Traders brace for a wild session as renewed Fed caution and key US data loom. A still-strong dollar (buoyed by cautious Fed comments) has pressured EUR and GBP, while USD/CAD stays on a knife-edge amid mixed signals. Sentiment remains cautious: risk appetite is muted, equities tepid, and positioning wary ahead of US GDP and inflation releases. Expect volatility spikes around Fed speakers and data; overall bias tilts toward a firmer USD on safe-haven flows as markets digest mixed central bank signals.

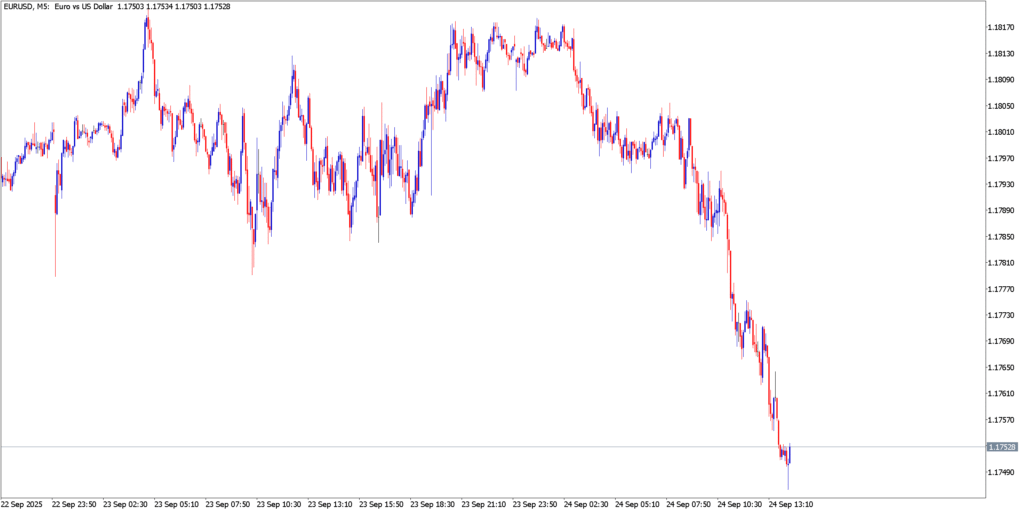

EUR/USD

The EUR/USD has tumbled sharply into the 1.1750s, breaching key support (50EMA) on Wednesday. The descent stopped near the lower end of its recent trading range (~1.1725). MACD has slid below its signal line, showing declining momentum consistent with the sell-off. The Stochastic oscillator is deeply oversold (well below 20), hinting any bounce may be shallow and short-lived. RSI has fallen toward 30, underscoring heavy bearish pressure. In sum, technicals are bearish – sellers dominate unless price quickly snaps back above resistance around 1.1780–1.1800.

Trading Strategy

- Bearish setup: On rallies, look to short below ~1.1780–1.1800 (recent support turned resistance) targeting 1.1725, then 1.1660 if breakdown occurs. A close under 1.1725 swings the pair to the next leg down (1.1660).

- Bullish setup: A firm bounce above ~1.1780–1.1800 would signal temporary relief. In that case, eye 1.1840 as the next resistance. Alternatively, failure to break below 1.1725 could allow a short-covering rally back toward 1.1780–1.1800.

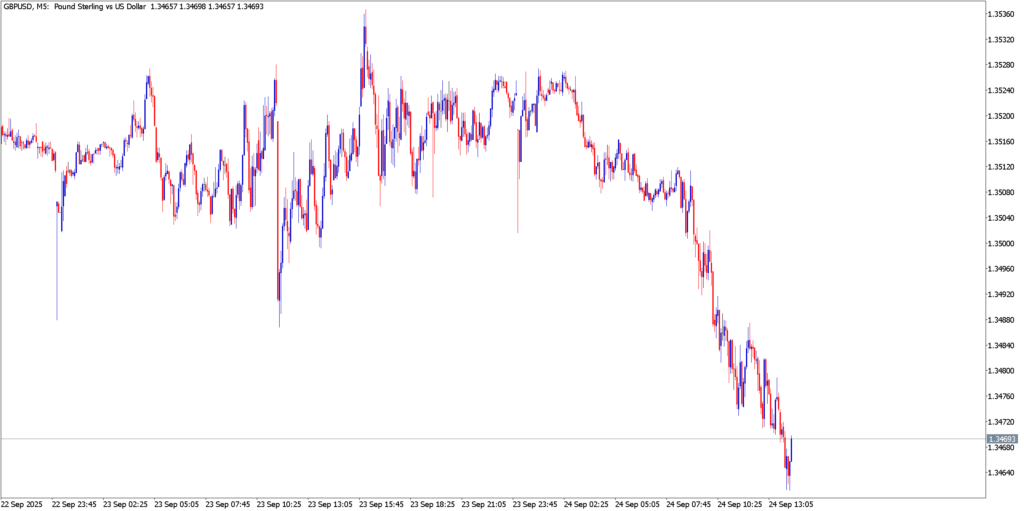

GBP/USD

GBP/USD has also slipped sharply, falling from the mid-1.35s into ~1.3460s on Wednesday. The pair broke down from a bullish channel and lost its short-term moving average support, signaling fresh downward pressure. Momentum indicators (MACD) would now be in negative territory, reflecting bearish control. The stochastic on GBP/USD is likely in oversold territory after this drop, suggesting near-term exhaustion. RSI is sliding toward oversold as well. Overall, the technical bias is down: there’s strong seller momentum at current levels, with only an oversold bounce likely.

Trading Strategy

- Bearish setup: On any relief rally, short around 1.3545–1.3550 (recent pivot) for a drop back toward 1.3420, then 1.3345. A break under 1.3420 (and its recent lows) would confirm bearish control and open 1.3340–1.3300.

- Bullish setup: A decisive break above ~1.3655 (above last week’s swing high) would negate the downtrend. Above 1.3655, push for 1.3740 initially, with 1.3875 as a longer-term target. Only a sustained move past ~1.3655/60 would shift bias back to the upside.

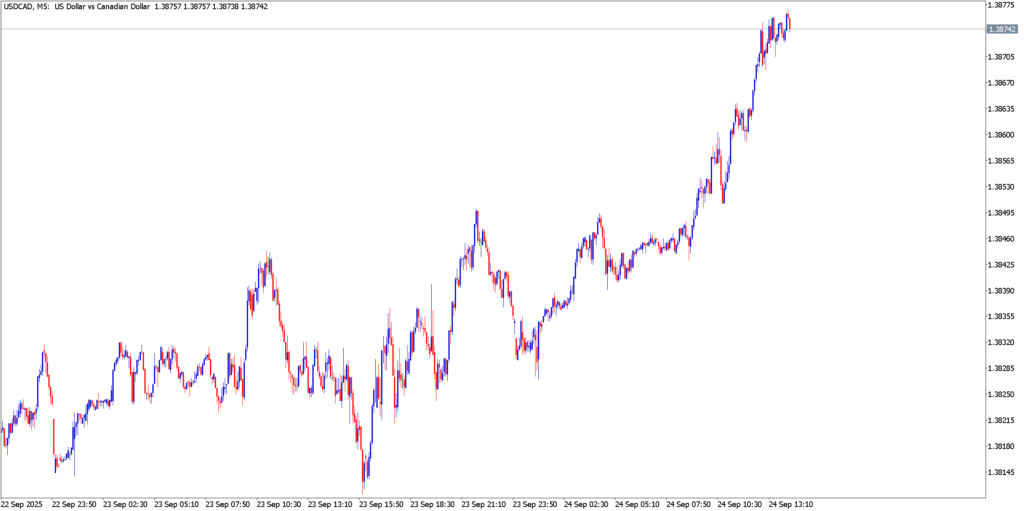

USD/CAD

USD/CAD rallied to test ~1.3900 resistance (near its 200-day EMA ~1.3863) on Wednesday, then consolidated. The short-term trend turned bullish as USD regained ground against CAD. MACD would be crossing above zero, confirming the recent upmove. The stochastic is approaching overbought levels (>80) after the rally, so a near-term pullback is possible. RSI is rising above 50, reflecting growing bullish momentum. In technical terms, USD/CAD is poking at key resistance; a decisive break above 1.3900 would open the way higher, while support holds near 1.3780–1.3800.

Trading Strategy

- Bearish setup: Fades look for shorts below ~1.3780–1.3800. A close under 1.3780 (the recent range floor) should target 1.3750 and then 1.3700. Below 1.3750, the broader uptrend would be in doubt, potentially sliding toward the lower 1.37s.

- Bullish setup: A break above key resistance around 1.3900–1.3915 unleashes a higher rally. Watch for stops above 1.3900 – a sustained run could target 1.4000+ (first major barrier). DailyForex suggests a USD/CAD long above ~1.3915 aiming for ~1.4200.

Market Outlook

The coming days are loaded with catalysts that could amplify moves. All eyes are on Thursday’s U.S. Q2 GDP and Friday’s core PCE inflation, with both sets of data expected to steer the Fed’s next steps. Fed speakers (Williams, Bowman, Barr, Daly) are on deck, and any hawkish tone will underwrite dollar strength. Outside the US, a quiet BoJ meeting and Eurozone PMI releases (midweek) are on the calendar. In short, risk appetite will hinge on these high-impact events. Traders should brace for volatility spikes – any surprises in the data or policy cues could send these FX pairs on sharp directional runs.