You can earn anywhere from a few dollars a day to thousands per month from forex trading, depending on your capital, skill level, risk management, leverage use, and consistency. There is no fixed income, profits vary, and losses are equally possible, especially for beginners.

Key Takeaways

- Forex trading income is not guaranteed and varies by trader.

- Earnings depend more on strategy and discipline than market luck.

- Beginners usually earn small or inconsistent returns early on.

- Leverage can increase profits and losses simultaneously.

- Long-term consistency matters more than short-term gains.

What Determines How Much You Can Earn From Forex Trading

How much you can earn from forex trading is influenced by several interconnected factors, and understanding them is essential for setting realistic expectations. Unlike salaried income, forex profits are performance-based and fluctuate with both market conditions and trader decisions.

Trading capital plays a major role. A trader with a $500 account cannot generate the same returns as someone trading with $10,000, even if both use the same strategy. Profits in forex are usually measured in percentages, meaning larger capital naturally produces higher dollar returns.

Skill level and experience strongly affect outcomes. Beginner traders often struggle with emotional decision-making and inconsistent strategies, while experienced traders rely on tested systems, data analysis, and discipline. Over time, experience improves trade timing, risk control, and profitability.

Trading strategy and consistency matter more than the number of trades placed. Traders who follow a clear plan, whether scalping, day trading, or swing trading, tend to achieve more stable results than those trading impulsively. Consistency in execution often separates profitable traders from losing ones.

Risk management ultimately determines survival and growth. Traders who risk too much per trade may see quick gains, but they also face rapid losses. Controlled risk allows capital to grow steadily and protects accounts during losing streaks.

Average Forex Trader Income: Realistic Expectations

When asking how much you can earn from forex trading, it’s important to look at realistic income ranges rather than extreme success stories. Most traders go through a learning phase where profits are inconsistent, and expectations need to align with skill development rather than overnight results.

Beginner traders often experience mixed outcomes in their first months. Many earn little to no profit initially, while some face losses as they learn market behavior, execution, and emotional control. Small monthly gains of 1%–3% are considered reasonable at this stage, with consistency being more important than income size.

Intermediate traders who have developed a structured strategy and proper risk management may achieve 3%–8% monthly returns under stable market conditions. At this level, profits become more predictable, but they are still not guaranteed every month.

Professional or highly experienced traders may target 8%–15% per month during favorable market periods, though even professionals face losing months. Their edge comes from discipline, capital preservation, and long-term consistency rather than constant high returns.

Forex Trading Profit Per Day, Week, and Month

Forex trading profits are best understood in percentages rather than fixed dollar amounts, because earnings scale directly with account size and risk exposure. This approach gives a clearer picture of what is realistically achievable over different timeframes.

On a daily basis, many disciplined traders aim for 0.2%–1% per day, depending on market conditions and strategy. Some days may produce no trades or even small losses, which is a normal part of trading. Expecting daily profits without losses is unrealistic.

On a weekly level, consistent traders may target 1%–3% returns, focusing on capital preservation rather than aggressive growth. Weekly performance often smooths out daily fluctuations, offering a more accurate view of progress.

Over a monthly period, realistic returns for skilled traders typically fall between 3%–10%. These figures depend heavily on market volatility, leverage use, and how strictly risk rules are followed. Larger gains are possible, but they usually involve significantly higher risk.

What matters most is long-term consistency, not short-term profit spikes. Traders who focus only on daily income often overtrade and expose themselves to unnecessary losses.

Can You Make a Living Trading Forex?

Making a full-time living from forex trading is possible but requires discipline, skill, sufficient capital, and realistic expectations. Most traders start part-time while learning, gradually scaling their accounts as they gain experience.

- Part-time vs. full-time trading: Beginner and intermediate traders often treat forex as a supplemental income source. Full-time trading demands consistent profits, effective risk management, and the ability to handle market stress without emotional decision-making.

- Capital requirements: To replace a standard salary, traders generally need a larger account balance. Small accounts limit daily and monthly profits, making it difficult to rely solely on trading for income. Using leverage, such as high leverage options up to 1:2000, can magnify profits but also increases the risk of losses.

- Emotional and discipline demands: Full-time trading is mentally challenging. Traders must stick to their strategies, manage risks, and avoid impulsive trades, even during periods of loss.

How Leverage Affects Forex Trading Earnings

Leverage is a powerful tool in forex trading that allows traders to control larger positions with a smaller amount of capital. It can significantly amplify profits, but it also magnifies losses, making risk management essential.

For example, using Defcofx’s high leverage options up to 1:2000, a trader can increase potential gains on a small account. However, high leverage also means that even minor market moves against a position can result in substantial losses. Therefore, leverage should be used strategically and cautiously.

Leverage affects earnings in the following ways:

- Profit potential: Higher leverage increases the dollar amount of profit from favorable price movements.

- Risk exposure: Losses are also magnified; without strict risk controls, accounts can be wiped quickly.

- Capital efficiency: Traders can free up capital for additional trades while maintaining exposure.

Forex Trading Income Potential With the Right Broker

The choice of broker directly affects your earning potential in forex trading. Key factors include spreads, commissions, execution speed, deposit and withdrawal efficiency, and available leverage. Selecting the right broker ensures that more of your profits stay in your account.

Defcofx provides several advantages that can impact trading income positively:

- No Commissions or Swap Fees: Low spreads starting from 0.3 pips reduce costs and increase net profits.

- High Leverage Options: Up to 1:2000 leverage, allowing traders to amplify returns with careful risk management.

- Fast Support and Withdrawals: Withdrawals completed within 4 business hours, even on weekends, ensure access to capital without delays.

- Global Reach: Accepts clients from all countries, offering multiple language options for a smoother trading experience.

- 40% Welcome Bonus: First-time deposits of $1000+ give traders additional funds to potentially increase earnings.

4 Common Myths About Forex Trading Earnings

Many beginners enter forex trading with misconceptions about potential profits, which can lead to unrealistic expectations and risky decisions. Understanding the reality is crucial to developing a sustainable trading approach.

Myth 1: Forex guarantees daily income

There is no fixed income in forex trading. Market conditions fluctuate, and even experienced traders have losing days. Expecting daily profits can lead to overtrading and unnecessary risk.

Myth 2: Small accounts can get rich quickly

While leverage can amplify returns, small accounts generally produce modest profits. Rapid wealth is rare and often comes with extreme risk. Traders should focus on steady growth rather than instant riches.

Myth 3: High leverage means easy money

Leverage multiplies both gains and losses. Using high leverage without proper risk management can wipe out an account in a short time. Knowledge, discipline, and strategy remain far more important than simply using leverage.

Myth 4: Forex profits are purely luck-based

Successful trading is driven by strategy, analysis, and risk control, not luck. Random wins may happen, but consistent income requires structured planning.

Is Forex Trading Profitable in the Long Term?

Forex trading can be profitable over the long term, but consistent earnings require skill, discipline, and realistic expectations. Profits aren’t guaranteed, and traders must account for market fluctuations, economic events, and trading psychology.

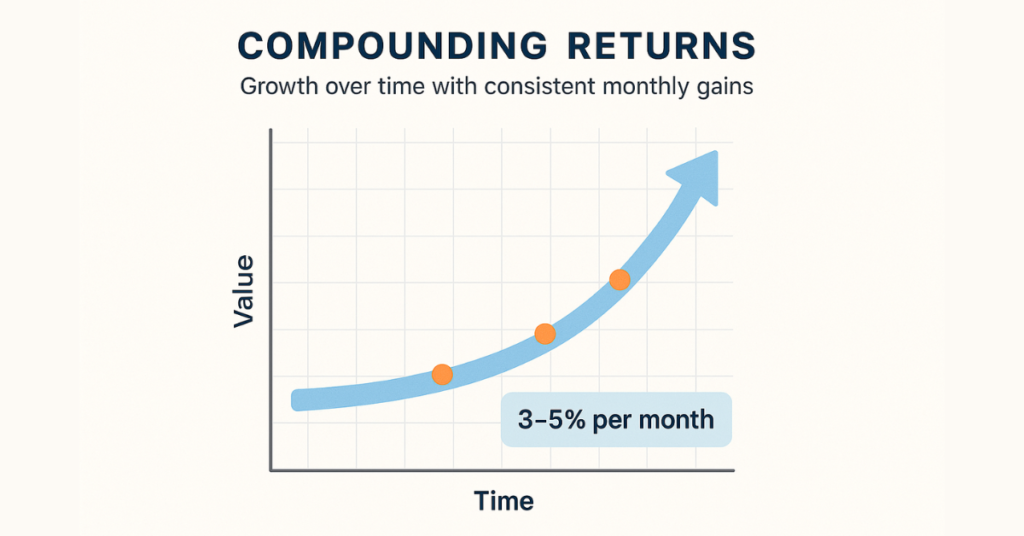

Compounding returns is a key factor for long-term profitability. Small, consistent gains reinvested over time can grow an account significantly. For example, achieving 3%–5% monthly returns consistently over a year can result in substantial growth without excessive risk.

Skill Development Timeline

Traders generally spend months to years mastering strategies, risk management, and emotional control. Long-term success relies on continuous learning and adaptation to changing market conditions.

Sustainability of Profits

Profitable traders focus on preserving capital as much as generating returns. Avoiding large losses ensures that growth compounds over time. Brokers like Defcofx, with low spreads, no swap fees, and fast withdrawals, support this process by reducing friction and keeping more capital available for trading.

Getting Started: How to Improve Your Forex Earning Potential

Improving your earnings in forex trading requires a combination of education, practice, and strategic broker selection. Following a structured approach increases the likelihood of consistent profits while minimizing losses.

- Learn and practice. Start with educational resources and demo accounts to understand market behavior, chart patterns, and trading tools. Practice builds confidence without risking real capital.

- Develop a Strategy. Choose a trading style such as scalping, day trading, or swing trading and stick to it. Successful traders consistently follow their strategies and adjust only based on performance data.

- Risk management. Always determine how much of your capital to risk per trade. Many professionals risk 1%–2% per position, ensuring losses don’t significantly impact overall account growth.

Final Thoughts on How Much Can You Really Earn From Forex Trading?

Earnings from forex trading vary widely based on capital, experience, strategy, risk management, and market conditions. While beginners may start with small or inconsistent gains, disciplined traders who follow tested strategies can achieve steady long-term profits.

Leverage, such as Defcofx’s high leverage options up to 1:2000, can magnify returns but also increase risk. Using a broker with low spreads, no commissions or swap fees, fast withdrawals, and global accessibility helps maximize net earnings. Realistic expectations, consistent execution, and continual learning are the keys to building sustainable income in forex.

Open a Live Trading AccountFAQs

Yes, forex trading can be profitable, but earnings depend on skill, strategy, capital, and risk management. Consistent long-term profits require discipline, realistic expectations, and proper broker conditions like low spreads and fast withdrawals.

Beginners typically earn small or inconsistent returns, often around 1%–3% monthly, while learning market dynamics, strategy execution, and risk control. Losses are common in the early stages.

It varies, but many traders take several months to a year to consistently earn profits. Success depends on practice, strategy, and emotional discipline.

Forex trading offers high earning potential, especially with leverage, but becoming wealthy quickly is rare and extremely risky. Long-term growth through skill and consistency is far more realistic.

Consistent earnings generally require sufficient starting capital, which varies based on trading goals. Using brokers with high leverage, low spreads, and fast withdrawals, like Defcofx, can help small accounts grow more efficiently.