Leverage in trading refers to using borrowed capital to increase the potential return on an investment. It allows traders to control larger positions with a smaller amount of their own money, magnifying both profits and losses.

Key Takeaways

- Leverage lets traders open larger positions using less capital.

- It amplifies both gains and losses.

- Common in forex, CFD, crypto, and margin stock trading.

- Higher leverage increases risk and requires strict risk management.

- Regulated brokers often cap leverage to protect traders.

What Is Leverage in Trading?

Leverage is a financial tool that allows you to gain exposure to larger market positions than your actual account balance would otherwise allow.

For example, with 10:1 leverage, you can control $10,000 in trades with just $1,000.

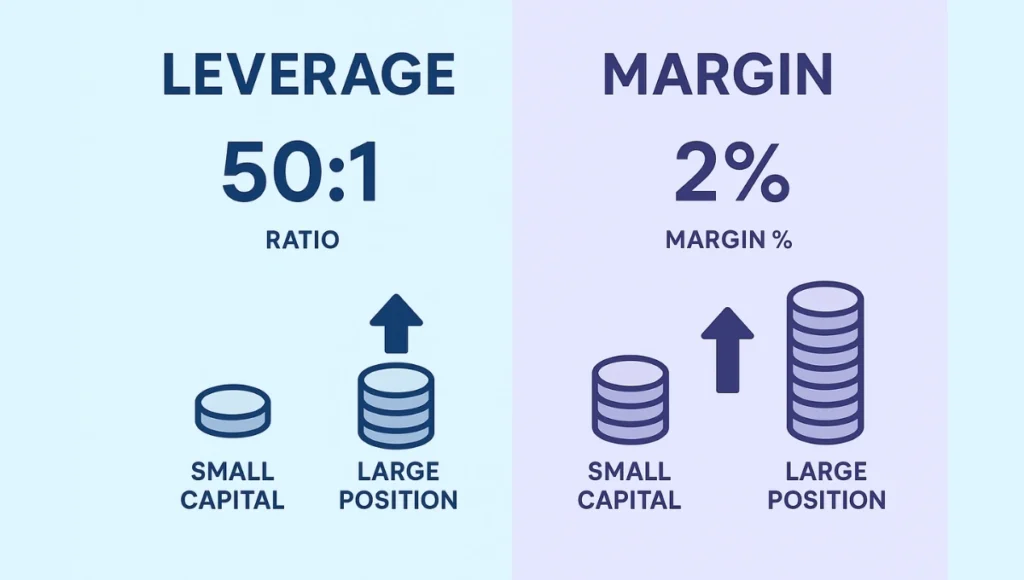

The ratio format is usually expressed as 10:1, 20:1, 100:1, or higher. A smaller required deposit is known as margin, which acts as collateral for the borrowed amount.

How Leverage Works: A Simple Example

Assume you have $1,000 in your trading account and want to trade with 50:1 leverage.

- Without leverage: You can buy $1,000 worth of an asset.

- With 50:1 leverage, you can buy $50,000 worth of the same asset.

If the market moves in your favor by 1 percent, your profit is $500 instead of $10. But if the market moves against you, the same 1 percent move would cost you $500 in losses.

Types of Leverage in Financial Markets

1. Forex Trading

Forex markets offer some of the highest leverage levels, often ranging from 50:1 to 500:1 depending on the broker and jurisdiction.

2. Stock Market (Margin Trading)

Stock traders can access leverage through margin accounts. Regulations in the US typically limit leverage to 2:1 for retail traders.

3. CFD Trading

Contracts for Difference (CFDs) allow traders to speculate on price movements using leverage without owning the underlying asset.

4. Crypto Trading

Leverage in crypto trading is popular but risky due to high volatility. Some exchanges offer up to 100:1 leverage on major pairs like BTC/USD.

4 Benefits of Using Leverage

- Access to larger market positions with limited capital.

- Potential for higher returns on small price movements.

- Ability to diversify trades without requiring a large balance.

- More trading opportunities with limited funds.

4 Risks of Using Leverage

- Magnified losses, which can exceed your initial investment.

- Margin calls if your position moves against you.

- Liquidation risk in highly leveraged positions.

- Increased stress and emotional decision-making.

How Margin Relates to Leverage

Margin is the amount of money required to open and maintain a leveraged position. It is directly related to leverage.

For example, if a broker offers 100:1 leverage, the required margin is 1 percent of the total position size. A $10,000 trade would require just $100 in margin.

If your account balance falls below the margin requirement due to market losses, you may receive a margin call, requiring you to deposit more funds or close your position.

Regulated Leverage Limits Around the World

| Region | Retail Leverage Cap | Notes |

| United States | 50:1 (Forex Majors) | Regulated by CFTC and NFA |

| European Union | 30:1 (Forex Majors) | ESMA rules for retail traders |

| Australia | 30:1 | ASIC rules apply |

| Japan | 25:1 | Tight leverage restrictions |

| Offshore Brokers | 100:1 to 500:1 | Often unregulated, higher risk |

Leverage and Risk Management

Using leverage wisely requires a solid risk management plan.

Here are 4 key practices:

- Never risk more than 1 to 2 percent of your trading account on a single trade.

- Always use stop-loss orders to limit downside.

- Avoid over-leveraging, especially in volatile markets.

- Focus on capital preservation rather than chasing big wins.

Popular Leverage Ratios and Their Use Cases

| Leverage Ratio | Best For | Risk Level |

| 1:1 to 5:1 | Beginners, long-term investors | Low |

| 10:1 to 20:1 | Intermediate traders | Moderate |

| 50:1 to 100:1 | Advanced day traders | High |

| 200:1 and up | Scalpers, expert traders | Very high |

Leverage in Different Trading Strategies

Day Trading

Day traders often use moderate to high leverage to profit from small intraday moves. Quick decision-making and discipline are critical.

Swing Trading

Swing traders use lower leverage and hold positions for days or weeks. They rely on technical patterns and fundamental trends.

Scalping

Scalpers open and close multiple positions in seconds or minutes, often using high leverage to extract profits from tiny moves.

Leverage and Psychology

Trading with leverage increases emotional pressure. The fear of loss or the excitement of fast profits can lead to poor decisions.

To stay grounded:

- Trade with a clear plan.

- Avoid revenge trading after losses.

- Keep position sizes appropriate for your risk appetite.

- Review trades and learn from both wins and losses.

How Defcofx Helps You Manage Leverage

Defcofx provides tools and resources to help traders use leverage effectively without taking unnecessary risks.

What Defcofx offers:

- Margin calculators to determine safe position sizing

- Educational content on leverage, margin, and risk

- Risk management tools to track exposure in real time

- Custom account types with adjustable leverage settings

Whether you’re a forex trader, crypto investor, or CFD trader, Defcofx ensures you understand your leverage and use it to your advantage, not against it.

Open a Live Trading AccountFinal Thoughts

Leverage is a double-edged sword in trading. While it can boost your profits, it can just as quickly magnify your losses. Learning how leverage works, practicing strict risk management, and choosing the right trading platform are essential steps to using leverage responsibly.

Start small, build experience, and never risk more than you can afford to lose. The smartest traders treat leverage as a calculated tool, not a shortcut to fast wealth.

Frequently Asked Questions (FAQs)

Leverage is using borrowed funds to open larger trading positions than your account balance would normally allow. It amplifies both gains and losses.

No. Beginners should start with low leverage to reduce the risk of large losses and gain experience without too much pressure.

The higher the leverage, the lower the margin required to open a trade. However, lower margin also means higher risk exposure.

If your losses exceed the margin, your broker may issue a margin call or liquidate your position. You can lose more than your initial investment if risk controls aren’t in place.

Most professionals recommend using no more than 5:1 or 10:1 leverage unless you have significant experience and a solid risk management plan.

Yes. Many brokers allow you to adjust your leverage settings, especially if you’re trading through platforms like MetaTrader or web-based dashboards.

A margin call is a broker’s request for you to deposit more funds when your account falls below the required margin level due to trading losses.

Explore Other Forex Terms with DefcoFX

Discover more forex glossary terms with DefcoFX to help boost your knowledge as a beginner trader: