To start investing in the stock market, learn the basics of how stocks work, choose a reliable online investing platform, open and fund an account, and buy diversified investments like stocks or ETFs. Begin with money you can afford to invest long term and manage risk consistently.

Important Key Points

- Investing in the stock market means buying ownership in companies to grow wealth over time.

- Beginners should focus on long-term investing, not short-term speculation.

- You don’t need a large amount of money to start, but you do need a clear plan.

- Risk is part of investing, and diversification is essential to manage it.

- Choosing the right platform and staying consistent matters more than perfect timing.

What the Stock Market Is and How It Actually Works

The stock market is a system where shares of publicly listed companies are bought and sold. When you invest in a stock, you’re purchasing partial ownership in a company, which means your investment value rises or falls based on the company’s performance and overall market conditions.

The market operates through buyers and sellers placing orders electronically, with prices determined by supply and demand. For beginners, understanding this ownership-based structure is key to making informed investment decisions.

Why People Invest in the Stock Market?

People invest in the stock market primarily to grow their money over time. Historically, stocks have delivered higher long-term returns compared to savings accounts or fixed-income options, making them attractive for building wealth and beating inflation.

Another key reason is compounding, where reinvested gains generate additional earnings over time. Investing also allows individuals to participate in the success of well-known companies and global economies, rather than relying solely on earned income.

For many beginners, the stock market serves as a long-term financial tool rather than a short-term income source, which is why patience and consistency are essential.

Is Stock Market Investing Safe for Beginners?

Investing in the stock market carries risk, and beginners must understand that prices fluctuate daily. While stocks have historically grown in value over the long term, short-term losses are possible, especially during market volatility.

Safety for beginners comes from education, diversification, and long-term planning. By spreading investments across multiple stocks or ETFs and staying consistent, risks are managed effectively without relying on luck or timing the market perfectly.

How Much Money Do You Really Need to Start Investing?

You don’t need a large sum to begin investing in the stock market. Many platforms allow you to start with small amounts, even as low as $50–$100, making it accessible for beginners.

It’s important to only use money you can afford to invest long term. Consistency and disciplined contributions over time often matter more than the initial amount invested.

Investing vs Trading: What’s Better for Beginners?

When starting in the stock market, understanding the difference between investing and trading helps beginners choose an approach that matches their risk tolerance, time availability, and experience level.

| Aspect | Investing | Trading |

|---|---|---|

| Purpose | Focuses on long-term wealth creation by holding assets as they grow in value over time | Focuses on earning short-term profits by taking advantage of frequent price movements |

| Holding Period | Stocks or ETFs are typically held for months or years | Positions may be held for minutes, hours, or a few days |

| Decision Basis | Decisions are based on company fundamentals, financial health, and long-term market trends | Decisions rely on charts, indicators, market timing, and short-term price patterns |

| Risk Exposure | Lower risk over time due to market averaging and long-term growth | Higher risk due to rapid price changes and timing errors |

| Market Volatility | Short-term market swings have limited impact on long-term positions | Volatility is essential and directly affects profits and losses |

| Emotional Involvement | Requires patience and discipline but less emotional pressure | High emotional pressure due to fast decisions and frequent losses or gains |

| Time Commitment | Requires occasional monitoring and periodic portfolio adjustments | Requires constant monitoring and quick reaction to market movements |

How to Start Investing in the Stock Market Step by Step

Starting in the stock market can seem overwhelming, but breaking it down into clear steps makes it manageable for beginners:

- Educate Yourself First: Learn the basics of stocks, ETFs, and market dynamics. Understanding how investments grow, the impact of volatility, and key financial terms is essential before committing money.

- Set Your Investment Goals: Define what you want to achieve: long-term wealth, retirement planning, or supplemental income. Goals help determine your investment strategy and risk tolerance.

- Choose a Reliable Platform or Broker: Select a trusted online brokerage that provides easy account access, low fees, and helpful resources. Platforms like Defcofx offer features such as high leverage options, no commissions or swap fees, and fast support and withdrawals, which can help beginners start confidently.

- Open and Fund Your Account: Complete registration, verify your identity if required, and deposit funds. Only invest money you can afford to leave invested long term.

- Start Small and Diversify: Buy a mix of stocks or ETFs instead of putting all funds into a single company. Diversification reduces risk and provides exposure to multiple sectors.

- Monitor and Adjust: Track your investments regularly and adjust based on goals, market conditions, or risk tolerance. Avoid reacting to short-term market fluctuations unnecessarily.

How to Choose a Stock Investing Platform or Broker

Selecting the right platform is an important step for beginners because it affects ease of use, cost, and access to learning resources. A good broker should provide a secure and user-friendly interface, transparent fees, and reliable customer support.

Here are 5 important factors to consider:

- Fees and Commissions: Look for low-cost platforms that don’t charge hidden fees. Defcofx, for example, offers no commissions or swap fees and spreads starting from 0.3 pips, helping beginners save on trading costs.

- Account Types and Minimum Deposits: Platforms should accommodate small initial investments while allowing flexibility to grow your account.

- Trading Tools and Resources: Access to charts, educational content, and market analysis helps beginners make informed decisions.

- Global Reach and Accessibility: Choose brokers that accept clients worldwide and offer multiple language options, like Defcofx’s global reach feature.

- Support and Withdrawals: Fast and responsive customer service is essential. Platforms with withdrawals processed within 4 business hours give added confidence to new investors.

Understanding Stock Types and Beginner-Friendly Investments

For beginners, understanding the types of stocks and investment options is essential to build a safe and diversified portfolio.

Common Stock Types

- Common Stocks: Represent ownership in a company with voting rights. Returns come from price appreciation and dividends.

- Preferred Stocks: Offer fixed dividends and priority over common stock in case of company liquidation but usually have limited growth potential.

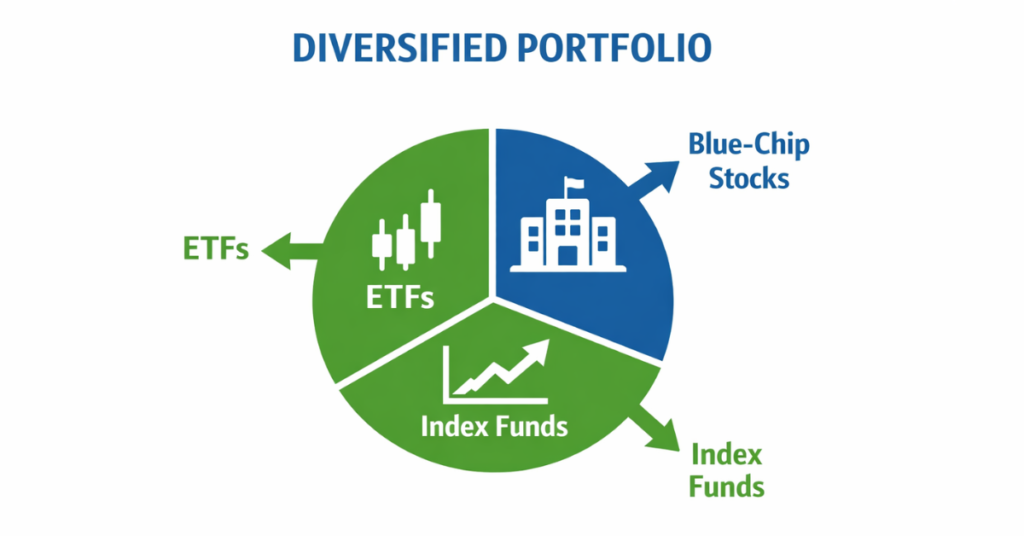

Beginner-Friendly Investments

- Exchange-Traded Funds (ETFs): Pooled investments that track indexes or sectors, offering instant diversification with lower risk than individual stocks.

- Blue-Chip Stocks: Large, established companies with stable earnings and dividends, suitable for long-term investing.

- Index Funds: Track overall market performance, reducing the risk of investing in single stocks.

How to Build a Beginner Investment Portfolio

Building a beginner-friendly portfolio requires balancing risk, diversification, and your long-term goals. A well-structured portfolio spreads investments across multiple assets, reducing exposure to a single company or sector.

4 Steps to Build a Portfolio:

- Determine Your Risk Tolerance: Decide how much risk you can comfortably handle. Younger investors may choose higher-risk growth stocks, while cautious beginners may prefer ETFs or blue-chip stocks.

- Diversify Across Sectors: Invest in different industries like technology, healthcare, and consumer goods to reduce sector-specific risk.

- Allocate Capital Wisely: Divide your investment funds between individual stocks, ETFs, or index funds according to your strategy.

- Rebalance Periodically: Review your portfolio every few months to maintain your desired risk and growth balance.

5 Common Beginner Mistakes and How to Avoid Them

Investing in the stock market can feel overwhelming for beginners. While mistakes are part of learning, some common errors can slow progress or cause unnecessary losses. The table below outlines frequent beginner mistakes and practical ways to avoid them.

| Beginner Mistake | Why It’s a Problem | How to Avoid It |

|---|---|---|

| Investing Without Research | Buying stocks based on tips, trends, or social media hype can lead to poor choices because the company’s financial health and long-term potential are unknown | Research each company carefully, review financial statements, understand the business model, and know why you are investing before buying |

| Emotional Investing | Fear during market downturns and greed during rallies often cause panic selling or buying at inflated prices, which reduces overall returns | Create a clear investment plan, stick to it, and ignore short-term market noise to avoid emotional decisions |

| Lack of Diversification | Investing all money in one stock or sector increases the risk of major losses if that investment performs poorly | Spread investments across multiple stocks, ETFs, or sectors to balance risk and improve stability |

| Chasing Quick Gains | Trying to profit from “hot stocks” or short-term trends increases risk and often leads to losses or high trading costs | Focus on long-term growth, avoid get-rich-quick strategies, and allow compounding to work over time |

| Neglecting Long-Term Planning | Without clear financial goals, investing becomes inconsistent and impulsive, reducing long-term success | Set clear objectives such as retirement, wealth building, or passive income, and regularly review your strategy |

How Online Trading Platforms Can Help Beginners

Online trading platforms simplify the process of investing in the stock market, making it accessible even for beginners with little prior knowledge. They provide the tools, resources, and support needed to make informed decisions and execute trades efficiently.

4 Key Benefits for Beginners:

- User-Friendly Interface: Platforms offer intuitive dashboards that make buying, selling, and tracking investments straightforward.

- Educational Resources: Tutorials, webinars, and market analysis help beginners learn at their own pace.

- Research Tools: Real-time charts, financial reports, and analytics allow users to make data-driven decisions.

- Accessibility: You can invest anytime, anywhere, from desktop or mobile devices.

How Defcofx Supports Beginner Investors

Defcofx provides beginner-friendly features that help new investors start their stock market journey safely and efficiently. While it’s not mandatory to use a specific platform, Defcofx integrates tools and services that simplify investing.

How Defcofx Helps Beginners:

- High Leverage Options: Offers up to 1:2000 leverage, giving traders flexibility to start small while accessing larger positions responsibly.

- 40% Welcome Bonus: Available for first-time deposits of $1000 or more, allowing beginners to increase their initial investment advantageously.

- No Commissions or Swap Fees: With spreads starting from 0.3 pips, beginners can invest without worrying about hidden costs eroding their returns.

- Global Reach: Accepts clients from all countries and provides multiple language options, making investing accessible worldwide.

- Fast Support and Withdrawals: Withdrawals are processed within 4 business hours, including weekends, ensuring liquidity and peace of mind for new investors.

Final Thoughts on How to Start Investing in the Stock Market

Starting to invest in the stock market can feel challenging, but by educating yourself, setting clear goals, and using the right tools, beginners can grow wealth steadily over time. Focus on long-term strategies, diversify your portfolio, and avoid common mistakes like emotional investing or chasing quick profits.

Open a Live Trading AccountFAQ’s

You can start with as little as $50–$100. Beginners should invest only money they can leave invested long-term and gradually increase contributions as they gain experience.

Stock investing carries risk, but beginners can reduce it by diversifying, focusing on long-term investments, and avoiding emotional decisions.

ETFs, index funds, and blue-chip stocks are beginner-friendly because they offer diversification and steady growth potential while minimizing risk.

Yes, a reliable online trading platform simplifies investing, provides research tools, and allows secure buying and selling of stocks. Platforms like Defcofx also offer low fees, high leverage options, and global access for beginners.

Absolutely. Many platforms allow small initial deposits, letting beginners learn and grow their portfolio over time. Consistency matters more than the starting amount.