In forex, M1, M5, and M15 refer to timeframes on a candlestick chart: M1 shows 1-minute candles, M5 shows 5-minute candles, and M15 shows 15-minute candles. These short timeframes help traders analyze quick price changes and make fast trading decisions, especially in scalping and intraday strategies.

Key Takeaways

- M1, M5, and M15 are short-term forex chart timeframes used for quick decision-making.

- Each timeframe shows how price moved during 1, 5, or 15-minute periods.

- Traders use them for scalping and intraday strategies.

- Choosing the right timeframe depends on trading style, risk tolerance, and speed of execution.

- These charts help spot entry/exit points, breakouts, and reversals.

What Do M1, M5, and M15 Mean in Forex?

In forex trading platforms like MetaTrader 4 (MT4) or TradingView, timeframes are marked as:

- M1 – Each candlestick = 1 minute of price data.

- M5 – Each candlestick = 5 minutes of price movement.

- M15 – Each candlestick = 15 minutes of trading activity.

These small timeframes offer a zoomed-in view of market behavior, perfect for short-term traders.

Importance of M1, M5, and M15 Timeframes

Forex is a fast-moving market. If you trade intraday or scalp, you need to react to changes quickly. That’s where M1, M5, and M15 come in. They allow traders to:

- Monitor microtrends.

- Spot short-term support and resistance

- Catch early breakouts

- Time-precise entries and exits

For example, a scalper might use the M1 chart to enter a trade based on momentum, while using M5 or M15 for confirmation.

Overview of M1, M5, and M15 Timeframes

| Timeframe | Duration Per Candle | Best For | Typical Use |

| M1 | 1 Minute | Scalping | Ultra-fast entries/exits |

| M5 | 5 Minutes | Scalping/Day Trading | Confirm breakouts, reversals |

| M15 | 15 Minutes | Intraday Trading | Trend spotting, cleaner signals |

How Traders Use M1, M5, M15 in Strategy

1. M1 – 1-Minute Chart

The M1 chart is for hyper-scalping. Traders make quick trades that last from seconds to a few minutes.

Example Strategy:

- Look for sharp breakouts during high volatility.

- Use moving averages (like EMA 5 and EMA 20) to time quick entries.

- Keep a tight stop-loss (3–5 pips).

Risk: Very fast-paced and emotional. High chance of overtrading.

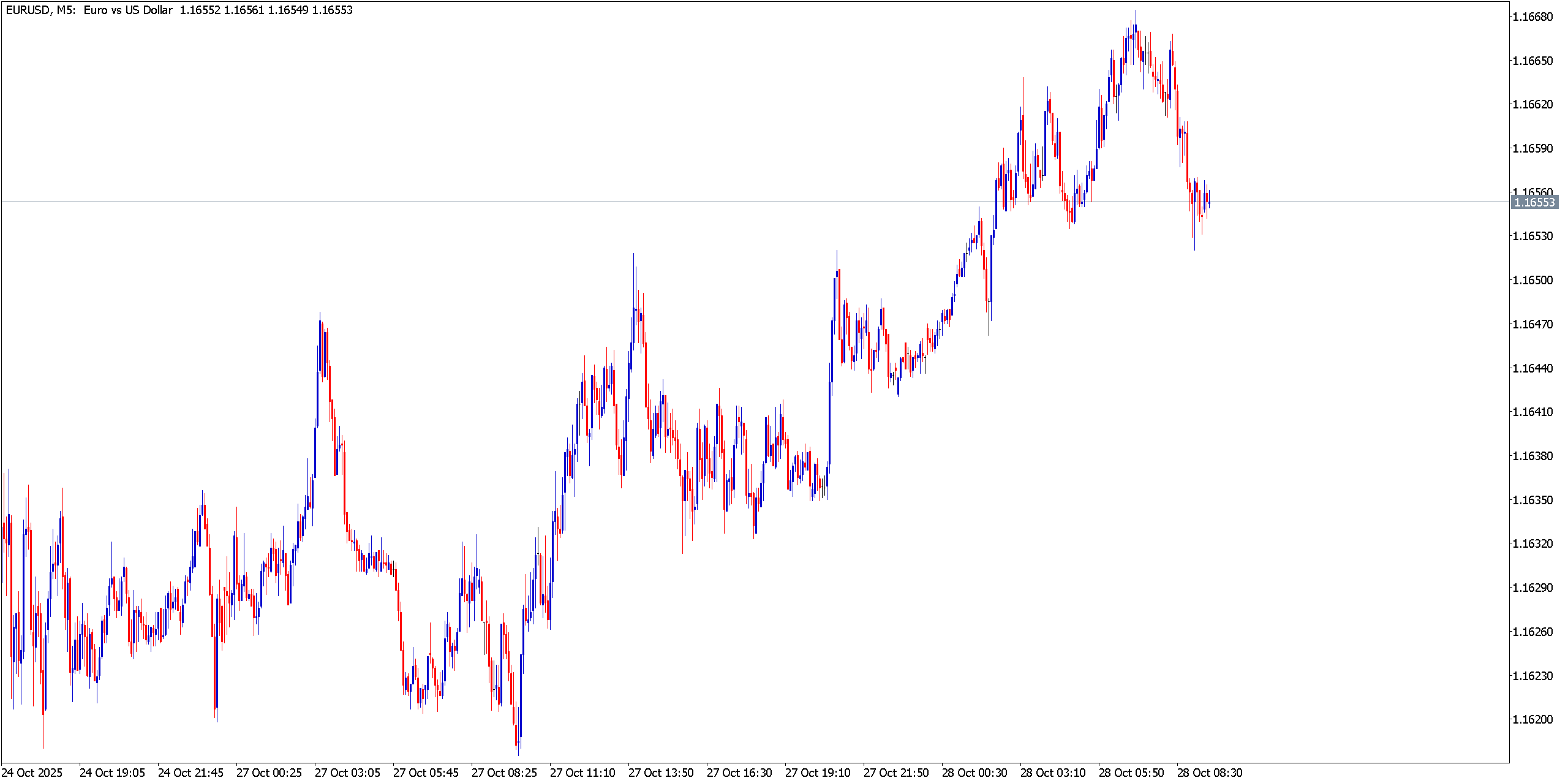

2. M5 – 5-Minute Chart

The M5 chart is the most common among scalpers and fast intraday traders. It balances speed with structure.

Common Setups:

- Breakouts from consolidation.

- RSI/Stochastic + Price Action for pullback entries.

- Entry confirmation after a larger time frame analysis (e.g., 1H or 4H).

It’s also used to find quick entries during news events or high volatility periods.

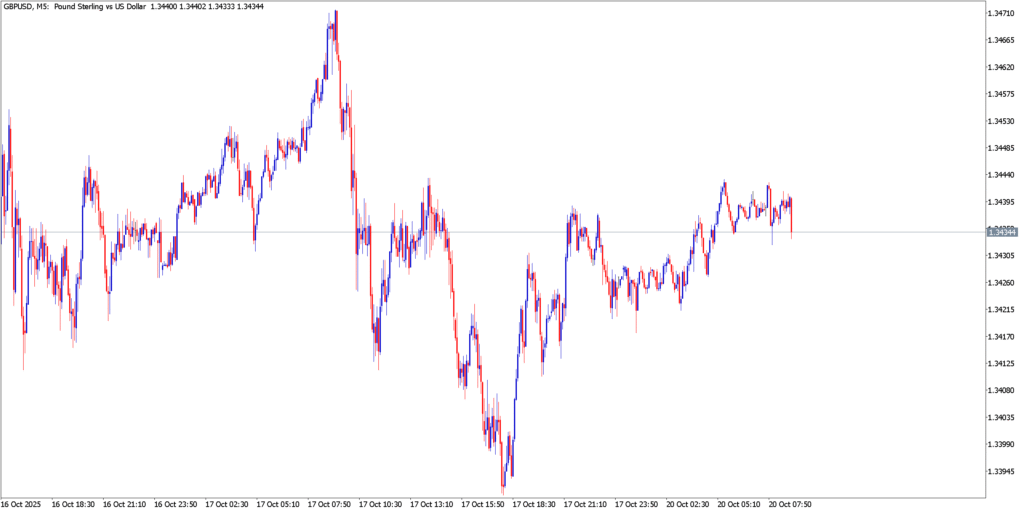

3. M15 – 15-Minute Chart

The M15 chart is often used by traders who want to avoid noise but still capture intraday moves.

Why it works:

- Shows clearer trends.

- Reduces false signals compared to M1 or M5.

- Suitable for short-term swing or intraday setups.

M15 is often used to find strong support/resistance, trade reversals, and manage multiple trades per day without too much noise.

M1, M5, M15 in Action

Some traders combine all three timeframes for multi-timeframe analysis:

- M15 for market bias (bullish/bearish)

- M5 for spotting the setup

- M1 for precise entry point

Example:

Let’s say you spot a bullish structure on M15. You zoom into M5 and see a retracement. On M1, you wait for a bullish engulfing candle and enter the trade.

This method increases entry accuracy and trade confidence.

Scalping on M1 or trading swings on M15 — you need a broker built for speed and accuracy. Start your journey with Defcofx.

Open a Live Account Now.Final Thoughts: What is M1, M5, M15 in Forex

So, what is M1, M5, M15 in forex? They are short-term timeframes used to analyze price movement over 1, 5, and 15 minutes per candle. These charts offer unique insight into intraday moves and are essential for scalpers and quick-action traders.

But remember, speed without discipline leads to mistakes. Learn to read the market context, combine multiple timeframes, and master your trading tools. Only then can you use M1, M5, and M15 to your advantage.

FAQs

M1 shows 1-minute price movements, ideal for very fast scalping. M5 is more stable and popular among intraday traders. M15 gives a smoother view of short-term trends and is often used to confirm setups.

M1 is faster but also more volatile and noisy. M5 is often preferred because it offers better structure while still being fast. Many traders use M1 for entry and M5 for setup confirmation.

Yes. The M15 chart is great for intraday trades with fewer false signals. It gives enough time to analyze the setup, place a trade, and manage it without being glued to the screen.

Trade during high-volume sessions like the London Open, New York Open, or major news releases. These times offer more movement and clearer setups.

Use a broker with tight spreads, low latency, and fast execution. ECN or raw spread accounts from Defcofx are ideal for traders using short timeframes.

Defcofx Forex Articles You Shouldn’t Miss

Discover powerful forex strategies in these top reads from Defcofx.