has legs, opening the door to $1.3400+ targets. Until then, the broader trend still looks capped and corrective – GBP/USD remains under a descending trendline from mid-July highs, reflecting a larger downtrend in play. On the support side, $1.3250 is near-term support, with major backstop around $1.3150, the multi-year low from last week. If sterling slips back under 1.3250, it would hint the bounce is faltering and put focus back on those lows.

Market Outlook

Cautious optimism is the tone for sterling. The pound has a tentative positive bias after rebounding off last week’s lows, but traders remain wary. Further gains will require fresh catalysts – possibly upbeat UK data or another bout of U.S. dollar weakness to push GBP/USD through the 1.3350 hurdle. Lacking that, sterling could easily stall and slip back, especially as the weight of central bank divergence (BoE easing vs. Fed pause) may reassert itself. The upcoming Bank of England meeting (Aug 7) is a major wildcard. A cut is expected, but the tone of BoE’s guidance will be pivotal – if Governor Bailey sounds very cautious on growth (dovish), the pound could turn south sharply. Conversely, if the BoE surprises by holding rates or signaling only a one-and-done cut, sterling might find a second wind. On the U.S. side, any signs that Fed rate cuts might not come as quickly (e.g. a strong ISM Services report or hawkish Fed remarks) could boost the dollar broadly and pressure GBP/USD lower. In summary, sterling’s intraday recovery is on fragile footing. A break above $1.3350 is needed to convince of a bullish turnaround, while a drop below $1.3250 would suggest the rebound is fading. With major event risk on the docket, expect choppy moves – the pound’s fate will track each twist in Fed expectations and BoE policy signals in the days ahead.

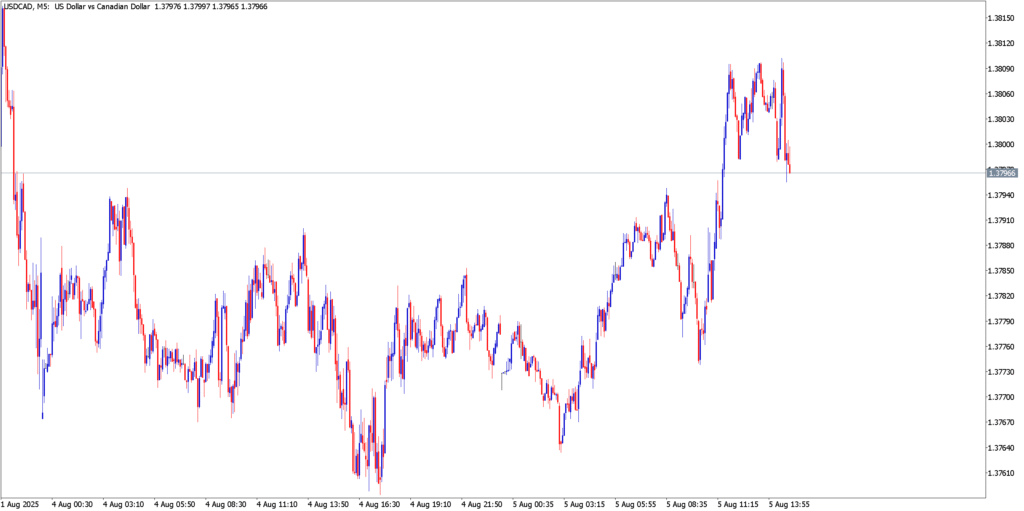

USD/CAD

The Canadian dollar (loonie) has been rocked by a perfect storm of bearish drivers. Chief among them is the crude oil crash – a sudden plunge in oil prices that accelerated into this week. Over the weekend, an unexpected OPEC+ supply boost of +547k barrels/day hit the wires, just as data showed weakening demand from China. This one-two punch knocked oil down over 4% since Friday, with Brent briefly trading in the high-$60s per barrel (multi-month lows). By Tuesday, crude was hovering near $65, continuing its slide. As Canada’s main export, oil’s collapse directly undercut the loonie, which often moves in tandem with crude. Also weighing on CAD was soft domestic news: last Friday’s report that Canada’s GDP contracted in the latest month, adding pressure on the Bank of Canada to stay accommodative. To top it off, safe-haven flows into the U.S. dollar (during Monday’s risk-off wave) and U.S.-Canada trade tensions (the U.S. has reportedly slapped new tariffs affecting Canada) created an ugly backdrop for the loonie. In essence, the market is repricing for a scenario of lower oil revenue, a dovish BoC, and potential trade friction, which propelled USD/CAD higher. Notably, the U.S. dollar itself was only moderately stronger – Fed rate-cut speculation has limited USD’s recovery – but the Canadian dollar’s weakness made the difference.

Intraday Price Action

After Monday’s oil-induced surge, USD/CAD entered Tuesday in consolidation just above 1.3800. In Asian hours, the pair actually dipped slightly (CAD saw a small bounce as oil steadied), but found support around C$1.3760–1.3780 – roughly the area of Friday’s lows and Monday’s breakout point. With oil prices sliding anew and risk sentiment still cautious, USD/CAD soon resumed its climb. By mid-European session, the pair was testing highs above the 1.3800 mark again. The bulls pushed the price up to ~1.3820, but encountered selling near that level, which was close to Monday’s intraday peak. On the 5-minute chart, upward momentum prevailed into the U.S. morning as each shallow dip was bought. The pair printed a series of higher lows and higher highs intraday, indicative of a strong short-term uptrend following Monday’s reversal. Technical indicators confirm the bullish bias – USD/CAD remained above its intraday moving averages, and the M5/M15 RSI hovered in positive territory (signifying persistent demand). By mid-day, the rally appeared to pause just ahead of the 1.3880 area – notable as last week’s high. In effect, USD/CAD has retraced most of its late-July decline, but has not yet broken out to new highs.

Key Technical Levels

The 1.3800 handle is now a pivot – trading above it bolsters the bull case. On an intraday basis, initial support lies around 1.3760–1.3780 (the day’s base and Friday’s low). A drop back below 1.3760 would mark a loss of upside momentum. Below that, the 1.3700–1.3750 zone is a broader support band containing last week’s lows. As for resistance, 1.3880 is the immediate ceiling, as it represents the peak from late last week and roughly coincides with the 200-day EMA just under 1.3900. This 1.3880-1.3900 region is a critical hurdle – a clear break above it would mark a bullish breakout to multi-month highs, likely accelerating momentum. Beyond 1.3900, the next psychological level is 1.4000, but traders will also eye 1.3920 (an interim technical level from early July). On the downside, any pullback that stays above 1.3750 preserves the bullish intraday structure, whereas a failure of 1.3700 would indicate the oil-shock boost is fading.

Market Outlook

The path of least resistance for now appears upward for USD/CAD, unless the key drivers reverse. The Canadian dollar’s fate is tied to oil, so all eyes are on whether this oil selloff is a brief blip or the start of a deeper slide. If crude prices keep sinking or even just languish at lows, the loonie will likely remain under pressure, making a USD/CAD break above 1.3900 more probable. In that event, bulls could target the mid-1.40s in the coming weeks. Another factor is global risk sentiment – any resurgence of risk-off (e.g. equity wobble, geopolitical flare) tends to hurt growth-sensitive currencies like CAD while aiding USD. Conversely, should we see a sharp rebound in oil (perhaps on OPEC intervention talk or a positive demand surprise), the Canadian dollar could find its footing and send USD/CAD back down. A stabilization of oil above $70 would likely cap USD/CAD below the 1.3900 threshold. We also have Canadian employment data due Friday, which could sway the BoC outlook; a strong jobs report might lend CAD some support, whereas weak numbers would reinforce the dovish narrative. Moreover, any signals from the Bank of Canada – officials hinting at policy stance – will be key. So far, the bias is that BoC will hold or even ease if growth wobbles, which is another headwind for CAD. In summary, near-term risks are skewed toward USD/CAD strength unless we get a quick recovery in oil or a notable improvement in risk appetite. Traders should watch the 1.3900 pivot on the upside and 1.3750 on the downside as decision points. With the loonie reeling, the U.S. dollar riding a modest comeback, and central banks in flux, volatility is back – offering opportunity but demanding vigilance in this climate of rapid-fire narrative shifts