| Currency Pair 1 | Currency Pair 2 | Correlation Coefficient | Relationship Type | Trading Insight |

| EUR/USD | GBP/USD | +0.85 | Strong Positive | Often move together; avoid duplicate exposure |

| EUR/USD | USD/CHF | −0.90 | Strong Negative | Common hedging pair due to inverse movement |

| GBP/USD | EUR/GBP | −0.80 | Strong Negative | Shared currencies create inverse behavior |

| AUD/USD | NZD/USD | +0.90 | Strong Positive | Highly correlated commodity currencies |

| USD/JPY | EUR/JPY | +0.75 | Moderate Positive | Influenced by Japanese yen movements |

| USD/CAD | AUD/USD | −0.60 | Moderate Negative | Oil and commodity price influence |

| EUR/USD | USD/JPY | −0.45 | Weak Negative | Partial inverse USD exposure |

| GBP/JPY | USD/JPY | +0.70 | Moderate Positive | JPY volatility affects both pairs |

These patterns match widely recognized correlation tendencies in forex markets, though exact coefficients fluctuate over time and should be checked in real time with correlation tools.

Key Takeaways

- A currency pairs correlation table measures how strongly forex pairs move together or in opposite directions, helping traders understand market relationships.

- Positive, negative, and neutral correlations allow traders to manage risk, avoid overexposure, and improve strategy planning.

- Correlation values change over time, so traders should review updated tables regularly to make informed decisions.

What Is a Currency Pairs Correlation Table?

A currency pairs correlation table is a structured matrix that displays how two forex pairs move in relation to each other over a specific period.

Each intersection in the table shows a correlation coefficient ranging from –1 to +1, allowing traders to instantly see whether two pairs typically move in the same direction, opposite direction, or show little relationship at all. This tool helps traders understand broader market behavior, spot hidden connections between pairs, and make more informed decisions when planning trades or managing overall exposure.

How Currency Correlation Works (Positive, Negative, Neutral)

Currency correlation reflects how two forex pairs behave relative to each other over time, measured through a coefficient between –1 and +1. A positive correlation means both pairs generally move in the same direction, a negative correlation means they move in opposite directions, and a neutral correlation suggests little to no connection in price movement.

A positive correlation (closer to +1) often appears between pairs sharing a common base or quote currency.

For example, EUR/USD and GBP/USD frequently rise or fall together because both are influenced by USD strength or weakness. Traders use this relationship to confirm trends or avoid placing multiple trades that unintentionally amplify the same market exposure.

A negative correlation (closer to –1) shows an opposite directional relationship. For instance, EUR/USD and USD/CHF often move inversely due to USD’s position within each pair. When one pair rises, the other typically falls. Recognizing negative correlations helps traders hedge positions or offset potential losses.

A neutral or weak correlation (around 0) indicates no consistent directional pattern. These pairs move independently, making them useful for diversification and for building strategies that rely on varied price behavior rather than synchronized movement.

Understanding these correlation types is essential for reducing risk, improving trade selection, and managing the combined effect of multiple trades across different currency pairs.

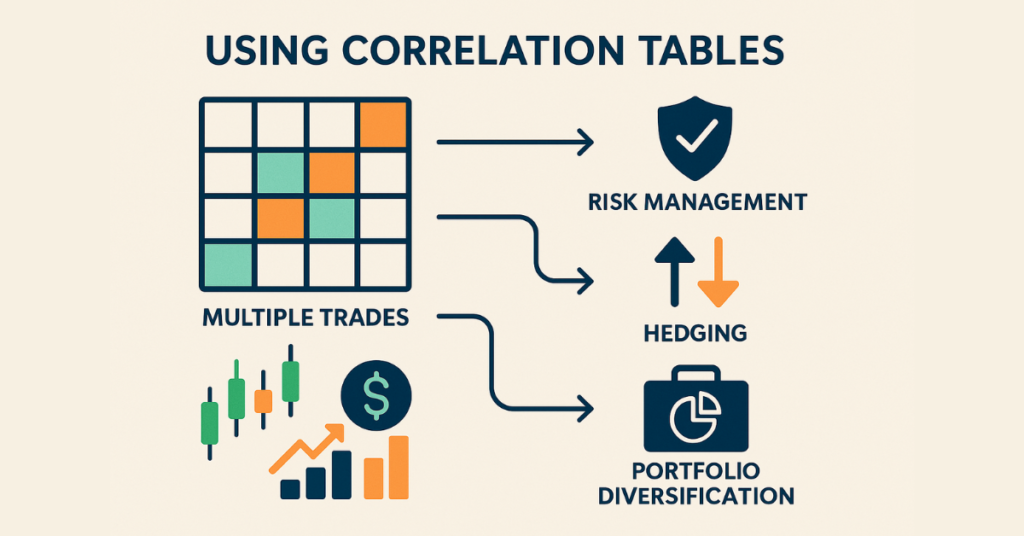

Why Traders Use Correlation Tables

Traders rely on currency pair correlation tables to make smarter, data-driven decisions. By understanding how pairs interact, they can:

- Manage Risk: Avoid placing multiple trades on highly correlated pairs, which could unintentionally double exposure to the same market movement.

- Hedge Positions: Use negatively correlated pairs to offset potential losses, balancing overall portfolio performance.

- Improve Strategy Accuracy: Confirm trends by checking correlations between different pairs before entering positions.

- Diversify Portfolios: Select weakly correlated or uncorrelated pairs to spread risk and reduce vulnerability to market swings.

How to Read a Currency Pairs Correlation Table

Reading a currency pair’s correlation table involves understanding the correlation coefficients and interpreting what they mean for your trading decisions:

- +1 (Perfect Positive Correlation): Both pairs move in the same direction. For example, EUR/USD and GBP/USD often rise or fall together.

- –1 (Perfect Negative Correlation): Pairs move in opposite directions. For example, EUR/USD and USD/CHF typically behave inversely.

- 0 (No Correlation): There is no predictable relationship; the pairs move independently.

To read the table effectively:

- Locate the intersection of the two pairs you want to analyze.

- Check the correlation coefficient.

- Determine whether the relationship is positive, negative, or neutral.

- Use this information to manage risk, plan trades, and avoid doubling exposure on correlated pairs.

By interpreting correlation tables correctly, traders can make informed decisions about position sizing, hedging, and diversifying their portfolio.

Sample Currency Pairs Correlation Table

Below is an illustrative example of a currency pairs correlation table showing typical relationships over a recent period:

| Currency Pair 1 | Currency Pair 2 | Correlation Coefficient |

| EUR/USD | GBP/USD | +0.85 |

| EUR/USD | USD/CHF | –0.90 |

| AUD/USD | NZD/USD | +0.88 |

| USD/JPY | XAU/USD (Gold) | –0.65 |

| USD/CAD | Oil (WTI) | +0.70 |

How Defcofx Helps:

When trading correlated pairs, using a broker with high leverage options up to 1:2000 and no commissions or swap fees allows traders to implement strategies efficiently. Defcofx also offers fast withdrawals within 4 business hours and a 40% welcome bonus for first-time deposits over $1000, making it easier to start trading safely and flexibly.

Open a Trading Live AccountMost Positively Correlated Currency Pairs

Some currency pairs consistently show strong positive correlations, meaning they tend to move in the same direction. Common examples include EUR/USD and GBP/USD or AUD/USD and NZD/USD. Traders often monitor these pairs to confirm trends or avoid unintentionally doubling exposure in the same market direction.

Trading positively correlated pairs can help reinforce signals in your strategy. However, using high leverage up to 1:2000 from brokers like Defcofx requires careful risk management, as large positions on multiple positively correlated pairs can magnify both gains and losses.

Choosing a broker like Defcofx with no commissions or swap fees ensures that transaction costs don’t erode profits when trading these pairs frequently.

Open a Trading Live AccountMost Negatively Correlated Currency Pairs

Negatively correlated currency pairs move in opposite directions. When one pair rises, the other typically falls.

A classic example is EUR/USD and USD/CHF. When the euro strengthens against the US dollar, the Swiss franc often weakens relative to it. Another common example is USD/JPY and XAU/USD (gold), where movements in the US dollar tend to have an inverse effect on gold prices.

Understanding negative correlations allows traders to hedge positions more effectively by offsetting potential losses in one pair with gains in another.

How Traders Use Negative Correlation

Traders often use negatively correlated pairs to balance their portfolios and reduce overall risk exposure. For example, holding a long position in EUR/USD while opening a short position in USD/CHF can act as a natural hedge during volatile market conditions.

Platforms like Defcofx support these strategies efficiently by offering:

- High leverage options up to 1:2000, allowing flexible position sizing.

- No commissions or swap fees, keeping multi-pair trading cost-effective.

- Fast support and withdrawals within 4 business hours, ensuring quick access to funds.

Strategic Benefits of Negative Correlation

Negative correlations also help in planning multi-pair trading strategies. Traders can combine positively and negatively correlated pairs to diversify exposure while staying aligned with broader market trends. Over time, this approach strengthens risk management and improves strategic decision-making in forex trading.

Least Correlated Currency Pairs

Some currency pairs show very weak or near-zero correlation, meaning their price movements are largely independent of one another. Common examples include EUR/JPY and USD/CHF, or AUD/USD and GBP/JPY.

Trading weakly correlated pairs together helps diversify a portfolio because the performance of one pair has little to no impact on the other. This independence is especially useful for traders who want to spread risk and avoid overexposure to a single market move.

Why Traders Use Weakly Correlated Pairs

Including least correlated pairs allows traders to distribute capital across different market behaviors. When one pair experiences volatility, the other may remain stable or move independently, helping smooth overall account performance.

Long-Term Portfolio Benefits

By combining positively correlated, negatively correlated, and weakly correlated pairs, traders can build more flexible and resilient trading strategies. Over time, this balanced approach reduces overall risk while maintaining consistent opportunities for profit.

How to Apply Currency Correlation in Trading Strategies

Currency correlation is a powerful tool that helps traders make informed decisions and optimize their strategies. One primary use is trend confirmation: if two positively correlated pairs move in the same direction, it reinforces the trend and increases confidence in entering a trade.

Conversely, negative correlations can be used for hedging positions, allowing traders to offset potential losses in one pair by taking positions in another that typically moves oppositely.

Another effective strategy is multi-pair trading, where traders monitor both highly correlated and uncorrelated pairs to diversify risk.

For example, combining a positively correlated pair with a weakly correlated pair balances potential gains and losses across the portfolio.

Using Correlation Tools on MT5 (Platform Integration)

MetaTrader 5 (MT5) provides built-in tools and indicators that help traders monitor currency pair correlations in real time. By using correlation indicators or Expert Advisors (EAs), traders can visualize relationships between multiple pairs, identify strong or weak correlations, and adjust their strategies accordingly.

Tools such as correlation heat maps and correlation matrices offer instant insights into which pairs are moving together and which are moving inversely. This makes it easier to plan trades, confirm trends, and manage risk more effectively.

Broker Support for MT5 Correlation Trading

When trading correlated pairs on MT5, access to a broker that fully supports advanced platform features is essential. Defcofx offers:

- MT5 with leverage up to 1:2000

- No commissions or swap fees, keeping multi-pair strategies cost-efficient

- Fast withdrawals within 4 business hours, allowing quick fund access

- Global reach with multiple language support, enabling traders worldwide to use MT5 seamlessly

Strategic Benefits of MT5 Correlation Tools

Using MT5 correlation features allows traders to combine positively and negatively correlated pairs more strategically. This supports trend confirmation, hedging, and risk balancing without taking unnecessary exposure.

By integrating correlation tools into daily trading routines, traders can make more informed decisions, reduce unintended risk, and optimize overall portfolio performance.

Where Defcofx Becomes Relevant for Correlation-Based Trading

When trading correlated currency pairs, choosing the right broker can significantly impact strategy execution and risk management. Defcofx supports traders with features that align closely with correlation-based trading needs without being over-promotional.

Traders benefit from high leverage options up to 1:2000, which allow them to take positions on multiple correlated pairs efficiently while maintaining capital flexibility. No commissions or swap fees ensure that executing trades across several pairs doesn’t erode potential profits.

Additionally, fast withdrawals within 4 business hours, even on weekends, provide the liquidity needed to adjust positions quickly when correlation relationships shift in the market.

With global reach and multiple language support, Defcofx ensures that traders from all countries can access correlation tools and platform features without barriers, further enhancing the usability and efficiency of correlation-based trading strategies.

Open a Trading Live AccountFAQs

A currency pairs correlation table shows how two forex pairs move relative to each other, helping traders manage risk, hedge positions, and diversify strategies.

Pairs like EUR/USD & GBP/USD or AUD/USD & NZD/USD often move in the same direction, providing trend confirmation opportunities.

Correlations are dynamic and can shift daily or weekly depending on market conditions, economic events, and geopolitical developments.

Yes, understanding correlations helps confirm trends, avoid overexposure, and manage risk, making trading strategies more precise.