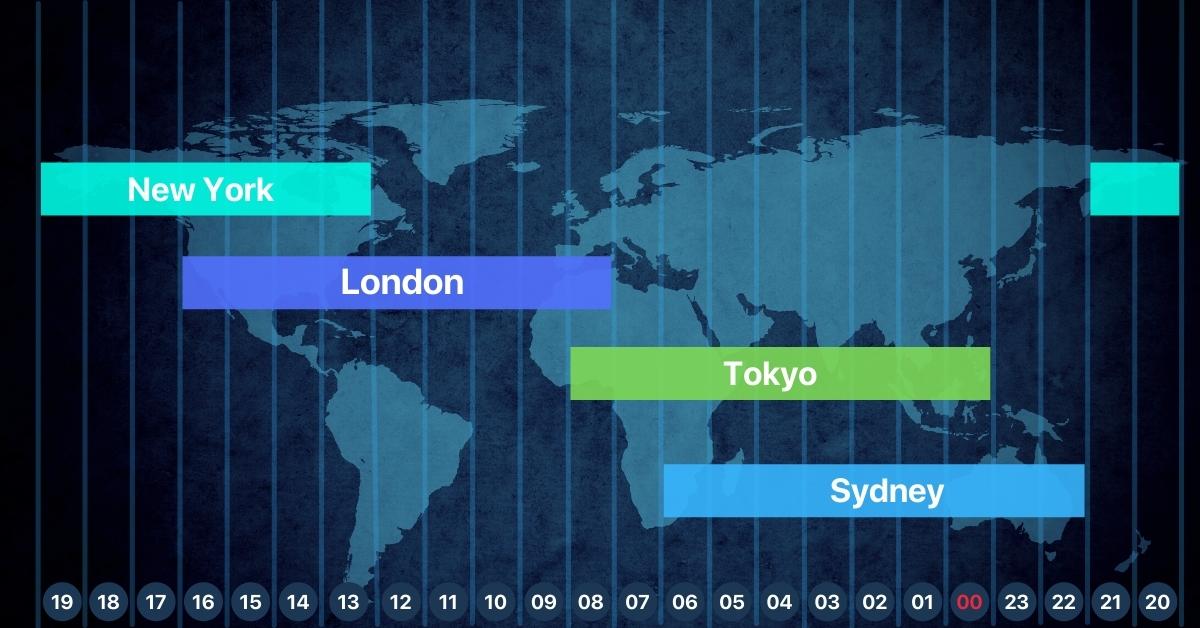

At 5 AM GMT, the forex market is usually still within the Asian trading session. However, this time can mark the early stirrings of the London session, especially during Daylight Saving Time (DST) or depending on your broker’s server time. Timing overlaps like this matter for liquidity and volatility.

Key Takeaways

- 5 AM GMT is generally part of the Asian session.

- The London session officially opens around 8 AM GMT.

- Overlaps begin forming by 6–7 AM GMT depending on DST and broker time.

- Asian-London overlaps offer stronger liquidity and price movement.

- Traders should adjust strategies based on volatility and active currency pairs.

What Is the Asian Session?

The Asian session, also called the Tokyo session, runs from around 12 AM to 9 AM GMT, with peak activity between 2 AM and 6 AM GMT. It’s known for:

- Lower volatility

- Narrower price ranges

- Focused trading in JPY, AUD, and NZD pairs

Trading during the Asian session typically suits range-bound strategies, scalping, and conservative setups.

What Is the London Session?

The London session is the largest and most volatile forex session, officially starting at 8 AM GMT and ending at 4 PM GMT. It accounts for over 30% of daily forex volume.

- Involves EUR, GBP, USD, and CHF

- Big news events often released at this time

- Strongest volume overlaps with New York session later in the day

This session is ideal for breakouts, news trading, and momentum strategies.

Is 5 AM London Session or Asian Session?

5 AM GMT still falls under the Asian session. However, market behavior may begin shifting depending on where you live and your broker’s time zone. Some traders see early volatility spikes from European institutions preparing for the London open.

Here’s a quick breakdown:

| Time (GMT) | Session Activity |

| 12 AM – 6 AM | Asian session in full effect |

| 6 AM – 8 AM | Asian-London overlap begins |

| 8 AM – 4 PM | Full London session |

Asian-London Overlap

The Asian-London overlap begins around 6 AM GMT and can last up to 8 AM. It’s when liquidity begins increasing as London traders come online, while Asia is still active.

This window is especially important because:

- Volume rises, making trades easier to enter and exit

- Price moves sharpen, especially in EUR/JPY, GBP/JPY, and AUD/JPY

- Many traders see this as the best time to shift from range strategies to trend setups

3 Factors That Affect Session Timing

The session you’re in at 5 AM depends on more than just GMT. Consider:

- Daylight Saving Time: When Europe is on DST, the London session may open one hour earlier in your local time.

- Broker Server Time: Brokers set candle open/close based on their internal clock. A 5 AM candle on one platform may represent a different time block elsewhere.

- Geographic Location: Your local clock may place you in an overlap even when it’s still 5 AM GMT.

5 Tips for Traders at 5 AM

If you’re trading at 5 AM, keep these pointers in mind:

- Watch for early volatility: EUR and GBP pairs may start moving.

- Avoid premature entries: Breakouts often fake out before 6–7 AM.

- Focus on pairs like EUR/JPY, GBP/JPY, and AUD/JPY for smoother transitions.

- Prepare your charts: Anticipate London setups by analyzing overnight price structure.

- Check news calendars: EU and UK news may cause pre-open spikes.

Defcofx offers ultra-low spreads and 1:2000 leverage, which is great for catching volatility during session overlaps.

Open a Trading Live Account4 Mistakes to Avoid Around 5 AM

- Thinking London is fully open at 5 AM GMT.

- Trading low-volume pairs like CAD/CHF during the Asia-London overlap.

- Ignoring broker time zones, which can cause confusion.

- Assuming quiet = safe:Thin liquidity often leads to surprise wicks and slippage.

Final Thoughts

So, is it the 5 AM London session or the Asian session? Technically, it’s still part of the Asian session, though early volatility can hint at London’s arrival. Traders should view 5 AM as a transition period where preparation meets opportunity. Don’t assume the market is fully awake, but don’t sleep on it either.

By understanding your broker’s clock, global time zones, and session behavior, you’ll position yourself ahead of the crowd, especially when overlaps begin to fuel momentum.

Join Defcofx for fast execution, multilingual support, and ultra-low spreads across global time zones.

Open a live account with DefcofxFAQs

No, the London session typically begins at 8 AM GMT. 5 AM is still within the Asian session, though early movement may begin as London traders prepare.

Focus on EUR/JPY, GBP/JPY, AUD/JPY, and USD/JPY. These pairs often show early volume as both Asian and European markets begin interacting.

Yes. During DST, session times shift by an hour in affected regions. Always confirm if your broker adjusts for this on their platform.

Be cautious. Breakouts during low liquidity can result in fakeouts. Wait for clearer confirmations or trade a smaller size until the London session is fully active.

Absolutely. Overlaps (like Asia-London or London-New York) offer high volatility and liquidity, which is perfect for day traders, scalpers, and momentum strategies.

Check your platform’s clock and compare it to GMT. Most brokers mention this on their website or FAQ section. Adjust your session planning accordingly.

In time zones like the UAE (GMT+4), 5 AM GMT is 9 AM local time, which is just as your morning starts. It’s a great time to prep for the London session ahead.

Defcofx Forex Articles You Shouldn’t Miss

Discover powerful forex strategies in these top reads from Defcofx.