Thursday’s session saw major currencies trading cautiously amid a slew of data and looming central bank cues. Flash PMI readings in Europe and the UK came in weaker than expected, underscoring growth worries. New Zealand’s dollar slumped after a surprisingly dovish 25bp RBNZ rate cut and a record trade deficit. The euro found some support from upbeat geopolitics (talks of a Ukraine–Russia peace summit), while traders braced for Fed Chair Powell’s Jackson Hole speech on Friday. Overall the tone was muted, with markets consolidating into the weekend on central bank uncertainty.

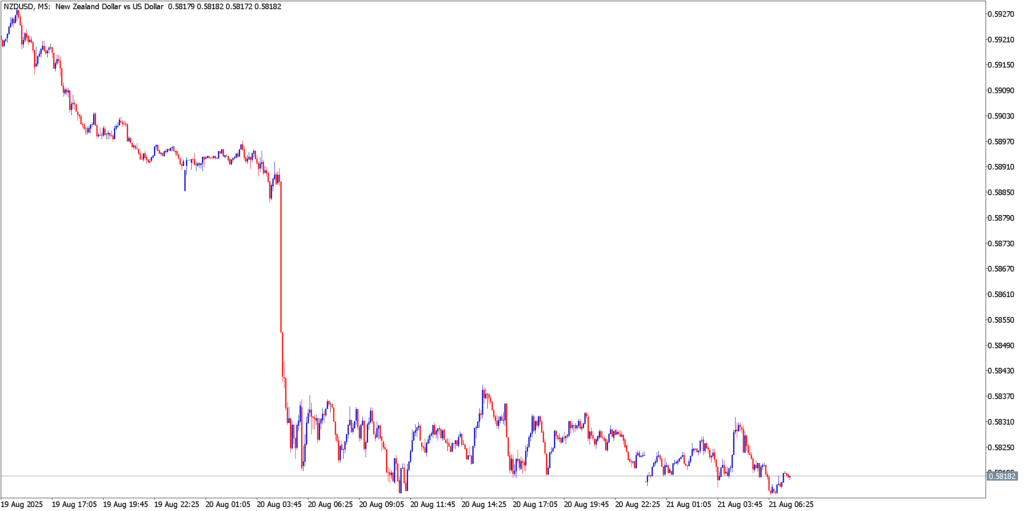

NZD/USD

Technicals in Focus

NZD/USD is in a clear downtrend after the RBNZ’s dovish 25bp cut on Aug 20. The 5-minute chart shows the pair plunging toward the 0.5815–0.5800 zone (around the 200‑DMA and lower channel boundary). Indicators reinforce the slide: RSI is deeply oversold and Stochastics are near cycle lows. Immediate resistance is now near 0.5900–0.5930 (recent consolidation high and mid-channel), with key support at 0.5815/0.5800 and then 0.5750. A break of 0.5800 could extend the decline, while a rebound off support could see a pullback.

Trading Strategy

- Bullish: Long above ~0.5830 (e.g. on a break above 0.5835) targeting 0.5900–0.5950 (next resistance zone). Place stops just under 0.5790 (below recent lows).

- Bearish: Short below 0.5800 targeting 0.5750 then 0.5700. Use a stop above 0.5830 to cap risk.

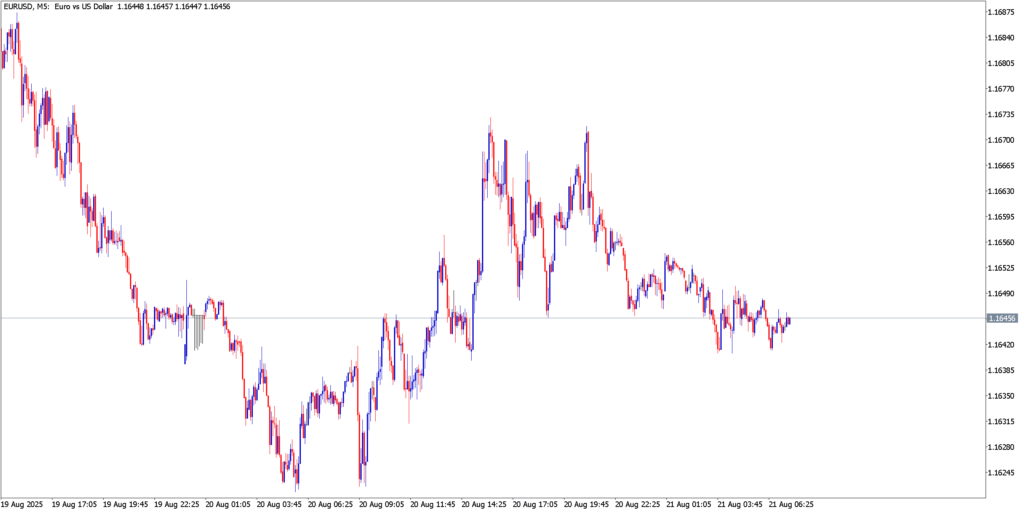

EUR/USD

Technicals in Focus

EUR/USD has stalled near 1.1640 after recent losses. On the short-term chart, price is trapped between support ~1.1640 (near the 20-/50-day moving averages) and resistance at 1.1700 (last swing high). Momentum is neutral-to-bearish: RSI is flattening around 50 (losing bullish momentum) and MACD is near zero. Key resistance stands at 1.1700–1.1788 (July highs), while support lies at ~1.1640 and 1.1600 (near the 20/50-day SMA and historical floor). In this range, additional consolidations are likely unless volatility spikes into Jackson Hole.

Trading Strategy

- Bullish: Buy above 1.1700, targeting 1.1788–1.1800 (prior highs). Place a stop just below 1.1680.

- Bearish: Sell on a break below ~1.1640, aiming for 1.1600 then lower (1.1600 area was prior support). Risk should be managed with a stop above 1.1675 (just above the recent high).

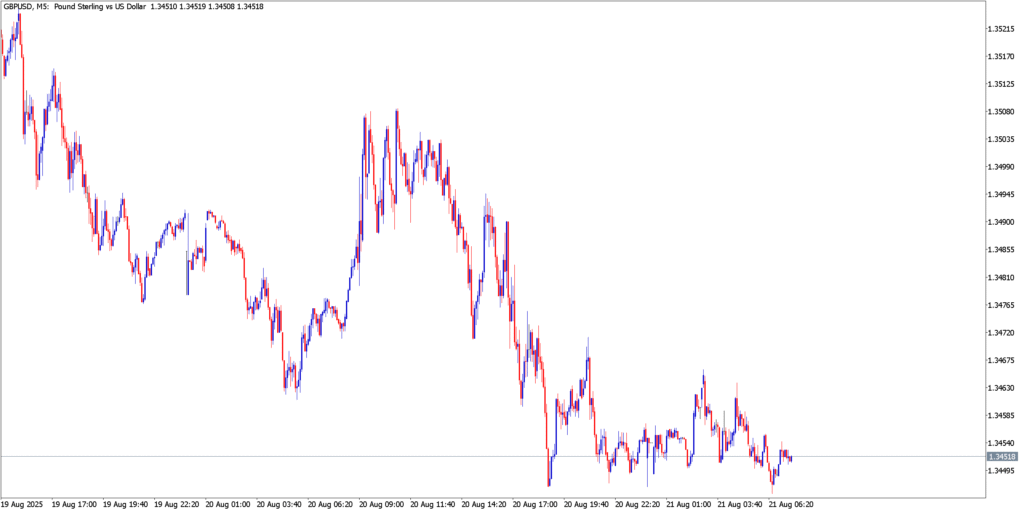

GBP/USD

Technicals in Focus

Cable has been under pressure, sliding from last week’s 1.3594 peak into the 1.3450 area. It trades below the daily pivot of 1.3500 and is pressing the first support (S1) at 1.3469. The short-term trend is down, with RSI and MACD signaling bearish momentum. Resistance sits at the 1.3500–1.3522 zone (daily pivot/R1) and then 1.3594 (recent top). On the downside, next support is around 1.3400–1.3398. Overall, GBP/USD looks rangebound-to-bearish until it clears these levels.

Trading Strategy

- Bullish: Go long on a move above 1.3500, targeting 1.3594 (recent high). Use a stop below ~1.3470 (just under the pivot).

- Bearish: Short below 1.3469, aiming for 1.3400 then 1.3398 support. Set a stop above 1.3510 to limit risk.

Market Outlook

- United States: All eyes are on Fed Chair Powell’s Jackson Hole speech (Friday) for clues on the timing of rate cuts. Thursday’s US data were mixed – jobless claims ticked up to 227K and Philly Fed fell to 8.1, reinforcing a cooling economy. Flash US PMIs (Aug) are due and could sway USD short-term. Treasury yields and the DXY have held firm ahead of Powell, but any hawkish hint could lift the dollar.

- Eurozone: Flash PMIs out Thursday showed stagnation (Eurozone manufacturing 49.5, services 50.6), suggesting very modest growth. With inflation slowing, the ECB is expected to hold rates at its September meeting. In the absence of big news, the EUR will likely track risk sentiment and Fed divergence. Geopolitical developments (Ukraine talks) remain a wildcard for EUR direction.

- United Kingdom: UK CPI surprised higher at 3.8% in July, pressuring the BoE to stay cautious despite having cut rates in early August. The MPC signaled that further rate cuts may slow if inflation remains elevated. Flash PMIs on Thursday (manufacturing at 48.3, services 52.0) and Friday’s retail sales will be watched, but unless data diverge sharply, GBP moves may be limited. BoE commentary this week emphasized inflation risk, which should keep sterling supported in downtrend scenarios.

- New Zealand: NZD outlook is soft. The RBNZ cut its OCR to 3.00% on Aug 20 flagging a “stalling” economy and softer inflation expectations. Analysts now see additional 25bp cuts in Oct/Nov as growth lags. The surprise trade deficit (-NZ$578M vs +NZ$70M forecast) adds to headwinds. Unless China demand picks up, NZD is likely to remain under pressure on dovish RBNZ outlook and weak data.

In summary, traders will navigate thin ranges and event risk ahead of Jackson Hole. Mixed PMI data and dovish central banks have kept USD, GBP, NZD and EUR near recent levels. The potential for surprise in key releases (PMIs, inflation) or speeches (Powell) means setups must carefully manage stops. In this climate, watch Fed/ECB divergence and geopolitical headlines as catalysts for volatile FX moves next week