If you want to use moving averages for swing trading, identify market trends by applying common averages like the 50 EMA or 200 SMA on your chart. Moving averages smooth price action, highlight entries and exits, and help traders stay aligned with momentum during medium-term swings lasting days or weeks.

Key Takeaways

- Moving averages help identify trends, filter noise, and pinpoint swing trading opportunities.

- Commonly used types include SMA (Simple) and EMA (Exponential), with EMAs being more responsive.

- Popular timeframes for swing trading are 20, 50, and 200 periods.

- Crossovers and price bounces from MAs offer entry/exit signals.

- Defcofx offers real-time MA indicators via MetaTrader 5 (MT5) for strategic swing setups.

What Are Moving Averages?

Moving averages are tools that calculate the average price over a specific number of periods. They’re plotted directly on your chart and act like dynamic support and resistance levels. They simplify volatile price movements, allowing traders to better visualize the trend and stay focused on swing opportunities.

There are 2 main types:

- Simple Moving Average (SMA): A basic average of closing prices over a set period.

- Exponential Moving Average (EMA): Gives more weight to recent prices, reacting faster to new market moves.

For swing traders who hold positions for several days to a few weeks, moving averages are essential for trend-following and strategic planning.

Why Moving Averages Matter in Swing Trading

Swing trading is all about catching medium-term moves within an ongoing trend. Traders aim to enter at pullbacks and exit before reversals.

Moving averages help by:

- Smoothing price action, making it easier to spot trends.

- Confirming trend direction so you’re not trading against momentum.

- Signaling entries/exits when the price bounces from or crosses the MA.

- Providing visual reference for stop-loss placement and profit targets.

A broker like Defcofx supports this approach with advanced charting tools and lightning-fast execution, ensuring your trades align with key MA levels even during fast-moving sessions.

Open a Live Trading AccountBest Moving Averages for Swing Traders

Different traders prefer different MAs depending on strategy:

- 20 EMA: Ideal for aggressive swing entries and short-term momentum.

- 50 EMA or SMA: Common mid-term trend filter used by institutional traders.

- 200 SMA: The long-term trend benchmark. The price above it indicates overall bullish sentiment.

Swing traders often use a combination, like the 50/200 crossover, to identify higher-probability setups.

Want to swing trade with precision? Open an account with Defcofx and get access to ultra-fast MT5 charts, customizable MA indicators, and tight spreads to make your swing entries count.

Open AccountMoving Average Crossover Strategies

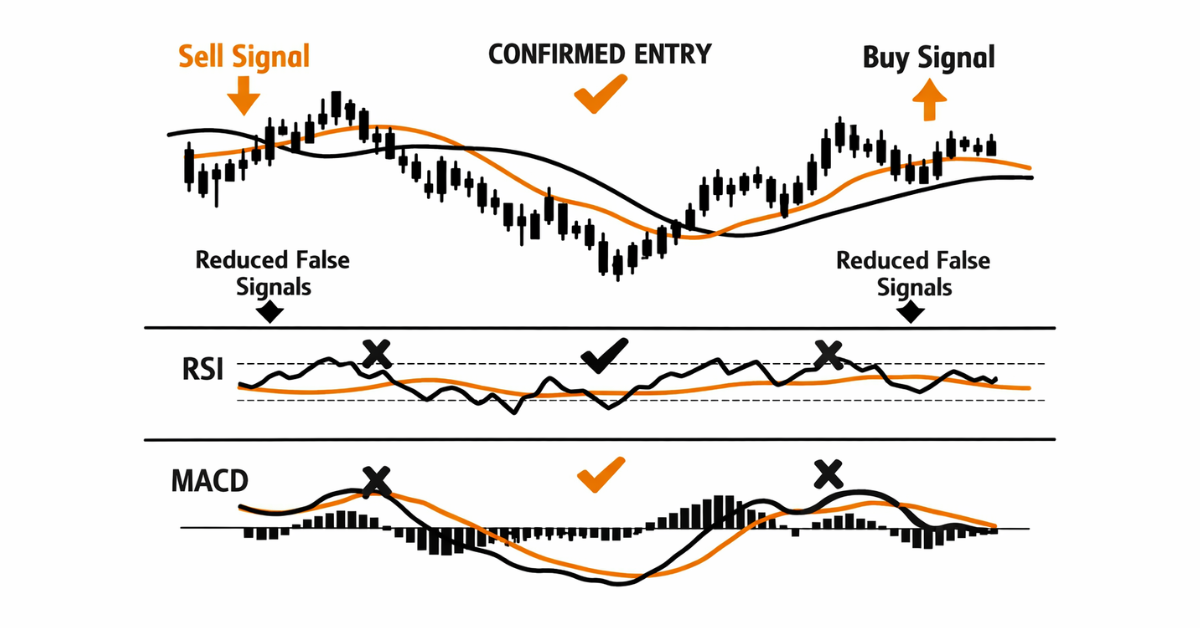

A moving average crossover happens when a short-term moving average crosses a long-term moving average on a price chart. Traders use this event to confirm a change in trend direction, not to predict exact tops or bottoms.

How it works:

- Bullish crossover (buy signal): When the 50-period EMA crosses above the 200-period EMA, it suggests that recent prices are gaining strength and an uptrend may be starting.

- Bearish crossover (sell signal): When the 50-period EMA crosses below the 200-period EMA, it indicates weakening price momentum and a potential downtrend.

Swing traders commonly monitor these crossovers on daily and 4-hour charts, as they help identify new trends early while avoiding short-term noise.

Important: A crossover is a confirmation tool, not a guarantee. Many traders combine it with support/resistance or volume to reduce false signals.

EMA vs SMA: Which should you use?

- EMAs (Exponential Moving Averages) react faster to price changes and are better suited for active swing traders.

- SMAs (Simple Moving Averages) move more slowly and help filter out market noise in choppy conditions.

Choose the one that matches your trading speed and risk tolerance.

Combining MAs with Price Action

One powerful way to use moving averages is to wait for price to pull back to a moving average, then enter in the direction of the trend.

For example:

- In an uptrend, when price retraces to the 20 EMA and forms a bullish candle, it may be a good swing entry.

- In a downtrend, a bounce off the 50 EMA with a bearish engulfing candle can confirm a short setup.

You can also use moving averages as dynamic support/resistance, meaning price may respect them similarly to how it respects horizontal support/resistance zones.

Moving Average in Different Market Conditions

In trending markets, moving averages shine. But in choppy or sideways markets, they can generate false signals. That’s why it’s essential to:

- Use trend filters like the ADX (Average Directional Index).

- Stick to higher timeframes like the 4-hour or daily chart.

- Wait for confluence between MAs and key price zones.

Using platforms like Defcofx, you can backtest your moving average strategies across different assets and market types, ensuring your edge remains consistent.

Final Thoughts

Moving averages are some of the most beginner-friendly yet powerful tools in swing trading. They simplify charts, identify trends, and offer actionable signals. Whether you’re using a crossover strategy or bouncing off dynamic support, these tools guide your entries and exits with clarity.

When used on a platform like Defcofx, you benefit from fast execution, customizable indicators, and tight spreads, helping your MA strategies work effectively. The key is to pair MAs with price structure, manage your risk wisely, and trade patiently within the trend.

Open a Live Trading AccountFAQs

What’s the best moving average for swing trading?

The 50 EMA is a favorite among swing traders because it filters midterm trends well. The 20 EMA works for shorter swings, while the 200 SMA shows long-term direction. Most traders combine two or more to confirm entries and trend strength.

How do I use moving averages for entry signals?

You can enter when the price pulls back to the moving average and shows a strong reversal candle. Another way is to enter on a moving average crossover. For example, if the 20 EMA crosses above the 50 EMA, it may signal a bullish move. Always confirm with price action.

Can I use moving averages on all timeframes?

Yes, but for swing trading, higher timeframes like 4-hour and daily are more reliable. Lower timeframes (1-min, 5-min) are better suited for scalping. Moving averages give fewer false signals when used on longer charts due to less market noise.

Do professional traders use moving averages?

Absolutely. Many institutional and retail traders rely on moving averages for trade entries, exits, and trend confirmation. They often pair MAs with price action and indicators like RSI or MACD. Defcofx’s MT5 platform supports all these tools for pro-level analysis.

What’s the difference between SMA and EMA?

SMA gives equal weight to all price points in the period, making it smoother but slower to react. EMA gives more weight to recent prices, so it’s more responsive to current market movements. Swing traders often prefer EMAs for quicker signal generation.

Are moving averages good in sideways markets?

Not really. In ranging or sideways markets, moving averages tend to flatten out, giving false signals. That’s why it’s crucial to check for clear trending conditions or combine MAs with support/resistance to reduce bad entries in choppy zones.

How many moving averages should I use?

Most swing traders use 2–3. A common combo is the 20 EMA, 50 EMA, and 200 SMA. This gives a view of short-, medium-, and long-term trends. Using too many MAs can clutter your chart and cause confusion. Simplicity often leads to better decisions.

8. Can I use moving averages on gold or crypto?

Yes, moving averages work across all markets: forex, crypto, commodities like gold, and indices. However, each asset has unique volatility, so test different MA settings. Defcofx offers access to multiple asset classes where you can apply your favorite swing strategies.

Defcofx Forex Articles You Shouldn’t Miss

Discover powerful forex strategies in these top reads from Defcofx.