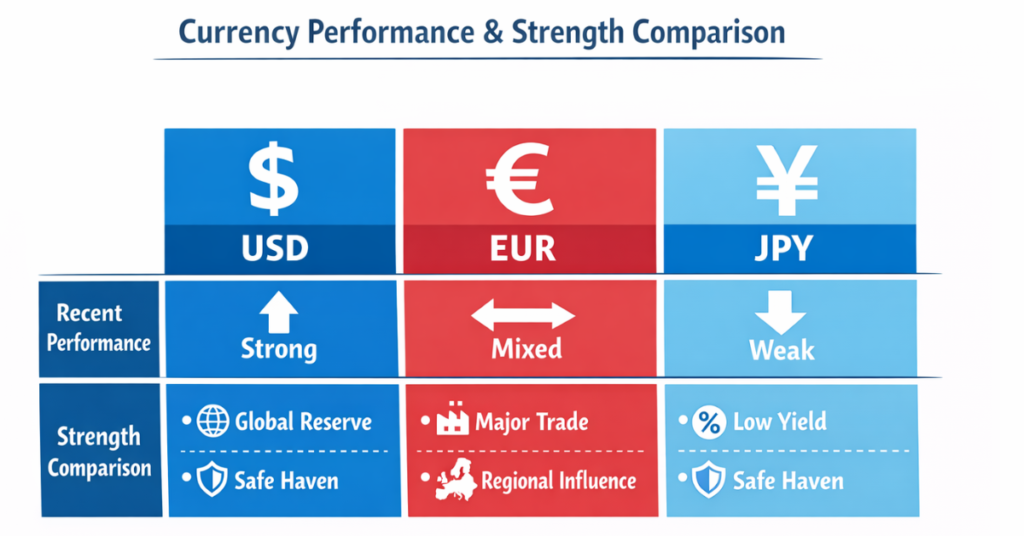

The 3 strongest currencies in the world are the United States Dollar (USD), the Euro (EUR), and the Japanese Yen (JPY). These 3 currencies are considered the strongest due to their global demand, economic stability, liquidity, and status as widely held reserve currencies, making them reliable for trading and investment.

Important Key Points

- The USD, EUR, and JPY are currently the world’s strongest currencies.

- Currency strength is determined by economic stability, inflation rates, interest rates, and global demand.

- Strong currencies are preferred by investors and traders for safer, high-liquidity trades.

- Understanding the strongest currencies helps in forex trading and international investment decisions.

- Traders using platforms like Defcofx can leverage up to 1:2000 and benefit from low spreads when trading these currencies.

What Determines Currency Strength?

Currency strength is determined by several key economic and financial factors that influence how much a currency is worth relative to others. Understanding these factors helps traders and investors identify which currencies are strong and reliable for trading.

5 Key Factors Influencing Currency Strength:

1. Economic Stability

A country with a strong and stable economy usually has a stronger currency. High GDP growth, low debt levels, and political stability all increase investor confidence, which boosts demand for the currency.

2. Interest Rates

Higher interest rates attract foreign capital, as investors seek better returns. This increases demand for the currency, strengthening its value. Conversely, low interest rates may reduce its appeal.

3. Inflation Rates

Low and stable inflation helps maintain a currency’s purchasing power. Currencies in countries with high inflation often weaken because their real value erodes over time.

4. Global Demand and Trade

Currencies that are widely used in international trade or as reserve currencies tend to be stronger. For example, the USD is dominant in global transactions, increasing its demand worldwide.

5. Geopolitical Stability

Political unrest, wars, or sanctions can reduce confidence in a currency. Conversely, countries with stable governance typically have stronger currencies due to consistent economic and financial policies.

The 3 Strongest Currencies Explained in Detail

The 3 strongest currencies USD (United States Dollar), EUR (Euro), and JPY (Japanese Yen) are widely recognized for their stability, global demand, and influence in international trade. Understanding why these currencies are strong helps investors and traders make informed decisions.

1. United States Dollar (USD)

The USD is the world’s most dominant currency and serves as the global reserve currency. It is widely used in international trade, finance, and commodity pricing, making it highly liquid and stable.

Reasons for USD Strength

- Strong U.S. economy with high GDP and low unemployment.

- Dominates global trade and commodity markets (oil, gold).

- High investor confidence due to political and financial stability.

Table: USD Historical Performance

| Year | USD Index Value | Notes |

| 2023 | 104.5 | Stable growth amid global economic uncertainty |

| 2024 | 105.2 | Strengthened against major currencies |

| 2025 | 106.0 | Continued demand in trade and reserves |

2. Euro (EUR)

The Euro is the official currency of the Eurozone, consisting of 19 European countries. Its strength comes from the combined economic power of these nations and its wide use in global trade.

Reasons for EUR Strength

- Represents one of the largest economic unions in the world.

- High trade volume within Europe and with global partners.

- Strong financial institutions and regulated monetary policy by the European Central Bank (ECB).

3. Japanese Yen (JPY)

The Japanese Yen is a safe-haven currency often sought during global uncertainty. It is known for low inflation, stable economy, and consistent monetary policy, making it one of the strongest currencies globally.

Reasons for JPY Strength

- Safe-haven status attracts investors in volatile markets.

- Low inflation maintains currency purchasing power.

- Strong domestic economy with high trade surpluses.

Table: JPY Key Facts

| Factor | Detail |

| Inflation | Low and stable |

| Trade Balance | Positive surplus strengthens currency |

| Market Perception | High confidence among investors |

Why These 3 Currencies Matter to Traders and Investors

The USD, EUR, and JPY aren’t only strong globally but also highly significant for traders and investors. Their stability and liquidity make them reliable for forex trading, international investments, and risk management strategies.

1. Reliable Trading Pairs

These 3 currencies form the backbone of the most traded forex pairs, such as USD/EUR, USD/JPY, and EUR/JPY. Their high liquidity ensures smoother transactions, lower spreads, and reduced slippage for traders.

2. Safe-Haven Investments

- JPY and USD are often considered safe-haven currencies during economic or geopolitical uncertainty.

- Investors often shift to these currencies to preserve capital and reduce risk exposure.

3. Investment Planning and Risk Management

- Strong currencies help maintain purchasing power for international investments.

- Currency strength insights allow traders to forecast trends and make informed trading decisions.

4. Trading on Platforms Like Defcofx

While the focus is on user information, traders can utilize strong currencies on reliable trading platforms. For example, Defcofx offers up to 1:2000 leverage, low spreads starting at 0.3 pips, and fast withdrawals, allowing traders to maximize opportunities with these 3 top currencies.

Open a Live Trading AccountTop Currency Pairs Involving the Strongest Currencies

The strongest currencies USD, EUR, and JPY form some of the most traded and reliable forex pairs. Understanding these pairs helps traders identify opportunities, manage risk, and take advantage of market movements.

Key Currency Pairs

| Currency Pair | Strength Factor | Trading Insight |

| USD/EUR | Combines the world’s strongest and second-strongest currencies | High liquidity; low spreads; suitable for swing and day trading |

| USD/JPY | Safe-haven pairing with strong global demand | Often used in risk-off trading strategies during volatility |

| EUR/JPY | Cross pair combining Eurozone stability and Japanese Yen safe-haven | Offers predictable price movements; ideal for intermediate traders |

| GBP/USD | Strong British Pound paired with USD | Volatile but profitable; requires careful risk management |

| AUD/USD | Australian Dollar paired with USD | Strong correlation to commodities; popular for short-term traders |

Final Thoughts on What is the 3 strongest currency?

The 3 strongest currencies in the world USD, EUR, and JPY remain the benchmark for stability, liquidity, and global influence. Their strength is determined by economic stability, interest rates, inflation control, and international demand, making them ideal for traders, investors, and safe-haven strategies.

Investors and traders benefit from understanding these currencies because they often provide more predictable market behavior, lower risk, and more reliable trading opportunities. In addition, high-liquidity pairs such as USD/EUR, USD/JPY, and EUR/JPY typically offer smoother execution and tighter spreads, which can reduce overall trading costs.

Moreover, because these pairs are heavily traded, they generally support better risk management through improved price stability and faster order filling. As a result, they remain central to both short-term trading and long-term investment strategies.

FAQ’s

The United States Dollar (USD) is widely regarded as the strongest currency due to its role as the global reserve currency, high liquidity, and stability. It is followed closely by the Euro (EUR) and the Japanese Yen (JPY).

Currency strength is influenced by:

Economic stability (GDP growth, political stability).

Interest rates (higher rates attract foreign investment).

Inflation rates (low inflation maintains purchasing power).

Global demand and trade (reserve currency usage increases strength).

Geopolitical stability (stable nations foster confidence in their currency).

Yes, strong currencies such as the USD, EUR, and JPY are widely available on most forex trading platforms. In fact, these major currencies are among the most actively traded pairs worldwide, which makes them easy to access for both beginners and experienced traders. For example, Defcofx allows traders to trade these currencies with up to 1:2000 leverage, low spreads starting from 0.3 pips, and fast withdrawals. As a result, trading becomes more efficient, smoother, and more accessible for a wide range of users.

Historically, the USD, EUR, and JPY are considered among the safest currencies because of their economic stability, strong global demand, and generally lower volatility compared to many emerging market currencies. In addition, during periods of market stress, investors often shift into these currencies as a defensive strategy. For example, safe-haven investors frequently prefer the JPY when uncertainty rises, since it has traditionally strengthened during global risk-off events.

Defcofx Forex Articles You Shouldn’t Miss

Discover powerful forex strategies in these top reads from Defcofx.