Non-Farm Payroll (NFP) is a major U.S. economic indicator released monthly that reports the number of new jobs created in all sectors except farms, government, private households, and non-profit organizations. This data reflects the strength of the U.S. labor market, making it one of the most watched releases in forex. Since the U.S. dollar is the world’s reserve currency, NFP figures often trigger strong price movements across global markets, especially currency pairs tied to USD.

Key Takeaways on Non-Farm Payroll (NFP)

- NFP measures monthly U.S. job growth excluding agriculture and non-commercial sectors.

- It is released on the first Friday of every month at 8:30 AM EST by the U.S. Bureau of Labor Statistics.

- The report has a direct impact on the U.S. dollar and a high influence on global forex markets.

- NFP outcomes shape expectations for Federal Reserve policy on interest rates.

- Strong job growth supports a stronger USD, while weak job growth typically weighs on it.

Why Does NFP Matter in Forex Trading?

The Non-Farm Payroll report matters because it offers a reliable snapshot of the U.S. economy. Job creation is directly linked to consumer spending, which drives the majority of U.S. economic activity. A strong NFP result usually signals robust economic conditions, potentially encouraging the Federal Reserve to consider higher interest rates. In contrast, weaker NFP data may indicate economic slowdown, which can pressure the Fed to lower or maintain rates.

For forex traders, this matters because changes in U.S. interest rate expectations often trigger immediate and substantial moves in USD-based pairs. That is why NFP releases are among the most volatile trading events each month.

How NFP Affects Forex Markets

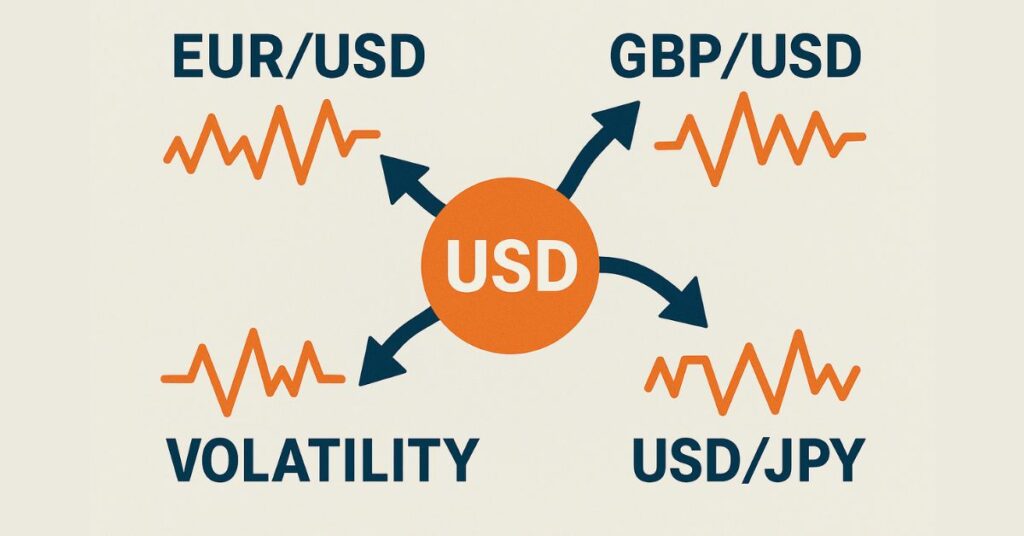

NFP results directly affect supply and demand for the U.S. dollar, which then influences global forex markets. For instance, when NFP exceeds expectations, investors often buy dollars in anticipation of tighter monetary policy, causing pairs like EUR/USD to drop. If NFP falls short, traders may sell dollars, giving strength to currencies like the euro, pound, or yen.

The effect is not limited to currencies. Gold and oil prices also shift during NFP releases, as both commodities are priced in USD. Traders should expect sudden widening of spreads, temporary liquidity shortages, and sharp price swings immediately after the release. This makes NFP both an opportunity and a risk in forex trading.

Example: NFP’s Impact on EUR/USD

Imagine economists forecast an addition of 200,000 jobs, but the actual Non-Farm Payroll (NFP) report shows only 100,000 jobs. This weaker-than-expected number reflects slower job growth and suggests economic weakness. As a result, the U.S. dollar tends to lose value, and EUR/USD may rise as traders move away from the dollar. Conversely, if the actual number surpasses forecasts, the U.S. dollar strengthens, causing EUR/USD to fall.

This is why traders analyze not just the headline figure but also previous revisions and the unemployment rate released alongside the NFP. Together, these numbers give a fuller picture of labor market conditions.

Strategies for Trading Non-Farm Payroll (NFP) in Forex

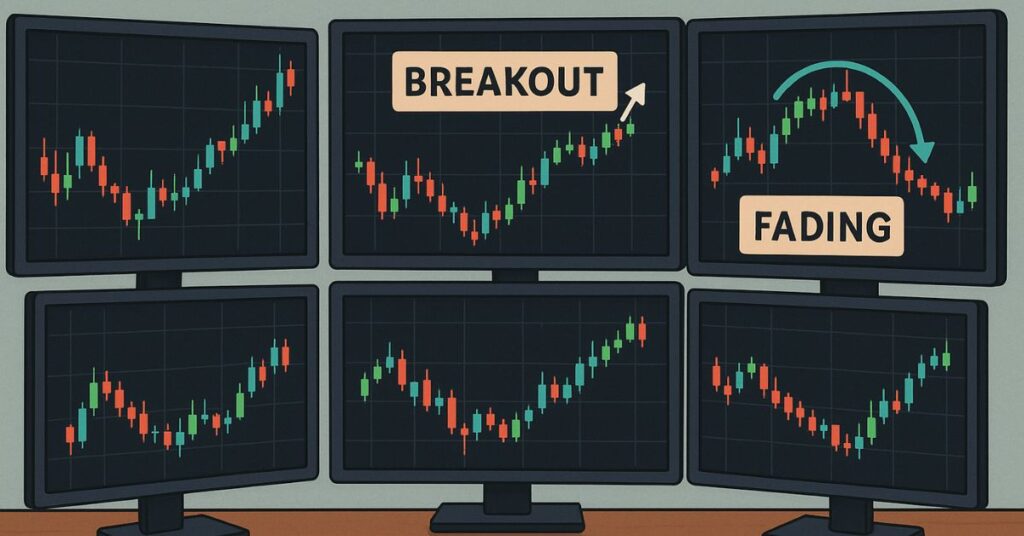

Breakout Trading After Non-Farm Payroll (NFP) Release

Some traders wait for the NFP number and trade the initial breakout once the direction becomes clear. If the dollar strengthens, they may short EUR/USD, and if it weakens, they may go long. While profitable in strong trends, this method carries the risk of false breakouts due to rapid price reversals.

Fading the First Move

Another approach is fading the initial move. Because markets often overreact to NFP releases, traders may wait for the first spike and then trade in the opposite direction once the market stabilizes. This strategy requires patience and strong technical confirmation before entering.

Sitting Out the Volatility

Professional traders often choose not to trade the initial release at all. Instead, they observe the market’s reaction, analyze the data, and adjust their positions over the following days. This approach avoids unpredictable volatility while still benefiting from the broader market trend established by NFP.

Managing Risks During NFP Trading

Trading during NFP isn’t suitable for all traders due to its extreme volatility. Risk management becomes even more critical in such environments. Traders should reduce their lot sizes, always use stop-loss orders, and avoid over-leveraging positions. It is also important to trade with brokers that provide transparent pricing and low spreads because transaction costs can rise sharply during high-impact events.

Choosing a broker with no hidden fees and fast execution is key for managing trades during NFP. Since spreads can widen dramatically, brokers with stable infrastructure and fair pricing protect traders from excessive slippage.

Why Defcofx is Suitable for NFP Trading

Defcofx provides the tools and environment traders need when navigating volatile events like NFP:

- High Leverage Options (1:2000): Manage large market swings with minimal margin requirements.

- Tight Spreads Starting at 0.3 Pips: Keep costs under control when volatility spikes.

- No Commissions or Swap Fees: Trade transparently with no hidden charges.

- Fast Withdrawals (within 4 hours, even on weekends): Access funds without delays.

- Global Reach: Accounts available to clients worldwide, with multilingual support.

Open an account with Defcofx today and prepare to trade high-volatility events like NFP with confidence.

Open a Live Forex Trading AccountFAQs on Non-Farm Payroll (NFP)

The name reflects the exclusion of farm workers and certain other categories like household employees and nonprofit staff. These jobs are excluded because they are highly seasonal and do not represent consistent economic trends.

The NFP report is released on the first Friday of every month at 8:30 AM EST. This consistent schedule allows traders to plan ahead and prepare their strategies in advance.

NFP has the strongest impact on USD-related pairs such as EUR/USD, GBP/USD, USD/JPY, and USD/CAD. It also influences commodities priced in dollars, like gold and oil.

Beginners can trade NFP, but it carries significant risk due to sudden volatility. It is recommended that new traders practice with demo accounts first and gain experience before risking real money during such high-impact events.

Yes. Strong NFP reports may support the case for higher interest rates, while weaker data can push the Fed toward maintaining or cutting rates. This is why traders closely connect NFP with monetary policy expectations.

No. Other reports, like the ADP Employment Report and weekly Unemployment Claims, also provide labor market insights. However, NFP is the most influential because of its wide coverage and official government release.

Explore Other Forex Terms with Defcofx

Discover more forex glossary terms with Defcofx to help boost your knowledge as a beginner trader: