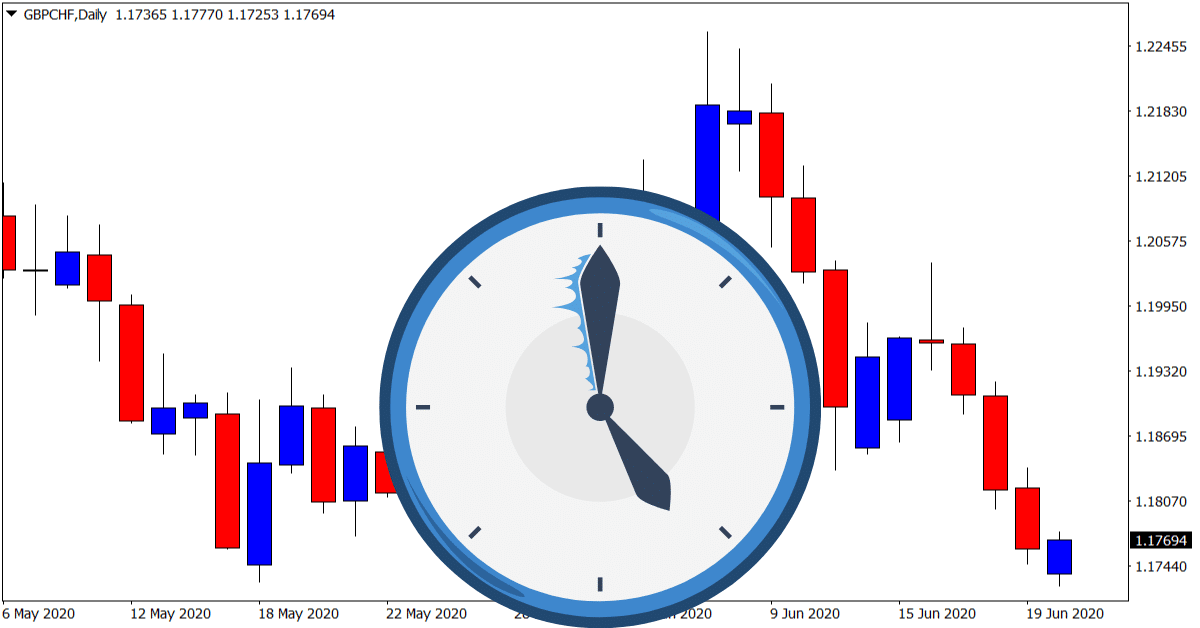

No, Forex is available 24 hours a day, but only 5 days a week, from Monday to Friday. The market opens in Sydney on Monday morning and closes in New York on Friday evening. Trading is paused over the weekend, although some brokers offer limited access to cryptocurrencies or weekend trading for specific instruments.

Key Takeaways

- Forex trading operates 24 hours a day, 5 days a week, not 7.

- The market opens with the Sydney session on Monday morning and closes with New York on Friday night.

- Weekends are considered off-hours, although some platforms offer crypto or synthetic market access during that time.

- Understanding the session schedule is key to planning trades and managing risk.

- Defcofx offers fast execution and global access within the 5-day trading window, maximizing opportunities for all time zones.

Why Forex Isn’t 7 Days a Week

Unlike crypto markets that run nonstop, forex markets pause on the weekends. This is because forex operates on a decentralized network of financial institutions, banks, and brokers, which follow traditional business hours. When these institutions are closed, there’s limited liquidity in the market, making it inefficient and risky to trade.

While electronic communication networks (ECNs) may allow access to some pricing data over the weekend, most brokers and platforms, including major liquidity providers, cease trading operations late Friday. Thus, the market remains inactive until Sunday evening (U.S. time), when the Sydney session kicks off the new week.

Forex Market Trading Hours by Session

To better understand when forex is actually open, here’s a breakdown of the major trading sessions around the world:

| Trading Session | Opens (GMT) | Closes (GMT) | Key Regions |

| Sydney | 10:00 PM | 7:00 AM | Australia, NZ |

| Tokyo | 12:00 AM | 9:00 AM | Japan, Asia |

| London | 8:00 AM | 5:00 PM | UK, Europe |

| New York | 1:00 PM | 10:00 PM | US, Canada |

What Happens to Forex Trading on Weekends?

On weekends, the interbank network that fuels forex trading is inactive. Most brokers do not allow trading on Saturday or Sunday. However, there are a few exceptions:

- Cryptocurrency Trading: Some brokers offer crypto trading 24/7, including weekends.

- Weekend Trading Options: A few brokers provide synthetic indices or weekend-specific assets. These aren’t part of the real forex market and carry higher spreads.

Even though you can’t place trades in the traditional forex market on weekends, many traders use this time to analyze charts, review trades, or plan for the week ahead.

How the Forex Trading Week Flows

The forex week begins in Sydney on Monday morning (Sunday evening in the US) and ends with the New York close on Friday. These five days offer constant movement thanks to overlapping time zones, allowing you to trade at almost any hour. But during weekends, when all four major sessions are offline, activity grinds to a halt.

For example, if you’re trading from the UAE, your forex week starts around 1:00 AM Monday and ends at around 1:00 AM Saturday. Weekend gaps may occur in prices, especially if news breaks during closed hours, which is something traders need to prepare for.

Does This Affect Swing and Day Traders?

Absolutely. For day traders, the 24-hour access during the week is ideal, especially when trading overlapping sessions for maximum volume. Swing traders, who hold positions for several days, need to be mindful of weekend gaps. A position held over the weekend may open at a different price due to sudden geopolitical or economic news, resulting in slippage.

This makes risk management essential, especially if you’re trading large positions or using leverage. Setting stop-loss orders and planning your exits before the weekend are vital steps.

How Traders Can Use Weekends Productively

Yes. Successful traders often use weekends for:

- Backtesting strategies

- Studying market structure

- Reading trading books or articles

- Journaling trades from the past week

- Updating watchlists for the coming week

In fact, this downtime often separates amateur traders from professionals. The best use the break to sharpen their edge.

Looking to trade with a broker that provides ultra-fast execution, multilingual support, and low spreads even during peak hours?

Start trading with DefcofxRisks of Trading Close to Market Open or Close

Although the market runs 24 hours a day for 5 days, not all times are ideal for trading. Volatility often spikes:

- At the market open (Sunday night) due to weekend news

- Near the market close (Friday evening) when traders close positions

These times can show erratic price movements and wider spreads. It’s usually best to trade during high-volume overlaps like the London–New York session.

Final Thoughts on “Is Forex 7 Days a Week?”

So, is forex 7 days a week? No. The 24/5 schedule still offers immense flexibility to trade across global time zones. The key is knowing when to trade and when to prepare. With the right broker like Defcofx, you’re always one step ahead.

Open a Trading Live AccountFAQs

No, the traditional forex market is closed on weekends. However, some brokers offer limited instruments like crypto or synthetic assets during this time.

Forex trading opens with the Sydney session around 10:00 PM GMT on Sunday, depending on your time zone.

Yes. Prices can open significantly higher or lower on Monday due to news or global events that occurred over the weekend.

Forex relies on the global banking system, which closes on weekends. Crypto, by contrast, runs on decentralized blockchain networks.

Absolutely. Weekend downtime is perfect for planning trades, journaling, or reviewing technical setups without live market distractions.

Defcofx Forex Articles You Shouldn’t Miss

Discover powerful forex strategies in these top reads from Defcofx.