As we move into Thursday, September 11, 2025, global markets are bracing for a potentially turbulent session, driven by a slew of significant economic events on the horizon. The U.S. dollar remains at the center of attention as traders digest recent data and position themselves ahead of key releases, particularly U.S. labor market figures – and looming central bank announcements. In the currency markets, the EUR/USD pair saw choppy price action amid mixed signals from both the Eurozone and the U.S. economies. The euro remains under pressure due to persistent concerns over the Eurozone’s growth outlook, as market participants await fresh cues from the European Central Bank (ECB) and upcoming U.S. economic reports. Meanwhile, USD/CAD tumbled sharply, reflecting a softer U.S. dollar and a rebound in oil prices that buoyed the oil-linked Canadian dollar; this move was likely exacerbated by traders repositioning ahead of the Bank of Canada’s next rate decision. Elsewhere, AUD/USD exhibited notable volatility, underscoring the market’s sensitivity to global risk sentiment and recent Australian economic readings. Traders are closely monitoring these developments as they assess the implications of upcoming U.S. data releases and shifts in risk appetite.

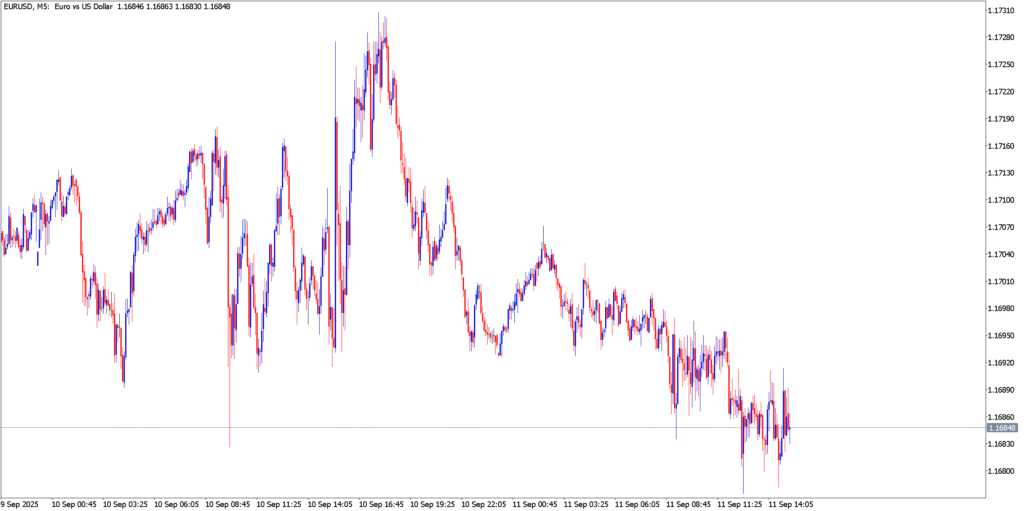

EUR/USD

Technicals in Focus

EUR/USD remained volatile, oscillating around the 1.1080 level by the session’s close after several intraday reversals. The pair’s back-and-forth movement reflected the tug-of-war between mixed Eurozone data and U.S. economic signals, with traders cautious ahead of major U.S. labor figures. On the technical front, indicators point to a market lacking clear conviction: the MACD is flatlining near the zero line with minimal histogram momentum – a sign of indecision – while the Stochastic oscillator sits in middle ground, offering no strong directional bias. Additionally, the 14-day RSI is subdued in the mid-40s, consistent with the pair’s range-bound behavior in recent days.

Trading Strategy: Neutral to Sell

- Short Setup: Consider short positions on a break below the 1.1080–1.1060 support zone, targeting a dip toward 1.1030–1.1000 initially and potentially extending to 1.0970–1.0950 on sustained bearish momentum. A tight stop-loss above 1.1110 is advised to manage risk.

- Alternate Long Setup: If EUR/USD manages to rally above 1.1110, it could signal a bullish breakout from the recent range. In that case, traders might look for a run up to 1.1140–1.1170. Any long positions should be protected with a stop-loss below 1.1060 in case the pair resumes its prior range trading.

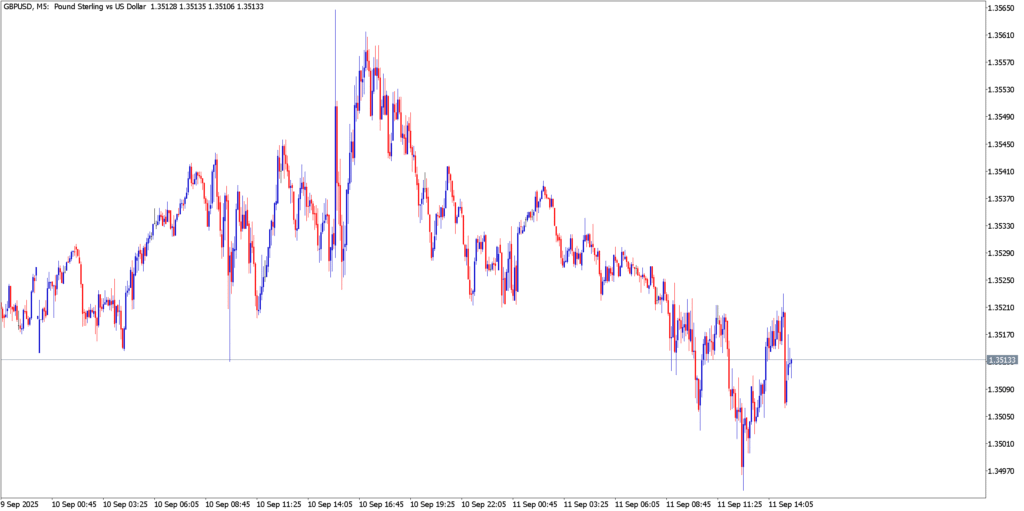

GBP/USD

Technicals in Focus

GBP/USD experienced a sharp sell-off, sliding down to the 1.3515 area after peaking near 1.3560 earlier in the session. This downward swing was fueled by a combination of broad U.S. dollar weakness and surging oil prices, which bolstered the Canadian dollar. From a technical perspective, bearish momentum has been building: the MACD has crossed decisively below its zero line, indicating sellers are gaining the upper hand. However, the Stochastic oscillator has dipped into oversold territory, hinting that the pair may be due for a corrective bounce or at least a pause in the downtrend. Meanwhile, the 14-day RSI hovers around neutral levels (near 50), reflecting an overall lack of a strong trend despite the recent drop.

Trading Strategy: Neutral to Sell

- Short Setup: A sustained break below the 1.3530–1.3500 region would reinforce the bearish case. Traders could initiate short positions aiming for a move down to 1.3470–1.3450 as a first target, with an extended objective around 1.3400–1.3380 if selling pressure persists. A stop-loss just above 1.3570 should cap risk in the event of an unexpected bullish reversal.

- Alternate Long Setup: On the flip side, if USD/CAD bounces and reclaims levels above 1.3570, it might signal an oversold rebound. In that scenario, a rally toward 1.3600–1.3630 could be on the cards. Any long trades taken on a break higher should have a stop placed below 1.3530, as a return below this level would negate the bullish attempt.

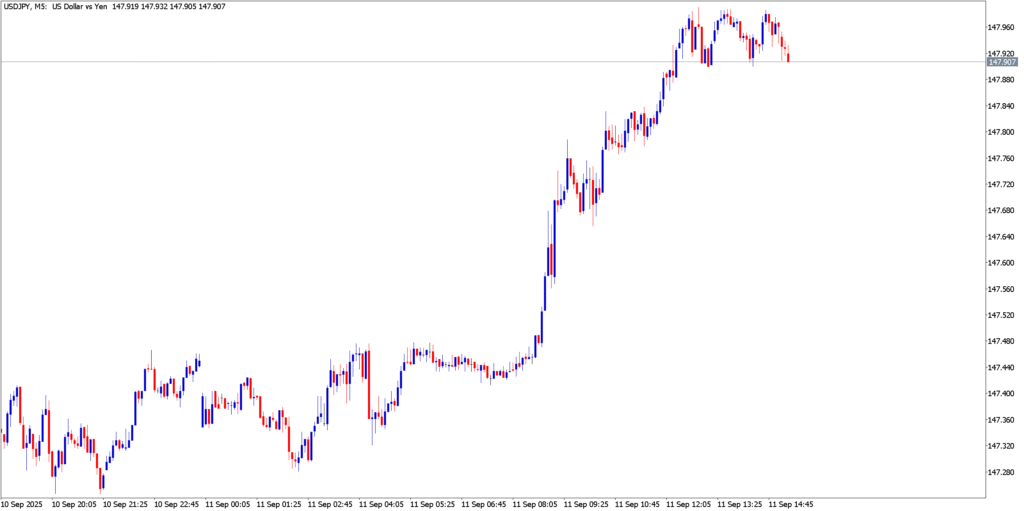

USD/JPY

Technicals in Focus

The USD/JPY pair saw significant volatility, whipsawing through the session before settling near 0.6725 after an earlier sharp pullback. The Aussie’s gyrations reflected shifting global risk sentiment and reaction to recent Australian economic cues, with traders turning cautious ahead of upcoming U.S. economic releases. Technically, the bearish momentum appears to be easing: the MACD is flattening out around the zero line, suggesting that downward momentum is waning. At the same time, the Stochastic oscillator has sunk into oversold levels, often a precursor to at least a short-term bounce or consolidation. The 14-day RSI remains stuck in a neutral range, around the mid-40s, reinforcing the view that AUD/USD is in a consolidation phase without a definitive trend at the moment.

Trading Strategy: Neutral to Buy

- Long Setup: With bearish pressure showing signs of exhaustion, traders can watch for a break above the 0.6720–0.6700 zone to consider long positions. A rebound from this area could target an upswing toward 0.6750–0.6780 initially, with bullish momentum potentially extending into the 0.6810–0.6840 region. A stop-loss below 0.6680 is prudent to guard against a deeper pullback.

- Alternate Short Setup: If downside risks resurface and AUD/USD slips below 0.6680, it would reassert the bearish trend. In that event, short positions could be entertained, eyeing a decline to 0.6650–0.6620 as an initial profit zone. Any shorts should be monitored with a stop just above 0.6720, since a recovery above this level would signal a false breakdown.

Market Outlook

Looking ahead, traders will be closely watching upcoming U.S. economic indicators, particularly employment-related data, for fresh clues about the strength of the U.S. economy and the likely trajectory of Federal Reserve policy. Any surprises in these reports could have outsized effects on the U.S. dollar’s direction and overall market volatility. In Europe, attention remains on the ECB, as market participants seek hints on how the central bank plans to navigate persistent inflation and sluggish growth. Any shift in tone from the ECB could quickly reverberate through EUR/USD given the euro’s vulnerable backdrop.

Meanwhile, in Canada, the Bank of Canada’s pending interest rate decision looms as a key risk event for USD/CAD. Traders have been factoring in domestic economic trends and commodity price movements, so any deviation from expectations by the BoC could spark a fresh wave of volatility in the pair. Over in Australia, the Aussie dollar’s fortunes will remain tightly linked to global risk sentiment and developments in major commodity markets. Overall, markets are poised to react swiftly to new information, staying highly sensitive to economic data releases and central bank communications. With sentiment on a knife’s edge, any unexpected news or shifts in policy rhetoric could trigger notable swings across these currency pairs as we head into the end of the week.