A cautious yet excited mood grips the forex market as a new week begins. Traders are grappling with a mix of slowing economic momentum and shifting central bank policies. Signs of cooling growth – like a surprisingly sharp drop in U.S. service-sector PMI to 53.3 in August (flash) from 55.7 – collide with still-stubborn inflation in some regions. This “push-pull” dynamic has set the tone: markets are torn between hopes of central bank relief and fears of economic stagnation. Geopolitical calm has allowed focus to return squarely to economics, with inflation trends and rate decisions in the spotlight.

Adding to the intrigue, central banks are on the cusp of potential pivots. New Zealand is expected to cut rates this week to prop up its flagging economy, even as core inflation there remains above target. In contrast, the U.S. Federal Reserve is projecting a steadfast front – July’s softer CPI gave doves some hope, but Fed officials gathering at Jackson Hole are likely to keep emphasising the fight against inflation. Meanwhile, the Eurozone and U.K. face their own crossroads: Europe’s growth is sputtering, and Britain has just delivered a “hawkish cut” in rates amid persistent price pressures. All of this is unfolding against a backdrop of choppy market sentiment. A modest risk-on bias early Monday lifted pro-growth currencies – NZD/USD even ticked above 0.5900 as upbeat risk appetite aided the Kiwi – but gains are tentative with major event risk on the horizon. In short, FX players are on edge: bracing for surprises from economic data and central bankers, while trying to parse whether the global economy is headed for a soft landing or new turbulence.

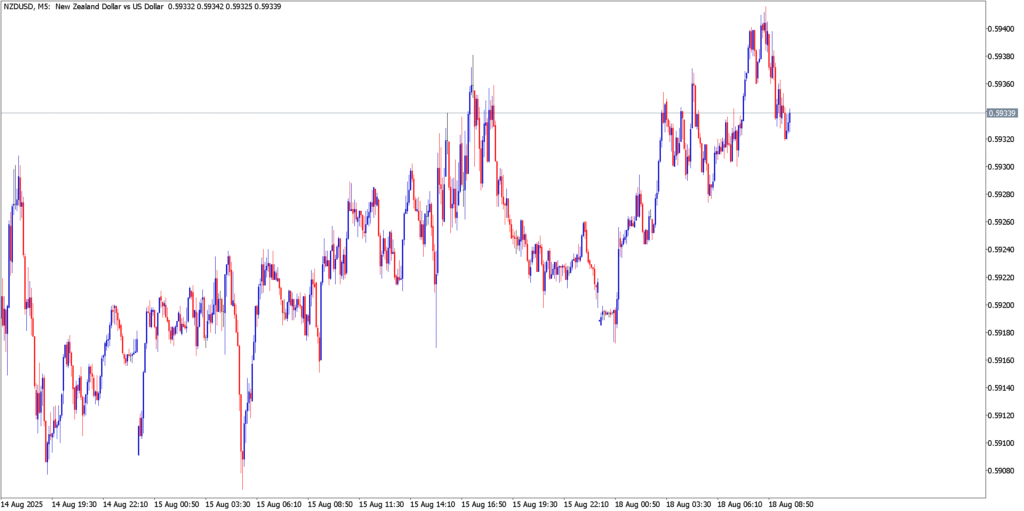

NZD/USD

Technicals in Focus

NZD/USD has been grinding higher in a shallow uptrend off last week’s lows. After bouncing from support around 0.5870 (a zone where buyers firmly defended the pair), the Kiwi dollar climbed toward $0.5940 resistance. On the 5-minute chart, the pair’s higher lows and higher highs underscore short-term bullish bias, though Monday’s Asian session saw momentum wane just below the prior peak. Momentum indicators hint at this loss of steam – the M5 RSI retreated from overbought levels above 70 and is now hovering in the 50–60 range, while stochastic oscillators have curled down from extreme highs. The MACD on M5 remains marginally in positive territory but its histogram is shrinking, indicating bullish momentum is fading. Still, NZD/USD holds comfortably above the 0.5900 handle, showing that buyers haven’t given up their control. Immediate support lies at 0.5920, with a stronger floor around 0.5900 (psychological level) and the 0.5870 pivot (last week’s trough). On the upside, $0.5940 is the key intraday barrier; a clear break would open the door toward the $0.6000 area, although ahead of the RBNZ decision bulls may be hesitant.

Trading Strategy

Given the mixed short-term signals, it’s prudent to map out both bullish and bearish scenarios:

- Bullish Idea: Buy on dips toward the $0.5920 support zone, anticipating that level to hold. Entry around 0.5920, with a target at 0.5975 (near Friday’s high and just below the psychological 0.6000 mark), and a stop loss under 0.5895 to avoid a false break. A more aggressive play would be buying a confirmed break above 0.5940, aiming for 0.5980.

- Bearish Idea: Sell into strength near the $0.5940 resistance area, which has twice capped rallies. A short position around 0.5935–0.5940 could seek a drop back to 0.5880 (roughly the midpoint of last week’s range). A stop loss at 0.5960 protects against a breakout, while taking profit in the 0.5880–0.5900 zone captures a move toward the lower end of the recent range. Bearish conviction would increase on a decisive break below 0.5900 – in that case, a swift slide to the mid-0.58s could ensue as that was a “strong support” area on the daily chart.

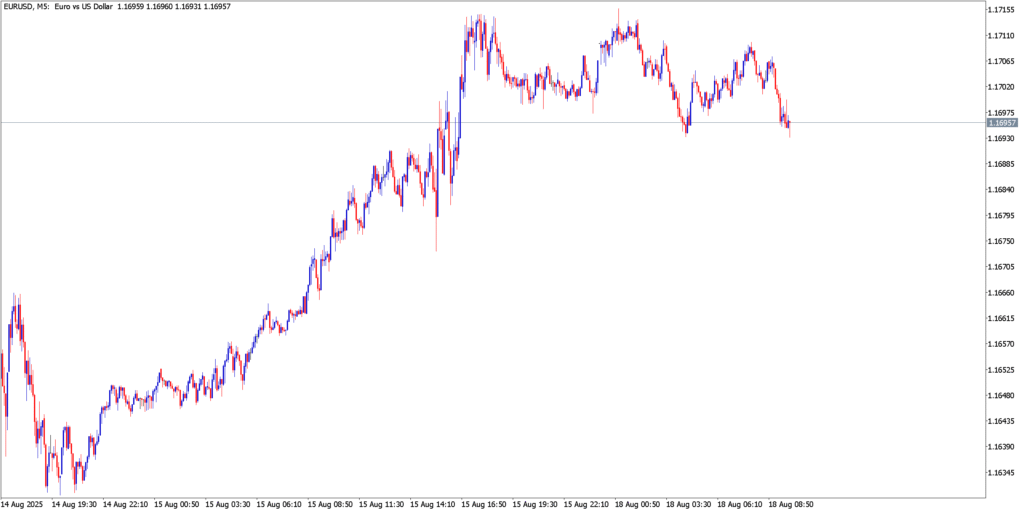

EUR/USD

Technicals in Focus

The euro’s rally extended late last week, with EUR/USD surging to a multi-day high around $1.1710 on Friday. Since then, the pair has eased modestly, but notably it remains within a well-defined ascending channel. Monday’s pullback appears to be a healthy correction of overbought conditions rather than a trend reversal. Indeed, momentum readings have moderated: the RSI, which flashed above 70 during the peak of the rally, has slipped back toward neutral 50–55, and we saw minor negative divergence forming as price made a higher high but RSI did not. The stochastic oscillator also rolled out of overbought territory, suggesting the euro is digesting gains. Importantly, supportive technical factors persist – EUR/USD is still trading above its 50-period moving average on intraday charts, and it holds within a minor bullish channel. The 0.1650–0.1660 region (approximately $1.1650) represents a critical support; this level is where the euro’s last pullback found a floor and also coincides with the lower bound of the channel. As long as 1.1650 holds, bulls remain in play. Overhead, initial resistance is at $1.1730, the intraday high set Friday. Beyond that, $1.1790 is flagged as a key level by technical analysts – it marks the next upside target if the euro’s uptrend resumes, and also aligns with a trend-line and Fibonacci extension from earlier price swings. In summary, EUR/USD’s technical bias is cautiously bullish, though the pair may consolidate in the near term to work off the recent overbought surge.

Trading Strategy

With the euro’s uptrend intact but momentum cooling, traders can position for either a continuation higher or a deeper pullback:

- Bullish Idea: Buy on a dip into the $1.1670–1.1690 support zone (the lower channel line). This strategy bets that 1.1650 support will hold. An entry in the high-$1.16s, with a stop loss just below $1.1640, allows room in case of a brief shakeout. Look for a rebound to $1.1730, the first resistance, with an extension target at $1.1790 if momentum returns (that’s the next significant resistance according to our analysis). The reward-to-risk appears favorable if the broader uptrend resumes.

- Bearish Idea: If EUR/USD’s rally falters, a short position on strength could be warranted. One approach is to sell near $1.1730 resistance, especially if a retest of that high shows signs of rejection (e.g. wicks on candles or bearish divergence). The target for shorts would be a retreat to around $1.1650 – the support that bulls must defend. A stop above $1.1760 can guard against a breakout to new highs. Alternatively, a more aggressive bear trade would short a confirmed break below $1.1650 (the channel support), aiming for a quick slide towards $1.1600. However, given the current trend, bearish trades should be nimble and watch for any resurgence in euro buying interest, especially if upcoming Eurozone data surprises positively.

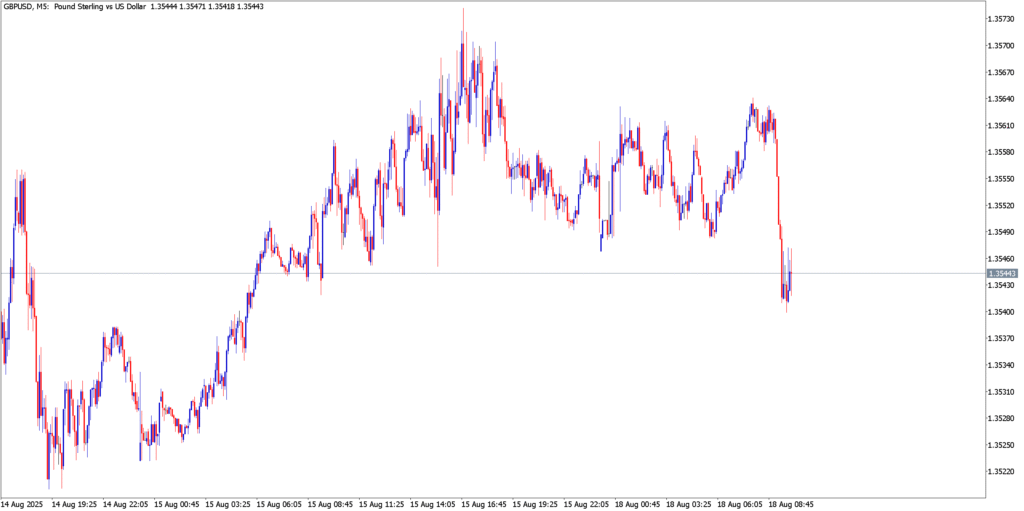

GBP/USD

Technicals in Focus

Sterling’s tone shifted abruptly to start the week. GBP/USD rallied into Friday’s close, nearly tagging the $1.3570 resistance zone, but bulls failed to push through. Early Monday, the pair saw a sharp sell-off, diving from the mid-1.3550s to as low as about $1.3520 in a matter of hours. This reversal has dented the short-term uptrend and puts sterling on the back foot. On the 5-minute chart, the dramatic drop sliced below a couple of minor support levels, turning the technical picture cautiously bearish intraday. The M5 RSI plunged from around 60 to under 30 during the sell-off – a move into oversold territory – before stabilizing, suggesting the decline was rapid enough to potentially prompt a near-term bounce. Similarly, the stochastic oscillator is lingering below 20, reflecting the recent downside momentum. The M5 MACD has crossed bearishly, with its signal line turning down and histogram in negative values, confirming the shift in momentum towards sellers. It’s worth noting that Monday’s low (~1.3520) aligns roughly with last week’s breakout point, making it an interim support. A more significant floor sits around $1.3500 (a round-number level and the vicinity of the 50-period moving average on higher timeframes). On the topside, immediate resistance is now the prior support at $1.3550–1.3560. Above that, $1.3570–1.3580 – the peak from Friday – remains the key hurdle that bulls must conquer to reclaim control. In summary, GBP/USD’s short-term technicals have weakened, but oversold conditions could fuel a corrective bounce before any further decline. Caution is warranted, as sterling’s fortunes are closely tied to fundamental news this week (from inflation data to central bank speak).

Trading Strategy

Given the pound’s sudden drop and fundamental cross-currents, traders should consider both recovery and continuation scenarios:

- Bullish Idea: Fade the drop by looking for a rebound from the $1.3520–1.3500 support zone. The strategy here is that the sell-off may have overshot in the short run (M5 RSI <30 hints at possible correction). A long entry near 1.3520 with a tight stop just below 1.3500 (to cap risk if 1.3500 gives way) could yield a bounce toward $1.3580. First target would be a return to 1.3560 (minor resistance from earlier consolidation), and if bullish momentum builds, a move to $1.3600 is conceivable. Keep in mind this is contrarian – it’s playing an oversold bounce, so profits should be locked in quickly if the pair finds relief.

- Bearish Idea: Align with the now-dominant momentum and sell on rallies. A reactive approach would be to sell any bounce back toward $1.3560–1.3570, which is the area of broken support and Friday’s high. This zone may now act as a ceiling. A short position around 1.3560 with a stop loss above 1.3600 (to allow a bit of wiggle room past the round number and recent high) could aim for a downside retest of $1.3500. If 1.3500 is conclusively breached, the decline could extend to $1.3450 (an area of interest from earlier August trading). Notably, broader fundamentals have turned negative for GBP – the Bank of England’s surprise rate cut to 4.75% (in a 5–4 vote) has soured sentiment – so bears may be emboldened. Yet, they should remain aware of any positive catalysts (strong UK data or improved risk tone) that might spark a larger-than-expected pound recovery.

Market Outlook

This week is packed with high-impact events across the U.S., U.K., New Zealand, and Eurozone, setting the stage for potential volatility. Monetary policy and inflation data will be front and center:

- New Zealand (NZD): The Reserve Bank of New Zealand meets on Tuesday (late Wednesday NZ time) and is widely anticipated to cut the OCR by 25 bps to 3.00%, continuing its shift toward supporting growth. Markets have essentially priced in this cut – it’s “all but expected” according to analysts – so the Kiwi’s reaction will hinge on forward guidance. Any hint of further easing (a “dovish cut”) could weaken NZD further, whereas a one-and-done signal might give the currency a relief bump. On the data front, New Zealand’s Q2 Producer Price Index underscores why the RBNZ has room to ease: producer input inflation slowed to +1.4% QoQ in Q2 from +2.9% in Q1, reflecting cooling cost pressures. Traders will also watch NZ’s trade figures due Thursday; however, the RBNZ decision and accompanying statement will be the primary driver for NZD this week.

- United States (USD): In the U.S., the macro focus is twofold: Fed communication and growth data. On Wednesday, the FOMC will release minutes from its July meeting. These minutes may reveal how unified (or not) policymakers were about keeping policy restrictive, and any discussion of future rate path could nudge the dollar. More crucially, from Thursday onward the spotlight turns to Jackson Hole – the Fed’s annual symposium (kicking off Thursday evening) where Fed Chair Jerome Powell is scheduled to speak on Friday. Market participants hope for clues on whether the Fed is leaning more dovish (acknowledging recent declines in inflation) or staying hawkish. Recall that U.S. inflation surprised to the downside in July – headline CPI cooled more than expected – giving the Fed some breathing room. But at the same time, U.S. economic activity has held up relatively well, and producer prices showed persistent underlying pressure in the latest report. Powell’s tone will be pivotal: a stern anti-inflation message could boost the USD, while hints of nearing an easing cycle would weigh on it. In terms of data, the U.S. calendar features flash PMI surveys on Thursday (to gauge August economic momentum) and July durable goods orders and housing data (Existing Home Sales on Thursday) – all pieces of the growth puzzle. Thus far, the U.S. has been an outperformer among developed economies, helping support the dollar, but any cracks in that narrative (e.g. much weaker PMIs) could challenge USD’s resilience.

- United Kingdom (GBP): The U.K. confronts a delicate balancing act. On Wednesday, July CPI inflation is released, and it’s expected to tick higher to around 3.7% YoY (from 3.6%). A slight uptick in inflation would underscore the Bank of England’s dilemma: inflation is still above target even as growth is sputtering. In fact, the BoE just cut rates for the first time in this cycle (25 bps earlier this month) in a split vote, citing concerns about economic slowdown. Officials termed it a “hawkish cut,” acknowledging that inflation won’t likely hit 2% until 2026. If Wednesday’s CPI comes in hot – say above forecast – it could revive bets that the BoE might have to pause its cutting cycle, or at least temper the pace of easing. Conversely, a softer inflation reading would validate the BoE’s decision to start cutting, possibly relieving some pressure on the pound. Aside from inflation, U.K. Retail Sales (July) are due Friday, which will provide a read on consumer demand. Expectations are subdued; any downside surprise in spending, coupled with the recent drop in monthly GDP (-0.2% m/m for July), would fuel worries that the U.K. is sliding toward a mild recession. Such growth concerns, alongside a widening current account deficit (now 4.1% of GDP), make the pound sensitive to risk sentiment and Fed moves. In the near term, GBP traders will be most laser-focused on the inflation figure and BoE speak – any signs that price pressures are persisting or worsening will put the BoE in a tough spot, potentially boosting GBP on the assumption they’ll slow cuts, whereas a relief on inflation could keep the BoE on its easing path (a negative for GBP fundamentals).

- Eurozone (EUR): The Eurozone’s calendar is lighter on blockbuster releases but still significant. Flash PMIs on Thursday will be the critical data – the Eurozone Composite PMI is forecast to hover just above 50, barely in growth territory. These surveys will reveal whether Europe’s economy is indeed stagnating (as recent data suggest) or seeing any nascent improvement. The manufacturing sector has been in contraction for months, so all eyes will be on services – which have been the lone engine of growth globally. A further slide in services PMI could stoke recession fears and weigh on the euro, while resilient numbers might reassure markets. On inflation, the Eurozone prints its final July CPI on Wednesday. This is typically not a market mover unless there’s a revision, since the flash estimate (annual CPI ~5.3% and core ~5.5%) is already known. Barring surprises, traders will look ahead to August inflation signals (for instance, Germany’s August CPI due the following week) and of course the ECB’s stance. There is growing chatter that the ECB may have finished its hikes and could even contemplate cuts in 2024 if growth stays weak. ECB President Lagarde is due to speak mid-week (at a conference), and any hints on policy or acknowledgment of economic weakness could impact EUR. Broadly, the euro’s fate this week will hinge on data vs. the Fed – if European PMIs disappoint while U.S. data/ Fed rhetoric stays firm, EUR/USD could face downward pressure; if the opposite occurs, the euro may extend its recent gains.

The forex market enters this week in a state of suspense, delicately poised between data and central bank drama. Volatility could spike as traders react to each new piece of information: a surprise in the U.K. CPI, a signal from the RBNZ about future cuts, a stray line in the Fed minutes, or an unexpected comment out of Jackson Hole. The US dollar’s direction will set the tone for many pairs, right now it’s flexing slightly on rising Treasury yields, but that could change if the Fed narrative shifts. Commodity currencies like NZD will take cues from risk sentiment and local central bank moves, the euro and pound will dance to the tunes of PMI and inflation figures. As always, careful risk management is key in such headline-driven markets. By week’s end, we’ll have a clearer sense of whether the late-summer forex landscape will be defined by central bank surprises or if the current ranges will hold as the dog days of August wind down.