To short the market means to sell an asset you don’t own in order to buy it back later at a lower price. Short selling explained simply: you borrow shares, sell them at today’s price, and aim to repurchase them cheaper, profiting from the decline.

Key Takeaways

- Shorting the market means profiting from falling prices.

- Short selling explained involves borrowing, selling, and buying back lower.

- A bearish trading strategy is used when traders expect price drops.

- Learning how to short stocks requires understanding margin and risk.

- The risks of short selling can be significant if the price rises instead of falls.

What Is Short Selling?

Short selling explained in basic terms: you sell first and buy later. In a normal trade, you buy a stock hoping it goes up. When you short the market, you do the opposite. You sell shares you borrow from a broker, then buy them back later.

- If the price falls, you keep the difference.

- If the price rises, you lose money.

This is why understanding the short-the-market meaning is critical before using it.

How to Short Stocks Step by Step

To understand how to short stocks, you must know the mechanics.

- First, you need a margin account. A broker lends you shares of a stock. You sell those shares at the current market price.

- Later, you buy the shares back to return them to the broker.

- If the price dropped, you profit. If the price increased, you take a loss.

For example:

- You short a stock at $100.

- Price falls to $80.

- You buy it back at $80.

- You make $20 per share (before fees).

This is a basic bearish trading strategy.

Why Traders Use a Bearish Trading Strategy

Markets don’t only go up. During recessions, economic slowdowns, or company-specific problems, stocks can fall sharply.

Trading strategies for falling markets allow traders to profit from these declines.

Short selling is commonly used when:

- Earnings are weak

- Market sentiment turns negative

- Technical breakdowns occur

- Economic data disappoints

A bearish trading strategy can also be used as a hedge to protect long positions.

The Short the Market Meaning in Index Trading

Shorting isn’t limited to individual stocks. Traders can short the overall market through:

- Index futures

- ETFs

- Contracts for difference (CFDs)

“Shorting the market,” meaning in this context, refers to betting that the overall market index will decline. This can be part of broader trading strategies for falling markets.

For example, if a trader believes the S&P 500 will drop due to economic uncertainty, they may short an index-related instrument instead of a single stock.

Risks of Short Selling

The risks of short selling are higher than many traders realize.

When you buy a stock, the worst-case scenario is losing your investment if the price goes to zero.

But when you short stocks, potential losses are unlimited because there is no cap on how high a stock can rise.

Other risks include:

- Short squeeze events

- Margin calls

- Borrowing fees

- Sudden news-driven spikes

A short squeeze occurs when many traders are short, and the price suddenly rises sharply, forcing them to buy back shares quickly, pushing the price even higher.

Comparing Long vs Short Positions

Here is a simple comparison table to clarify:

| Feature | Going Long | Short Selling |

| Market Expectation | Price rises | Price falls |

| Profit Potential | Unlimited upside | Limited (price can only go to zero) |

| Loss Potential | Limited to investment | Unlimited |

| Emotional Pressure | Fear of losing gains | Risk of short squeeze |

Understanding this difference is essential before deciding how to short stocks.

Technical Signals for Short Selling (Simple Explanation)

Short selling means trading with the expectation that a price will fall, not rise. To do this safely, traders look for clear bearish signals on the chart that show selling pressure is increasing.

Common Technical Signals Used for Short Selling

- Break Below Key Support: When price falls below an important support level, it shows buyers are no longer defending that area. This often signals further downside.

- Lower Highs and Lower Lows: A series of lower highs and lower lows confirms a downtrend. This structure tells traders that sellers are in control.

- Bearish Engulfing Patterns: A bearish engulfing candlestick occurs when a strong red (bearish) candle completely covers the previous bullish candle. This signals a shift from buying pressure to selling pressure.

- Rising Volume on Down Days: Higher volume when prices fall shows strong participation from sellers. This confirms that the downward move has strength behind it.

Why Traders Combine Signals

Technical traders rarely rely on just one signal. When multiple bearish indicators align, the probability of a successful short trade increases.

Combining technical breakdowns with weak company fundamentals (such as poor earnings or negative news) can further improve the odds of a bearish trading strategy.

Psychological Challenges of Short Selling

Short selling is mentally more challenging than buying because it goes against the natural long-term direction of markets, which generally rise over time. This makes short trades feel riskier and emotionally heavier.

Why Shorting Feels Different

When you buy a stock, your potential loss is limited to what you invested. In short selling, losses can increase quickly if the price rises instead of falls. This creates extra psychological pressure and requires strong discipline.

3 Common Emotional Challenges Short Traders Face

Fear of Loss: Because prices can rise unexpectedly, fear often causes traders to exit short positions too early, even when the setup is still valid.

Greed: When a short trade starts working, greed can tempt traders to hold the position too long, hoping for more downside. This can result in giving back profits if the price suddenly reverses.

Going Against the Trend: Since markets tend to rise over time, short traders are often trading against the broader market direction, which requires confidence in their analysis and strict adherence to their strategy.

Why Emotional Control Matters

Successful trading strategies for falling markets depend heavily on:

- Clear entry and exit rules

- Predefined stop-loss levels

- Controlled position sizing

Emotional discipline helps traders stick to their plan instead of reacting impulsively to price movements.

In short selling, emotional control is just as important as technical analysis.

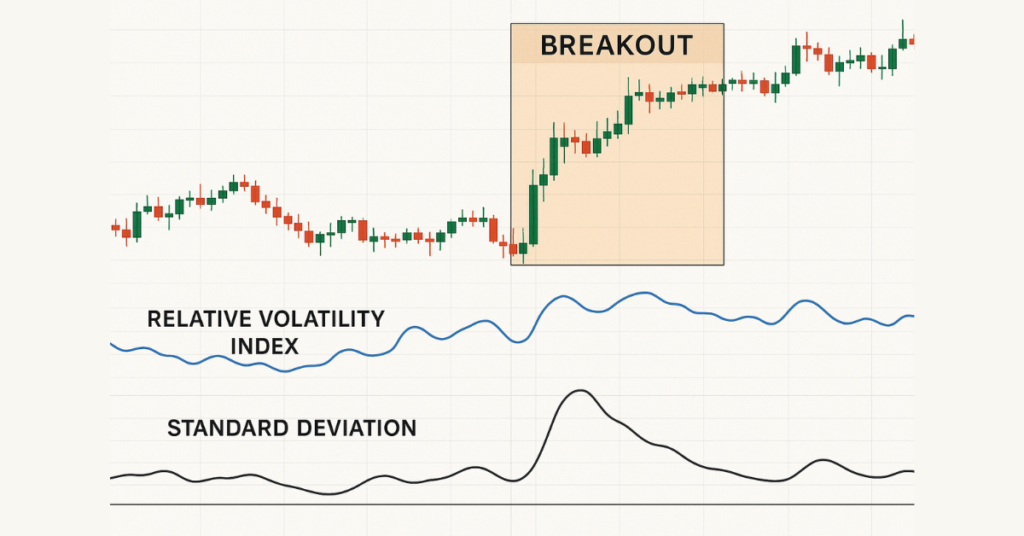

Short Selling in Volatile Markets

During high volatility, short selling can become more attractive. Rapid declines create opportunities.

However, volatility also increases the risk of sharp rebounds.

Timing is critical. Entering too early before confirmation may lead to losses.

Shorting the market does not mean blindly betting against growth. It means identifying structured opportunities in declining trends.

Practical Example of Short Selling

Imagine a company reports weak earnings. The stock breaks below major support at $50.

You decide to short at $48. If the price falls to $40, you buy back and profit from the difference. But if the price unexpectedly rises to $60, losses accumulate quickly.

This highlights why the risks of short selling must always be considered.

Trading Conditions and Execution

Short selling requires efficient execution and proper margin management. Traders using bearish trading strategy approaches often look for platforms that offer competitive spreads, flexible leverage, and fast withdrawals to manage both long and short exposure efficiently.

For example, brokers like Defcofx provide high leverage options, tight spreads, and quick withdrawal processing, which can help traders manage both upward and downward market opportunities effectively. Proper trading conditions support disciplined strategy execution in volatile markets.

Final Thoughts: What Does It Mean to Short the Market

Short selling explained simply means profiting from falling prices by selling first and buying later. Understanding how to short stocks requires knowledge of margin accounts, risk management, and market psychology.

While a bearish trading strategy can provide opportunities during downturns, the risks of short selling are significant, including unlimited loss potential. Traders who apply structured trading strategies for falling markets and strict risk controls are better positioned to navigate market declines responsibly.

Frequently Asked Questions

What does it mean to short the market?

Shorting the market means selling an asset you do not own with the expectation that its price will fall. You aim to buy it back later at a lower price and profit from the difference.

How do beginners learn how to short stocks?

Beginners should first understand margin accounts, borrowing mechanisms, and risk management. Practicing on demo accounts and studying short selling explained examples can help build confidence.

What are the biggest risks of short selling?

The risks of short selling include unlimited losses, short squeezes, and margin calls. Since prices can rise indefinitely, risk control is critical.

Is short selling only for professional traders?

Short selling is often used by professionals, but retail traders can also short stocks if their broker allows margin trading. Proper education and caution are necessary.

What are common trading strategies for falling markets?

Common trading strategies for falling markets include short selling, buying inverse ETFs, using put options, and trading bearish chart patterns confirmed by volume.

Discover More Trading Guides by Defcofx

- Good Stocks to Invest in for Beginners

- Best Currency Pairs to Trade during Sydney Session

- How Do Exchange Rates Impact International Trade?

- Best Currency Pairs to Trade During the Tokyo Session

- Is Day Trading Profitable?

- Mexican Peso vs Dollar: Market Trends & Insights

- Pairs Trading – Market-Neutral Stock & Forex Guide