Another tumultuous trading day unfolded on Wednesday, 5 November 2025, with the U.S. Dollar on a tear and its major counterparts scrambling. The Greenback’s resurgence – driven by fading Fed rate-cut bets and risk-off currents – sent EUR/USD and GBP/USD sliding toward multi-month lows, while AUD/USD was left licking its wounds after a post-RBA plunge. Traders were gripped by high drama as upbeat U.S. data and central bank signals fueled a dollar rampage, leaving the Euro clinging to support, the Pound bruised ahead of the Bank of England, and the Aussie dollar struggling at the bottom of its charts. We break down the day’s key moves and themes in this news-style recap, covering each pair’s technical and fundamental story.

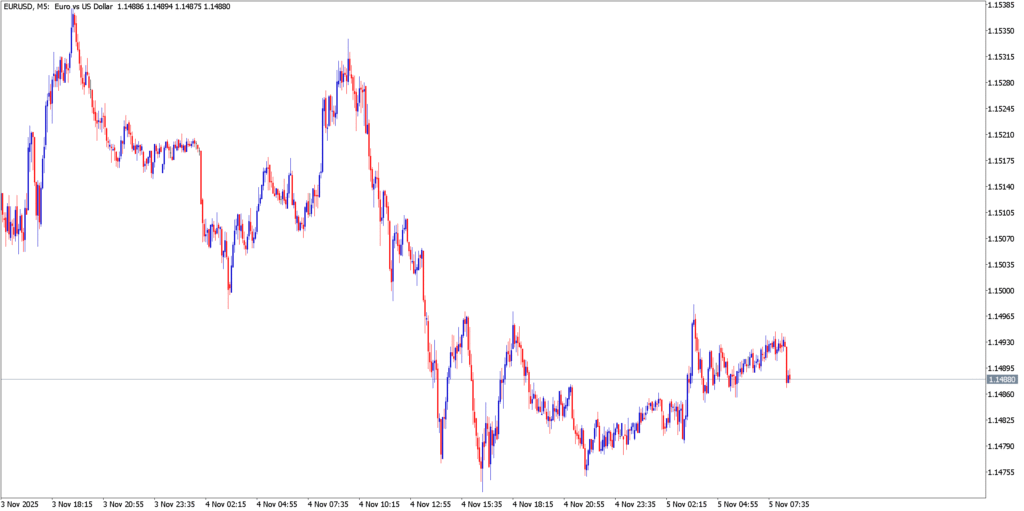

EUR/USD

Technical Analysis

The euro spent the day on the back foot, consolidating near 1.1500 after five straight days of losses. On the 5-minute chart, EUR/USD’s recovery attempts were stunted by a downward-sloping trendline from earlier in the week. The pair’s intraday high barely kissed 1.1530, and sellers quickly re-emerged. A double-bottom pattern appeared to form around the 1.1480 level – roughly the week’s floor – illustrating firm support there. However, lower highs on the M5 chart underscored persistent bearish momentum. The 1.1540–50 zone acted as immediate resistance, aligning with the prior session’s breakdown point. With the euro’s short-term moving averages still pointing lower, the path of least resistance remained to the downside. A decisive break beneath 1.1480 could open the door to fresh lows, whereas a push above 1.1540 would be needed to dent the near-term downtrend. Overall, the Euro’s technical posture was one of uneasy stability – clinging to support by its fingernails as the U.S. Dollar’s onslaught eased just enough for a breather.

Fundamental Analysis

The Euro’s weakness came amid a potent cocktail of U.S. strength and euro-bloc uncertainty. Early in the day, the single currency found brief support from surprisingly robust Eurozone data – final October services PMI ticked up, signaling resilience in the service sector. This helped EUR/USD halt its slide and “halt its five-day losing streak” around 1.1490 as Wednesday began. However, any euro relief was fleeting. The U.S. Dollar’s broad surge – underpinned by waning expectations of another Fed rate cut – quickly overpowered euro buyers. Traders braced for key U.S. releases (ADP jobs and ISM services data) that ultimately reinforced U.S. economic vigor. The ADP report showed a rebound in private payrolls (forecast +31k after the prior month’s surprise drop), and the ISM Services PMI came in around a solid 51 (signaling modest expansion). These results bolstered the view that the Federal Reserve may not deliver a December rate cut after all, a stark change from just a week ago. In fact, Fed rate futures shifted sharply – the probability of a December cut plunged to 67% from 94% a week prior – fueling the dollar’s fire. Meanwhile, the European Central Bank’s stance offered little help to the euro: with Eurozone inflation cooling and the ECB having paused hikes, officials remained cautious and gave “no hints” of any policy rescue for growth. The combination of U.S. economic resilience and dwindling Fed dovish bets left EUR/USD under heavy fundamental pressure. By day’s end, the euro was bruised and barely unchanged – a minor victory considering the dollar’s rampage, but hardly a sign of strength. The broader sentiment remains guarded; without a shift in Fed expectations or a spark of Eurozone optimism, the euro’s respite at 1.15 could prove temporary in the face of the dollar dominance narrative.

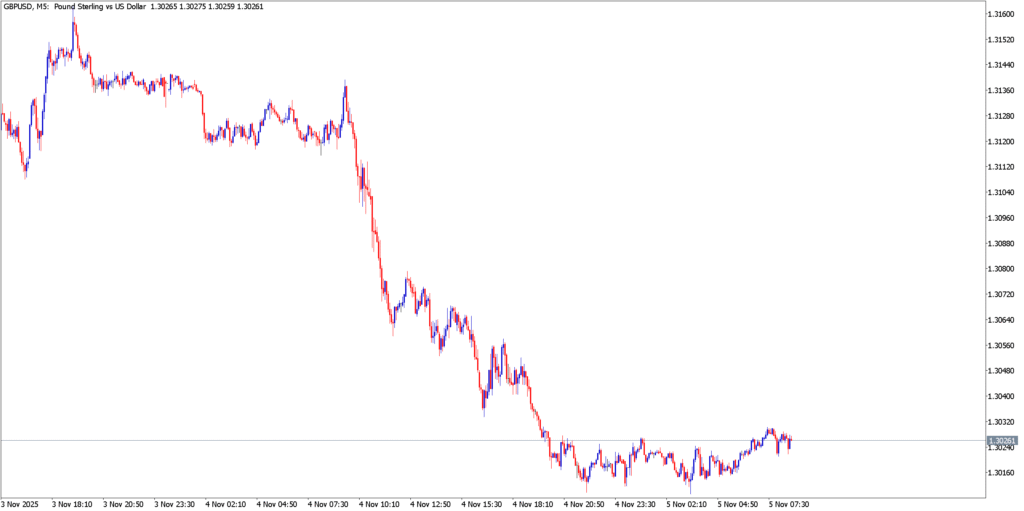

GBP/USD

Technical Analysis

It was a dramatic round trip for GBP/USD, as the pair attempted to stabilize after a steep collapse. Technical signals flashed warnings early: on Tuesday, Cable plunged below the 1.3100 support, slicing through a seven-month floor as if it were butter. By Wednesday, the 5-minute chart showed the pound trying to carve out a base near 1.3000 – a major psychological level. The intraday action was relatively muted (a far cry from the prior day’s fireworks) with GBP/USD oscillating in a tight range roughly between 1.3010 and 1.3040. This sideways grind on the M5 chart hinted at consolidation. Notably, sterling’s modest bounce in the London morning fizzled out near 1.3030, where short-term resistance from the overnight highs kicked in. A series of higher lows around 1.3010 suggested buyers were cautiously defending that zone, preventing any slip into the 1.29s. Momentum indicators on short-term charts began crawling out of oversold territory, reflecting how overstretched Tuesday’s drop had been. Still, the overall trend remains bearish – the pound is trading well below its 20- and 50-period MAs on the M5, and each rebound has been shallow. To signal any meaningful technical reversal, GBP/USD would need to break back above 1.3100 (the prior support-turned-resistance). For now, bearish control persists, with immediate support at 1.3000 and deeper support near 1.2950 if that gives way. The pound ended the day seemingly in a holding pattern, as traders waited for the next catalyst to jar it loose from the 1.30 handle.

Fundamental Analysis

The British pound’s troubles on Wednesday were rooted in both domestic jitters and the overpowering influence of the U.S. dollar. After Tuesday’s rout – which saw GBP/USD shed nearly 0.9% on a combination of dollar strength and UK fears – the pound managed only a meek recovery. One cap on sterling’s bounce was looming event risk: the Bank of England’s policy decision set for the next day. Markets widely expect the BoE to stand pat, voting likely 6–3 to keep rates unchanged. With UK inflation still about 3.8% (nearly double the 2% target), the Bank is not ready to signal easing, but a minority of dovish votes for cuts is growing. This policy limbo kept traders from aggressively bidding the pound higher. Moreover, the UK’s own news cycle added pressure. On Tuesday, Chancellor Rachel Reeves hinted at “broad tax rises” in her upcoming budget, targeting top earners and aiming to stick to “iron-clad” fiscal rules. The specter of tighter fiscal policy and higher taxes soured sentiment on UK assets, contributing to the pound’s decline. As Convera’s analysts noted, the pound was “hit after a poorly received speech” from Reeves, amplifying its fall. By Wednesday, those fiscal fears lingered, limiting GBP/USD’s upside. On the U.S. side, the pound simply couldn’t escape the dollar’s gravitational pull – upbeat U.S. labor and services data reinforced U.S. growth optimism and pushed the USD Index (DXY) to fresh three-month highs near 100.0. Safe-haven flows into the dollar were also in play as global equities slumped (the S&P 500 fell another 1%+, Nasdaq 2% down), leaving risk-sensitive currencies like GBP on the defensive. In all, sterling found itself stuck between a rock and a hard place: apprehension about domestic policy and BoE caution on one side, and a rampaging U.S. dollar on the other. The result was a tentative stalemate around $1.30 – a pause that felt like the calm before either the BoE-inspired relief or another storm if the dollar rally resumes unabated.

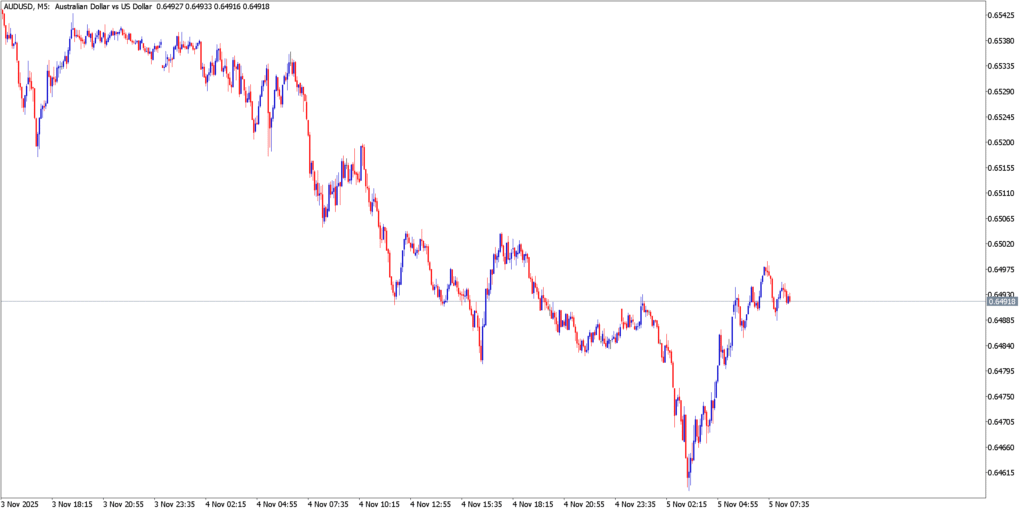

AUD/USD

Technical Analysis

The Australian dollar’s technical picture remained bleak, with AUD/USD slumping to the lower end of its range and probing levels not seen in weeks. On the 5-minute timeframe, the pair’s post-RBA free-fall was evident – a sharp drop that drove AUD/USD near 0.6500, followed by a feeble attempt to stabilize. The short-term charts show the Aussie forming a potential bearish flag pattern: after the steep selloff, prices moved in a narrow consolidation band between roughly 0.6485 and 0.6520. This sideways drift looked more like a pause than a reversal. Each bounce toward 0.6520 (the top of the flag) was met with fresh selling interest, indicating that bears still controlled the narrative. A clear break below 0.6480 could trigger another leg down, with eyes on 0.6450 and even the 0.6400–0.6420 zone (lows from mid-October as seen on larger timeframes) as possible support targets. Technical indicators reinforce the downbeat tone: AUD/USD remains below its short-term MAs, and momentum oscillators on intraday charts are unable to exit oversold territory, reflecting persistent selling pressure. One silver lining for the bulls is that volume (in a notional sense) tapered off during the decline, hinting at seller exhaustion. Still, without a catalyst, the Aussie’s trend is clearly downward. The 0.6540 level – coinciding with the 21-day exponential moving average and recent swing high – now stands out as an important resistance. It would take a push above that and 0.6600 (psychological hurdle) to signal that AUD/USD has bottomed. Until then, the technicals depict an asset wilting under pressure, with any rebounds likely to be sold into quickly.

Fundamental Analysis

The Aussie’s woes on 5 Nov were set in motion a day earlier by its own central bank and then compounded by the global rush into U.S. dollars. In the pre-dawn hours of Tuesday, the Reserve Bank of Australia delivered exactly what markets expected – no change in interest rates, holding the cash rate at 3.60%. But it was the tone of the RBA that rattled Aussie traders. Governor Michele Bullock struck a cautious stance, voicing concern that core inflation above 3% is “not ideal” and hinting the bank might need to keep policy tighter for longer to tame prices. Crucially, Bullock “refrained from guiding on when and how much the RBA will cut”, emphasizing uncertainty on the inflation outlook. In other words, any hopes for an early-2026 rate cut cycle were dampened. This hawkish hold paradoxically hurt the Australian dollar – as it signaled the RBA’s hands are tied amid sticky inflation, even while Australia’s growth slows. The immediate reaction was brutal: AUD/USD tumbled to near 0.6500, revisiting 10-day lows as the news hit. Adding fuel, fresh data showed Australian Q3 inflation unexpectedly accelerated (1.3% QoQ vs 0.7% prior), reinforcing the RBA’s cautious stance. By Wednesday, the Aussie remained under siege. The currency was one of the day’s weakest performers, down about 0.5–0.7% against the USD. As analysts noted, the AUD was “the weakest against the Japanese Yen” and fell against most majors, highlighting broad-based softness. Global factors then delivered the coup de grâce: the U.S. dollar’s surge on strong U.S. data and risk-off sentiment hit commodity-sensitive currencies hard. With Wall Street in retreat and commodity prices lackluster, investors sought safety in USD, leaving the Aussie with little support. Even a mild uptick in China’s outlook (e.g. rumors of tariff lifts on U.S. goods) did little to stem AUD’s slide. In sum, the Australian dollar was beset by a one-two punch – a domestically driven selloff on RBA and inflation worries, followed by a externally driven pummeling from the roaring dollar. Traders will now watch if upcoming Aussie data (like trade balance figures on Thursday) or any improvement in risk appetite can give AUD/USD a much-needed bounce, or if the pair will continue drifting toward its multi-year lows set last month.

Market Outlook

Wednesday’s forex saga underscored a dominant theme: King Dollar’s comeback. A confluence of factors – resilient U.S. economic data, shifting Fed expectations, and global risk aversion – empowered the USD to extend its winning streak, leaving rivals battered. The euro and pound, both already on the defensive from local issues, were no match as the dollar index charged to three-month peaks. The Euro managed to hold its line at 1.15 by day’s end, but its slight gain felt precarious against a backdrop of an ECB in wait-and-see mode and lingering growth worries in Europe. The British pound limped into the close just above 1.30, its fate hanging on the next day’s Bank of England meeting – a potential make-or-break event that could either shore up sterling (if the BoE surprises hawkishly) or accelerate its slide (if dovish tones prevail). The Australian dollar, meanwhile, is nursing wounds near its lows, hoping that stabilization in equity markets or positive news from China might staunch the bleeding.

Looking ahead, the broader forex sentiment appears cautiously tilted in the dollar’s favor, but not without volatility on the horizon. Central bank rhetoric and economic releases will remain key. Fed officials have shown a split – some emphasizing lingering inflation risks, others fretting about growth – which could inject two-way risks into the dollar’s trajectory. The next 24-48 hours bring high drama potential: the Bank of England’s decision (and Governor’s commentary) will set the tone for sterling, and the all-important U.S. Non-Farm Payrolls looms on Friday. A weak NFP could revive Fed rate cut whispers and clip the dollar’s wings, whereas another strong jobs report might cement the dollar’s supremacy into year-end. Until then, the forex arena remains on edge. Risk sentiment is fragile – evidenced by falling stocks and geopolitical undercurrents – so any flight-to-safety tends to favor the USD and JPY. In contrast, high-beta currencies like the Aussie and emerging market FX are vulnerable if turmoil persists.