Forex traders witnessed a whirlwind of volatility this Friday as major currency pairs went into overdrive. Without any major news catalyst, the charts themselves drove jaw-dropping moves. GBP/USD spiked then reversed violently, EUR/USD collapsed in a sudden sell-off, and USD/JPY whipsawed in a dramatic turnaround, all in one session.

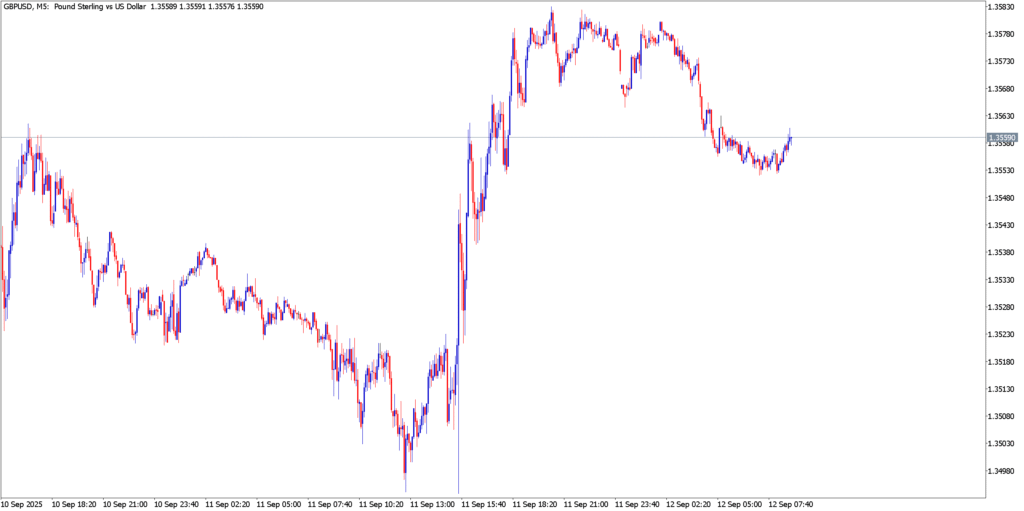

GBP/USD

The British pound took traders on a wild ride, surging early to a fresh peak near 1.3560 before an abrupt reversal slammed it back down below 1.3500 in hours. This bull-trap spike above key resistance saw bullish momentum evaporate fast – a classic whipsaw that caught many off guard. MACD initially extended further into positive territory during the rally, but quickly rolled over, hinting the buying frenzy was unsustainable. The RSI flashed overbought (>70) at the morning high then peeled back sharply, confirming a momentum shift as the pair plunged. Even the Stochastic oscillator showed a bearish divergence at the top, foreshadowing the reversal as price overextended. After bulls failed at 1.3560, GBP/USD found temporary footing around the psychological 1.3500 support, trimming losses by the close but leaving a chaotic intraday range in its wake.

Strategy: Neutral to Sell

The failed breakout flips bias downward. Consider shorting near 1.3520 if bounces fade, targeting a drop to ~1.3440, with a stop above 1.3570 to cap risk.

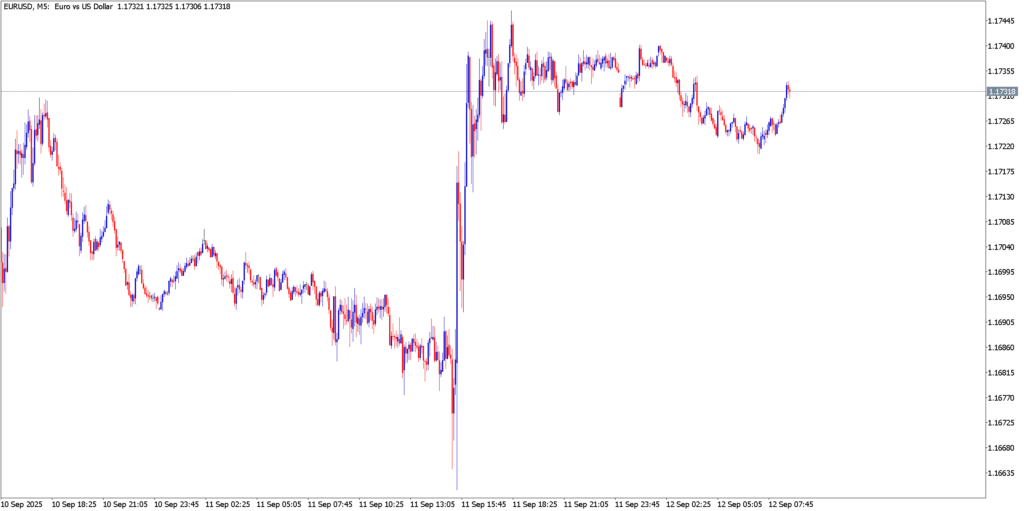

EUR/USD

The euro’s modest uptick unraveled into a free-fall, as EUR/USD nosedived from above 1.1700 to the mid-1.1600s in a flash sell-off. Once the pair cracked support around 1.1680, stop-loss selling cascaded and EUR/USD sank to multi-week lows with barely a bounce. Bearish momentum dominated – the MACD histogram plunged deeper below the baseline, reflecting accelerating downside pressure. The RSI slid swiftly toward oversold territory under 30, yet the absence of any relief rally underscored how one-sided the drop was. Stochastics lingered at ground-zero, confirming a glut of bearish momentum with no clear bottoming signal by day’s end. Having sliced through key support levels, the pair’s slide finally stalled just above 1.1600, but the damage was done – Euro bulls were in full retreat.

Strategy: Sell

Traders could use any bounce toward 1.1660 as a short entry, aiming for ~1.1580 as the next downside target. Place a stop just above 1.1700 in case of an upside reversal.

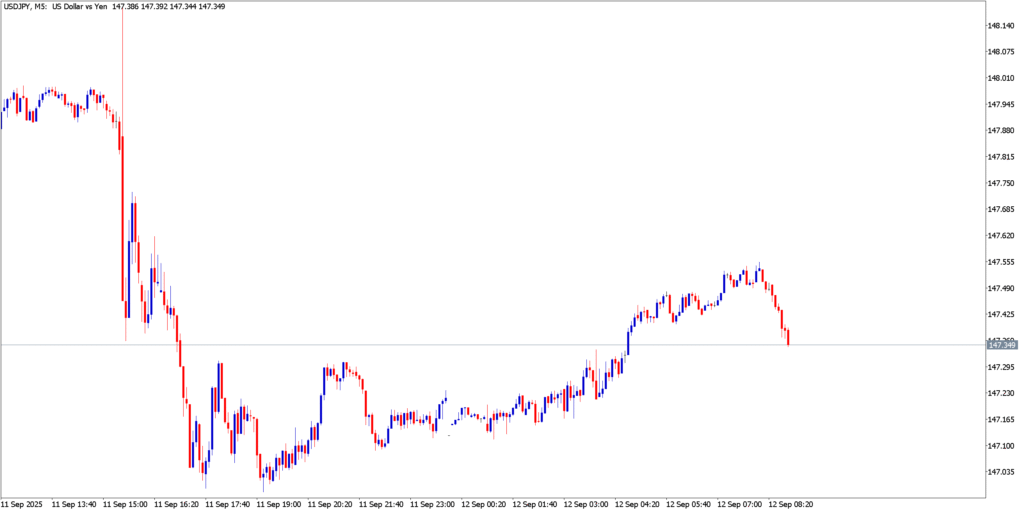

USD/JPY

USD/JPY put on a show of extreme volatility, plunging and then skyrocketing in a breathtaking V-shaped reversal. The pair initially tanked from just shy of 149.0 down to the mid-147.00s as a wave of yen strength triggered a swift sell-off. But within the same session, dollar bulls roared back and erased the drop – USD/JPY rebounded explosively, surging right back up to challenge the 149.00 handle by afternoon. This whiplash turnaround had momentum indicators scrambling. The MACD, which flashed a bearish cross during the plunge, just as quickly flipped bullish as the recovery gained traction, reflecting the violent swing in momentum. RSI went from oversold during the dip to near-overbought after the spike, an extraordinary intraday reversal of sentiment. Meanwhile, a bullish crossover in Stochastics appeared almost immediately after the low, confirming that the pair’s momentum flipped back up at breakneck speed. By the close, USD/JPY was pressing on resistance near 149.0 – a dramatic round trip that left traders reeling.

Strategy: Neutral to Buy

With bullish momentum reasserted, watch for a break above 149.00 as a long trigger. A successful push higher could target the psychological 150.00 level next. Consider a stop below ~148.40 to guard against another sudden reversal.

Today’s wild swings underscore just how sensitive the forex market is to trend shifts and technical levels. Even without news drivers, volatility spiked as breakouts and breakdowns fed on themselves. Trendlines snapped and support/resistance levels gave way, unleashing outsized moves in seconds. This heightened volatility has put traders on high alert – with the market on a hair-trigger, any hint of a trend change is enough to spark dramatic fireworks across the major pairs.