Forex markets are being whipsawed by a mix of trade-war tensions, shifting central bank outlooks, and volatile commodities. Safe-haven flows are buoying the Japanese yen amid global uncertainty, while Federal Reserve rate-cut bets have put the U.S. dollar on the defensive to the benefit of the British pound. At the same time, slumping oil prices earlier in the week knocked the Canadian dollar lower, though USD weakness is now helping the loonie recover. Below is a detailed technical and news analysis for USD/JPY, GBP/USD, and USD/CAD as of Thursday, 07 August 2025, including key levels, intraday trade ideas, and the macro forces at play.

USD/JPY

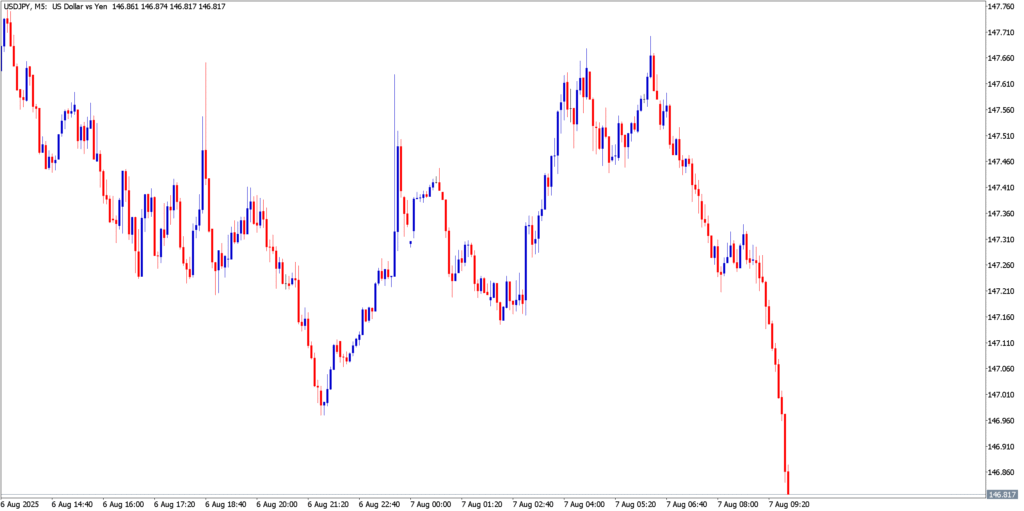

The USD/JPY pair is trading around ¥146.8 in the wake of a sharp pullback from its 150+ highs seen last week. The yen’s strength has been fueled by a surge in safe-haven demand as traders seek shelter from escalating trade-war tensions and global growth fears. U.S. dollar sentiment has also soured on expectations that the Fed may cut interest rates soon – a view reinforced by a disappointing U.S. jobs report and soft ISM data, which have markets pricing in a possible Fed rate cut by September. This cocktail of tariff drama and Fed dovishness has put the dollar on the back foot and given yen bulls the upper hand.

The pair extends its slide, posting lower highs and lower lows as risk-off sentiment boosts the yen. Recent candlesticks show long upper wicks near ¥147.4, indicating strong selling pressure on intraday bounces. Momentum is trending bearish – the breakdown below the 50-period moving average and a breached trendline has intensified negative pressure. The 146.70 area (yesterday’s low) is immediate support, a level that held during the post-NFP tumble on Tuesday. A decisive break beneath ¥146.7 could open the door to the next support around ¥145.70 (a support zone identified on intraday charts). On the upside, any rebounds are likely to confront resistance at ¥147.50–¥147.70, a region of prior highs that also coincides with the 50-period EMA and the underside of the broken trendline, making it a key barrier for now.

Intraday Trade Idea

Consider a sell on rallies. For example, if USD/JPY bounces toward ¥147.30, traders might enter short around that resistance zone, with a stop loss above ¥147.70 and a target near ¥146.50. This risk-reward favors the prevailing downtrend, anticipating another roll over from resistance. Alternatively, a break below ¥146.70 could signal momentum for a quick short trade targeting the mid-146s, but caution is warranted in case of a false break.

News & Outlook

Political headlines are dominating USD/JPY’s moves. Reports of new U.S. tariffs on dozens of countries – part of President Trump’s “reciprocal” trade measures taking effect today – have rattled markets and driven safe-haven yen buying. (Notably, the White House’s latest tariffs include levies up to 40% on various nations’ goods, underscoring the trade-war escalation.) If trade tensions continue to fester, risk sentiment may stay fragile, keeping USD/JPY under downward pressure. Additionally, traders are alert to any Japanese officials’ comments as yen strength accelerates – after last year’s interventions, a approach of ¥150.0 could prompt jawboning or action from Tokyo. On the U.S. side, a batch of weekly jobless claims data is due later (1:30 pm BST), and a higher-than-expected number could further support the case for Fed easing, potentially weakening USD and aiding the yen. Overall, the bias for USD/JPY remains cautiously bearish. Unless we see a sharp improvement in risk appetite or a hawkish tilt from the Fed, rallies are likely to be sold. A sustained break below the mid-146s would expose the ¥145 handle, whereas relief rallies would need to reclaim ¥148+ to ease the current downtrend.

GBP/USD

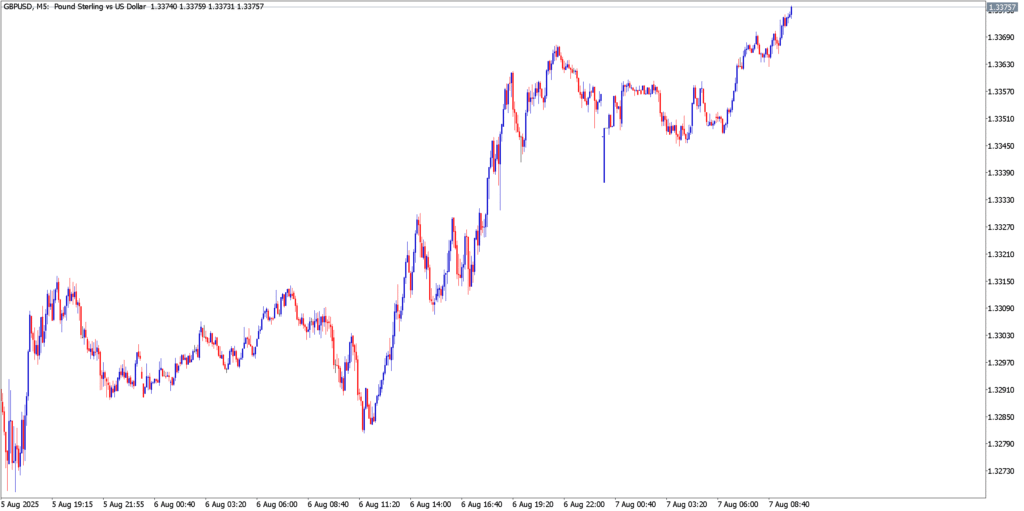

GBP/USD is hovering in the mid-$1.33s, having rebounded off weekly lows ahead of a critical Bank of England policy announcement. The pound has benefited from broad USD softness this week – fueled by growing speculation of Fed rate cuts – which has helped cable recover from the $1.3250 area to above $1.3370. However, Sterling’s upside is being capped by caution as traders brace for the BoE’s interest rate decision at noon. With the UK economy showing signs of strain, markets widely expect the BoE to cut rates by 25 bps from 4.25% to 4.00% today. This rate cut is largely priced in, so the pound’s next move will hinge on the tone of the Bank’s communication – any unexpectedly dovish signals about further easing could quickly undermine the currency.

The pair maintains an intraday uptrend, marked by higher lows and a series of bullish candles since yesterday. Price action shows GBP/USD climbing above $1.3350 (a level that acted as pivot resistance earlier in the week), and that level now turns into near-term support. The $1.3380–1.3400 zone is the next hurdle – this morning’s high around $1.3375 is testing that region. Notably, momentum indicators are flashing caution: on the M5 chart, RSI has reached overbought territory, and a slight negative divergence is forming as price makes marginal new highs. This suggests bullish momentum may be stalling ahead of the BoE event. Key technical levels to watch include support at $1.3330, which aligns with the 50-period moving average and a minor trendline. A drop back below $1.3330 would indicate a loss of upside momentum. On the topside, $1.3400 is a psychological resistance; a clear break above it would mark a one-week high for cable and could invite additional buying, targeting the next resistance around $1.3450.

Intraday Trade Ideas

Given the event risk, traders may consider two scenarios:

- Bullish: If the BoE delivers a cut but with a less dovish outlook (or a split vote showing some members opposed to cuts), GBP/USD could break convincingly above $1.3380. A long entry on a breakout, with a stop loss under $1.3340 and an initial target around $1.3450, would play a short-term continuation of the upmove.

- Bearish: Conversely, a dovish surprise (e.g. hints of further cuts or a larger cut) might send GBP/USD tumbling. A short position could be considered on a break below $1.3300 support, aiming for a move to the $1.3220 area, with a stop loss around $1.3350. This would capitalize on a momentum reversal if Sterling slides on the BoE news.

News & Outlook

The Bank of England’s policy meeting is front and center for GBP traders. The consensus is for a 0.25% rate cut, but focus will be on the vote split, forward guidance, and the BoE’s updated forecasts. If the vote reveals a few members voted for a deeper cut, or Governor Bailey strikes a very cautious tone on growth, it would signal further easing ahead – a scenario likely to weigh on the pound. On the other hand, if the BoE emphasizes still-elevated inflation (UK CPI was ~3.6% in June) and frames today’s cut as a “one-and-done” for now, the pound could find support. Aside from the BoE, domestic headlines about the UK’s fiscal outlook have been a background drag: the NIESR warned that the Treasury may need to hike taxes this autumn to plug a budget shortfall. Talk of higher taxes and fragile growth is undermining confidence, underscoring that the UK’s challenges extend beyond just monetary policy. In the U.S., any surprise in the weekly jobless claims this afternoon could briefly sway GBP/USD via dollar moves, but a larger catalyst will be Fed speak and yields post-BoE. In summary, GBP/USD’s near-term fate hinges on the BoE. A balanced or hawkish-leaning cut could help the pound extend its rebound, whereas a decidedly dovish message might see Sterling give back its recent gains. Expect volatility around the announcement – managing risk is paramount.

USD/CAD

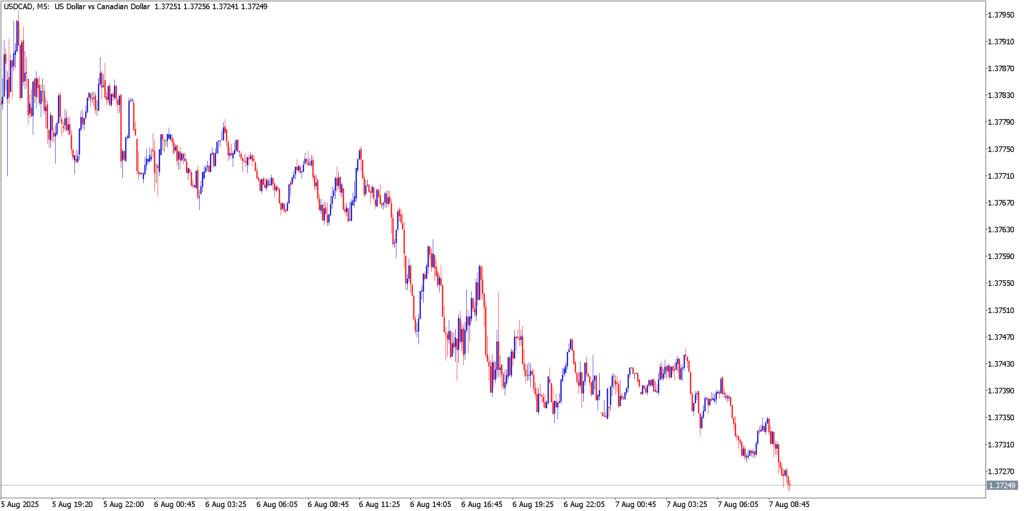

USD/CAD has slipped to the C$1.3725 area, with the Canadian dollar showing resilience after recovering from an oil-induced selloff. Earlier in the week, an oil price plunge (as OPEC+ boosted output supply) sent the loonie tumbling and lifted USD/CAD to test highs near 1.3800. Now, however, a softer U.S. dollar and a mild bounce in crude have combined to pull the pair back down. The Canadian currency is finding support from the broad risk-on tilt that has crept into markets mid-week (improved sentiment has helped commodity currencies), as well as positioning ahead of key North American data. With no major Canadian data out today, USD/CAD traders are watching oil price gyrations and upcoming U.S. labor figures for direction.

The pair has rolled over from the C$1.3790 region and is grinding lower in a neat intraday downtrend channel. Support at 1.3725 – which corresponds to the late-July low and the bottom of a triangle pattern identified by technical analysts – is now being tested. This level is significant; it’s where buyers previously emerged, and indeed some forecasts projected an upward rebound from this area. If 1.3725 holds through today’s sessions, it could form a short-term base for USD/CAD. Below here, the next support is around C$1.3700, and further down the 1.3625 level is a critical threshold – a break under 1.3625 would invalidate the recent corrective bounce and signal a deeper decline toward the mid-1.3400s. On the upside, immediate resistance lies at 1.3780, where the falling 50-period moving average on the M5 and yesterday’s consolidation highs converge. Above that, the 1.3800 round figure remains a psychological and technical barrier; regaining 1.3800 would shift intraday momentum back in favor of USD strength and could target 1.3870 next. For now, trend indicators point downward, and RSI readings are hovering around oversold territory – suggesting the pair may either consolidate or attempt a modest bounce from the current support.

Intraday Trade Ideas

The proximity of support offers a potential bounce trade if one anticipates a short-term correction. A possible setup is to buy near C$1.3720 with a tight stop loss below C$1.3690, aiming for a rebound to C$1.3795 (just below the 1.3800 resistance). This would rely on oil prices stabilizing and the USD finding some footing. Conversely, if bearish momentum persists and 1.3700 gives way, a breakdown trade could be to sell a breach of that level, with a stop around 1.3740 and a target of C$1.3650 – capturing a continuation toward the next support zone.

News & Outlook

The Canadian dollar’s recent swings have been closely tied to the oil market’s volatility. On Monday, oil dropped to its lowest in a week as traders digested an OPEC+ decision to raise output, which contributed to the loonie’s weakness. Since then, crude prices have steadied, offering the CAD some relief. Traders should keep an eye on any further OPEC or geopolitical news that could jolt oil prices, as another leg down in oil would likely pressure the Canadian dollar again. Beyond commodities, the general risk mood and U.S. economic signals are influencing USD/CAD. Fed rate-cut speculation (fueled by the same weak U.S. data that is affecting other USD pairs) is limiting the dollar’s upside, even against the CAD. Later today, the U.S. jobless claims report could spark a reaction: a higher-than-expected claims number may weaken the USD broadly, potentially pushing USD/CAD below its range. Looking ahead, traders are also mindful of tomorrow’s Canadian employment report (if scheduled – the first Friday of the month often brings Canada jobs data alongside U.S. NFP in this cycle). Any strong surprise in Canadian jobs could be a catalyst for the loonie. For now, market sentiment is cautiously positive on the CAD as it bounces off support. However, if the USD/CAD pair decisively breaks below the current floor (1.3720/00), it would signal a bearish shift, potentially targeting the low-1.36s or even 1.3500s. Conversely, a climb back above 1.3800 would put bulls back in the driver’s seat. In summary, USD/CAD is at a key inflection point – the price action around 1.3725 will likely determine whether the pair extends its downslide or stabilizes for a rebound going into the weekend.