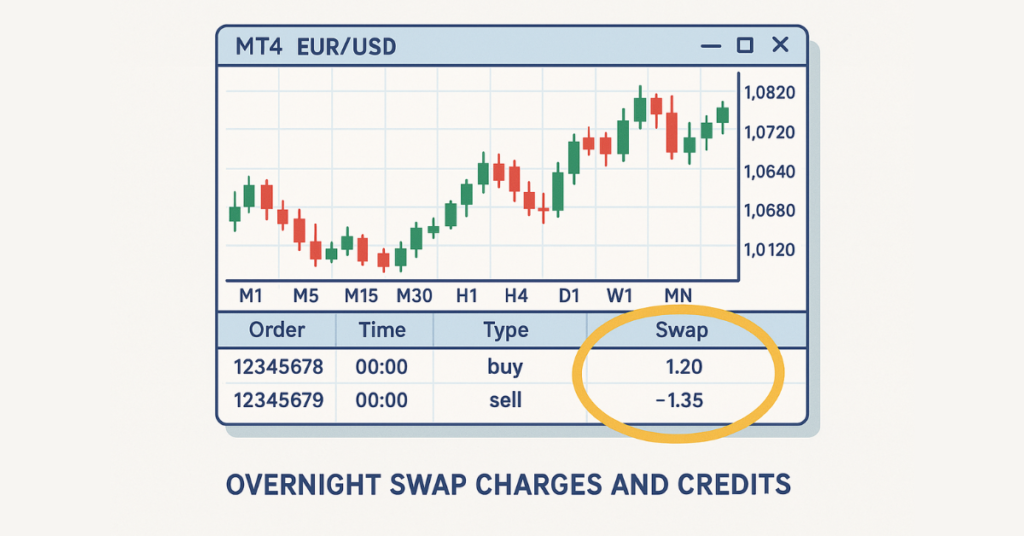

Swap on MetaTrader 4 (MT4) is the overnight interest charged (or credited) for holding a position past the platform’s daily rollover. It reflects interest-rate differentials between currencies, varies by instrument and broker, and can be positive or negative, affecting profits on positions held overnight.

Key Takeaways

- MT4 swap is the overnight interest applied when positions stay open past rollover time.

- Swap can be positive (credit) or negative (charge) depending on interest-rate differences.

- MT4 displays swap values for each instrument in the specification window.

- Swap impacts long-term trades more than short-term ones.

- Different assets have different swap rates.

What Is Swap on MT4?

Swap on MT4 refers to the cost or credit applied when a trade is held overnight, based on the interest-rate difference between the two currencies or financial instruments involved. In forex, every currency has its own benchmark interest rate, and when a position remains open past the platform’s rollover time, MT4 automatically applies a swap reflecting that rate differential.

This overnight adjustment is often called a rollover fee or overnight financing charge, and although the names differ, the mechanism is the same: traders either pay or receive interest depending on whether they are holding the higher-yielding or lower-yielding currency. MT4 calculates and posts swap once per day, and the amount can vary across instruments, trading conditions, liquidity, and market volatility.

Understanding swap is essential because it affects the real cost of holding trades. Overnight fees accumulate gradually, so long-term, swing, or position traders should consider swap impact before committing to extended holding periods.

How Swap Works in MT4

Swap in MT4 depends on whether a position is long (buy) or short (sell) and the interest rates of the currencies involved. If you hold a long position in a currency with a higher interest rate than the one you are selling, you may earn a positive swap, which is added to your account.

Conversely, holding a long position in a lower-interest currency or a short position in a higher-interest currency results in a negative swap, which is deducted from your account.

MT4 calculates swap daily at the platform’s rollover time, usually at 00:00 server time. Special rules apply on Wednesdays, where a triple swap is charged to account for weekend interest.

Swap amounts vary across instruments; forex pairs, commodities, indices, and crypto CFDs each have different overnight adjustments depending on market liquidity, volatility, and broker policies.

This section ensures traders understand not just the mechanics of a swap but also its practical implications for holding positions overnight.

Where to See Swap on MT4

Viewing Swap on MT4 Desktop

To check the swap for any instrument on MT4 desktop:

- Open the Market Watch window.

- Right-click the instrument and select Specifications.

- In the specification window, locate Swap Long and Swap Short; these show the overnight interest credited or charged per lot.

This allows traders to plan their trades and understand potential overnight costs or gains before opening positions.

Viewing Swap on MT4 Mobile

On MT4 mobile:

- Open the Quotes tab and select the desired instrument.

- Tap on Details or Specification.

- Scroll to find Swap Long and Swap Short values.

This section ensures traders know exactly where to find swap information on both desktop and mobile MT4 platforms.

MT4 Swap Calculation Explained

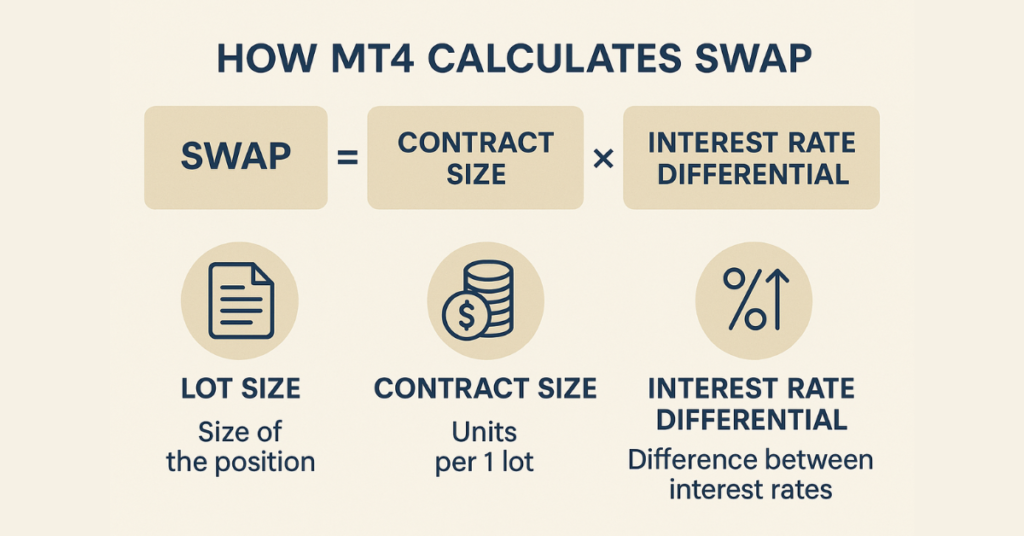

How MT4 Calculates Swap

MT4 calculates swap based on three main factors:

- Interest rate differential between the two currencies in a forex pair or underlying asset rates for CFDs.

- Position size (lot size): Larger positions incur higher swap charges or credits.

- Broker’s multiplier: Some brokers adjust swap slightly based on their policies.

The general formula is

Swap = (Lot Size × Contract Size × Interest Rate Differential) ÷ 365

For example, holding 1 standard lot of EUR/USD overnight may generate a small positive or negative swap depending on the EUR and USD interest rates at that time.

Why Swap Differs Across Instruments

Different asset classes attract different swap values:

- Major forex pairs: Usually have lower swaps due to high liquidity.

- Exotic forex pairs: Higher swaps because of wider spreads and volatility.

- Commodities & indices CFDs: Swap reflects the underlying interest or financing costs.

- Crypto CFDs: Swap may be higher due to borrowing costs and market volatility.

Why Swap Matters for Traders

Understanding swap is crucial because it directly impacts the profitability of trades held overnight. Even small swap charges can accumulate over time, especially for long-term or swing trades.

- Positive swap can act as additional income for traders holding positions in higher-yielding currencies. This is the basis of the carry-trade strategy, where traders earn interest while maintaining profitable positions.

- Negative swap increases trading costs, gradually reducing net gains if not managed properly. Traders holding positions in lower-yielding currencies or leveraged trades are most affected.

How to Reduce or Avoid Swap Fees on MT4

Traders who want to minimize or eliminate swap charges have several strategies available:

Trade Short-Term

By opening and closing positions within the same trading day, traders avoid overnight fees entirely. This approach is ideal for scalpers and day traders who do not intend to hold positions long-term.

Use Swap-Free (Islamic) Accounts

Some brokers offer swap-free accounts where overnight fees are waived. These accounts are especially useful for traders who follow Sharia-compliant principles or want to avoid negative swaps on long-term positions.

Choose Instruments With Lower Swap Costs

High-liquidity forex pairs or certain CFDs generally carry smaller swap charges, while exotic pairs and volatile assets have higher overnight costs. Checking swap values before trading helps plan positions efficiently.

MT4 Swap vs Rollover vs Overnight Fee

While these terms are often used interchangeably, understanding their differences is important:

| Term | Definition | When It Applies | Example |

| Swap | Interest charged or credited for holding a position overnight. | Daily at MT4 rollover time. | Long EUR/USD held overnight may earn or pay interest. |

| Rollover | The process of extending the settlement date of an open position. | Automatically at daily rollover. | The position moves from today’s settlement to the next day. |

| Overnight Fee | General term for any overnight cost, including swap. | Daily; varies by broker and instrument. | Some brokers may show a fixed fee instead of an interest-based swap. |

Final Thoughts on What is Swap on Mt4

Understanding swap on MT4 is essential for every trader, especially those holding positions overnight or engaging in swing and position trading. Swap affects your trading costs and profits, depending on whether it is positive or negative, and varies across assets and market conditions.

By knowing how swap is calculated, how to view it on MT4, and strategies to minimize its impact, traders can make informed decisions and protect their capital.

FAQs

Swap is the overnight interest charged or credited for holding a position past the daily rollover in MT4.

Swap is generally calculated using the lot size, contract size, and interest rate differential: Swap = (Lot Size × Contract Size × Interest Rate Differential) ÷ 365

Swap rates depend on the broker’s policies, financing costs, and the assets’ interest rates or liquidity.

Swap-free (Islamic) accounts waive overnight fees, but terms may vary. Always verify conditions with your broker before trading.

Yes, crypto CFDs on MT4 usually have overnight swap charges due to borrowing costs and market volatility.