On Monday, the forex market saw the US dollar strengthen notably, driven by an unexpected surge in U.S. manufacturing data that reshaped investors’ expectations for growth and the Federal Reserve policy outlook. The ISM Manufacturing PMI for January 2026 jumped to 52.6, much higher than forecasts and signaling a broad expansion in manufacturing activity. This immediate surprise boosted sentiment in U.S. equities and supported a cleaner economic performance narrative, reducing the probability of rapid rate cuts in 2026 and bolstering the greenback’s appeal.

Across major USD pairs, the dollar’s rebound was visible in modest weakness in EUR/USD and GBP/USD, while USD/JPY held firm near elevated levels despite ongoing yen volatility. The session reminded markets that robust economic data can still shift positioning even early in the month.

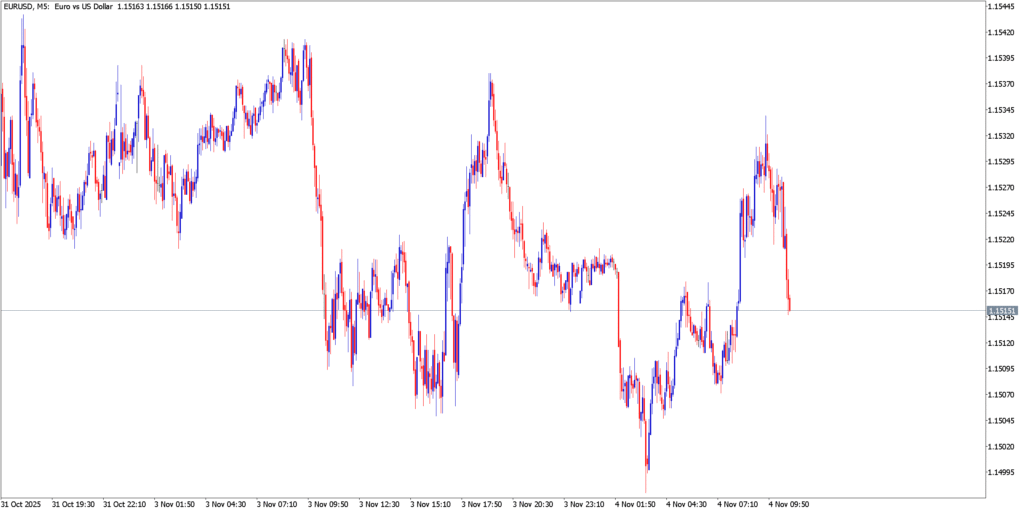

EUR/USD

Technical Analysis

EUR/USD retraced lower during Monday’s session, challenging support around the lower end of its recent trading range. Technical momentum turned mildly bearish as the stronger dollar pressured the pair, and intraday price action failed to reclaim intermediate resistance. A break below the immediate support zone would open the door to further downside toward multi-session lows near the mid-1.17 area, while a rebound back above recent resistance would be needed to slow the corrective move.

Fundamental Analysis

The euro’s relative weakness reflected the shift in market pricing following U.S. data. With stronger manufacturing activity pointing to sustained economic resilience, traders scaled back some USD bearish positioning, giving the dollar the upper hand. Meanwhile, European economic indicators were largely mixed or lackluster, providing little fresh support for EUR/USD on the day.

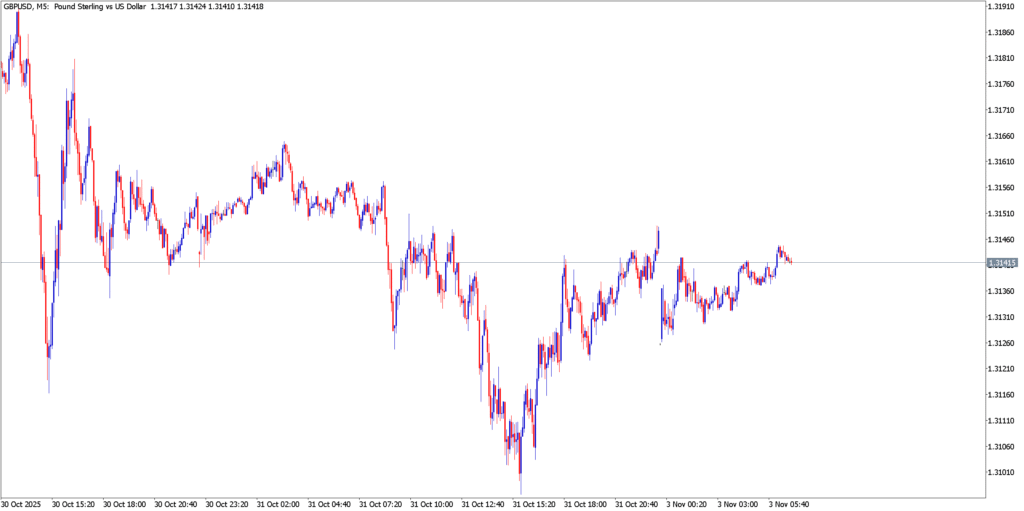

GBP/USD

Technical Analysis

GBP/USD also traded lower on Monday, with downside pressure building as the dollar regained traction. Price action dipped toward key short-term support levels, and technical momentum broadly aligned with USD strength. The pair’s inability to break higher despite resilient UK fundamentals suggests short-term bears may remain in control if selling pressure continues.

Fundamental Analysis

Sterling’s weakness was not due to weakness in UK data. In fact, UK equities and PMI indicators showed stability, but rather came from broader dollar repricing. With global traders prioritizing U.S. strength and recalibrating Fed expectations, GBP/USD struggled to maintain prior near-term gains. Market commentary highlighted noise around interest rate expectations, with some analysts cautioning that traders have misread Fed signals in the past 18 months.

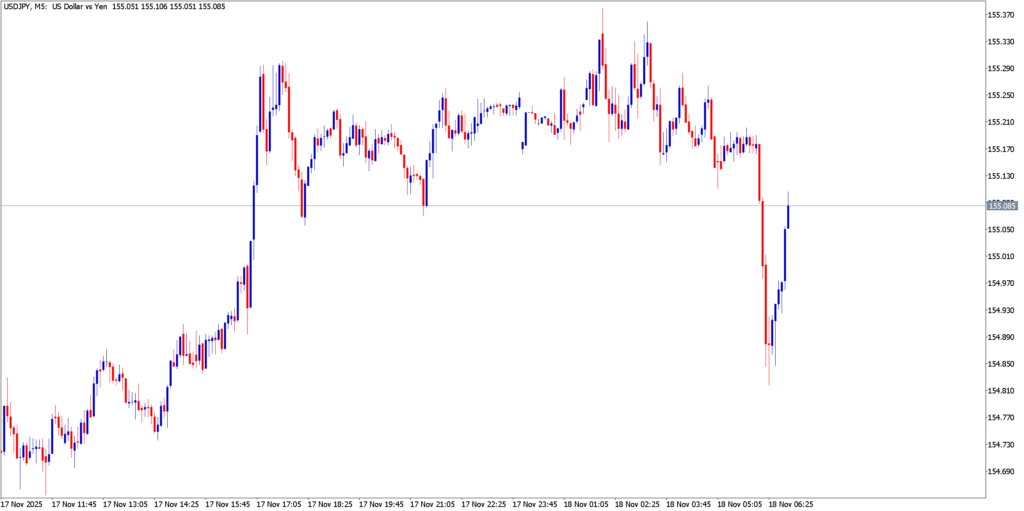

USD/JPY

Technical Analysis

USD/JPY maintained its grip above key support areas, trading near the mid-150s. Technical structure remained constructive, albeit with signs of short-term consolidation after extended gains. The pair respected lower support levels and buyers defended pullbacks, underscoring the underlying bullish bias.

Fundamental Analysis

The yen’s soft tone continued to support USD/JPY, partly as traders remained cautious about possible policy accommodation in Japan compared with the more resilient U.S. data backdrop. Asian markets also processed influences from broader risk flows and Japanese political developments, but the net effect for USD/JPY was steady upside pressure, anchored by the stronger dollar narrative.

Market Outlook

Looking ahead to Tuesday, attention remained on economic data and key central bank decisions on the calendar, including the Bank of England policy announcement later in the week. While Monday’s dollar strength set the tone, markets are keen to see whether additional indicators will reinforce or soften expectations around relative monetary policy paths and macro performance.