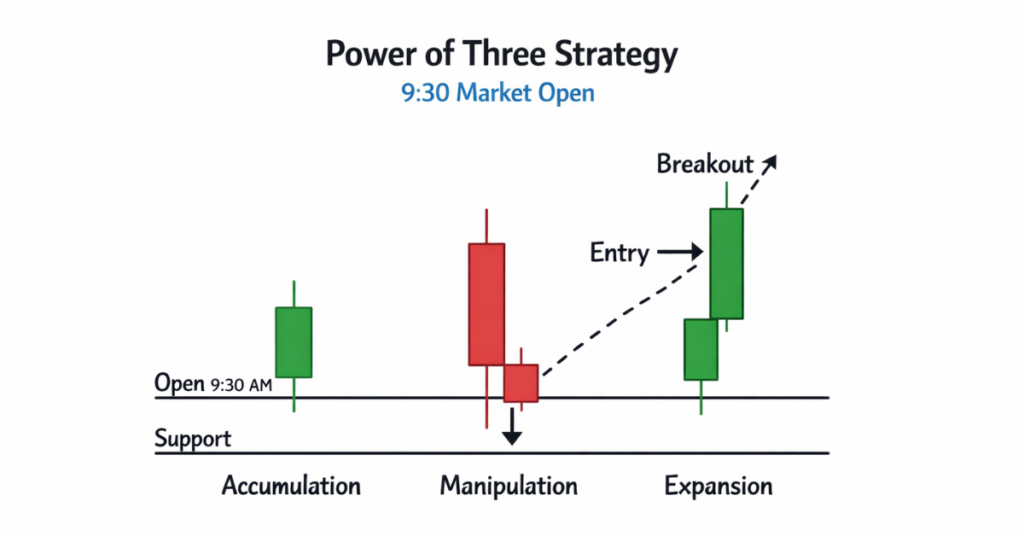

The Power of Three trading strategy at the 9:30 market open is a method that identifies three consecutive price bars to predict market direction. It helps traders spot high-probability entries, manage risk efficiently, and capitalize on early market volatility. This strategy is ideal for both stocks and Forex intraday trading.

Key Takeaways

- The Power of Three strategy uses three consecutive bars to forecast short-term market trends.

- It is highly effective during the 9:30 market open due to increased volatility and liquidity.

- Traders can manage risk while identifying high-probability trade setups.

- This strategy applies to both Forex and stock markets, making it versatile for intraday trading.

- Using brokers with features like low spreads and fast execution can enhance the strategy’s effectiveness.

Introduction to the Power of Three Trading Strategy

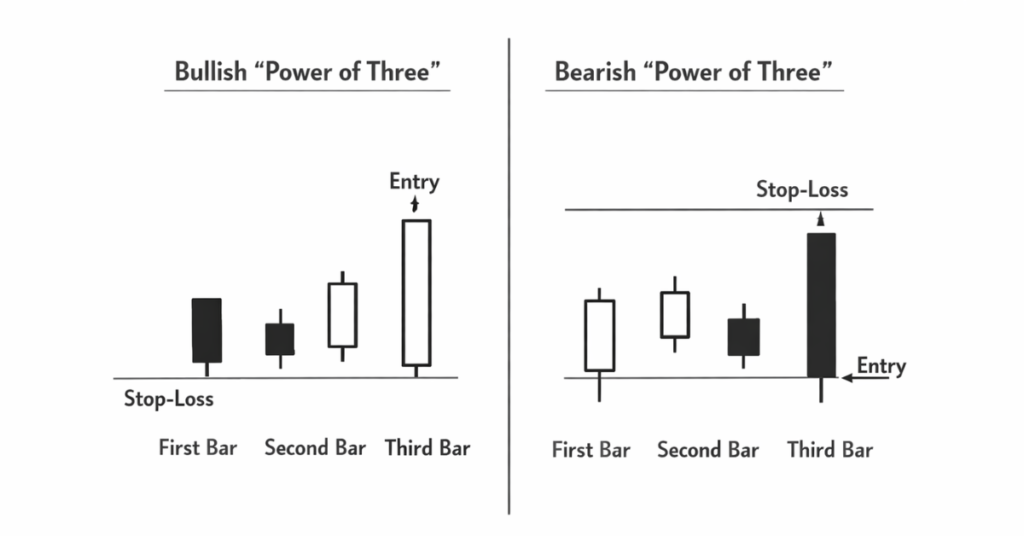

The Power of Three trading strategy is a popular intraday method used to identify potential market reversals or continuations. It focuses on analyzing three consecutive price bars to determine market sentiment and predict short-term movements. The first bar usually indicates the current trend, the second bar shows hesitation or consolidation, and the third bar confirms the direction, signaling an optimal entry point for traders.

Originally developed by professional day traders, this strategy is widely applied in both Forex and stock markets, especially during periods of high volatility. Its simplicity makes it accessible for beginners, while its reliability appeals to experienced traders seeking structured, high-probability setups.

Why it works: By concentrating on short-term price patterns, the strategy captures early momentum shifts, helping traders avoid entering too late and reducing the risk of being caught in sudden reversals.

Why the 9:30 Market Open Matters

The 9:30 AM market open marked the official start of the New York Stock Exchange (NYSE) trading session, one of the most volatile and liquid periods of the day. This time is critical because sudden price movements often occur as traders react to overnight news, economic data, and pre-market activity.

For the Power of Three strategy, this volatility creates high-probability trade setups, as patterns form quickly and provide clear signals for intraday entries. Increased liquidity ensures tighter spreads and faster execution, allowing traders to capitalize on short-term momentum efficiently.

Traders using Forex or stock instruments benefit equally, as major currency pairs and popular stocks experience similar early-session volatility. Understanding market behavior at this time gives traders a strategic edge when applying the Power of Three method.

Step-by-Step Guide to Using Power of Three at 9:30 Market Open

Applying the Power of Three strategy at the 9:30 market open involves a clear, step-by-step approach to identify high-probability trades. Here’s how traders can execute it effectively:

- Identify the First Bar (Trend Indicator):

- Observe the initial price movement at market open.

- The first bar reflects the dominant market sentiment—whether bullish or bearish.

- Analyze the Second Bar (Hesitation or Consolidation):

- The second bar typically shows market indecision, creating a potential reversal or continuation signal.

- A smaller or sideways bar indicates traders are testing support or resistance levels.

- Confirm with the Third Bar (Entry Signal):

- The third bar confirms the direction. A breakout or continuation of the trend signals a potential entry.

- Enter the trade in the direction of the confirmed trend with proper stop-loss placement.

- Set Risk Management Parameters:

- Place stop-loss orders just below/above the second bar to limit potential losses.

- Calculate position size according to account risk tolerance.

- Avoid over-leveraging, especially during volatile market opens.

- Execute and Monitor:

- Open the position once the third bar confirms the trend.

- Monitor for sudden reversals and be ready to exit if the trade invalidates.

Trading Examples and Charts

To understand the Power of Three strategy at the 9:30 market open, let’s look at practical examples that illustrate its application in real trading scenarios.

Example 1: Bullish Setup

- First Bar: Strong upward movement at market open, indicating bullish sentiment.

- Second Bar: Small consolidation or hesitation bar, showing the market is pausing.

- Third Bar: Breakout continues upward, confirming the trend.

- Action: Enter a long position just above the third bar, with a stop-loss below the second bar.

Example 2: Bearish Setup

- First Bar: Sharp decline at market open, indicating bearish momentum.

- Second Bar: Small upward or sideways bar, showing temporary hesitation.

- Third Bar: Downward continuation, confirming a sell signal.

- Action: Enter a short position below the third bar, stop-loss above the second bar.

| Bar | Bullish Setup | Bearish Setup |

| First Bar | Strong upward | Strong downward |

| Second Bar | Small pause/consolidation | Small pause/consolidation |

| Third Bar | Breakout upward | Breakout downward |

| Entry Point | Above third bar | Below third bar |

| Stop-Loss | Below second bar | Above second bar |

Notice that these examples are applicable to both Forex and stock trading, making the strategy versatile for intraday traders. By observing real-time price bars and following the three-bar pattern, traders can capture early session momentum with greater confidence.

Benefits of Using Power of Three at 9:30 Market Open

The Power of Three strategy offers several advantages for traders, particularly when applied at the 9:30 market open:

- High-Probability Trade Setups:

By focusing on three consecutive bars, traders can identify clear entry and exit points, reducing guesswork and improving the likelihood of successful trades. - Early Momentum Capture:

The strategy takes advantage of the volatility and liquidity during the market open, allowing traders to enter positions early in the trend and maximize intraday profits. - Versatility Across Markets:

This method works for both stocks and Forex, giving traders flexibility across multiple instruments. - Structured Risk Management:

Stop-loss placement below/above the second bar ensures that losses are minimized while allowing profitable trades to run, making it a disciplined approach to trading.

High leverage up to 1:2000 for flexible trading.

Low spreads from 0.3 pips and no swap fees, reducing costs.

Fast support and withdrawals, ensuring smooth fund management during intraday trading.

Common Mistakes to Avoid

Even a reliable strategy like the Power of Three at the 9:30 market open can fail if traders make common errors. Being aware of these pitfalls helps protect capital and improve long-term results.

- Over-Leveraging:

- Using excessive leverage can magnify losses. Stick to a sensible risk percentage per trade.

- Defcofx offers up to 1:2000 leverage, but it should be used cautiously.

- Ignoring Market Volatility:

- The 9:30 market open is highly volatile. Entering without proper analysis can lead to slippage or sudden losses.

- Misreading Bar Patterns:

- Entering trades without confirming the third bar can result in false signals. Always wait for trend confirmation.

- Poor Risk Management:

- Failing to use stop-loss orders or setting them too far can increase losses.

- Always position your stop-loss strategically relative to the second bar.

- Chasing Trades:

- Entering late into a setup, thinking the trend will continue, often leads to being stopped out quickly.

Defcofx Advantages for Traders Using This Strategy

While the Power of Three strategy can be applied independently, using a broker with advanced trading features can significantly enhance its effectiveness. Defcofx offers several advantages that complement this strategy:

- High Leverage Options:

- With up to 1:2000 leverage, traders can take larger positions and maximize potential returns while maintaining flexible risk management.

- 40% Welcome Bonus:

- New clients depositing $1000 or more receive a 40% bonus, giving additional capital to test strategies like the Power of Three.

- No Commissions or Swap Fees:

- Low spreads starting from 0.3 pips ensure that intraday trades remain cost-effective, an important factor when executing quick trades at the 9:30 market open.

- Global Reach:

- Defcofx supports clients from all countries and offers multiple language options, allowing traders worldwide to access the platform seamlessly.

- Fast Support and Withdrawals:

- Withdrawal requests are completed within 4 business hours, even on weekends, and support is responsive, ensuring smooth fund management during active trading sessions.

Final Thoughts on Power of three for Trading at 930 Market open

The Power of Three strategy at the 9:30 market open is a reliable and versatile method for capturing early market momentum in both stocks and Forex. By analyzing three consecutive price bars, traders can identify high-probability trade setups, manage risk effectively, and capitalize on intraday volatility.

Proper execution requires patience, discipline, and strict risk management, particularly during the volatile market open. When combined with brokers like Defcofx, traders benefit from high leverage up to 1:2000, low spreads starting from 0.3 pips, a 40% welcome bonus, fast withdrawals, and global access, making the strategy easier to implement efficiently.

Overall, mastering this strategy can enhance intraday trading performance, provided traders follow structured steps, avoid common mistakes, and leverage reliable trading tools.

FAQs

Identify three consecutive bars at the 9:30 open—first bar shows trend direction, second bar indicates hesitation, and the third bar confirms the trade. Enter in the confirmed direction with a stop-loss below/above the second bar.

Yes, it is simple to understand and implement. Beginners can start with small positions, observe the bar patterns, and gradually apply risk management techniques to gain confidence.

Absolutely. The strategy works well for both markets, especially during high-volatility periods like the 9:30 market open, allowing traders to capture intraday momentum efficiently.

Place stop-loss orders near the second bar, calculate trade size according to account risk tolerance, and avoid over-leveraging. Brokers like Defcofx allow high leverage options but disciplined risk management is crucial.

Yes. Features like low spreads, fast execution, high leverage, and quick withdrawals make it easier to implement intraday strategies effectively, reducing slippage and increasing trade efficiency.