As we head into Tuesday, September 9, 2024, global markets are positioned for a session that could see heightened volatility, driven by a series of significant economic data releases. The U.S. dollar remains the focal point as traders react to recent data and prepare for upcoming reports, particularly U.S. labor market data and central bank announcements.

In the currency markets, the EUR/USD pair experienced a choppy session, largely influenced by mixed economic signals from the Eurozone and the U.S. The euro remains under pressure amid ongoing concerns about the region’s economic outlook. Traders await further insights from the European Central Bank (ECB) and upcoming U.S. releases, including jobless claims and ISM non-manufacturing reports.

Meanwhile, the USD/CAD pair saw a sharp sell-off, reflecting a weaker U.S. dollar and a rebound in oil prices, which buoyed the Canadian dollar. The movements were also influenced by positioning ahead of the Bank of Canada’s rate decision.

The AUD/USD pair exhibited notable volatility, underscoring the market’s sensitivity to global risk sentiment and recent Australian economic data. Traders are closely monitoring developments as they assess the implications of upcoming U.S. economic figures and overall risk sentiment.

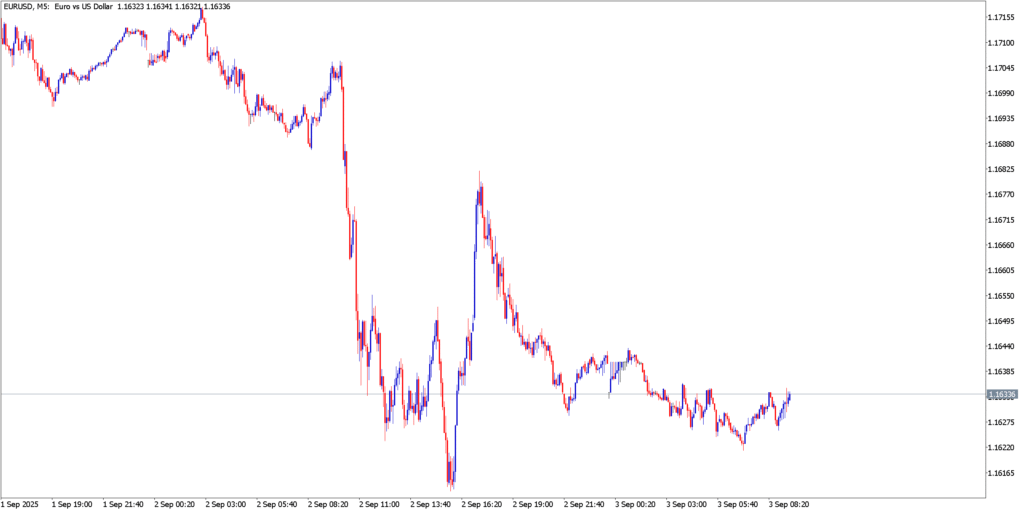

EUR/USD

Technicals in Focus

The EUR/USD pair remained volatile, closing near the 1.1080 level after oscillating throughout the session. The pair’s movements were influenced by mixed Eurozone and U.S. economic data, with traders showing caution ahead of U.S. labor data. On the technical front, the MACD indicator is hovering near the zero line, with histograms showing minimal momentum, suggesting indecision in the market. The Stochastic Oscillator is in neutral territory, offering no clear directional bias. The 14-day RSI remains subdued, reflecting the pair’s current range-bound behavior.

Trading Strategy: Neutral to Sell

- Sell below 1.1080–1.1060 with targets at 1.1030–1.1000 and 1.0970–1.0950, with a stop loss above 1.1110.

- Buy (Alternative) above 1.1110 with targets at 1.1140–1.1170, with a stop loss below 1.1060.

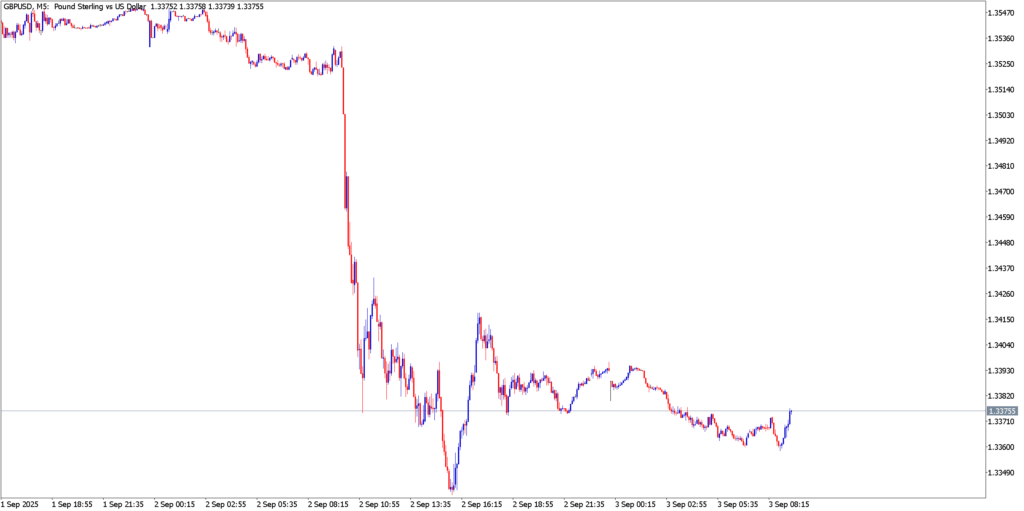

GBP/USD

Technicals in Focus

The GBP/USD pair experienced a sharp sell-off, dropping to the 1.3516 level after hitting a session high of 1.3562. This movement was largely driven by Canadian employment data and fluctuations in oil prices, which impacted the Canadian dollar. On the technical side, the MACD has crossed below the zero line, indicating increasing bearish momentum. The Stochastic Oscillator is in oversold territory, suggesting that the pair may soon see a corrective bounce. The 14-day RSI is neutral, offering no clear directional bias.

Trading Strategy: Neutral to Sell

- Sell below 1.3530–1.3500 with targets at 1.3470–1.3450 and 1.3400–1.3380, with a stop loss above 1.3570.

- Buy (Alternative) above 1.3570 with targets at 1.3600–1.3630, with a stop loss below 1.3530.

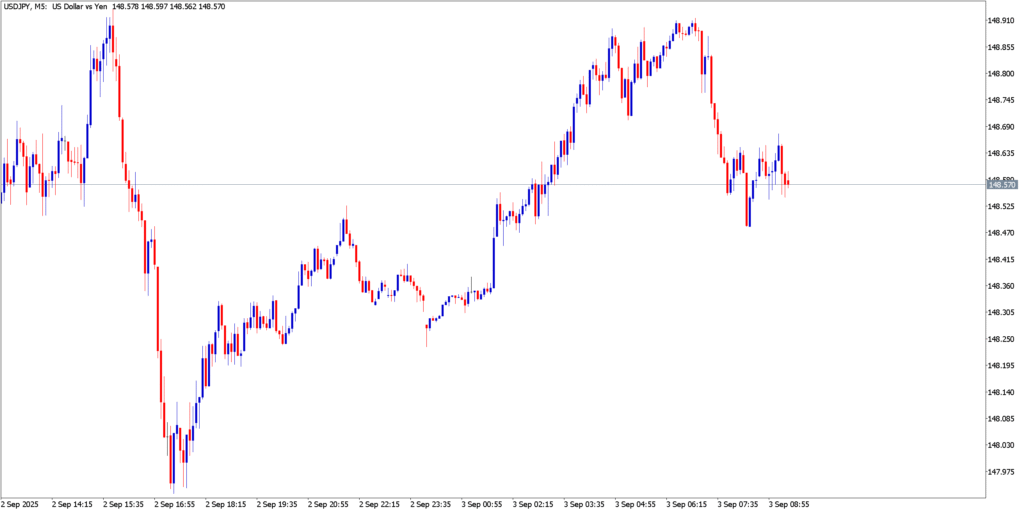

USD/JPY

Technicals in Focus

The USD/JPY pair experienced significant volatility, closing near the 0.6726 level after a sharp downward move. This movement was largely driven by risk sentiment and recent Australian economic data, as traders remain cautious ahead of upcoming U.S. economic releases. On the technical side, the MACD is near the zero line, indicating weakening bearish momentum. The Stochastic Oscillator is in oversold territory, suggesting a potential for further upside. The 14-day RSI is neutral, reflecting the pair’s current consolidation phase.

Trading Strategy: Neutral to Buy

- Buy above 0.6720–0.6700 with targets at 0.6750–0.6780 and 0.6810–0.6840, with a stop loss below 0.6680.

- Sell (Alternative) below 0.6680 with targets at 0.6650–0.6620, with a stop loss above 0.6720.

Market Outlook

Looking ahead, the U.S. initial jobless claims and non-farm productivity data will be closely watched, as they could provide key insights into the strength of the U.S. labor market and the future direction of the U.S. dollar. Additionally, traders will monitor any updates from the ECB as they gauge the central bank’s policy stance amidst ongoing economic uncertainties in the Eurozone.

In Canada, the Bank of Canada’s rate decision will be a critical factor for USD/CAD movements, particularly in light of recent employment and trade balance data. The Australian dollar’s performance will also be closely tied to global risk sentiment and developments in trade dynamics. Overall, markets are expected to remain highly sensitive to economic data releases and central bank communications, with potential for increased volatility as traders react to new information.