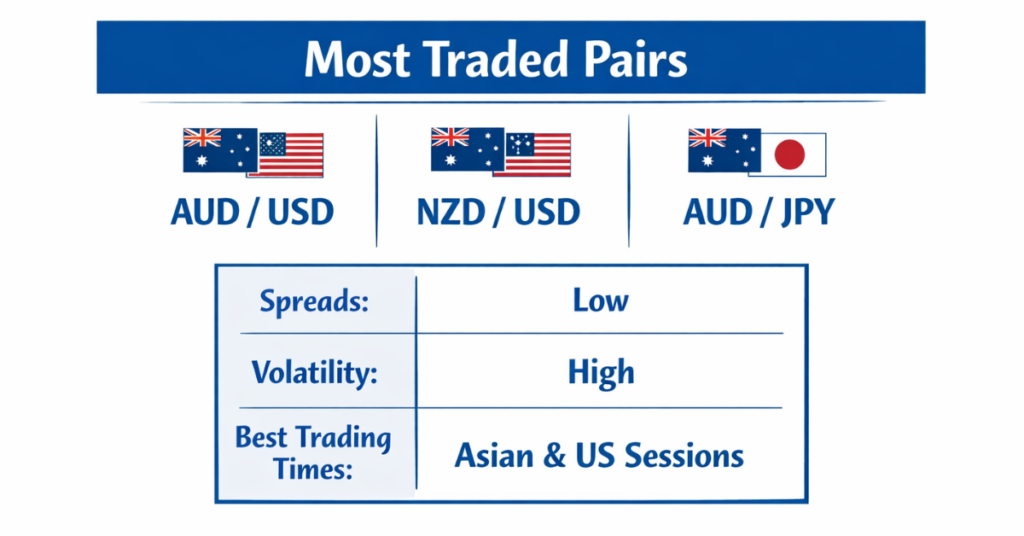

The best currency pairs to trade during the Sydney session are AUD/USD, NZD/USD, and minor crosses like AUD/JPY because they offer moderate price movement and stable liquidity. Beginners benefit from tight spreads starting at 0.3 pips (the small cost per trade), flexible leverage options, and fast withdrawals, making this session easier to manage while learning forex trading.

Key Takeaways

- The Sydney session is ideal for trading AUD/USD, NZD/USD, and minor crosses due to predictable liquidity and moderate volatility.

- Traders can access flexible leverage options, but beginners should start with lower leverage to reduce risk and trade more safely.

- Low spreads starting at 0.3 pips and no commissions or swap fees make trades cost-effective.

- Supports global clients with fast account setup and withdrawals completed within 4 business hours, even on weekends.

- Understanding session timing and currency behavior is essential for strategic trading and risk management.

Beginner Trading Terms Explained

- Pip: The smallest price movement in a currency pair. Fewer pips usually mean lower trading costs.

- Spread: The difference between the buy and sell price. Lower spreads help beginners save money.

- Leverage: Borrowed capital that allows traders to control larger trades with smaller deposits. Higher leverage increases both profit potential and risk.

- Swap Fee: A fee charged for holding a trade overnight. Swap-free trading helps reduce long-term costs.

- Volatility: How much prices move. Moderate volatility is easier for beginners to handle.

An Overview of the Sydney Forex Session

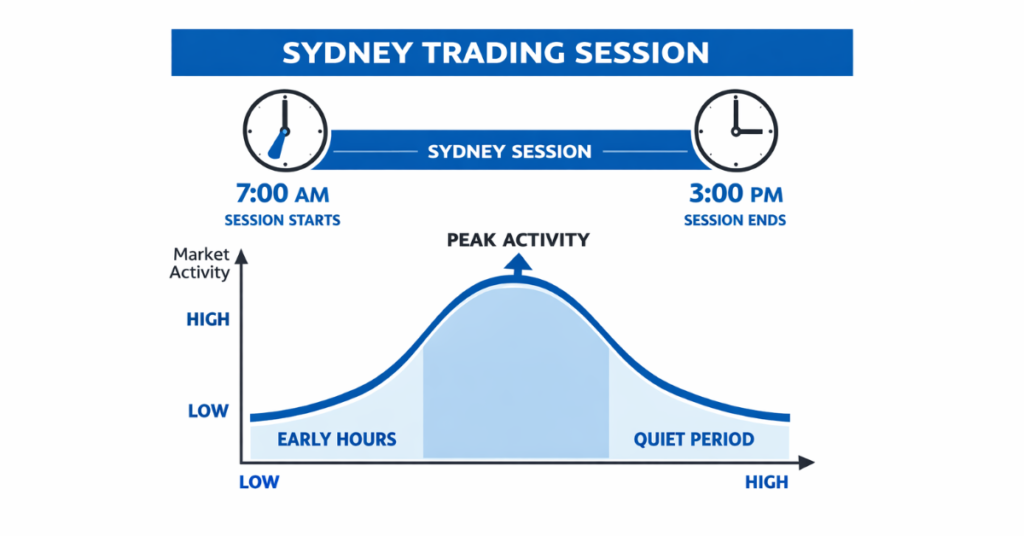

The Sydney forex session runs from 10:00 PM to 7:00 AM GMT, marking the start of the global trading day. While the session begins with lower liquidity, trading activity gradually increases as AUD and NZD pairs gain momentum.

This Sydney session is ideal for traders who prefer moderate volatility and want to take advantage of early market trends before the London and New York sessions open. It also provides opportunities to practice strategic entry points and test trading strategies in a relatively calm environment.

3 Key Points About Sydney Session Trading:

- Liquidity: Starts low but picks up as Australian and New Zealand markets fully open.

- Volatility: Moderate, making it suitable for both beginners and experienced traders.

- Best Pairs: Focus on AUD/USD, NZD/USD, and other minor crosses.

Top Currency Pairs to Trade During Sydney Session

The most tradable currency pairs during the Sydney session are AUD/USD, NZD/USD, AUD/JPY, and minor crosses. These currency pairs benefit from moderate volatility, sufficient liquidity, and predictable market behavior, making them ideal for strategic trading.

Comparison Table: Top Sydney Session Pairs

| Currency Pair | Average Spread | Volatility | Best Trading Time | Notes |

| AUD/USD | 0.3–0.5 pips | Moderate | 12:00 AM – 6:00 AM GMT | Highly liquid, tight spreads |

| NZD/USD | 0.4–0.6 pips | Moderate | 1:00 AM – 7:00 AM GMT | Good for trend-following |

| AUD/JPY | 0.5–0.8 pips | Moderate | 2:00 AM – 6:00 AM GMT | Correlated with Tokyo session |

| AUD/NZD | 0.6–0.9 pips | Moderate | 12:00 AM – 5:00 AM GMT | Cross pair, suitable for range trading |

Beginner Example Trade During the Sydney Session

A beginner trader selects AUD/USD during the Sydney session because of steady price movement and good liquidity.

- Account Balance: $100

- Leverage Used: 1:50

- Trade Size: Small lot

- Stop-Loss: 20 pips

- Take-Profit: 40 pips

This setup limits risk while helping beginners understand price movement and trade management.

Key Factors Beginners Must Understand When Trading the Sydney Session

Trading during the Sydney session requires a careful balance of strategy, timing, and risk management. While it is considered a quieter session compared to London or New York, understanding the market dynamics can give traders a strong edge.

- Liquidity and Volatility: The session starts with lower liquidity, which can lead to small price movements, but volatility increases as the Australian and New Zealand markets fully open. Pairs like AUD/USD and NZD/USD become more active, offering clear trends for both short-term and swing trades. Traders should focus on pairs with sufficient trading volume to avoid slippage.

- Risk Management: Utilizing high leverage options can maximize potential profits, but it also increases exposure. Proper position sizing, setting stop-losses, and maintaining discipline are essential to avoid major losses. Combining moderate leverage with careful risk assessment ensures a safer trading environment.

- Market News and Events: Economic reports, central bank announcements, and regional data releases from Australia or New Zealand can create sudden volatility. Traders need to monitor the economic calendar to anticipate spikes in AUD and NZD pairs. Ignoring these can lead to unexpected price swings.

- Trading Strategies: The Sydney session is ideal for range trading during calmer periods and breakout strategies when volatility spikes. Pairing this with technical indicators like moving averages or RSI can improve entry and exit timing. Beginners can start with smaller trades while learning session patterns, whereas experienced traders can leverage timing overlaps with Tokyo for additional opportunities.

- Timing Overlaps: The overlap between the Sydney and Tokyo sessions creates slightly higher liquidity in JPY pairs like AUD/JPY and NZD/JPY. This period is often considered the most active within the Sydney session, providing better trading opportunities.

8 Benefits of Trading During the Sydney Session

Trading during the Sydney session offers several advantages for both beginners and experienced traders.

- One of the main benefits is the opportunity to trade AUD and NZD currency pairs with moderate volatility, which allows for predictable price movements and easier trend identification.

- Smooth Market Entry: The Sydney session occurs before the London and New York sessions, providing a quieter environment to plan trades and test strategies without the extreme volatility of major sessions.

- Opportunities in Key Pairs: Popular pairs like AUD/USD, NZD/USD, and AUD/JPY experience steady liquidity, making them ideal for both short-term and swing trading.

- Cost-Effective Trading with Defcofx: Traders benefit from tight spreads starting at 0.3 pips, no commissions, and no swap fees, ensuring that trading costs remain low.

- High Flexibility: With leverage options available up to 1:2000, traders have flexibility in position sizing. Beginners are strongly advised to start with lower leverage (such as 1:50 or 1:100) to control risk while learning market behavior.

- Global Accessibility: Defcofx supporting the Sydney session welcome clients from all countries, offering multiple language options for a seamless trading experience.

- Fast Support and Withdrawals: Defcofx ensures reliable customer support and processes withdrawals within 4 business hours, including weekends, enhancing trader confidence.

- Strategic Preparation: Trading in this session allows beginners to learn market behavior, while experienced traders can identify setups for the upcoming London session.

5 Common Mistakes to Avoid

Trading during the Sydney session can be profitable, but many traders make avoidable mistakes that reduce efficiency and increase risk. Recognizing these pitfalls helps maintain consistent performance.

- Over-Leveraging: Using the maximum leverage without proper risk management can lead to significant losses. Always calculate position size relative to your account balance.

- Ignoring Market News: Economic announcements from Australia or New Zealand can create sudden price swings. Failing to monitor these events can result in unexpected losses.

- Trading Illiquid Pairs: Avoid pairs with low volume during early Sydney hours, as slippage and wide spreads can occur. Focus on AUD/USD, NZD/USD, and AUD/JPY for consistent liquidity.

- Poor Timing: Entering trades at the very start of the session, when volatility is low, may result in slow-moving positions and missed opportunities. Wait for market activity to pick up.

- Lack of Strategy: Trading without a defined plan or technical setup increases the likelihood of mistakes. Always follow a well-tested strategy with entry, exit, and stop-loss levels.

6 Tips for Maximizing Profits

Maximizing profits during the Sydney session requires a combination of strategy, timing, and risk management. Following these tips can help traders make the most of moderate volatility and predictable trends.

- Use Limit and Stop Orders: Placing limit orders at key support/resistance levels and stop orders for risk management ensures trades are executed efficiently without emotional decisions.

- Pairing Trades Strategically: Focus on AUD/USD, NZD/USD, and minor crosses. Correlating pairs or trading related instruments can provide hedging opportunities and reduce risk exposure.

- Monitor Economic Calendars: Keep track of Australian and New Zealand economic releases, such as employment data or central bank announcements, to anticipate volatility spikes.

- Manage Leverage Wisely: High leverage up to 1:2000 should be used cautiously. Smaller positions with calculated risk allow for potential gains without excessive exposure.

- Trade During Active Overlaps: The overlap between the Sydney and Tokyo sessions provides higher liquidity, especially for JPY pairs, creating more trading opportunities.

- Analyze Trends and Patterns: Use technical indicators like moving averages, RSI, or trendlines to confirm market direction and improve entry and exit timing.

| Tip | Benefit |

| Limit & Stop Orders | Controlled entries and exits |

| Strategic Pairing | Hedge risk and improve trade efficiency |

| Monitor Economic Calendar | Anticipate market volatility |

| Manage Leverage | Minimize risk while maximizing potential gains |

| Trade During Session Overlap | Increased liquidity and smoother execution |

| Analyze Trends & Patterns | Better timing for entry and exit |

Beginner Checklist Before Trading the Sydney Session

- Trade AUD/USD or NZD/USD for better liquidity

- Use low leverage (1:50–1:100)

- Always set a stop-loss

- Avoid trading during major economic news

- Trade during the Sydney–Tokyo overlap

- Start with small position sizes

Final Thoughts on Best Currency Pairs to Trade during Sydney Session

The Sydney forex session offers traders a unique opportunity to trade AUD, NZD, and minor currency pairs with moderate volatility and predictable trends. By focusing on high liquidity pairs, monitoring market news, and applying disciplined strategies, traders can improve their efficiency and potential profits.

Using a broker like Defcofx that offers flexible leverage options, tight spreads starting at 0.3 pips, no commissions or swap fees, and fast withdrawals within 4 business hours creates a supportive environment for both beginners and experienced traders. Global accessibility ensures traders from any country can participate, while bonuses like the 40% welcome bonus for first-time deposits add extra value.

Open a Live Trading AccountFAQs

The most traded pairs during the Sydney session are AUD/USD, NZD/USD, AUD/JPY, and minor crosses. These pairs offer moderate volatility, predictable trends, and good liquidity for both beginner and experienced traders.

The Sydney session runs from 10:00 PM to 7:00 AM GMT, with market activity increasing after the Australian and New Zealand markets open. Liquidity is higher later in the session, creating more trading opportunities.

The session has moderate volatility and predictable trends, allowing beginners to practice trading strategies with less risk compared to the London or New York sessions. Tight spreads and low trading costs also make it beginner-friendly.

Yes, traders can use leverage up to 1:2000, but it should be applied cautiously with proper risk management. High leverage amplifies profits but also increases potential losses.

Range trading: Works well during low volatility periods.

Breakout strategies: Effective when AUD and NZD pairs experience sudden price moves.

Technical analysis: Using indicators like moving averages, RSI, or trendlines helps improve entry and exit timing.

Economic releases from Australia and New Zealand, such as employment data, central bank announcements, and GDP reports, can create significant volatility. Monitoring the economic calendar is crucial to avoid unexpected market moves.

Yes, brokers offering tight spreads from 0.3 pips, no commissions or swap fees, fast withdrawals within 4 business hours, and global accessibility provide an ideal environment for Sydney session trading.