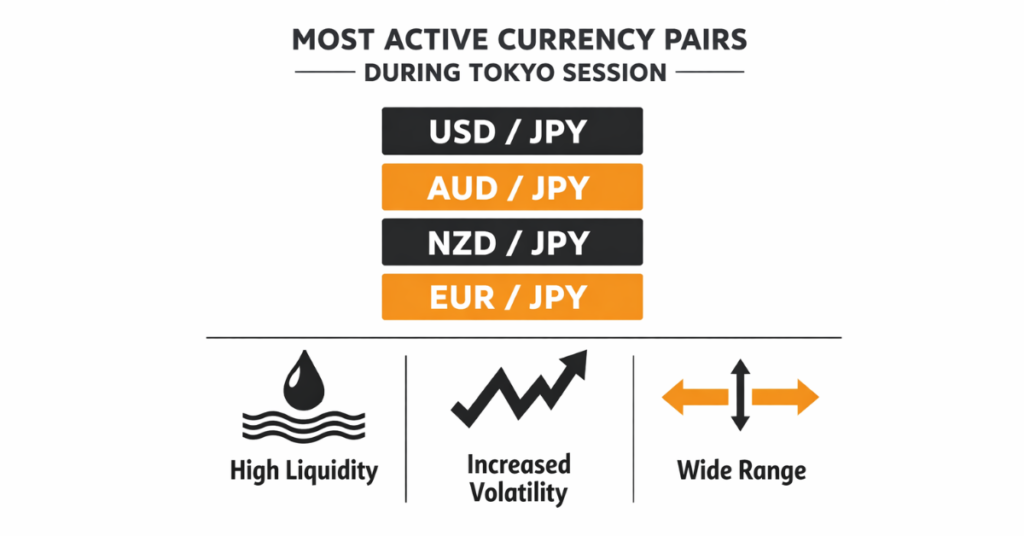

The best currency pairs to trade during the Tokyo session are JPY-based pairs like USD/JPY, AUD/JPY, NZD/JPY, and EUR/JPY. These pairs show the most consistent liquidity and stable price action during Asian hours, making them suitable for low-volatility, range-focused trading strategies.

Key Takeaways

- The Tokyo session is best suited for JPY-based currency pairs due to higher regional liquidity and consistent participation from Asian markets.

- USD/JPY, AUD/JPY, NZD/JPY, and EUR/JPY tend to offer smoother price action, tighter spreads, and more predictable movements during Asian trading hours.

- Volatility is generally lower compared to London and New York, which makes the Tokyo session ideal for range trading and disciplined risk management.

- Choosing the right broker and trading conditions is critical, as execution speed and spreads play a bigger role when price movements are smaller.

What Is the Tokyo Forex Session and Why It Matters

The Tokyo forex session is one of the three major global trading sessions and marks the start of Asian market trading. Liquidity mainly comes from Japan, Australia, New Zealand, and other Asia-Pacific economies. Because Tokyo is a major financial center, this session is especially important for JPY currency pairs.

Why the Tokyo Session Matters

The Tokyo session has a different trading style compared to London and New York:

- Lower volatility in most pairs

- More range-bound price action

- Cleaner technical levels (support/resistance often holds better)

- Fewer aggressive breakouts

This makes it suitable for traders who prefer structured setups instead of fast momentum moves.

Key Drivers During Tokyo Hours

Price action in this session is mainly influenced by:

- Bank of Japan (BoJ) policy signals and comments

- Japan economic releases (inflation, GDP, employment, etc.)

- Regional sentiment from Asia-Pacific markets

- Institutional flow early in the trading day

Best Use for Traders

The Tokyo session works best if your goal is:

- JPY-focused setups (e.g., USD/JPY, EUR/JPY, GBP/JPY)

- Consistent, controlled trading conditions

- Range strategies and technical trading

Tokyo Session Trading Hours (With Global Time Conversions)

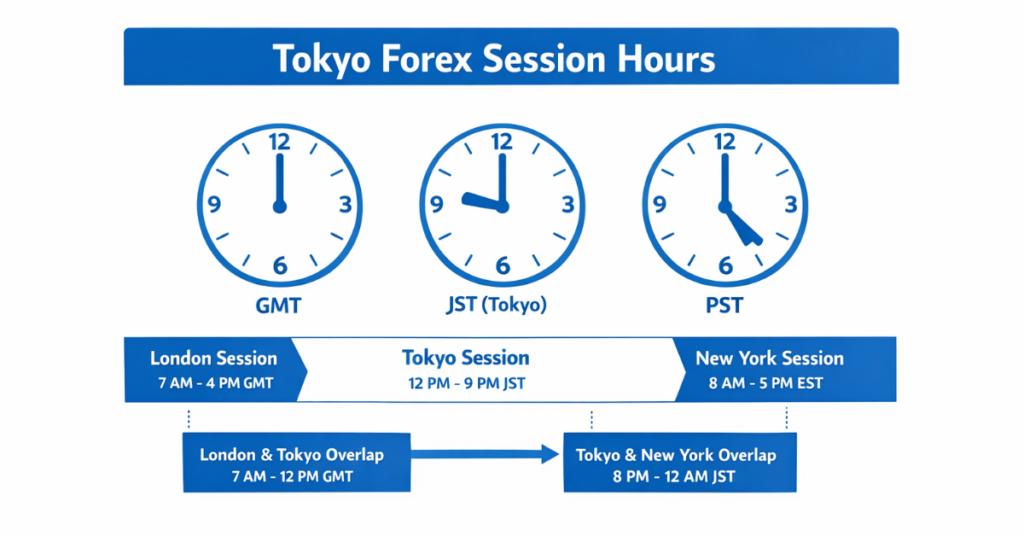

The Tokyo forex session runs from 00:00 to 09:00 GMT, marking the start of the Asian trading day. Liquidity mainly comes from Japan and nearby Asia-Pacific markets, which is why JPY pairs tend to be more active and generally more stable than many other pairs during these hours.

Tokyo Session Time Conversions

To trade this session correctly, you need to match it to your local time:

- GMT: 00:00 – 09:00

- Pakistan Standard Time (PKT): 05:00 – 14:00

- Japan Standard Time (JST): 09:00 – 18:00

- U.S. Eastern Time (ET): 20:00 – 05:00

This schedule suits traders in Asia and Australia, and also U.S.-based traders who prefer overnight trading.

Liquidity and Activity During the Session

Liquidity is usually strongest in the early to mid-Tokyo hours, when Japanese banks and institutions are most active. Activity may slow later in the session until the Tokyo–London overlap, where volatility often starts to increase.

Understanding these timing shifts helps traders focus on the pairs that actually move during Tokyo hours, rather than trading when the market is inactive.

Why JPY-Based Pairs Dominate the Tokyo Session

JPY-based currency pairs dominate the Tokyo session because the Japanese Yen is the most traded currency in Asia, and Tokyo is one of the region’s main financial centers. During these hours, Japanese banks, corporations, and institutions execute large volumes, which creates strong and steady liquidity in Yen pairs.

That liquidity usually leads to:

- Tighter spreads

- Smoother price movement

- Cleaner technical behavior (support/resistance levels often hold better)

This makes the Tokyo session a good fit for traders who prefer controlled conditions over high volatility.

Most Active JPY Pairs in Tokyo

The highest activity typically comes from pairs such as:

- USD/JPY

- AUD/JPY

- NZD/JPY

- EUR/JPY

These pairs combine the Yen with highly traded currencies, offering a balance of liquidity + tradable movement.

What Moves These Pairs During Tokyo Hours

JPY pairs can react strongly to Japan-related catalysts, including:

- Bank of Japan rate decisions and guidance

- Inflation, trade, and GDP releases

- Risk sentiment across Asia-Pacific markets

These events can drive intraday direction and create short-term trading opportunities.

Why Non-JPY Pairs Often Underperform in Tokyo

Trading non-JPY pairs during Tokyo hours is often less efficient because volume is lower in currencies like GBP or CAD. That can lead to:

- Wider spreads

- Slower price movement

- Less reliable setups

- Higher slippage risk

For traders using range-based or technical strategies, sticking to JPY pairs matches the session’s natural market flow and improves execution quality.

Best Currency Pairs to Trade During the Tokyo Session

During the Tokyo session, traders should focus on JPY-based and select Asia-Pacific pairs that exhibit consistent liquidity and controlled volatility. The top pairs include:

- USD/JPY: The most actively traded pair during the Tokyo session, offering stable price movements and tighter spreads. It’s ideal for range trading and technical setups.

- AUD/JPY: Combines the Australian Dollar with the Yen, reflecting commodity market sentiment and regional economic flows. Offers moderate volatility and predictable intraday swings.

- NZD/JPY: Similar to AUD/JPY, this pair provides opportunities during Asian hours, influenced by New Zealand economic data and commodity exports.

- EUR/JPY: Less active than USD/JPY but still tradable during Tokyo hours, especially during early European overlap. Good for traders who prefer slightly wider movement.

- AUD/USD & NZD/USD: While not Yen pairs, these currencies remain somewhat active due to their proximity to the Asian markets, though spreads can be higher.

Trading Tip: Focus on pairs with high liquidity during Tokyo hours and avoid European or U.S.-centric pairs like GBP/USD or USD/CAD, as they experience minimal movement until London and New York sessions start.

Market Behavior of Tokyo Session Forex Pairs

Currency pairs during the Tokyo session typically exhibit lower volatility and range-bound movements compared to the London and New York sessions. This is because Asian markets, while liquid, have fewer participants than European or U.S. markets, which leads to smoother price action and predictable intraday patterns.

4 Key characteristics of Tokyo session pairs:

- Tighter ranges: Most JPY pairs fluctuate within defined intraday levels, making them suitable for range trading strategies.

- Lower volatility spikes: Sudden price swings are less frequent unless there’s a significant Japanese economic release.

- Liquidity peaks early: The first few hours after Tokyo market opens see the most trading activity, gradually slowing as the session progresses.

- Influence of regional news: Japan, Australia, and New Zealand economic data often create short-term directional moves in JPY, AUD, and NZD pairs.

For those using brokers like Defcofx, the low spreads from 0.3 pips and fast execution complement Tokyo session trading, helping traders maximize small intraday moves efficiently.

Open a Live Trading AccountBest Trading Strategies for the Tokyo Session (With Examples)

The Tokyo session is known for lower volatility, range-bound price action, and steady liquidity (especially in JPY pairs). Unlike London or New York, big breakout runs are less common. That means Tokyo trading works best with strategies that target smaller, repeatable moves instead of chasing large trends.

Below are the most effective strategies for Tokyo hours, including simple examples so you can apply them.

1) Range Trading (Most Reliable in Tokyo)

During Tokyo hours, many JPY pairs trade inside clear intraday ranges. This makes support and resistance trading one of the most consistent strategies.

How it works: You identify the session range, then trade the bounce from key levels.

Example: USD/JPY trades between 148.20 (support) and 148.55 (resistance) for 2–3 hours.

A range trader can:

- Buy near 148.20 with a stop below the range

- Take profit near 148.45–148.55

Add-on (to improve accuracy): Use a 15-minute chart and only take trades when price shows confirmation (e.g., rejection wick or double bottom/top) at the range edge.

2) Scalping Small Moves (Best for Tight Spreads)

Tokyo session spreads on JPY pairs are often tight, which makes it suitable for short scalps targeting small price swings.

How it works: You take quick trades on minor pullbacks or micro-breaks and aim for small targets.

Example: AUD/JPY breaks above a short-term level at 96.40, then retests it.

A scalper can:

- Enter after the retest holds

- Target +8 to +15 pips

- Exit quickly instead of holding for a trend

Add-on (risk control rule): Keep scalping simple:

Risk 5–7 pips to target 8–15 pips, and avoid trades when spreads widen.

3) Breakout Trades During Session Overlaps (Tokyo–London)

Tokyo by itself is usually range-based, but volatility can increase during overlaps—especially when London starts opening. That’s when small breakout opportunities appear.

How it works: You wait for the market to build a tight range, then trade the breakout when volume increases.

Example: EUR/JPY consolidates in a narrow box between 161.10–161.25.

When London begins, price breaks above 161.25 with momentum.

A breakout trader can:

- enter on the break (or first retest)

- target the next resistance zone (e.g., 161.55–161.70)

Add-on (avoid fakeouts): Only take breakouts when there is:

- a clean candle close beyond the range

- and price is breaking into “open space” (no nearby resistance)

4) News-Based Intraday Trading (Japan + Asia-Pacific Releases)

Tokyo session can become volatile for short periods during major releases from Japan, Australia, or New Zealand.

How it works: You trade the post-news reaction after direction becomes clear (instead of guessing before news).

Example: BoJ-related news causes USD/JPY to spike 30–50 pips.

Instead of entering immediately, a trader waits for:

- the first spike to complete

- a pullback into a key level

- then enters in the direction of the confirmed move

Add-on (safe execution tip): Avoid placing market orders during the first seconds of the release.

Instead, wait 2–5 minutes for spreads to normalize and structure to form.

Quick Recommendation (Best Setup for Most Traders)

If you’re new to Tokyo trading, start with this approach:

Range Trading on USD/JPY or AUD/JPY because it matches Tokyo’s natural behavior and reduces unnecessary volatility risk.

Spread, Cost, and Execution Considerations During Tokyo Session

When trading during the Tokyo session, trading costs and execution speed become critical because price movements are smaller and tighter ranges dominate. Even minor spreads or delays can significantly impact profitability, making it essential to choose pairs and brokers that offer low-cost execution.

Key points to consider:

- Tight Spreads:

- JPY-based pairs like USD/JPY, AUD/JPY, and NZD/JPY typically offer the tightest spreads during Tokyo hours, often starting from 0.3 pips.

- Brokers like Defcofx enhance trading efficiency with zero commissions or swap fees, ensuring that traders keep more of their profits even on small intraday moves.

- Execution Speed:

- Fast order execution is crucial in range-bound sessions where small price differences matter.

- Delayed execution can result in missed entries or slippage, especially for scalpers capturing minor price changes.

- Liquidity Considerations:

- Liquidity is strongest in the early Tokyo hours, particularly for USD/JPY, AUD/JPY, and NZD/JPY.

- Trading pairs with low liquidity can lead to wider spreads and unpredictable price jumps.

- Broker Reliability:

- A broker that offers fast support and withdrawals, like Defcofx, adds an extra layer of confidence for traders executing multiple trades during the session.

Risk Management Tips for Trading the Tokyo Session

Even though the Tokyo session usually has lower volatility than London or New York, risk management still matters. Since price moves are often smaller, mistakes like oversizing or using high leverage can wipe out gains quickly.

1) Use Smart Position Sizing (Don’t Oversize)

Tokyo session ranges are often tighter, so traders sometimes increase lot size to “make it worth it.” That’s risky.

Best practice:: Size trades so a stop-loss hit only costs 1–2% of your account.

Example: If your stop-loss is 15 pips, your lot size should be small enough that losing 15 pips does not exceed your risk limit.

Add-on (important leverage note): Avoid over-leveraging even if your broker offers very high leverage (e.g., up to 1:2000). High leverage increases both upside and downside, and Tokyo session moves can still spike unexpectedly.

2) Place Stop-Loss and Take-Profit Around the Range

Tokyo pairs often respect support/resistance levels, so stops and targets should match that structure.

Best practice:

- Stop-loss: just outside support/resistance

- Take-profit: near the opposite side of the range

Example: USD/JPY range:

- Support: 148.20

- Resistance: 148.55

A range buy near support could use:

- SL: 148.10 (outside the range)

- TP: 148.45–148.55 (near resistance)

Add-on (avoid “tight stops”): Don’t place stops directly on the level, Tokyo pairs often wick the level before reversing.

3) Avoid Low-Liquidity Pairs During Tokyo Hours

Not all currency pairs trade well during Tokyo. Some pairs become slow, spread-heavy, or inconsistent.

Best practice: Focus on high-liquidity pairs during Tokyo hours, such as:

- USD/JPY

- AUD/JPY

- NZD/JPY

Example: Trading GBP/CAD during Tokyo often results in:

- Wider spreads

- Slow movement

- Random spikes due to low volume

Add-on (simple rule): If spreads widen or price moves in choppy 1–2 pip jumps, skip the pair.

4) Watch Economic News (Tokyo Can Spike Fast)

Tokyo session is calm most of the time, but news from:

- Japan

- Australia

- New Zealand

can trigger sudden volatility.

Best practice:

- Check the calendar before trading

- Avoid entering right before high-impact news

- Reduce exposure if already in a trade

Example: If an AUD news release is scheduled in 10 minutes and you’re trading AUD/JPY, consider:

- Closing early

- Tightening risk

- Reducing position size

Add-on (slippage protection): Avoid market orders during the first minutes after major releases. Spreads can widen and stops may slip.

Who Should Trade the Tokyo Session

The Tokyo session is particularly suited for traders who prefer lower volatility, predictable price action, and disciplined trading strategies. While it may not offer the large swings seen in London or New York, its structured environment provides opportunities for steady gains.

Ideal traders for this session include:

- Beginners and Intermediate Traders:

- Lower volatility makes it easier to identify clear support and resistance levels.

- Range-bound conditions reduce the risk of large, unpredictable losses.

- Part-Time Traders in Asia-Pacific Time Zones:

- Traders in Japan, Australia, and surrounding regions can trade during normal daytime hours.

- Active liquidity for JPY, AUD, and NZD pairs ensures smoother execution.

- Scalpers and Range Traders:

- The session’s predictable movements allow scalpers to capture small intraday gains.

- Range trading strategies thrive in the tight channels of USD/JPY, AUD/JPY, and NZD/JPY.

- Traders Using Cost-Efficient Brokers:

- Platforms offering low spreads, no commissions, and fast execution, like Defcofx, enhance profitability during this session.

- Quick withdrawals and 24/7 support allow traders to manage positions effectively.

5 Common Mistakes Traders Make During the Tokyo Session

Many traders lose money in the Tokyo session for the same reasons: they trade the wrong pairs, use the wrong expectations, or apply strategies that don’t match Tokyo’s market behavior.

1) Trading the Wrong Currency Pairs

A common mistake is trading pairs that are inactive during Tokyo hours. Pairs like GBP/USD or USD/CAD often show limited movement in this session, which can lead to wider spreads, slower execution, and low-quality setups.

Better approach: Focus on JPY-based pairs where liquidity is strongest.

2) Expecting London/New York Volatility

Tokyo is naturally lower volatility. Traders who force breakout-style setups the way they would in London or New York often end up taking weak signals and getting stopped out repeatedly.

Better approach: Use strategies built for Tokyo conditions (range setups, small scalps, controlled breakouts).

3) Ignoring Session Overlaps

Some traders treat Tokyo hours as “flat” from start to finish and ignore overlaps. However, the Tokyo–London transition can increase liquidity and create short trend moves.

Better approach: Be selective, save breakout attempts for overlap periods where volume supports them.

4) Over-Leveraging (Especially With High-Leverage Brokers)

Over-leveraging is a major risk, especially when brokers offer very high leverage (e.g., up to 1:2000). Tokyo’s smaller price moves can tempt traders to oversize positions, which makes even small reversals dangerous.

Better approach: Keep leverage controlled and size positions based on stop-loss distance, not “how quiet the session feels.”

5) Trading Without Watching Regional News

Ignoring economic releases from Japan, Australia, or New Zealand can lead to sudden spikes that stop traders out or cause slippage, especially on JPY pairs.

Better approach: Check the calendar before trading and reduce risk before high-impact announcements.

Why Defcofx Is Suitable for Trading the Tokyo Session

While the Tokyo session has lower volatility, trading efficiency and execution speed are crucial to capitalize on its range-bound movements.

Defcofx is particularly suitable for this session because it provides low spreads starting from 0.3 pips, no commissions or swap fees, and fast order execution, which ensures that small intraday moves can be effectively captured.

Defcofx platform also supports high leverage options up to 1:2000, allowing experienced traders to adjust their exposure according to their risk appetite. Additionally, Defcofx offers fast support and withdrawals within 4 business hours, including weekends, which helps traders manage positions and access profits quickly. Its global reach and multi-language support make the platform accessible to traders worldwide, aligning with the international nature of Tokyo session trading.

By combining cost-efficient trading conditions, high execution speed, and reliable support, Defcofx allows traders to maximize opportunities during the Tokyo session without compromising safety or operational efficiency. This makes it an ideal choice for both range traders and scalpers focusing on JPY-based pairs.

Open a Live Trading AccountFinal Thoughts on Choosing the Best Forex Pairs for the Tokyo Session

The Tokyo session is best approached with discipline, strategy, and a focus on liquidity. JPY-based pairs such as USD/JPY, AUD/JPY, NZD/JPY, and EUR/JPY consistently offer the tightest spreads, predictable price ranges, and smoother execution, making them ideal for traders seeking controlled intraday opportunities.

Understanding the session’s market behavior, timing, and regional economic influences is essential. Traders should prioritize active pairs, monitor relevant news releases, and avoid over-leveraging despite the availability of high leverage options up to 1:2000. Range trading, scalping, and selective breakout strategies during session overlaps are particularly effective approaches.

Choosing the right broker can significantly impact performance during this session. Platforms like Defcofx provide low spreads starting from 0.3 pips, zero commissions or swap fees, fast execution, and reliable support, helping traders maximize profits while minimizing operational risks.

FAQs

The Tokyo session runs from 00:00 to 09:00 GMT, which is 05:00 to 14:00 Pakistan Standard Time and 09:00 to 18:00 Japan Standard Time. Liquidity is highest during the early hours, especially for JPY-based currency pairs.

The most active and tradable pairs are USD/JPY, AUD/JPY, NZD/JPY, and EUR/JPY. These pairs have consistent liquidity, tighter spreads, and smoother price movements during Asian trading hours. Some traders also monitor AUD/USD and NZD/USD, though they are less active.

The Japanese Yen is heavily traded in Asia, and Tokyo is a major financial hub. High institutional activity, central bank operations, and corporate transactions increase liquidity for JPY pairs, resulting in tighter spreads and predictable price action.

Range trading and scalping are most effective due to the session’s lower volatility. Selective breakout trades during session overlaps (Tokyo–London) and news-based intraday trades can also be profitable. Risk management with proper stop-losses is crucial.

Yes, the Tokyo session is ideal for beginners because of its lower volatility and predictable ranges. Traders can clearly identify support and resistance levels and practice disciplined trading strategies without facing large, erratic price swings.