Global forex sentiment is cautious to start the week, as traders digest stubborn inflation surprises and central bank bombshells. Last week’s U.S. CPI data showed price pressures easing slower than hoped, rekindling debate on the Fed’s next steps. Meanwhile, the Australian Dollar reels after the RBA’s dovish shock – policymakers held off on a widely expected hike (keeping rates at 3.60% vs 3.85% forecast), underscoring growth worries. Fears of economic stagnation are creeping in elsewhere as well – Japan just averted recession with a barely positive GDP, and Europe’s recovery remains fragile. Looming over everything are geopolitical tensions in trade: new U.S. tariffs on imports have rattled confidence, threatening to exacerbate a slowdown in global demand. Amid these cross-currents of sticky inflation, surprise policy moves, and simmering trade risks, major currency pairs are volatile and trend conviction is low. Traders are bracing for high-impact data and central bank cues in the days ahead to set the tone.

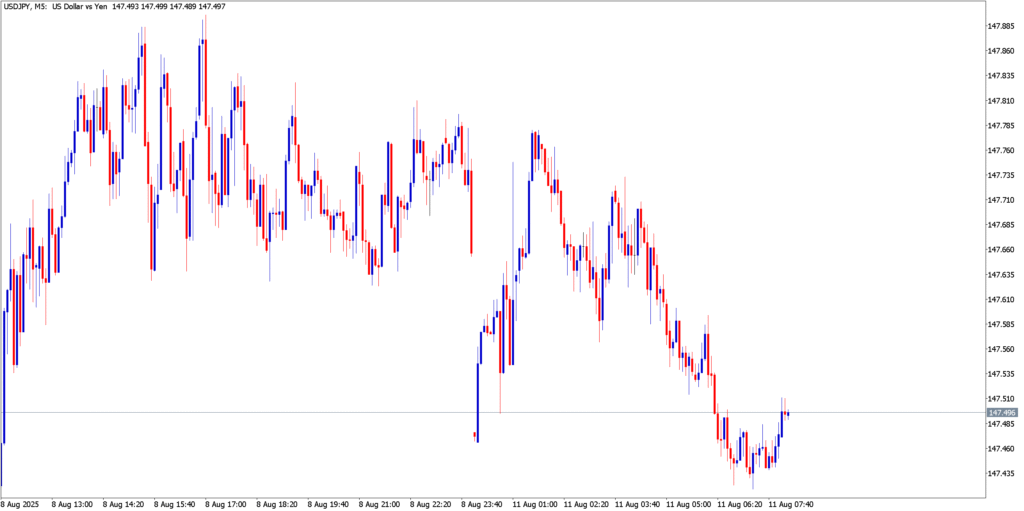

USD/JPY

Technicals in Focus

USD/JPY is range-bound with a slight bullish bias after rebounding from lows near ¥146.70 late last week. The pair continues to post higher lows, finding support around ¥147.30 (near the 50-period M.A. and recent trendline). Overhead, resistance at the ¥148.30-¥148.50 zone remains formidable – the price has failed to close above this mid-range ceiling. Momentum signals are mixed on the M5 chart: MACD hovers flat near the zero line, and RSI is in the mid-50s (neutral), while the Stochastic oscillator has curled up from oversold levels. This suggests waning bearish momentum and a potential base forming, but no clear breakout yet – the tone is cautious unless key levels give way.

Trading Strategy

Given the indecisive momentum, it’s prudent to map out both bullish and bearish setups:

- Bullish: A sustained break above ¥148.33 on strong volume would signal an upside continuation. Traders could go long on a clear breakout above this resistance, with a stop-loss tucked below ¥147.70, targeting a rally to ¥148.80, then ¥149.30. This play waits for confirmation of bullish momentum before entry.

- Bearish: If USD/JPY fails to penetrate the ¥148 zone or spikes toward ¥147.70 and stalls, a fade trade is attractive. Consider shorting into strength around ¥147.70, with a stop placed above ¥148.10 (just beyond recent highs), aiming for a pullback to ¥146.30 as a primary target. Initial support comes in at ¥147.30 and ¥146.70, so partial profits could be taken near those levels. This counter-trend setup anticipates a slide back into the range if bullish attempts falter.

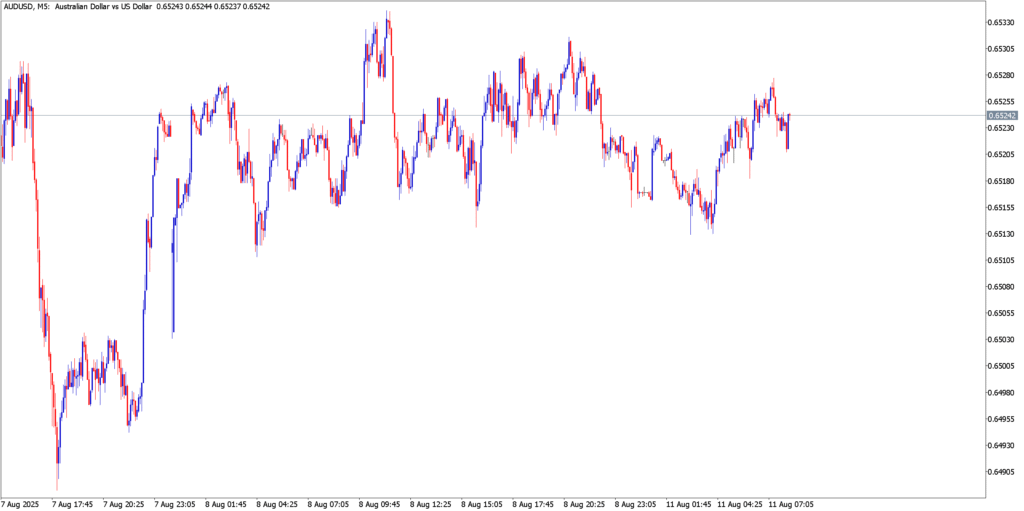

AUD/USD

Technicals in Focus

AUD/USD has been whipsawing within a 0.6490–0.6540 range in recent sessions, reflecting uncertainty after the RBA’s surprise move. The pair bounced from the ¥0.649 area (key support) and is now hovering around $0.6525. The immediate pivot is $0.6500 – price action above this level tilts bias modestly upward, while a breach below would signal renewed weakness. Technical indicators paint a neutral picture. The RSI is around 50, indicating flat momentum. MACD on the M5 timeframe is lackluster, straddling the signal line without clear direction, and Stochastic readings have recovered from oversold territory but are not yet overbought. With trend strength muted (ADX low around 15), AUD/USD appears to be in consolidation mode – awaiting a catalyst to break its coil. Upside progress is capped by minor resistance at $0.6530/40, whereas support at $0.6490 and $0.6470 must hold to prevent a deeper slide.

Trading Strategy

The backdrop of an accommodative RBA and looming data means AUD/USD could move sharply on news. Potential approaches are:

- Bullish: If the pair stabilizes above the $0.6500 pivot and risk sentiment improves, a long position on dips is viable. For instance, buying around the $0.6500–0.6480 support zone (near the 50-EMA) with a stop-loss under $0.6470 (below last week’s low). Targets would be $0.6540 (recent range top), then $0.6580 if momentum carries – roughly the area of early-week highs. This strategy banks on the idea that the Aussie’s pullback is overdone and a relief bounce could follow, especially if U.S. dollar softness resumes.

- Bearish: Conversely, with the prevailing downtrend still intact on higher timeframes, rallies may be sold. A plan is to use a sell limit order near $0.6510 (the key resistance from recent highs). A stop at $0.6530 limits risk (just above the range), while downside targets lie at $0.6430 and $0.6410 – the next support zone from last month. This setup anticipates that any bounce will be short-lived, given Australia’s dovish tilt and China growth concerns, thus positioning for a continuation lower.

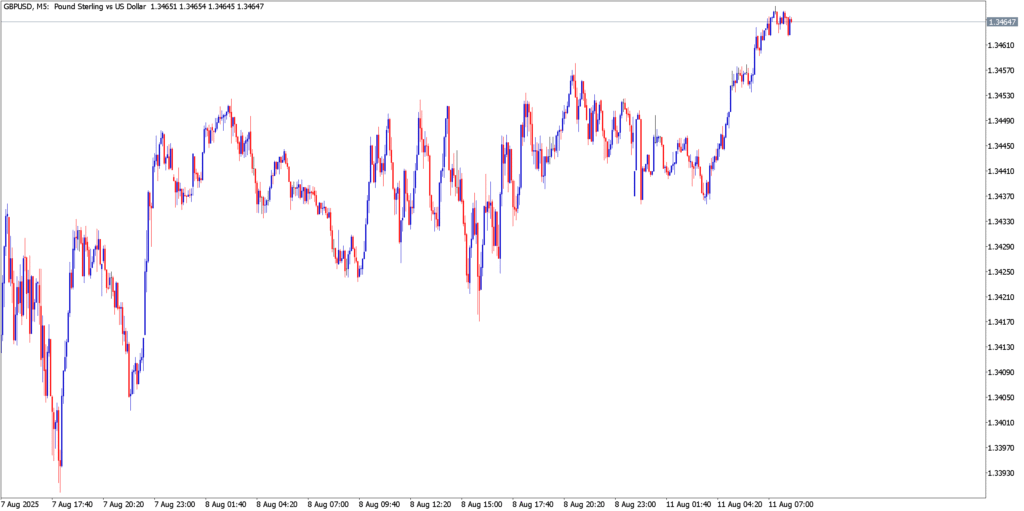

GBP/USD

Technicals in Focus

GBP/USD remains in an uptrend on intraday charts, but is testing a critical ceiling. The pound has rallied into the mid-1.34s, holding near three-day highs around $1.3460. This level around $1.3460–1.3470 is a notable resistance, which coincides with last week’s peak. The recent upswing has been underpinned by a series of higher lows — and the 50-period SMA now rising through ~1.3340 provides support on dips. However, momentum indicators show signs of overextension. The RSI on the M5 chart is nearing 70, hovering just below the overbought threshold. Similarly, stochastic oscillators are likely in high territory, reflecting the sharp run-up. MACD momentum is positive but appears to be flattening out, suggesting bull momentum may be stalling. Candlesticks are also getting smaller at the top of the range, hinting at possible exhaustion. In summary, the bullish trend is intact but at risk of a pullback if buyers cannot punch through the 1.3460s barrier.

Trading Strategy

With GBP/USD at an inflection point, the game plan can go two ways depending on the breakout vs. rejection at resistance:

- Bullish: A clear break above $1.3462 would confirm the pound’s strength. Traders can look to buy a decisive rally through this resistance (preferably on a closing basis or with strong volume). The initial target would be $1.3515, followed by $1.3585 – extensions from recent Fibonacci and price swing projections. A tight stop-loss below $1.3400 (e.g. under $1.3402) contains risk in case of a false breakout. If momentum is robust, this trade rides the bullish continuation to new highs, capitalizing on any U.S. dollar weakness or hawkish-BoE surprises.

- Bearish: If the 1.3460s level holds firm and produces a reversal signal (e.g. a failure swing or bearish candlestick pattern), a downside reaction is likely. A short position is attractive on a rejection at resistance. Entry could be around the current levels (1.3440–1.3460), with a stop just above $1.3480 to guard against a fake-out spike. Profit targets would focus on a pullback toward $1.3345 (first support) and $1.3280. These correspond to the 50-period SMA and the last significant swing low, respectively. Given the pound’s recent run, even a healthy correction could revisit those supports without altering the broader uptrend. Bearish traders are thus aiming to capture a short-term dip within the range.

Market Outlook

As forex markets navigate these technical levels, the focus shifts to a high-impact economic calendar in the days ahead. Several key events are likely to drive USD, JPY, GBP, and AUD volatility:

- United States (USD): Inflation and consumers take center stage. On Tuesday, U.S. CPI (July) is due, and any surprise in core inflation will sway Fed expectations. Markets are pricing in that the Fed’s hiking campaign is over, with even a 25 bp rate cut by September now anticipated by some. A hotter-than-expected CPI print, however, could challenge that dovish view and give the dollar a boost. Later in the week, attention turns to U.S. Retail Sales (Fri) – a barometer of consumer health. Forecasts point to modest spending growth in July, so any deviation could spark outsized USD moves. Soft retail figures (alongside last week’s slump in the NY Empire Fed index) would reinforce slowdown fears, whereas upside surprises might revive confidence in the U.S. economy’s resilience. Also, on tap are Fed speakers and the University of Michigan consumer sentiment survey (Fri), which will be parsed for inflation expectations. In sum, the dollar’s near-term direction hinges on whether incoming data reinforces the “peak inflation, cooling growth” narrative or upends it.

- Japan (JPY): With Tokyo markets reopening after Monday’s holiday, traders will digest Japan’s Q2 GDP numbers. The preliminary GDP (due mid-week) is expected to show that Japan returned to growth in Q2, narrowly avoiding a technical recession. Indeed, consensus sees a mere ~0.1% QoQ expansion, but any upside surprise here (e.g. a stronger annualized figure) could fuel speculation of the BoJ tightening down the line. The yen would likely firm up on signs the economy is running hotter – especially as inflation in Japan has crept above 2% recently, putting pressure on the BoJ. Apart from GDP, Japan’s calendar features June industrial production (final) and trade data, but these are secondary. The main driver for JPY will be global risk sentiment and yields. If U.S. data push Treasury yields lower (on Fed cut bets), USD/JPY could see renewed downward pressure, whereas a risk-on mood could weaken the yen. Overall, the bias for yen in the coming days leans bullish-neutral, given potential supportive news on the domestic front and its status as a safe haven if market jitters persist.

- United Kingdom (GBP): The pound faces a slew of domestic data that will shape Bank of England expectations. On Tuesday, the UK’s June jobs report is released, with focus on wage growth and the unemployment rate. Pay growth has been robust (near 5% YoY recently) – too hot for the BoE’s liking – so sterling could find support if wages surprise on the upside again, reinforcing inflationary pressures. Conversely, any softening in pay or a tick up in joblessness may ease the urgency for further BoE hikes. Then on Thursday comes the first estimate of Q2 GDP. Britain’s economy likely grew only marginally (the previous quarter was +0.1% QoQ), so the question is whether Q2 stagnated or managed a small expansion. A downside miss (zero or negative growth) would revive recession worries and could hurt GBP sentiment, while a better-than-expected GDP would suggest the UK is weathering the storm of high rates. Alongside GDP, watch UK June industrial output and trade figures on Thursday for a fuller picture. The BoE has struck a cautious tone about over-tightening, so this week’s data will be pivotal – sterling traders will recalibrate rate expectations with each release. Given the pound’s recent strength, it may take significant positive surprises to extend the rally, whereas any disappointment could trigger a deeper pullback from the highs.

- Australia (AUD): The Aussie enters a critical week digesting the RBA’s latest move and awaiting important data. Early Tuesday in Sydney, the RBA policy decision will set the tone – the market overwhelmingly expects a 25 bp rate cut to 3.60% as growth and inflation cool. If the RBA delivers the cut (or even hints at more to come), AUD could stay under pressure, barring a dovish move already fully priced in. However, any surprise hold or hawkish rhetoric would catch traders off guard and likely spark a sharp short-covering rally in AUD pairs. Just a day after the RBA, Australia’s July employment report (Wed) will test the currency’s mettle. Last month saw job gains cool and unemployment tick up to 4.3%. Should the new data show a strong jobs rebound – for instance, well above +20K employment change or unemployment back near 4% – it might alleviate some recession fears and give the Aussie a lift. On the other hand, a weak labor report would reinforce the RBA’s dovish stance and could send AUD/USD through support. Outside of domestic factors, Australia’s fortunes are tied to China’s outlook; any headlines about Chinese stimulus or lockdowns can sway the Aussie. Net-net, AUD traders are on high alert: with monetary policy shifting and high-impact data in play, volatility is expected. Caution is warranted as the currency could swing sharply on each new development.

Diverging central bank trajectories and fresh economic data will keep forex markets on their toes this week. Traders should stay nimble and focused on the key inflection points highlighted above. With inflation proving sticky yet growth showing pockets of weakness, the FX landscape is one of potential quick reversals. Expect the USD/JPY, AUD/USD, and GBP/USD pairs (along with others) to take cues from the event risks ahead – offering both opportunities and hazards. In such an environment, it’s all about carefully aligning trades with the prevailing fundamental drivers and managing risk, as the market narrative can shift in an instant. Stay tuned for a dynamic week in FX.