Global FX markets are bracing for another volatile session as central bank rhetoric, weak European data, and sliding oil prices collide with U.S. dollar strength. The Fed’s cautious signals on rate cuts continue to underpin the greenback, while the euro struggles on sour German sentiment, sterling wrestles with slowing growth and hawkish BoE voices, and the loonie battles soft oil and a freshly dovish Bank of Canada. With traders eyeing upcoming U.S. GDP and PCE inflation, the stage is set for sharp swings across major pairs.

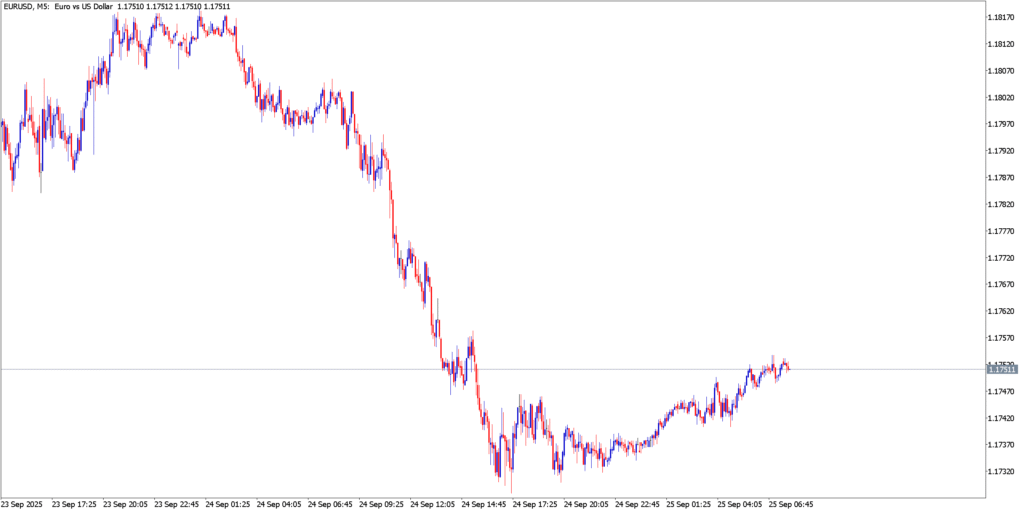

EUR/USD

The euro opened under pressure as weak German sentiment and Fed caution weighed on EUR/USD. German business morale (Ifo index) unexpectedly fell to 87.7 in September, sapping confidence in the euro-zone recovery and contributing to a drop in EUR/USD to about $1.173 (down ~0.7% overnight). Meanwhile U.S. Fed speakers (e.g. Daly) signaled more rate cuts ahead (though timing is uncertain), keeping the dollar firm as a safe-haven. The ECB has held rates at 2% this month and markets largely see it as done with easing, but policymakers warned that a too-strong euro could force a renewed rate cut. In fact, ECB officials note that a rapid euro rally would further depress inflation, suggesting the central bank has a “contingency cut” ready. This dynamic – firmer dollar, tepid EU growth – explains the recent EUR/USD slide and the risk of further swings.

Key factors: German Ifo business climate fell short (87.7 vs 89+ expected); ECB on hold but agile on cuts if the euro soars; Fed’s cautious stance has bolstered USD safe-haven flows.

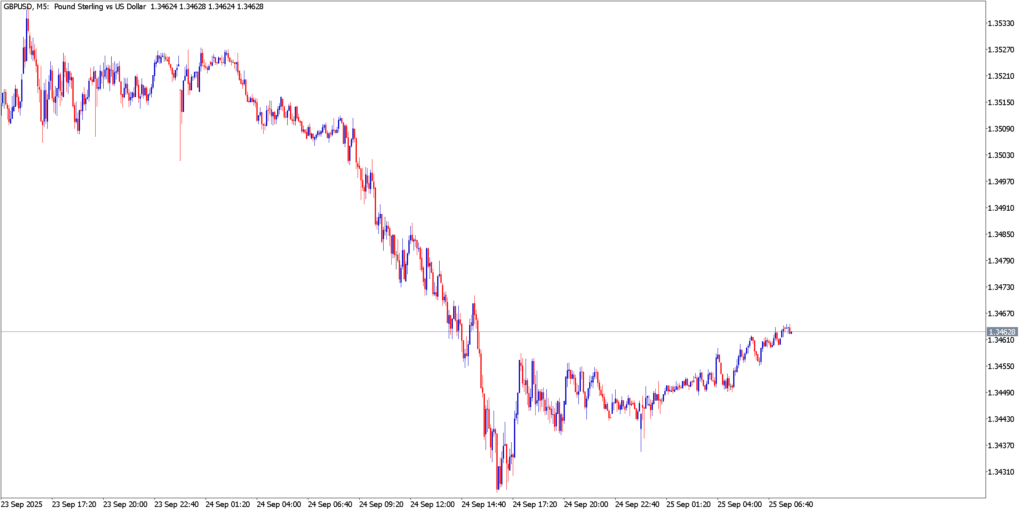

GBP/USD

The pound traded lower as UK data disappointed and BoE hawks kept a tight grip on policy. Wednesday’s flash PMI showed UK services growth slowing sharply (services PMI 51.9 vs 54.2 in August), reinforcing fears of a loss of momentum. Sterling briefly fell on the report (GBP/USD around 1.3450), reflecting a risk-off market mood that lifted the dollar. In speeches, BoE policymaker Megan Greene cautioned against early rate cuts, citing upside inflation risks. With UK inflation still the highest in the G7 (3.8% in August) and service-sector price pressures persistent, she stressed a “cautious approach to rate cuts” going forward. In short, GBP/USD is grappling with domestic growth fears on one side and lingering BoE hawkishness on the other – a combination that has kept Sterling on the defensive amid global dollar strength.

Key factors: UK services PMI fell more than expected, denting growth outlook; BoE’s Greene and other hawks signaled delaying rate cuts (inflation risks skewed high); USD safe-haven demand (Fed policy uncertainty) pressured GBP.

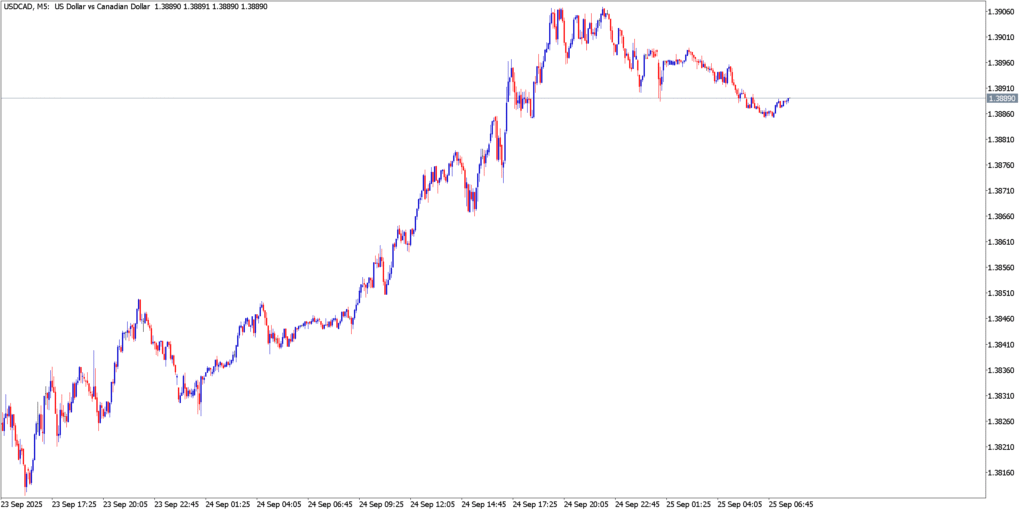

USD/CAD

The U.S. dollar remained firm against the Canadian dollar, keeping USD/CAD near multi-week highs (~1.38–1.39). Earlier this week the Bank of Canada cut its policy rate to 2.5% (first cut since March) citing weak growth, high unemployment and trade uncertainties. Canada’s economy has been hit by U.S. and Chinese tariffs on commodities, a jobs market that shed over 100,000 positions, and sluggish price pressures. These factors prompted Governor Macklem to insist Canada must follow “a more independent path” than the Fed, implying further BoC easing ahead. Meanwhile oil – Canada’s key export – has been trading below prior highs. Brent crude is near $69/bbl (around a two-month low), amid rising OPEC+ output and signs of building global supply. With oil subdued, the loonie’s support is fragile. The net result is a stronger USD/CAD: the pair briefly paused a 3-day rally (around 1.3890) as the dollar retraced slightly, but underlying forces (low oil, BoC bias) leave CAD vulnerable. Traders will watch upcoming Canada GDP and U.S. growth/PCE data for further direction.

Key factors: BoC cut to 2.5% on Sept 17 as tariffs and weak jobs dent growth; Brent oil trades in upper-$60s (well below summer peaks), keeping CAD under pressure; Fed/dollar strength and political risks (US budget talks) also boost USD demand.

Market Outlook

Looking ahead, volatility remains the name of the game. For EUR/USD, soft euro-zone data and an ECB on high alert for currency strength keep the downside bias intact. GBP/USD faces pressure from sluggish services activity even as the BoE leans hawkish, a mix that could trap sterling in choppy ranges. Meanwhile, USD/CAD’s fate hinges on whether oil can stabilize; if crude remains soft, the loonie may extend losses under a more dovish BoC. All eyes now turn to U.S. GDP and PCE releases – potential catalysts that could either reinforce the dollar’s dominance or spark a long-overdue pullback. Traders should stay nimble: sudden spikes in volatility remain highly likely.