Lower currency value means a currency loses purchasing power against other currencies due to inflation, weak growth, capital outflows or policy moves. It raises import costs, pressures domestic prices and trade balances, and creates both risks and forex trading opportunities for speculators or hedgers.

Key Takeaways

- Definition: “Lower currency value” = reduced exchange strength and purchasing power.

- Main causes: inflation, interest-rate gaps, trade deficits, political instability, and monetary expansion.

- Major effects: higher import costs, inflationary pressure, altered trade competitiveness, and capital flow shifts.

- For traders: currency weakness creates volatility opportunities for short positions, hedging, and pair strategies.

- Article focus: causes, effects, trader strategies, risk management, and institutional responses.

Understanding Lower Currency Value

A lower currency value occurs when a nation’s money buys fewer foreign goods or services than before, meaning its exchange rate falls compared to others. In forex, this is known as currency depreciation, a normal outcome of changing market forces like supply, demand, and investor confidence.

If 1 USD = 250 PKR today and becomes 260 PKR next month, the PKR has lost value.

It now takes more units of the local currency to buy the same foreign amount.

Depreciation vs Devaluation

While both terms refer to a weaker currency, the cause differs:

| Term | Driven By | Description | Example |

| Depreciation | Market Forces | Natural fall due to inflation, trade imbalance, or investor outflow | PKR weakening vs USD after inflation rises |

| Devaluation | Government Decision | Officially lowering the fixed exchange rate | China’s RMB devaluation to boost exports |

5 Causes of Lower Currency Value

Several interconnected economic and political forces drive a currency’s value down. Understanding these causes helps traders, investors, and policymakers anticipate market trends and respond effectively.

Top 3 Causes of Currency Depreciation

- High Inflation: Erodes purchasing power and makes exports less competitive.

- Falling Interest Rates: Reduces foreign investment inflows.

- Trade Deficits: When a country imports more than it exports, currency demand drops.

1. Inflation and Purchasing Power

When domestic prices rise faster than in other countries, the currency’s real value declines. Foreign buyers need more of that currency to purchase the same goods, reducing its demand globally.

2. Interest Rate Differentials

Lower interest rates make investments in that country less attractive, leading foreign investors to move capital elsewhere for better returns weakening the local currency.

3. Trade and Current Account Deficits

A nation spending more on imports than it earns from exports sends its currency abroad without equivalent inflows. Over time, this excess supply of local currency leads to depreciation.

4. Political and Economic Instability

Unstable governance, policy uncertainty, or conflict can cause investors to lose confidence and withdraw capital, leading to a sharp fall in currency value.

5. Money Supply Expansion

When central banks print more money or engage in excessive quantitative easing, the increase in circulation dilutes currency strength, reducing its external value.

Effects of Lower Currency Value

A fall in a currency’s value reshapes an economy’s trade dynamics, purchasing power, and financial stability. While some sectors may benefit, others experience higher costs and reduced profitability. Understanding these effects helps traders and policymakers respond strategically.

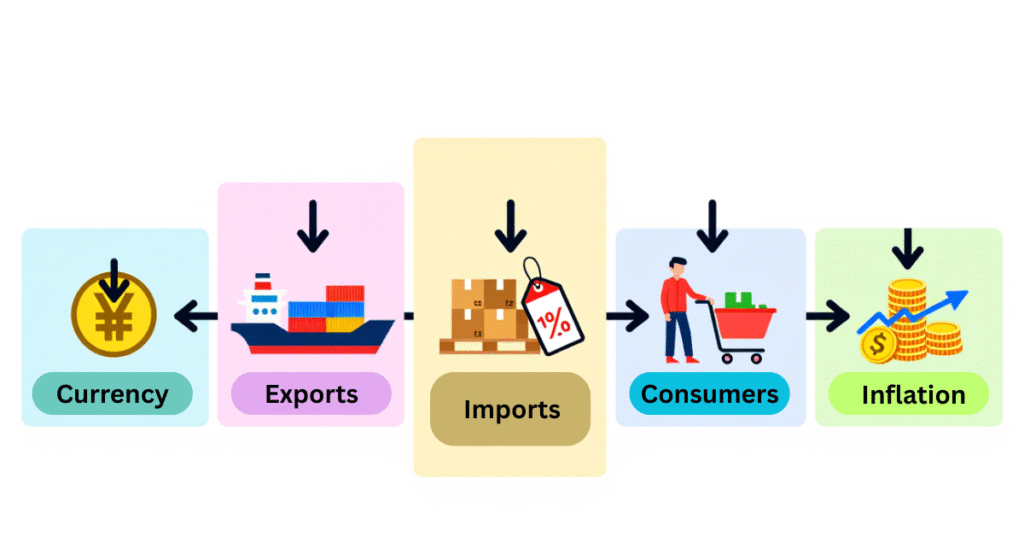

1. Impact on Imports and Exports

When a currency weakens, exports become cheaper for foreign buyers, boosting demand for local goods. However, imports get more expensive, raising costs for businesses dependent on imported materials and for consumers buying foreign products.

Example: If the Euro weakens against the USD, European goods become more affordable for U.S. buyers, but imported U.S. goods cost more in Europe.

2. Inflationary Pressure

A weaker currency means imported goods (like oil or electronics) become pricier, leading to imported inflation. Central banks often respond with tighter monetary policies, raising interest rates to control inflation which can slow growth.

3. Effect on Consumers and Businesses

- Consumers face higher prices and lower purchasing power.

- Businesses reliant on imports see rising costs and reduced profit margins.

- Export-oriented companies may gain competitiveness internationally.

4. Investment and Capital Flow

Foreign investors may withdraw capital when returns fall due to depreciation, further weakening the currency. However, opportunistic investors may re-enter markets to purchase undervalued assets.

5. Impact on Forex Traders

For traders, falling currency values create high-volatility conditions, offering profitable setups through short-selling or pair trading strategies provided risks are managed properly.

Currency Depreciation vs. Currency Devaluation

Though often used interchangeably, currency depreciation and currency devaluation have distinct meanings tied to how and why a currency loses value. Understanding this difference helps traders and economists assess whether a currency fall is market-driven or policy-driven.

Devaluation: Government or central bank decision to deliberately reduce the currency’s value in a fixed exchange rate system.

1. Currency Depreciation (Market-Driven)

Occurs when a nation’s currency weakens due to changes in demand and supply within the forex market.

Causes include: inflation, lower interest rates, trade deficits, and reduced investor confidence.

Example: The Japanese Yen often depreciates when the Bank of Japan maintains low interest rates compared to the U.S. Federal Reserve.

2. Currency Devaluation (Policy-Driven)

Happens when a government intentionally lowers the official exchange rate to stimulate exports, reduce trade deficits, or manage debt repayments.

Example: In 2015, China devalued the yuan to make exports more competitive.

| Feature | Depreciation | Devaluation |

| Cause | Market Forces | Government Decision |

| Exchange Rate System | Floating | Fixed/Managed |

| Frequency | Continuous or Gradual | Rare and Sudden |

| Example | USD/JPY rate movements | China 2015 Yuan devaluation |

| Investor Reaction | Market-driven adjustment | Policy shock or speculation |

3. Why It Matters to Traders

For forex traders, identifying whether a move is depreciation or devaluation affects how they interpret momentum and risk:

- Depreciation trends allow for gradual position adjustments.

- Devaluation events often create sudden spikes in volatility, ideal for short-term trading opportunities.

How Lower Currency Value Affects Traders and Investors

A lower currency value impacts not only governments and economies but also individual traders and investors. Currency depreciation can create both risks and profitable opportunities, depending on one’s market position and strategy.

1. Opportunities for Forex Traders

Currency weakness often brings strong directional trends in forex pairs, which skilled traders can capitalize on.

For example, if the EUR/USD weakens due to Eurozone inflation, traders might short the euro against the dollar.

Trading Benefits During Depreciation:

- Increased Volatility: More price swings, more trading opportunities.

- Predictable Trends: Depreciating currencies often move in one direction for extended periods.

2. Risks for Investors and Importers

Investors holding foreign assets may see their returns eroded when converted back into a weaker domestic currency.

Similarly, import-based businesses face higher input costs, which can reduce profit margins and fuel inflation domestically.

3. Safe-Haven and Hedging Strategies

When currencies fall, traders often shift funds into safe-haven assets such as the USD, CHF, gold, or U.S. Treasuries.

Advanced traders use:

- Currency Hedging: Balancing positions in correlated pairs.

- Carry Trades: Borrowing in weak currencies and investing in high-yield ones.

- Options and Futures: Managing downside risk while maintaining exposure.

4. Psychological Impact on Traders

Rapid depreciation phases can amplify market fear or greed. Maintaining discipline, risk limits, and emotional control is vital during volatile sessions.

Why This Matters for Forex Strategy

Understanding how currency value shifts influence trade flow, inflation, and monetary policy helps traders anticipate macro-driven price movements. Platforms like Defcofx make it easier for traders to act quickly, with fast order execution and withdrawals processed in under 4 hours, ensuring capital flexibility in dynamic markets.

Final Thoughts on Lower Currency Value

A declining currency value can reshape a nation’s economic landscape raising import costs, driving inflation, and influencing trade flows yet it also presents strategic opportunities for traders and exporters. While depreciation often reflects underlying challenges like inflation or capital outflows, it can temporarily aid export competitiveness if managed with balanced policy measures. For economies with persistent weaknesses, however, prolonged depreciation risks eroding purchasing power and investor confidence.

In the forex world, lower currency value fuels volatility creating clear directional trends ideal for shorting weaker currencies or hedging against inflation. Traders who use disciplined risk management and macroeconomic awareness can turn these movements into profitable setups. With the right tools and timely execution, currency depreciation becomes more than a macro event; it becomes a tactical advantage for informed traders.

FAQs About Lower Currency Value

A lower currency value means that a country’s money buys fewer goods and services domestically or internationally. It usually happens due to inflation, low interest rates, trade deficits, or policy decisions that reduce investor demand for that currency.

Currencies lose value when:

1. Inflation rises faster than in other countries

2. Central banks lower interest rates

3. Trade deficits expand

4. Political instability reduces investor confidence

Governments print more money or devalue the exchange rate

Not always. It can boost exports by making them cheaper globally, improving trade balances. However, it also raises import costs and can lead to inflation. The overall effect depends on the country’s economic structure and policy response.

Traders profit by predicting the weakening trend and taking short positions or pairing strong currencies against weaker ones (e.g., USD/JPY, GBP/TRY).

1. With brokers like Defcofx, traders gain access to:

2. High leverage up to 1:2000

3. No commissions or swap fees

4. Fast execution and withdrawals (within 4 hours)

Depreciation: Market-driven fall in a floating currency.

Devaluation: Government-initiated reduction in a fixed currency’s value.

Defcofx Forex Articles You Shouldn’t Miss

Discover powerful forex strategies in these top reads from Defcofx.

- New York Session Forex Pairs List

- Best Currency Pairs to Trade During London Session

- How Much is 0.5 Lot Size in Dollars

- Best Time To Trade NZD/USD

- Why is Yen so Weak?

- Is NZD/USD a Major or Minor Pair?

- Trailing Stop Limit: Definition, Uses & Trading Guide

- When Does a Bearish Market Become Bullish in Forex?

- Countries That Use The US Dollar