With $1,000, most day traders realistically make 1%–3% per day, or about $10–$30, depending on strategy, risk control, and market conditions. Beginners often earn less or lose money initially, while consistent profitability requires discipline, experience, and strict risk management rather than aggressive trading.

Key Takeaways

- With $1,000, most day traders realistically target 1%–3% per day, not fixed income.

- Profitability depends more on risk management, discipline, and consistency than account size.

- Beginners often experience losses early while learning strategies and emotional control.

- Small accounts are highly sensitive to trading costs, leverage misuse, and overtrading.

- Long-term growth is possible, but capital preservation comes before profits.

Is $1,000 Enough for Day Trading?

Yes, $1,000 is enough to start day trading, but it comes with clear limitations. With a small account, traders must focus on markets that allow flexible position sizing and margin efficiency. You won’t have much room for error, which makes discipline and risk control essential.

Unlike larger accounts, a $1,000 balance cannot absorb repeated losses or wide stop-losses. This is why most successful small-account traders focus on percentage returns, limit risk per trade, and avoid overtrading. The goal at this stage isn’t income, it’s learning consistency while protecting capital.

Realistic Profit Expectations With a $1,000 Account

With a $1,000 day trading account, realistic daily profits range between $10 and $30, assuming a disciplined approach and controlled risk. Weekly gains can accumulate to roughly $50–$150, but these figures vary widely depending on market volatility, trading strategy, and individual skill.

It’s important to understand that high returns are not guaranteed. Beginners often experience losses, and aggressive trading can quickly deplete a small account. Profit should always be measured in percentage terms rather than fixed dollar amounts, as this approach protects the account from large swings.

What Affects How Much You Can Make Day Trading?

Several factors directly influence potential profits when day trading with $1,000:

- Market Volatility: Highly volatile markets offer more profit opportunities but also increase risk. Traders must adapt strategies accordingly.

- Trading Strategy: Scalping, swing trading, and momentum trading yield different returns. Consistency in a chosen strategy is key.

- Risk Management: Setting stop-losses and limiting risk per trade (often 1–2% of capital) protects the account from significant losses.

- Win Rate & Risk-to-Reward Ratio: Even with a modest win rate, favorable risk-to-reward setups can lead to consistent gains.

- Discipline & Psychology: Emotional control, avoiding revenge trading, and sticking to a plan heavily impact profitability.

Can Beginners Make Money Day Trading With $1,000?

Yes, beginners can make money day trading with $1,000, but it requires realistic expectations, patience, and structured learning. Most beginners initially face challenges due to inexperience, emotional trading, and misunderstanding risk management. Early profits are often small, inconsistent, or may even turn into losses as they learn the dynamics of the market.

Key considerations for beginners:

- Learning Curve: Understanding charts, indicators, market patterns, and trading platforms takes time. Beginners often spend weeks or months just refining basic skills before seeing consistent profits.

- Capital Limitation: A $1,000 account cannot support large position sizes, meaning profits per trade are naturally smaller. Attempting high-risk trades to compensate can quickly deplete the account.

- Risk Management: Limiting each trade to 1–2% of the account prevents catastrophic losses. This means that even a series of losing trades will not wipe out the account.

- Psychological Discipline: Emotional control is crucial. Fear, greed, and impatience often lead to overtrading, revenge trades, or abandoning strategies prematurely.

Tip: Using demo accounts or trading small positions initially allows beginners to practice strategies and build confidence without risking the full $1,000.

Day Trading Forex With $1,000: Profit Potential Explained

Forex is often preferred for small accounts like $1,000 due to its high liquidity, low capital requirements, and leverage options. A small account can still take meaningful positions thanks to margin trading, allowing traders to potentially earn 1–3% daily, while carefully managing risk.

Why Forex is suitable for small accounts:

- High Leverage Options: Brokers like Defcofx offer up to 1:2000 leverage, allowing traders to control larger positions with smaller capital. This can amplify profits but also losses if not managed properly.

- Low Costs: Trading with low spreads starting from 0.3 pips, and no commissions or swap fees, ensures that small accounts are not eaten up by fees, making every trade more efficient.

- Flexible Position Sizing: Traders can scale trades according to their account size, keeping risk per trade minimal.

- Global Reach: Forex markets are accessible to traders worldwide, allowing $1,000 accounts to trade during major sessions, maximizing opportunities.

By focusing on strategic position sizing, discipline, and cost-efficient trading, beginners and intermediate traders can grow a $1,000 account gradually.

Open a Live Trading AccountHow Leverage Impacts Earnings (And Losses)

Leverage allows traders to control a larger position with a smaller amount of capital, which can significantly amplify potential profits for a $1,000 account. For instance, using leverage of 1:200, a trader can effectively control $200,000 worth of currency, making even small market movements more impactful. However, leverage also magnifies losses, and a poorly managed trade can quickly deplete a small account.

This is why risk management is crucial: limiting exposure to 1–2% per trade and using stop-loss orders helps protect capital while still taking advantage of leverage. High leverage can also affect trading psychology, tempting traders to increase position sizes impulsively after gains or losses, which often leads to inconsistent results. Ultimately, leverage does not generate profit on its own, it magnifies outcomes, so responsible use combined with discipline is essential for sustainable growth. Using maximum leverage recklessly is extremely risky, especially for beginners.

Example Scenarios: Daily, Weekly, and Monthly Returns

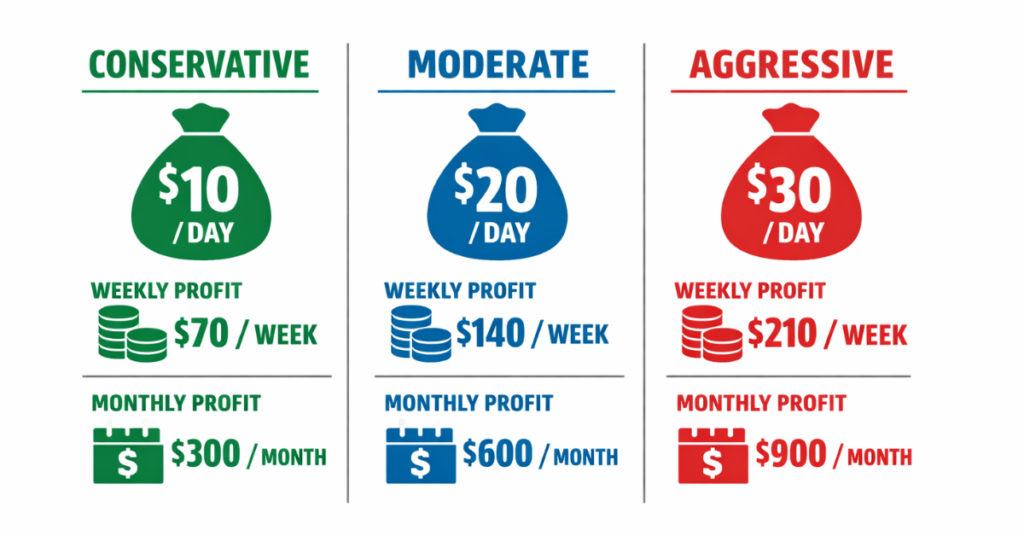

To understand what a $1,000 account can realistically earn, let’s consider three typical day trading scenarios based on disciplined risk management and modest profit targets. In a conservative approach, traders aim for 1% daily profit, earning around $10 per day. Weekly, this totals roughly $50–$60, and monthly gains can reach $200–$250, assuming consistent execution and market conditions.

A moderate approach targets 2% daily, translating to $20 per day, $100 per week, and $400 per month, but requires careful attention to volatility and risk per trade. An aggressive approach, aiming for 3% daily, can yield around $30 daily, $150 weekly, and $600 monthly; however, this level of risk is only suitable for experienced traders, as losses can compound quickly.

How to Grow a $1,000 Day Trading Account Over Time

Growing a $1,000 day trading account requires a combination of consistent profits, disciplined risk management, and patience. Instead of focusing on large daily gains, traders should prioritize small, steady returns that compound over time. For example, achieving a modest 1–2% daily profit consistently can lead to significant growth when reinvested properly.

Successful account growth also depends on strategy refinement and learning from mistakes. Tracking trades, analyzing outcomes, and adjusting approaches based on market conditions are essential for improving win rates and minimizing losses. Position sizing is critical. Traders should never risk more than a small percentage of the account on a single trade.

Additionally, using brokers that offer high leverage, low spreads, and fast withdrawals, such as Defcofx, can enhance trading efficiency. Features like up to 1:2000 leverage, spreads starting from 0.3 pips with no commissions, and rapid withdrawal options allow traders to maximize opportunities while keeping costs low.

Trading Costs and Why They Matter With Small Capital

When trading with a $1,000 account, costs such as spreads, commissions, and swap fees have a significant impact on profitability. Even small fees can erode gains quickly, especially when targeting daily returns of 1–3%. Minimizing these costs is therefore essential for small-account traders.

Using brokers that provide low spreads starting from 0.3 pips and no commissions or swap fees, like Defcofx, allows traders to keep more of their profits. Reduced costs mean that every winning trade contributes more effectively to account growth, and traders can execute strategies without worrying about fees eating into gains.

Withdrawals, Support, and Capital Access

For a $1,000 trading account, having fast and reliable access to funds is crucial. Traders may need to withdraw profits or adjust their positions quickly, and delays can affect strategy execution or overall confidence. Equally important is responsive customer support to resolve account, technical, or trading issues without unnecessary downtime.

Brokers like Defcofx enhance trading efficiency with features such as withdrawals completed within 4 business hours, including weekends, and dedicated support available whenever needed. This ensures that traders can manage their capital effectively, focus on trading decisions, and avoid frustrations that can arise from slow fund processing or inadequate support.

Is It Possible to Make a Living Day Trading With $1,000?

Making a full-time income from a $1,000 account is extremely challenging and generally not recommended for beginners. While small accounts can generate consistent profits, the limited capital restricts earning potential and increases vulnerability to market fluctuations. Traders need years of experience, disciplined strategies, and strict risk management to scale up gradually.

Key points to consider:

- Daily Profit Limits: Realistic daily earnings are usually $10–$30, which is not sufficient for living expenses.

- Consistency Over Time: Small accounts grow slowly, requiring patience and compounding profits to increase capital.

- Risk Management: Over-leveraging or aggressive trades to accelerate growth can quickly lead to account depletion.

- Psychology: Emotional control is critical; stress from needing income can lead to impulsive decisions.

- Scaling Accounts: To make day trading a primary income, traders must first grow the account over months or years before relying on it for living expenses.

Who Should (And Shouldn’t) Day Trade With $1,000?

Not every trader is suited to day trading with a $1,000 account. Understanding who benefits from small-capital trading helps avoid unnecessary losses and frustration.

Suitable for:

- Beginners looking to learn trading skills without risking large sums.

- Traders who prioritize disciplined risk management and are comfortable with small, gradual profits.

- Individuals willing to invest time in practice and strategy refinement.

- Those who can accept losses as part of the learning process and focus on capital preservation.

Not suitable for:

- Traders seek immediate, high income from day trading.

- Individuals with low risk tolerance who cannot handle occasional losses.

- People who lack patience or discipline and chase quick profits.

- Traders who need capital for essential living expenses, as small accounts cannot reliably provide full-time income.

Final Thoughts on How much can you make day trading with $1000?

Day trading with $1,000 is possible, but realistic expectations and disciplined risk management are essential. Beginners should focus on learning, consistency, and small gains rather than chasing large profits. Daily returns of 1–3% are achievable with proper strategy, but small accounts require patience and careful trade sizing.

Growing a $1,000 account over time involves gradual compounding, strict stop-loss usage, and avoiding over-leveraging. Traders must understand that high leverage can amplify both gains and losses, and that trading costs, emotional control, and market volatility all play a significant role in profitability. While it is unlikely to earn a full-time income immediately, a disciplined approach can steadily increase capital and trading skills.

Open a Live Trading AccountFAQs

Most traders earn 1%–3% daily, translating to about $10–$30 per day. Results vary based on strategy, risk management, and market conditions. Beginners may see lower profits or occasional losses initially.

Yes, it is enough to start, especially in markets like forex that allow small positions and high leverage. However, small accounts require careful risk control, realistic expectations, and disciplined trading.

Beginners can make money, but consistent profits take time, learning, and disciplined practice. Focusing on small, steady gains and protecting capital is more important than chasing large daily profits.

It is extremely difficult. $1,000 accounts are best for learning and skill development. Full-time income typically requires growing the account substantially over months or years.

Spreads, commissions, and swap fees can significantly reduce profits in small accounts. Choosing brokers with low spreads, no commissions, and minimal fees helps maximize earnings and supports sustainable growth.

Leverage amplifies both gains and losses. Responsible use of leverage, combined with risk management, is essential to prevent large drawdowns while maximizing earning potential.