Traders woke up to a brewing storm. Global central bankers are on edge after the U.S. Fed’s independence was publicly challenged – President Trump’s surprise firing of Fed Governor Lisa Cook has sparked fears of political interference. These Fed jitters added to rising inflation worries and trade tensions, fueling wild swings in FX markets. In this environment, even mundane data can trigger big moves. Tuesday’s headlines ranged from stubborn inflation in Japan to hints of more rate cuts down under, all while oil and gold ripped higher on the uncertainty.

- Fed Independence Fear: Trump’s unprecedented move on Monday (firing Fed Governor Cook) sent the dollar reeling. Central banks now worry U.S. policy may be “politically motivated,” shaking markets worldwide.

- Trade & Inflation Jitters: Renewed talk of U.S. tariffs stoked global inflation fears. European stocks slipped on news of new tariff threats and rising price pressures. Precious metals rallied (gold hit a 2-week high) while oil softened (Brent fell ~1.6%).

- US Data Surprises: U.S. Durable Goods orders fell 2.8% in July – a much smaller drop than the -3.8% consensus. Core capital goods orders actually jumped +1.1%. CB Consumer Confidence was 97.4 (above the 96.4 forecast), and the Atlanta Fed trimmed Q3 GDPNow to 2.2% (from 2.3%). These “surprises” were modest but underlined a mixed economic picture.

- Asia Focus: Japan’s core CPI slowed unexpectedly to 2.0% YoY (vs. 2.4% expected), signaling easing inflation pressure. RBA minutes (late Tuesday local time) confirmed policymakers want more rate cuts to hit their 2–3% inflation target, keeping the AUD trapped in a tight range.

- Key Takeaway: In short, markets are on edge. Fed and central-bank politics dominate sentiment, so even solid U.S. data only momentarily buoyed the dollar. Oil’s reversal (down ~1.6%) bolstered commodity currencies. The result: wild intra-day reversals in EUR/USD and AUD/USD, and a sudden USD/CAD slide.

Economic Data & News Recap

Tuesday’s calendar was packed, but nothing changed the narrative. U.S. Durable Goods (July) fell 2.8% MoM, far better than the -3.8% consensus. Core orders jumped +1.1% (suggesting underlying investment strength). Consumer Confidence came in at 97.4 (versus 96.4 expected), a modest beat but still below July’s 98.7. The Atlanta Fed’s GDPNow Q3 estimate was cut to 2.2%, slightly trimming growth hopes. In Asia, Japan’s core CPI cooled to 2.0% YoY (compared to a 2.4% forecast, hinting that BOJ inflation is ebbing. Overall, data were roughly inline or a touch better, but Fed political drama and global risk trends overrode any bullish USD effect.

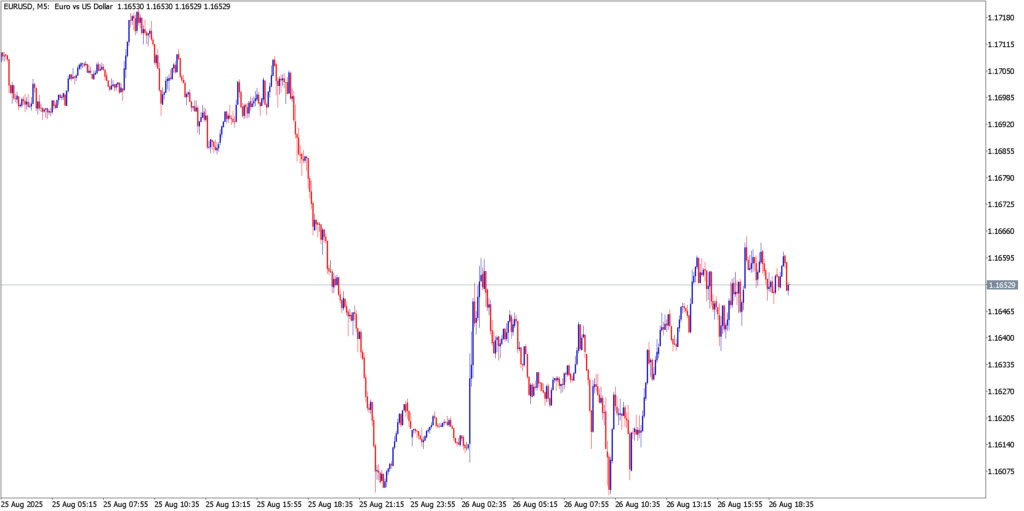

EUR/USD

The euro traded choppily all day. EUR/USD was near 1.1625 early in Europe, then slipped to the day’s lows (~1.1580) into the U.S. morning, likely on a brief USD bid from the relatively upbeat durable-goods report. However, a massive Asian-session bounce (around 02:30 GMT) reversed those losses, lifting EUR/USD to ~1.1650. This spike aligns with continuing risk flows on Fed independence fears. Technically, the pair has been trading at its 20-day EMA (around 1.164) and probing support near 1.1620. In other words, EUR/USD shows no clear trend – it’s rangebound between ~1.1585 and 1.1679 (the next fibo resistance) as traders flip between dollar pulls and pushes.

The net result is a “mixed trend” scenario. After dropping below 1.1590, EUR/USD quickly reversed to the mid-1.16s. The day’s swings likely reflect newsflow: solid US orders boosted the dollar mid-session (pressuring EUR), but later on, mounting Fed turmoil revived the euro. Heading into Wed, support is eyed near 1.1620–1.1580, with resistance near 1.1670–1.1740. Traders will watch if EUR/USD can hold above the former; a break higher could target the old July high at 1.1830.

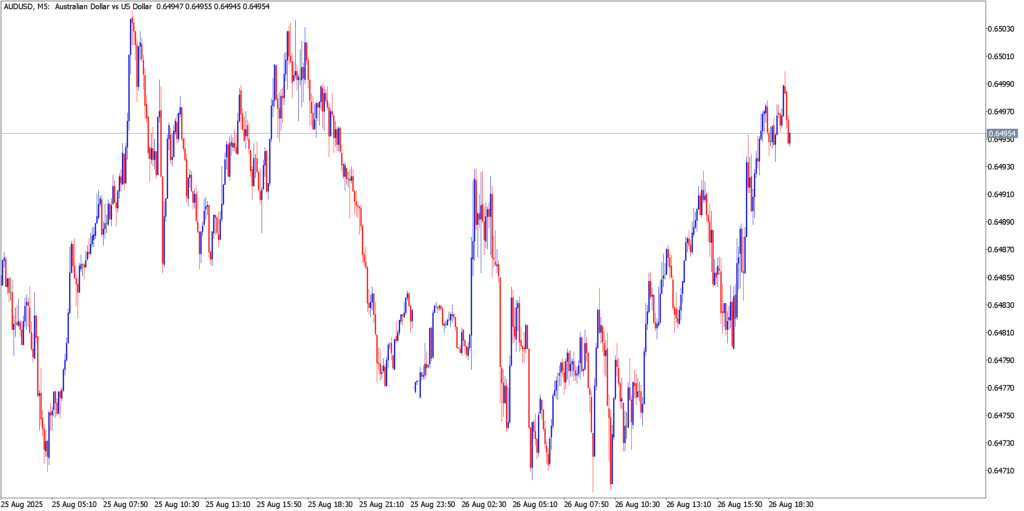

AUD/USD

The Aussie similarly saw a seesaw day. AUD/USD opened around 0.6480 and briefly rallied towards 0.6500, but then sold off into mid-Australian-session lows near 0.6470. In the late session (Asia on Wed), it bounced back toward 0.6495. This tight trading range matches commentary that AUD/USD “moved in a narrow range” as traders parsed the RBA’s dovish minutes and U.S. turmoil.

Intra-day, the swings appear tied to the same forces as EUR/USD. The early drop may reflect a pick-up in USD and a dip in commodity demand on global risk aversion (oil was lower on Tue). The late rally mirrors the euro’s: USD weakness after Fed news gave AUD a lift. Key technical levels are around 0.6470 support and 0.6517 resistance (the 38% fib from Aug 20). Until the RBA minutes or U.S. news shifts sentiment, expect the pair to oscillate in this range. Traders will note if AUD/USD can break above ~0.6515–0.6520 (targeting the upper Bollinger Band near 0.6590) or if a break below 0.6470 exposes 0.6400 support.

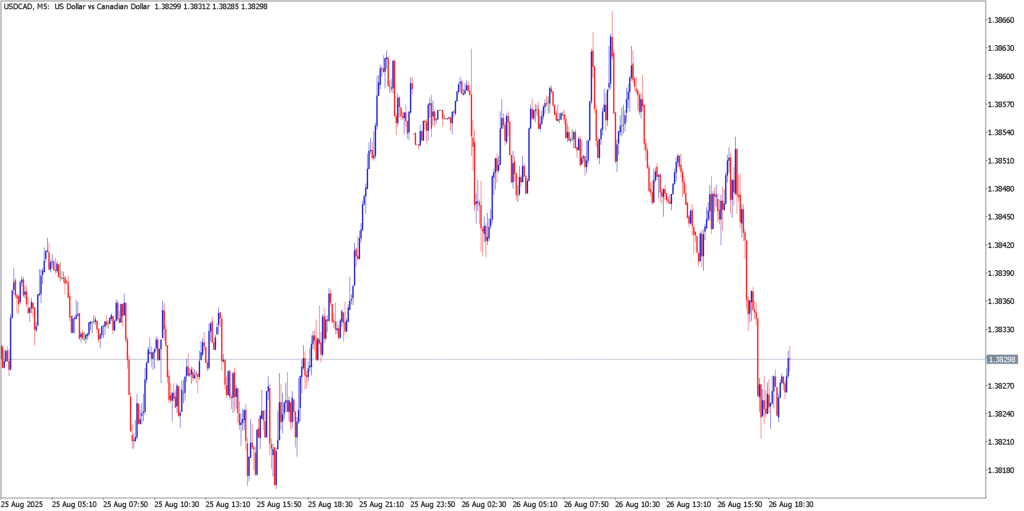

USD/CAD

USD/CAD moved counter to the above pairs. Early Tuesday saw the greenback rallying (USD/CAD up) into the mid-1.3860s on profit-taking in CAD. However, around late U.S. hours it collapsed, tumbling below 1.3820 by end of session. This “sharp fall after a rally” reflects a quick unwind of the dollar squeeze. The timing aligns with commodities – oil prices turned down, which strengthens oil-linked CAD – and a broad USD pullback. In effect, the brief USD rally (perhaps on robust data) gave way to profit-taking and commodity-backed CAD strength.

Technically, USD/CAD’s late drop broke the intraday uptrend line. Key near-term support lies around 1.3810–1.3800; a sustained move below could target the 1.3760 area. On the upside, initial resistance is ~1.3860 (the prior high). For now, traders note that oil (Brent) slid ~1.6% on Tuesday, which tends to pressure USD/CAD lower. Unless oil reverses or U.S. data radically shifts, expect USD/CAD to test 1.3810-1.3800 support after this pullback.

Conclusion

Tuesday’s FX action was anything but dull. Mixed technical patterns – intraday reversals in EUR/USD and AUD/USD, and a USD/CAD squeeze-then-dump – underscore how big-picture themes are driving flows. In short: the dollar was under pressure. Fed controversy and risk sentiment changes repeatedly dominated Tuesday’s moves. US economic releases (Durables and Confidence) beat forecasts but only briefly lifted USD. Meanwhile, Japan’s cooling inflation and hints of more RBA easing kept the yen and aussie in check. Commodity shifts (oil down, gold up) also played a key role.

Traders should brace for continued volatility. Dollar moves now depend more on political drama and Fed signals than on routine data. Support and resistance levels noted above will be critical; watch whether EUR/USD and AUD/USD can hold their mid-day swings, and if USD/CAD tests sub-1.38. Upcoming Fed comments and any new trade/inflation news will be key catalysts. The day’s action reinforces that in today’s markets, “all-cash” headlines – from Fed independence to international tensions – can blow up any trend.