Currency markets were jolted on December 22, 2025, by a confluence of central bank signals and year-end positioning. The U.S. dollar extended its slide in the wake of the Fed’s recent rate cut, putting the Dollar Index on track for its worst annual drop since 2017. Broad dollar weakness, combined with fresh verbal intervention threats from Japan, sparked a sharp rebound in the yen and lifted major counterparts like the euro and pound to multi-month highs. Risk sentiment was mixed – geopolitical tensions drove some safe-haven flows (gold spiked to a record high above $4,400 amid early-week risk aversion) even as equity markets held firm on hopes of easier monetary policy in 2026. With holiday-thinned liquidity exaggerating moves, traders saw big trends emerge in several major currency pairs on the day.

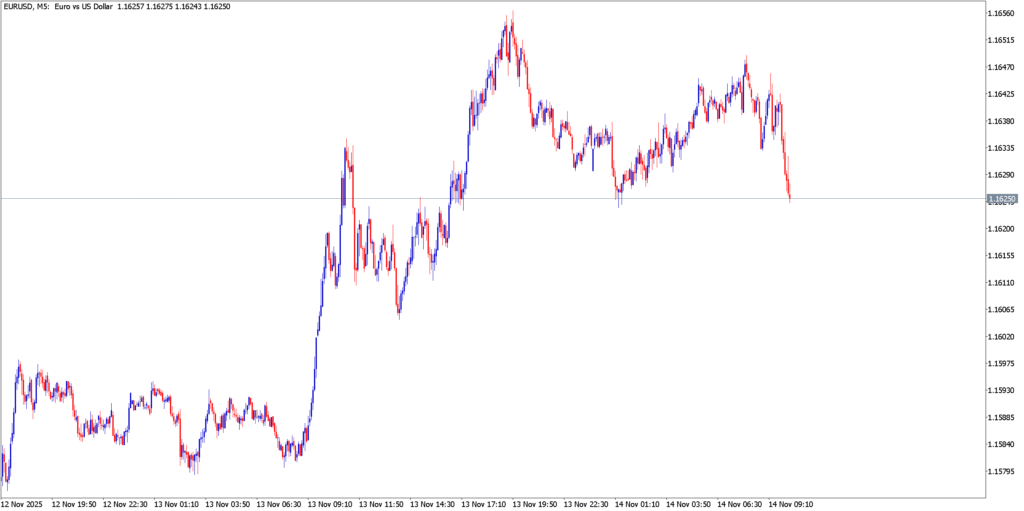

EUR/USD

Fundamental Analysis

The euro climbed against the weakening U.S. dollar, with EUR/USD rising about 0.4% to trade around the mid-1.17s. Last week’s European Central Bank meeting left rates unchanged and effectively “closed the door” on rate cuts anytime soon, according to ECB President Christine Lagarde. This steady stance – Lagarde noted policy is “in a good place” – contrasts with the U.S. Federal Reserve’s dovish turn. The Fed’s 25 bp rate cut on Dec 10 and signals of gradual easing have markets pricing in multiple U.S. rate reductions in 2026. This policy divergence (a patient ECB vs. a Fed tilting to easing) widened the euro’s yield advantage, providing fundamental support. Euro zone optimism has also inched up after the ECB’s upgraded growth forecasts, while soft U.S. data (slowing payrolls and inflation) reinforced the dollar’s downtrend. As a result, EUR/USD held firmly above the 1.17 handle into the holidays, digesting the central bank news and anticipating a pivotal U.S. GDP report the next day.

Technical Analysis

The EUR/USD uptrend remained intact on the charts, with the pair hovering just below this month’s high near 1.1800. Despite a brief pullback from that peak, the euro-dollar maintained trade above its 50-day and 100-day exponential moving averages (EMAs), a sign of sustained bullish momentum. In fact, a small bullish flag pattern formed on the daily chart – a continuation setup hinting at further upside. Momentum indicators confirm the positive bias: the Relative Strength Index and MACD continued to point higher, supporting the case for another leg up. Key levels to watch are 1.1800 as immediate resistance (a break of which could open the door toward the 1.19–1.20 zone), and 1.1600 as strong support on dips. Market commentary noted that as long as the pair holds above ~1.17 and U.S. yields remain under pressure, “buy-on-dips” may be favored by traders, with the narrowing Fed–ECB rate gap keeping the medium-term bias tilted bullish.

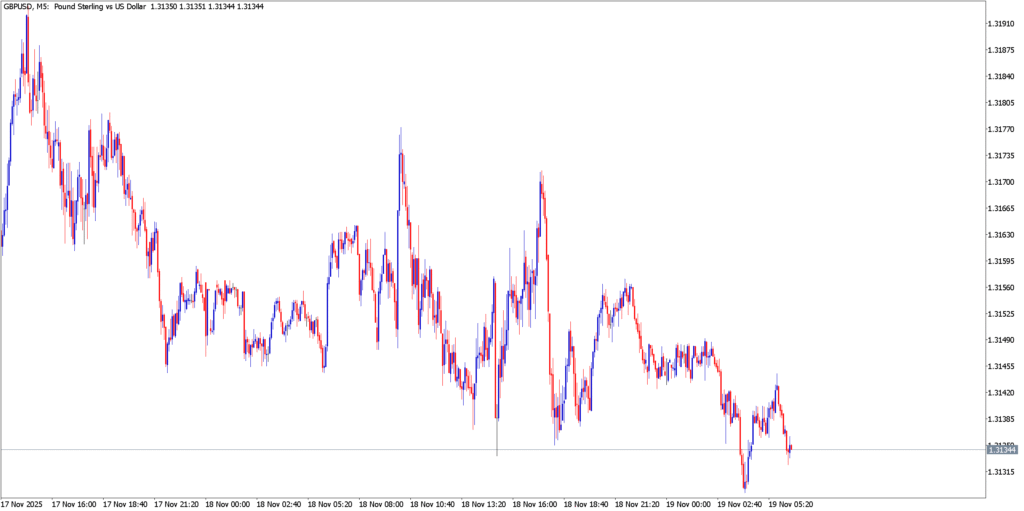

GBP/USD

Fundamental Analysis

The British pound also outperformed the dollar, pushing GBP/USD toward 11-week highs around the mid-1.34s. Sterling was buoyed by a mix of UK and U.S. factors. On the UK side, the Bank of England delivered its fourth rate cut of the year last week (25 bp to 3.75%), but struck a surprisingly hawkish tone by signaling that further easing will be very gradual. Policymakers indicated not many more cuts may be needed given inflation is still well above target. This tempered pace of easing lent support to the pound. Additionally, Britain’s final Q3 GDP reading, confirmed at +0.1% QoQ growth, came in slightly better than feared, helping alleviate recession worries. On the U.S. side, continued dollar softness (the DXY index hovered around 98.3) and caution ahead of upcoming U.S. data (like GDP and core PCE) kept the greenback on the defensive. By Monday’s close, GBP/USD was up about 0.6% on the day at $1.3458, with sterling’s monthly gain topping 1%. This put the pair within a hair of its highest level since mid-September, as traders balanced the BoE’s cautious optimism against a broadly weaker USD.

Technical Analysis

On the charts, GBP/USD has been grinding higher in an ascending channel, though bulls ran into a notable ceiling just below $1.3470. In fact, the pair’s recent peak at 1.3460 (touched on Dec 16) remains the key near-term resistance to beat. Multiple tests of this zone have so far failed to decisively clear it. The good news for bulls is that sterling’s pullbacks have been shallow – the pair is comfortably trading above its 50-day and 100-day EMAs, and even above trend indicators like the daily Supertrend line. Momentum is constructive: the RSI indicator has been rising and is nearing overbought territory, reflecting strong buying pressure (though also warning of possible consolidation ahead). Given this setup, immediate support lies around 1.3300 (a level that coincides with recent swing lows and the bottom of the current range). A dip under 1.3300 would undermine the bullish structure and could trigger a deeper pullback. Conversely, a clear break above 1.3460 would confirm a range breakout – opening the door to the psychologically important 1.3600 level next. Analysts describe the outlook as “cautiously bullish,” with sterling’s further gains likely requiring continued dollar weakness and no negative surprises from UK data.

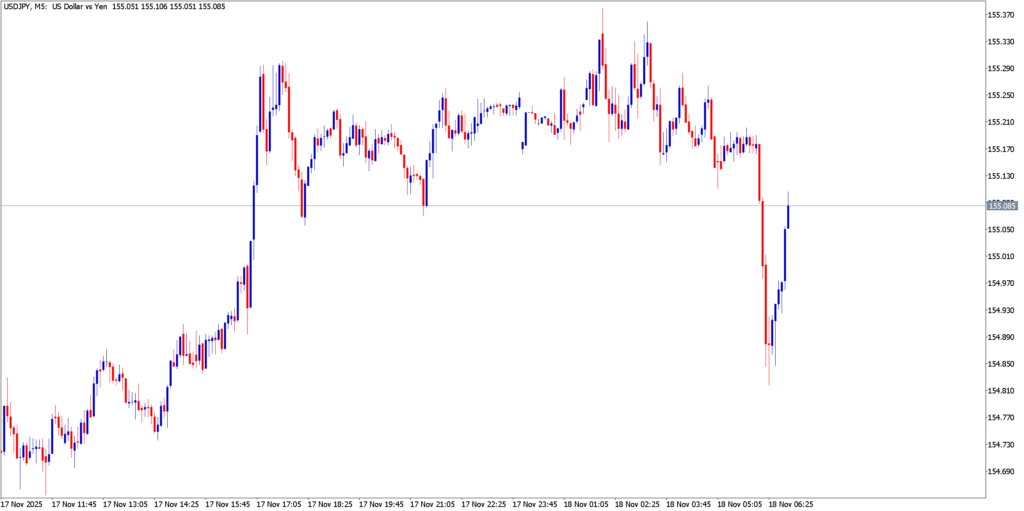

USD/JPY

Fundamental Analysis

The U.S. dollar/Japanese yen pair took an unexpected turn as the yen surged sharply higher to start the week. After a prolonged slide that saw yen crosses hit multi-decade lows, Japan’s currency finally caught a bid on Monday – USD/JPY fell about 0.5% to the mid-156s, marking the dollar’s largest one-day drop against yen since late November. The reversal was triggered by clear verbal intervention warnings from Tokyo: top officials said they stood ready to “take appropriate action” against “one-sided” yen declines. Traders took this as a strong hint that actual FX intervention (yen-buying by authorities) could be imminent if yen weakness persists. This jawboning came just days after the Bank of Japan’s own actions – the BoJ surprised markets by hiking its policy rate to 0.75% on Friday (the highest Japanese rates in 30 years). However, that tightening had paradoxically failed to boost the yen last week, as Governor Ueda’s cautious tone and Japan’s huge yield gap kept yen bears in control. Now, with officials drawing a line in the sand and the dollar softening globally, yen short-covering kicked in. It’s worth noting that the yen’s bounce also coincided with year-end risk reduction by investors – Japan’s fiscal uncertainties (record budget spending plans) and the prospect of Ueda speaking again on Dec 25 added extra incentive to square positions. By the end of the day, USD/JPY hovered around ¥156.9, well off the ¥157.7 highs seen last week. The fundamental tug-of-war remains: a slightly less accommodative BoJ and looming intervention threat vs. a still sizeable U.S.–Japan rate differential and global carry trades that have punished the yen for months.

Technical Analysis

Despite Monday’s drop in USD/JPY, the overall technical trend remains bullish for the dollar against the yen – though momentum has become more two-sided. The pair is essentially in a 300-pip range roughly between ¥155 and ¥158 for now. On the upside, ¥158.0–158.5 emerges as a key resistance zone, not only because it’s near recent highs but also due to the perceived “intervention threshold” around ¥160. Traders suspect Japanese authorities will become increasingly aggressive if USD/JPY approaches 160. On the downside, initial support lies at ¥155.0 (a level that has acted as a floor recently) with stronger support around ¥153 if that fails. Notably, the 50-day EMA is also near the mid-¥155s, so a decisive break below 155 and the 50-day average could signal a trend shift lower. For now, however, bulls are still “in control” – the late-week rebound prior to this session showed the strength of dip-buyers, with one analyst calling Friday’s big green candlestick “no joke”. The carry trade dynamic (earning interest by shorting yen) continues to underpin the pair as well. In summary, USD/JPY may stay range-bound unless either a breakout above 158 (renewing the rally) or a drop below 155 (inviting more yen strength) occurs. The bias has moderated to neutral/bullish; many expect any extreme moves toward 160 to be met with official pushback, keeping the pair in check as 2025 comes to a close.

Market Outlook

Heading into year-end, the macro landscape favors a still-soft U.S. dollar, but with important nuances. The dollar’s once-large yield advantage has rapidly eroded – the Fed and BoE are easing into 2026 while the ECB is on hold and the BoJ is slowly tightening, narrowing rate differentials that had propped up the greenback. Indeed, the Dollar Index is down nearly 9% year-to-date, on pace for its worst yearly performance in eight years. This trend provides a supportive backdrop for euro and sterling strength to continue, provided no sudden shifts in central bank messaging. However, traders are exercising caution. With liquidity thinning into the Christmas holiday, even minor data surprises or stray comments can spark outsized volatility. All eyes are on upcoming U.S. economic reports and any clues from officials (for instance, BoJ Governor Ueda’s speech on Dec 25) that could sway sentiment.

In summary, the euro’s bullish bias appears intact as long as the Fed stays dovish and the Eurozone outlook holds steady – a run toward 1.20 is on the table in early 2026 if momentum persists. The pound, while firm, may face a ceiling if UK growth struggles or the BoE reverts to a more cautious stance; sterling’s recent rally could stall out in the mid-1.30s absent additional catalysts. As for the yen, it remains the wild card – further BoJ normalization or actual FX intervention could ignite more yen gains (pushing USD/JPY down), but absent that, the entrenched carry trade still favors USD/JPY staying elevated in its range. Taken together, the foreign exchange market’s theme is policy divergence converging: the dollar is under pressure as global central banks recalibrate policy, and traders should be prepared for larger moves even in traditionally quiet holiday sessions. Stay tuned as these macro currents set the stage for early 2026’s forex direction.