Global markets are treading carefully after recent central bank moves, with volatility elevated but steadying by Thursday. Traders remain cautious, having seen the U.S. dollar weaken sharply after expected policy shifts, before finding footing overnight. The U.S. Dollar Index is firming around 96.8, up about 0.3% from yesterday’s lows, suggesting the greenback has regained some support after an early dip. Overall, investors are positioned defensively: risk assets are consolidating and major FX crosses are trading within established ranges as the market awaits the next catalyst.

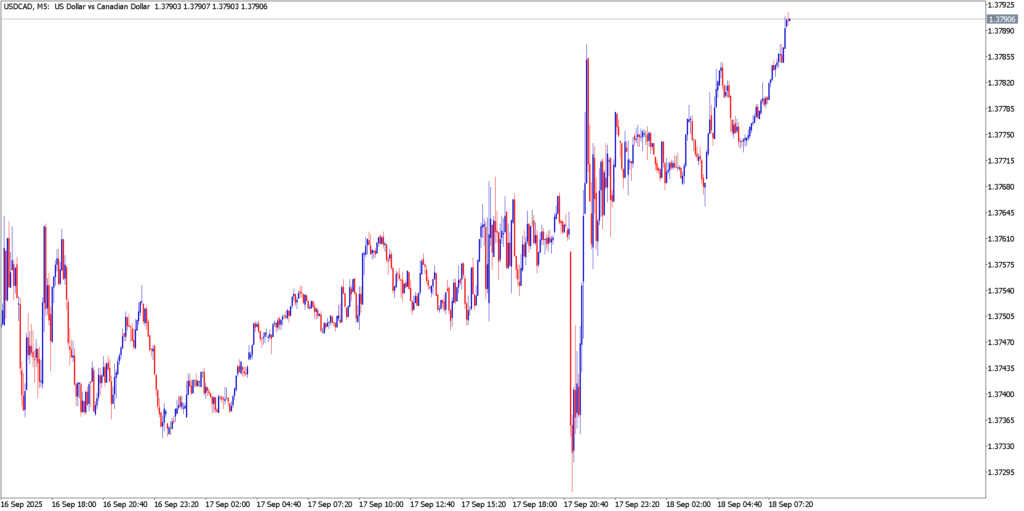

USD/CAD

The USD/CAD pair spent Wednesday in a choppy range, briefly dipping to a key support around 1.3725 before rebounding sharply into Thursday. The drop to 1.3725 matches the recent low noted by analysts, after which bulls stepped in to push price back toward the 1.3790 area. On the intraday chart, momentum indicators have flipped bullish: the MACD histogram is rising off its lows, signaling that momentum is picking up. The 14-day RSI had fallen into oversold territory near the recent low and is now recovering toward neutral, while the Stochastic Oscillator has crossed out of the oversold zone, suggesting the decline has been overdone. However, the pair is still trading below its 50-period moving average, so caution remains.

- Bias: Neutral-to-Bullish. USD/CAD appears to have found support and is attempting to offload oversold conditions.

- Entry Zone: Look to buy dips around 1.3740–1.3750, ideally on a pullback toward the recent support or a break above immediate resistance near 1.3775.

- Take Profit: Target 1.3800–1.3830 on the upside, near the recent high of 1.3790 and next resistance.

- Stop Loss: Keep stops below the swing low at 1.3720 to guard against a new breakdown if support fails.

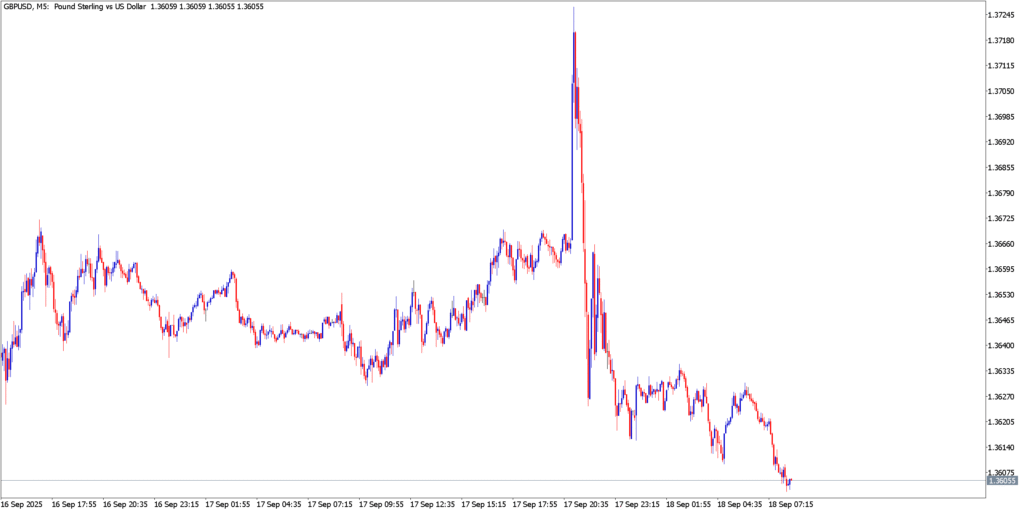

GBP/USD

GBP/USD pulled back from recent highs and closed below 1.3665 resistance on Wednesday. The intraday chart shows a clear bearish leg: the pair dropped from around 1.3720 into the 1.3600–1.3610 area by Thursday morning. Momentum has turned negative – MACD is below its signal line, and the slope is downward – reflecting the recent selling pressure. Importantly, the 14-day RSI has slipped into oversold territory, and the Stochastic is likewise deep in oversold readings, suggesting sellers may be exhausted. Analysts note a main bullish trend is still in force and GBP/USD remains above its 50-period moving average, hinting that this drop could be a corrective pullback rather than a trend reversal. Positive divergence between price and RSI is apparent, reinforcing the view that the decline may be limited.

- Bias: Neutral-to-Bullish. The pair is in a shallow pullback within an uptrend. Oversold indicators imply bulls could defend near current levels.

- Entry Zone: Consider buying between 1.3600–1.3620 on minor dips. Also watch for a decisive break above 1.3665 (former support now resistance) to signal resumed upside momentum.

- Take Profit: Look for 1.3665–1.3700 as the first upside targets, with a stretch goal near the prior top around 1.3720.

- Stop Loss: Place a stop below the recent swing low at 1.3580 to cap risk if the pullback extends into open support.

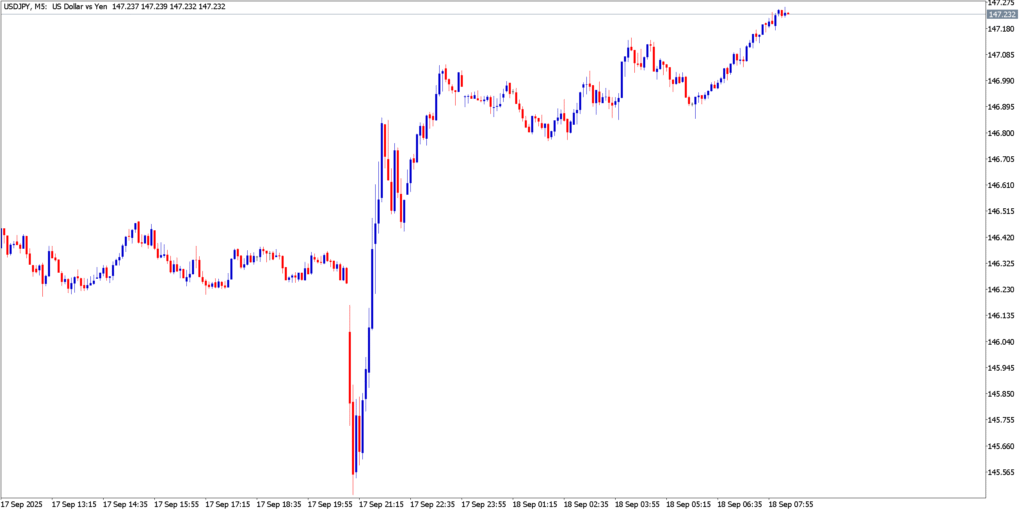

USD/JPY

USD/JPY saw a sharp move higher late Wednesday into early Thursday. The pair briefly tested support at 145.85, then surged through 146.00 and pushed up toward 147.20. This strong rally has put momentum firmly on the bulls’ side – the MACD is rising and above its signal line, confirming robust bullish momentum. The Stochastic Oscillator has shot above 80 into overbought territory, and the RSI has likewise climbed above 70. This indicates the pair has become overextended in the short run. However, despite the rally, USD/JPY is still trading below its 50-period moving average, suggesting the broader trend isn’t decisively bullish yet.

- Bias: Neutral-to-Bullish. The pair broke above key resistance at 146.00, but indicators are overbought after the rush higher. A pause or pullback is likely before continuation.

- Entry Zone: Look to buy on a modest retracement into the 146.20–146.40 area (former resistance turned support). Alternatively, a break and close above 147.00 could be used as a fresh buy signal.

- Take Profit: Initial targets at 147.50–147.70, then 148.00 on further strength.

- Stop Loss: Place a stop below the swing low of 145.85, or more conservatively under 146.00, to protect against a reversal back under support.

Market Outlook

Heading into the remainder of the week, USD crosses are likely to trade cautiously within recent ranges. The U.S. dollar may find firmer footing as risk sentiment remains mixed; watch for any clear breakout if yields or equities swing sharply. USD/CAD looks poised to consolidate between 1.3720–1.3830 unless a fresh catalyst drives a breakout. GBP/USD may stabilize in the 1.3600–1.3665 band unless broader GBP strength resumes. USD/JPY’s strong push towards 148.00 could be met with resistance; any pullback is expected to find support near 146.00. In all pairs, breakthroughs of these key levels would set the tone for next week – but without new data or surprises, expect more range-bound trading and position-squaring in the near term.