Indices in forex are market-wide measures that track the aggregated price performance of a basket of equities or assets; traders access them via index CFDs on forex platforms to speculate on overall market movements, hedge exposure, or diversify beyond individual currency pairs.

Key Takeaways

- Forex indices represent the performance of grouped stocks or assets traded through index CFDs on forex platforms.

- They help traders gauge broader market direction rather than individual instruments.

- Indices often show smoother trends, making them useful for diversification and macro-based strategies.

What Are Indices in Forex?

Indices in forex refer to stock market benchmarks such as the S&P 500, NASDAQ 100, FTSE 100, or DAX 40 made available as index CFDs on forex trading platforms. Instead of buying actual shares, traders speculate on the overall movement of these market baskets. Each index represents the performance of a selected group of top companies from a country or region, allowing traders to analyze and trade an entire market’s direction through a single instrument.

On forex platforms, indices function as leveraged derivatives, meaning traders can go long or short depending on their market view without owning any underlying stocks. Because indices respond to macroeconomic trends, interest-rate shifts, geopolitical events, and earnings cycles, they attract traders seeking broader market exposure with less noise than individual stocks.

How Indices Work in the Forex Market

Indices in the forex market operate as contract-for-difference (CFD) instruments, meaning traders speculate on price movements without owning the underlying stocks. Each index is built from a weighted group of major companies; some use market-cap weighting (like the S&P 500), while others use price weighting (like the Dow Jones). The combined performance of these companies determines the index’s overall price.

Unlike currency pairs driven mainly by monetary policies and global demand, indices react strongly to corporate earnings, economic data, political shifts, and sector health. Their movement often reflects broader investor sentiment; strong economic conditions usually push indices higher, while uncertainty or major events can create sharp volatility. Forex traders use this behavior to capture macro-level trends and diversify away from purely currency-driven setups.

Why Indices Appear on Forex Trading Platforms

Forex trading platforms include indices to give traders diversified exposure beyond currencies. By offering major global indices as CFDs, brokers allow traders to speculate on entire markets, hedge currency positions, or follow macroeconomic trends without buying individual stocks.

Indices are particularly attractive because they often show smoother trends than single equities, reducing noise and making technical analysis more consistent. Traders can trade indices 24/5, similar to forex pairs, and use advanced platform tools like charting, indicators, and automated strategies to capture market movements efficiently.

Most Popular Global Indices Traders Use

Traders often focus on well-known global indices because they reflect the performance of major economies and provide liquidity for trading. Some of the most popular include:

| Region | Index | Characteristics |

| United States | S&P 500 (SPX) | Tracks 500 leading U.S. companies; broad market indicator. |

| United States | NASDAQ 100 | Focuses on tech-heavy companies; higher volatility. |

| United States | Dow Jones 30 | Price-weighted index of 30 major industrial companies. |

| Europe | FTSE 100 | Tracks the 100 largest U.K. companies; sensitive to GBP and EU trends. |

| Europe | DAX 40 | Germany’s top 40 companies react to EU economic shifts. |

| Asia | Nikkei 225 | Japan’s top 225 companies are currency and export driven. |

| Asia | Hang Seng | Hong Kong’s major companies are influenced by China and Asian markets. |

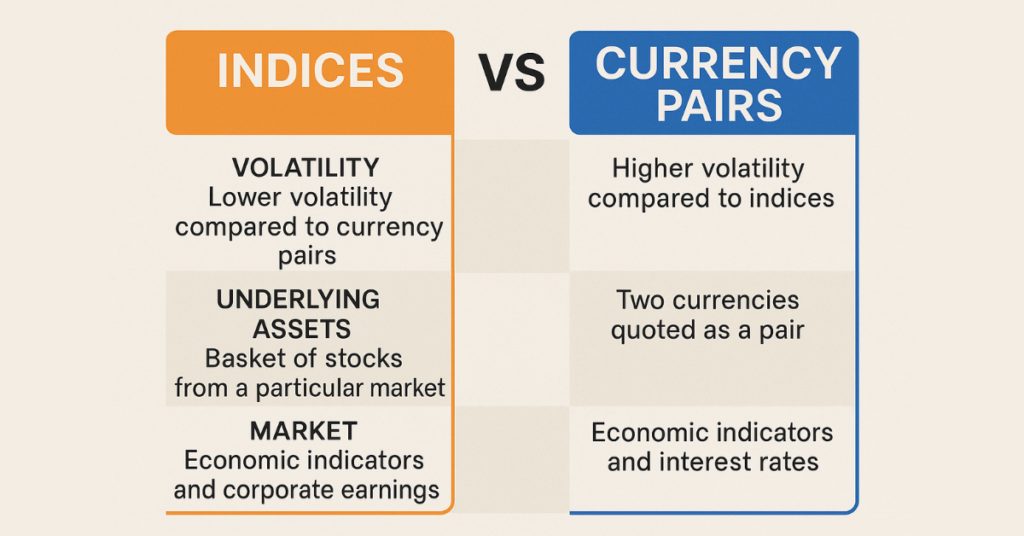

Difference Between Indices and Currency Pairs

| Aspect | Indices | Currency Pairs |

| Underlying Assets | Represent the aggregated value of a group of stocks from a specific market or sector | Represent the exchange rate between two currencies |

| Volatility | Generally smoother trends due to diversification across multiple companies | Can experience sharp spikes due to geopolitical events or central bank actions |

| Market Drivers | Driven mainly by corporate earnings, economic indicators, and overall market sentiment | Influenced by interest rates, monetary policy, and global trade conditions |

| Trading Approach | Suitable for macro-level speculation on entire markets, often used for hedging or diversification | Requires focus on micro-level and short-term price movements |

Why Traders Choose Indices in Forex Trading

Traders often prefer indices because they provide broad market exposure through a single instrument, reducing the need to monitor multiple stocks individually. Indices capture the overall trend of a country or sector, making them ideal for diversification and macro-based strategies.

Other advantages include

- Smoother price action: Less volatility than individual stocks, making trends easier to identify.

- Hedging opportunities: Traders can offset risk in currency positions with correlated index moves.

- Global market access: Indices allow traders to speculate on top economies worldwide without directly investing in each stock.

How to Trade Indices in Forex

Trading indices in forex involves several steps that combine market analysis, platform execution, and risk management. Here’s a comprehensive guide:

Selecting the Right Index

Traders first choose an index based on market familiarity, volatility, and liquidity. For example:

- S&P 500: Broad U.S. market exposure, moderate volatility

- NASDAQ 100: High-tech focus, higher volatility

- FTSE 100: UK exposure, sensitive to GBP and EU news

Choosing a Trading Platform

A reliable forex broker is essential. Platforms like Defcofx offer:

- High leverage options up to 1:2000 for greater market exposure.

- Global access with multiple language options.

- Advanced charting tools for technical analysis.

Determining Position Size and Leverage

Indices trading uses CFDs, meaning traders don’t own the underlying asset but speculate on price movements. Leverage magnifies both profits and losses, so using Defcofx’s risk management tools and moderate position sizing is crucial.

Analysis Approach

- Technical Analysis: Trendlines, moving averages, and RSI indicators are commonly used to identify entry and exit points.

- Fundamental Analysis: Economic events, earnings reports, and geopolitical developments drive index movements.

- Sentiment Analysis: Watching market sentiment can help predict short-term price swings, especially in volatile indices like NASDAQ.

Executing the Trade

Once the analysis is done, traders open a long (buy) or short (sell) CFD position. The profit or loss depends on the price movement relative to the position size and leverage used.

Monitoring and Exiting Trades

- Set stop-loss and take-profit levels to manage risk

- Monitor economic calendars for upcoming events that could impact indices

- Adjust positions based on market trends or platform notifications

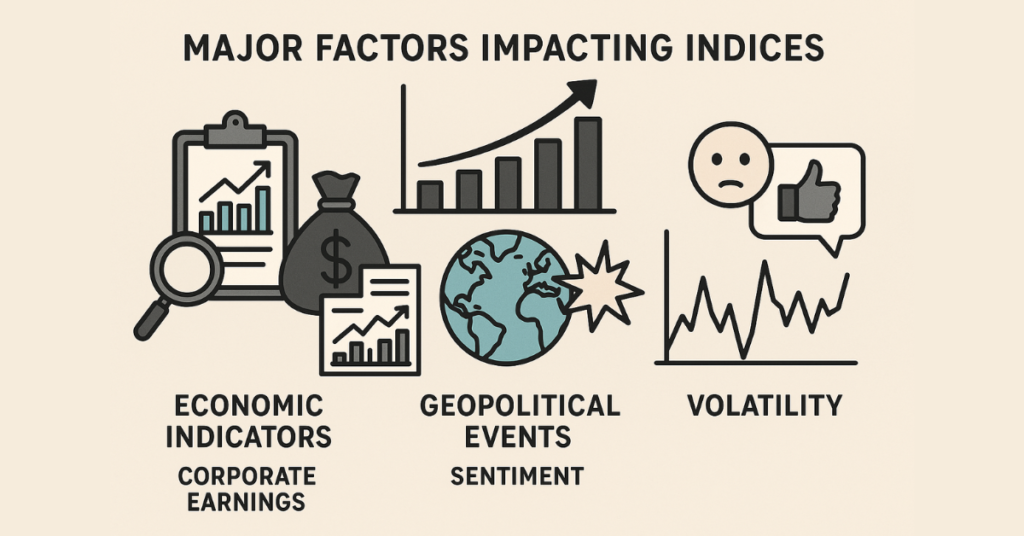

Market Conditions That Affect Indices

Indices in forex are influenced by a combination of economic, corporate, and geopolitical factors, which impact their overall price movements. Understanding these conditions helps traders anticipate trends and manage risk effectively.

Economic Indicators

Major economic releases can move indices significantly:

- GDP Reports: Strong economic growth often boosts stock markets and indices.

- Inflation Data (CPI, PPI): High inflation can pressure central banks to raise interest rates, affecting indices.

- Employment Figures (NFP, Unemployment Rate): Labor market health influences consumer spending and corporate profits, impacting index prices.

Corporate Earnings and News

- Quarterly earnings reports of index constituents can create upward or downward pressure.

- Mergers, acquisitions, or scandals of large companies can sway index performance.

Geopolitical Events

- Elections, trade negotiations, sanctions, or conflicts can trigger volatility.

- Indices like FTSE 100 or DAX 40 are especially sensitive to regional geopolitical developments.

Market Sentiment and Risk Appetite

- Positive sentiment drives bullish trends, while fear or uncertainty often triggers declines.

- Indices often move in tandem with broader investor sentiment rather than individual company fundamentals.

Volatility Patterns

- Some indices, such as NASDAQ 100, are more volatile due to tech-heavy compositions.

- Others, like the S&P 500, reflect broader market trends and typically exhibit smoother movements, suitable for trend-following strategies.

Where Defcofx Fits Into Index Trading

Defcofx provides traders with a comprehensive platform for index trading, combining advanced tools, flexible account options, and global accessibility. It is ideal for traders seeking diversified exposure to major indices while leveraging modern forex features.

Key Advantages of Trading Indices on Defcofx

- High Leverage Options: Traders can access up to 1:2000 leverage, allowing for larger market exposure while maintaining manageable capital allocation.

- 40% Welcome Bonus: First-time deposits of $1000 or more are rewarded with a 40% bonus, giving traders extra funds to explore index trading.

- No Commissions or Swap Fees: Low spreads from 0.3 pips with no hidden fees make trading more cost-efficient.

- Global Reach: Supports clients from all countries and multiple language options, enabling traders to operate from anywhere.

- Fast Support and Withdrawals: Withdrawals are processed within 4 business hours, including weekends, ensuring liquidity and convenience.

Platform Features Supporting Index Trading

- Advanced charting tools for technical analysis.

- Automated trading options for algorithmic strategies.

- Real-time market news to track economic and geopolitical events affecting indices.

4 Risks of Trading Indices

Trading indices in forex offers opportunities, but it also comes with significant risks that traders must understand and manage carefully.

Market Volatility

Indices can experience sudden price swings due to economic releases, geopolitical events, or corporate earnings reports. While indices are generally smoother than single stocks, high-volatility indices like the NASDAQ 100 can still lead to rapid gains or losses.

Leverage Risks

Using high leverage amplifies both profits and losses. Traders must use appropriate position sizing and risk management to avoid overexposure.

Gaps and Overnight Events

Indices can gap outside regular trading hours due to global news or market shocks. These gaps can cause positions to open at unexpected prices, leading to potential losses.

Liquidity and Execution Risk

During market opens, closes, or major news events, spreads may widen and execution may be slower. Choosing a platform with fast execution and tight spreads is crucial.

5 Beginner Tips for Forex Index Trading

Trading indices can be highly rewarding, but beginners should follow structured strategies to minimize risk and build experience effectively.

Start Small and Manage Risk

- Begin with smaller positions to limit potential losses.

- Use stop-loss and take-profit orders to protect capital and lock in profits.

Understand Market Sessions

- Different indices react differently depending on regional trading hours.

- For example, U.S. indices like the S&P 500 are most active during U.S. market hours, while the Nikkei 225 sees higher volatility in Asian sessions.

Focus on Technical and Fundamental Analysis

- Combine technical indicators (trendlines, moving averages) with fundamental news (economic data, earnings reports) to make informed decisions.

- Track major events such as central bank announcements or geopolitical developments that may influence index movements.

Practice on a Demo Account

- Platforms like Defcofx offer demo accounts to simulate index trading without real financial risk.

- Beginners can experiment with leverage, position sizing, and strategies before moving to a live account.

Diversify Your Trading Portfolio

- Avoid concentrating all capital in a single index.

- Spread risk by trading multiple indices or combining with forex pairs to reduce overall portfolio volatility.

Final Thoughts on What are Indices in Forex

Indices in forex provide traders with an efficient way to gain exposure to entire markets rather than individual stocks. They offer smoother trends, diversification opportunities, and macro-level trading potential. While risks such as volatility, gaps, and leverage exist, careful analysis and disciplined risk management make indices a valuable addition to any trading strategy.

Defcofx enhances the trading experience with high leverage options up to 1:2000, low spreads starting from 0.3 pips, no commissions or swap fees, global access, and fast withdrawals, giving traders both flexibility and efficiency.

FAQs

Yes. Many forex brokers like Defcofx offer indices as CFDs, allowing traders to speculate on broad market movements alongside currency pairs.

Indices are influenced by economic data, corporate earnings, geopolitical events, central bank policies, and overall market sentiment.

Indices like the S&P 500 or FTSE 100 are often preferred by beginners due to their broad market exposure and relatively smoother price trends.

It depends on your strategy. Indices provide macro-level exposure and diversification, while forex focuses on currency pairs and interest rate-driven movements. Both have unique advantages.

Yes. Platforms offer leverage, but high leverage increases both profit potential and risk, so it should be used cautiously.