Investor sentiment turned sharply cautious on Nov 25, 2025. The U.S. dollar strengthened on fresh Federal Reserve rate-cut bets, while risk-linked commodity currencies sank. The New Zealand dollar and Australian dollar both hit multi-month lows as central banks eyed further stimulus. Meanwhile, USD/CAD held near year-to-date highs amid softer oil prices. Overall, markets awaited key central bank moves (RBNZ decision tomorrow) and watched inflation data, a classic “risk-off” environment where safe-havens held sway.

NZD/USD

Technical Analysis

The 5-minute NZD/USD chart shows the Kiwi trading in a short-term downtrend. Recent candles formed a brief bounce from multi-week lows (around the 0.5600 area) but quickly ran into resistance. Price remains below the 50-period exponential moving average, highlighting ongoing bearish pressure. A descending trendline caps the upside, and momentum indicators just turned mildly positive from oversold, suggesting the bounce may not last. In short, NZD/USD looks like it is correcting the prior sell-off but still bound by its main bearish channel. Key technical levels: support lies near 0.5580–0.5600 (recent lows), while resistance is around 0.5650–0.5665 (short-term downtrend highs).

Fundamental Analysis

The Kiwi is under heavy pressure on policy expectations. Markets now widely price in a 25 bp cut by the RBNZ at its Nov 26 meeting – virtually guaranteeing more NZD softness. FXStreet notes NZD/USD “remains weak near 0.5605” as the expected rate cut drags the Kiwi down. In addition, the Fed’s pivot to easier policy (now ~80% odds of a Dec cut) puts further downside on NZD/USD, since a weaker USD could paradoxically limit how far the pair falls as the NZD’s catalyst is actually the rate cut. Indeed, Reuters reports the Kiwi at about 0.5607 on Tuesday, after sliding over 2% in November ahead of the RBNZ meeting. Beyond central banks, traders note that global risk aversion (soft Chinese data, broader USD strength) would also hurt the export-driven Kiwi. In sum, with RBNZ cut soon and little support in sight, NZD/USD looks set to retest 0.5550 unless U.S. data abruptly changes the outlook.

AUD/USD

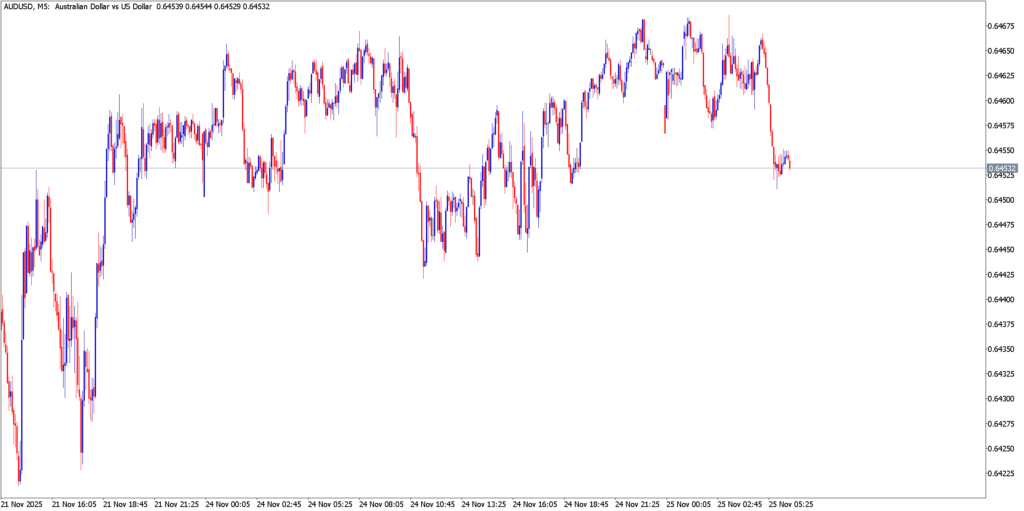

Technical Analysis

The AUD/USD 5-min chart is also clearly trending lower. Price has plunged below recent support and the 50-EMA, hugging a downward-sloping trendline. The latest candlesticks show the Aussie trading near its weakest levels since August. A brief pause above ~0.6425 failed, and RSI is in oversold territory without signs of bullish divergence. Overall, technical indicators reinforce that sellers remain firmly in control. Key levels: immediate support is near 0.6425 (early Nov low), with resistance only up at 0.6480–0.6500 (last pullback high and trendline).

Fundamental Analysis

The Australian dollar is under similar pressure from both global risk factors and relative policy trends. Geopolitical news spooked markets: escalating China-Japan tensions (over Taiwan) undermined risk sentiment, making AUD one of the day’s worst performers. This offset Australia’s surprisingly strong data. For example, November PMIs showed Aussie manufacturing and services in expansion, reinforcing the RBA’s cautious (still-hawkish) stance. In other words, domestic fundamentals are not dire, but external factors are dragging AUD down. Meanwhile, like NZD, AUD is affected by U.S. Fed policy swings. Recently, New York Fed’s Williams and other officials have turned dovish, lifting the chance of a December Fed cut to ~75%. Such Fed easing (if it occurs) would put broad downward pressure on the USD – a potential relief for AUD – but for now, the net effect is that Fed talk is keeping the USD soft while AUD is falling for other reasons. Traders will watch the RBA (no change expected but updates on inflation) and regional data, but the near-term bias is that Aussie likely remains vulnerable until risk sentiment improves or policy signals shift.

USD/CAD

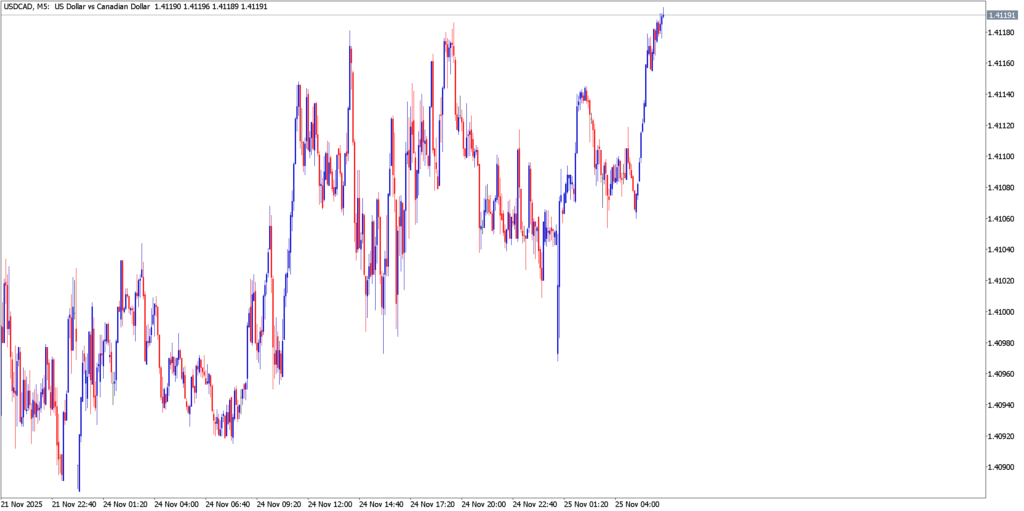

Technical Analysis

By contrast, USD/CAD is drifting higher on the short-term chart. The pair has been riding a minor uptrend, forming higher lows backed by its 50-EMA. The latest 5-min candles show USD/CAD around C$1.4110, after a modest rally from ~1.4050. A supportive trendline from this week provides technical support on pullbacks. Momentum turned positive after briefly oversold, suggesting a mild bullish tilt. Resistance is seen up near 1.4200 (last week’s swing high), with support at 1.4050–1.4080. In summary, short-term charts favor the USD slightly, but price is range-bound and sensitive to fundamental news.

Fundamental Analysis

The Canadian dollar’s performance today reflects two offsetting themes. First, U.S. interest rate expectations have shifted as Fed officials signaled cuts. Recent Fed comments (e.g. Gov. Waller) have raised the odds of a December cut to ~81%. This Fed-dovish stance puts downward pressure on the USD generally. In USD/CAD terms, a weaker USD would pull the pair down, but that effect is being countered by the second theme: oil. Canada’s economy is oil-dependent, and crude prices have drifted lower this week (~$58–59/barrel) amid hopes of Ukraine peace and inventory builds. Reuters notes oil around $59.4 and CAD falling to near two-week lows (~C$1.4095) as a result. Put simply, the CAD is struggling because cheaper oil hurts Canada’s terms of trade. The net effect is USD/CAD staying roughly range-bound: U.S. Fed easing (weaker USD) vs. weak oil (weaker CAD) are balancing out for now. Key note: if oil rebounds, CAD could rally; if U.S. data undercuts Fed cuts, the USD might strengthen.

Market Outlook

Tuesday’s action leaves markets in a defensive stance. The US Dollar has regained ground as Fed rate cut pricing climbs, but commodity-linked currencies face headwinds. The Kiwi and Aussie appear poised to probe fresh lows unless something snaps the current trends. Watch for this week’s big events: RBNZ’s policy decision (Nov 26) is critical for NZD, and any Fed minutes or U.S. PPI/retail data can sway USD sentiment. In Canada, oil prices and BoC commentary will guide USD/CAD next. For now, traders should be cautious: risk aversion and policy uncertainty rule the day, favoring the US dollar and pressuring the NZD/AUD pair, while USD/CAD may trade within a tightening band until clearer signals emerge.