Thursday’s inflation shock has currency markets reeling: U.S. wholesale prices saw their sharpest jump in years, upending the “done deal” of a Fed rate cut and boosting Treasury yields and the dollar. Meanwhile, Japan’s yen is finding footing after a surprise return to growth in Q2, stoking speculation of a Bank of Japan pivot. From safe-haven flows into the yen to pressure on risk-sensitive currencies, the forex landscape is on edge. Traders are also bracing for a high-profile U.S.–Russia meeting, adding geopolitical tension to an already volatile mix. It’s a pivotal end to the week, with sentiment torn between inflation anxieties and cautious optimism about global stability.

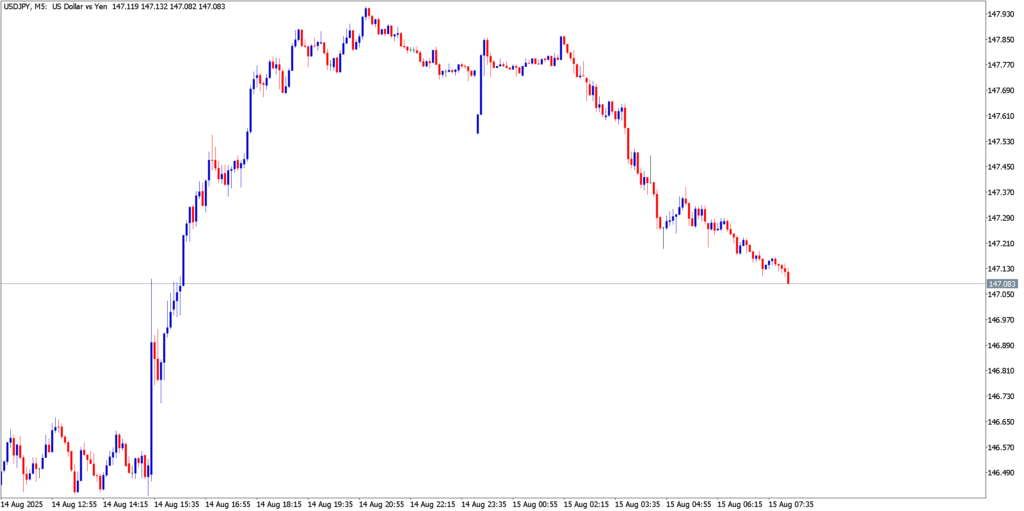

USD/JPY

Technicals in Focus

USD/JPY bulls pushed the pair to a 5-month high near ¥147.90 after a surprise surge in U.S. PPI sparked a broad dollar rally. The pair then pulled back toward ¥147.00 overnight as the yen regained strength on strong Japanese GDP data (Q2 growth 0.3% vs. 0.1% exp.). Despite this dip, the short-term uptrend remains intact – prices are still trading above prior intraday lows, and momentum indicators show only a modest cooling. The M5 MACD histogram, while positive, is ticking down as the recent pullback slows bullish momentum. The Stochastic oscillator has rolled out of overbought territory, and RSI has retreated from above 70 to the mid-50s, indicating the rally is pausing but not yet reversing. Key resistance lies at the ¥148.00 psychological level (recent peak), while immediate support is seen around ¥147.00 (former breakout level) followed by ¥146.50 should a deeper correction unfold.

Trading Strategy

- Bullish: A potential long setup could emerge on dips into the ¥146.80–147.20 support zone. If the pair stabilizes here, buyers may target a rebound to ¥148.00, with an extension toward ¥148.50 if upside momentum returns. A stop-loss tucked below ¥146.40 (just under this week’s swing low) protects against a deeper yen rally.

- Bearish: For a short setup, look for any rally failing near ¥147.80–148.00 resistance. A rejection in that zone could invite sellers, aiming for a pullback to ¥147.00 and ¥146.50. A stop-loss above ¥148.30 (beyond the recent high) would cap risk on a bearish trade.

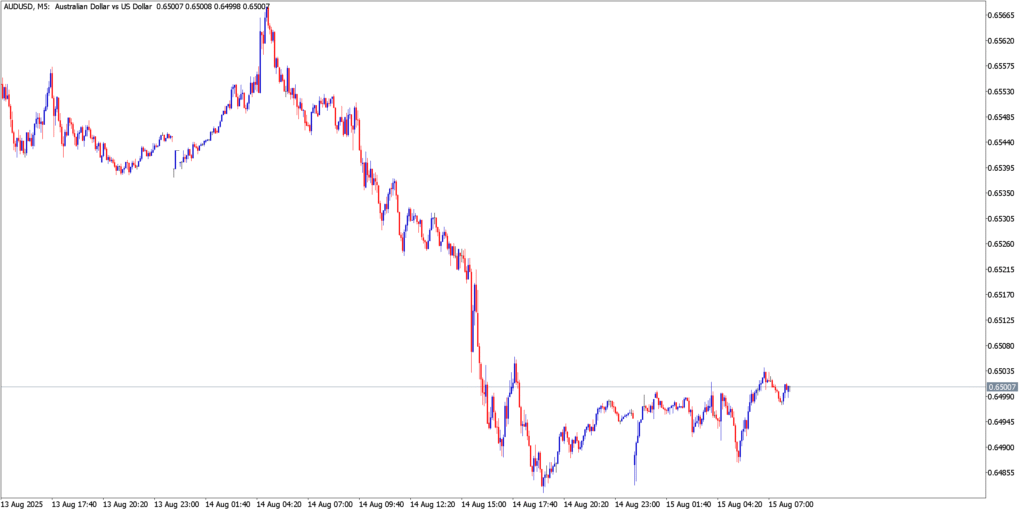

AUD/USD

Technicals in Focus

AUD/USD’s relief bounce early Thursday was short-lived. The pair initially spiked toward $0.6560 on in-line Australian jobs data, but upside momentum faltered as the Aussie underperformed amid a broad USD rebound. The 5-minute chart shows a sharp reversal into a downtrend, with a slide to a 2-week low around $0.6485 before a modest bounce to the $0.6500 area. The bias remains bearish in the intraday term – the MACD on M5 is below the zero line, confirming downward momentum, though its histogram is starting to contract as selling pressure eases. The Stochastic oscillator has been lingering in oversold territory and is just beginning to curl higher, hinting at possible base-building. Similarly, RSI dipped under 30 at the lows and has crept back toward 40, indicating deeply oversold conditions are moderating. Immediate resistance is now around $0.6530–$0.6550 (recent support-turned-resistance and the midpoint of Thursday’s drop). On the downside, the $0.6480 low is key support; a clean break below that could open the door to the $0.6450 zone.

Trading Strategy

- Bullish: Contrarian bulls may watch for a double-bottom or basing pattern near $0.6480 support. A long position on a clear bounce off this floor could target a recovery to $0.6550, with a stretch goal of $0.6580 if momentum improves. A stop-loss under $0.6450 is prudent, given that a break of support would invalidate the rebound scenario.

- Bearish: The prevailing trend favors selling into strength. A short entry around $0.6550–$0.6560 (the prior swing high) is attractive if the rally stalls. Bears would eye a retreat back to $0.6480 and possibly new lows. A stop-loss above $0.6600 (just beyond a major round number and Thursday’s high) contains the risk in case of a bullish surprise.

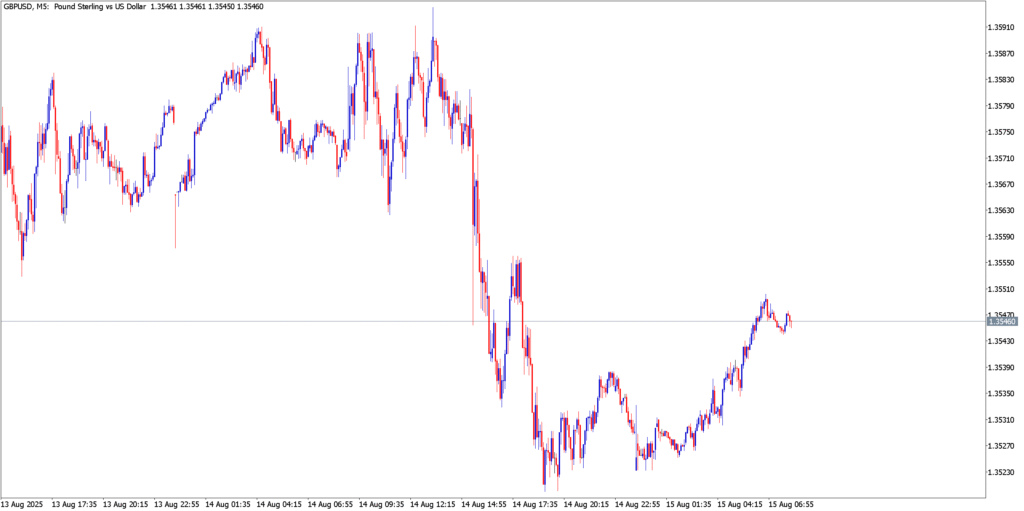

GBP/USD

Technicals in Focus

GBP/USD failed to sustain its mid-week rally, rejecting the 1.3600 handle as U.S. inflation headlines boosted the dollar late Thursday. After peaking near $1.3590, the pair sold off about 70 pips, finding support around $1.3520 despite Britain’s upbeat GDP report (Q2 +0.3% QoQ vs. 0.1% forecast). This pullback keeps the short-term range intact – sterling’s uptrend paused at resistance, but no major breakdown occurred as buyers defended the $1.3500 area. Momentum indicators reflect this cooling: the M5 MACD has dipped slightly below its signal line, and the Stochastic oscillator bounced out of oversold after Thursday’s drop, suggesting limited downside follow-through so far. RSI on the 5-min chart recovered from the low-30s back to around 50, indicating momentum is neutralizing. Resistance remains firm at $1.3590–1.3600 (a double-top region and psychological level). A move above that would signal a bullish continuation. On the downside, $1.3520 is immediate support (overnight low), with a stronger floor at the $1.3500 round figure – a level that, if broken, could accelerate declines toward $1.3450.

Trading Strategy

- Bullish: With UK data surprising to the upside, bulls may look to buy dips into the $1.3500–1.3520 zone. A long position in this support region, if reinforced by a stabilizing RSI, could target a rebound to $1.3600. A breakout above $1.3600 would aim for the next resistance around $1.3650. It’s wise to place a stop-loss below $1.3470 to guard against a deeper pullback that breaches the week’s support.

- Bearish: Conversely, if GBP/USD’s bounce fades under $1.3590, bears may step in. A short entry near $1.3580 (previous high) can ride a potential slide back to $1.3520, with an extended target at $1.3500. A stop-loss just above $1.3620 will cap the risk, in case sterling strength re-emerges and breaks the recent highs.

Market Outlook

- USD: The U.S. Dollar faces a crossroads as traders digest mixed signals. On one hand, the blowout PPI and firm job market data have tempered hopes for aggressive Fed easing. Markets still overwhelmingly expect a 25 bp Fed rate cut on September 17 (about a 90% probability priced in), but bets on deeper cuts this year have been pared back. Friday’s U.S. data — including retail sales and the Michigan consumer sentiment survey — will be pivotal in confirming the consumer’s resilience. Any upside surprise in spending or sentiment could further challenge the dovish narrative, while soft numbers would reinforce rate-cut expectations. Beyond data, the Trump-Putin summit could sway broader risk appetite: any reduction in geopolitical tensions may undermine demand for the safe-haven dollar, whereas disappointment or discord could do the opposite.

- JPY: The Japanese Yen has a newfound bid thanks to Japan’s return to growth. The stronger-than-expected GDP is fueling talk that the Bank of Japan might finally inch toward policy normalization. Speculation is growing that the BoJ could consider a rate hike or tweak its ultra-easy stance if inflation remains elevated. So far, BoJ officials (like Governor Ueda) remain cautious, but traders will be closely watching Japan’s upcoming CPI release and any hints of hawkishness. In the meantime, the yen will take cues from global risk sentiment – it tends to strengthen if equity market volatility rises or if the U.S.–Russia meeting heightens uncertainty. With Treasury yields still elevated post-PPI, USD/JPY may stay buoyant, but any further signs of BoJ tightening (or a slide in U.S. yields) could ignite a more durable yen rally.

- GBP: The British Pound enters next week on a slightly back foot, but the UK’s economic backdrop is showing resilience. The surprisingly robust UK GDP data for Q2 (and June) eased fears of stagnation, even if the Bank of England views the strength with skepticism. The BoE has signaled caution and is not in a rush to cut rates; indeed, markets are pricing in only roughly 15 bps of BoE rate cuts by year-end. In contrast, the Fed is expected to ease more, which could eventually favor GBP if those trajectories hold. Near term, sterling traders will focus on UK inflation (CPI) figures and consumer spending data to gauge if price pressures are easing enough for the BoE to consider policy relief. Headline UK inflation is still above target, so any upside surprise there could revive bets on the BoE holding rates higher for longer – a supportive factor for the pound. Political noise (Brexit deal tweaks or fiscal news) appears on the backburner for now, leaving monetary policy expectations as the prime driver for GBP/USD in the days ahead.

- AUD: The Australian Dollar remains vulnerable after this week’s dovish turn by the Reserve Bank of Australia. The RBA cut rates by 25 bps on August 12 to 3.60%, citing moderating inflation back toward the 2–3% band. With Australia now in easing mode, markets suspect further gradual rate reductions could follow if growth or inflation data disappoint. This policy bias is likely to cap Aussie dollar rallies. Additionally, traders will be monitoring China’s economic signals closely – as Australia’s largest trading partner, any signs of slowdown in Chinese output, demand, or credit growth tend to weigh on AUD. On the flip side, if upcoming Chinese data or commodity prices show improvement, the Aussie could find some relief. Domestically, attention turns to Australia’s jobs report and retail sales in the coming weeks for clues on economic momentum. Overall, with the Fed’s path uncertain and global risk sentiment in flux, AUD is expected to trade on the defensive; it may lag on any market rallies and fall further if risk-off mood or weak data persists.