Global forex markets are navigating a minefield of central bank surprises and geopolitical crosswinds as we end the first week of August 2025. The U.S. dollar is attempting to rebound from its weekly lows after a mix of data showed higher jobless claims and easing labor cost growth in the U.S. (226,000 new claims vs. 221,000 expected; unit labor costs up just 1.6%). These figures hint at a cooling labor market and waning inflation pressures, fueling speculation that the Federal Reserve may hold off on further tightening. Meanwhile, political drama in Washington adds spice to the mix: President Trump’s renewed tariff agenda – including fresh levies on India and threats toward China – is clouding the global trade outlook. Against this backdrop, diverging monetary policies across the Atlantic and Pacific are driving sharp moves in GBP/USD, USD/JPY, and USD/CAD. Market sentiment has been seesawing between cautious optimism (boosted by strong Chinese export growth and hopes of stimulus in Beijing) and risk aversion (amid deflation whispers in Asia and trade-war jitters). The result is an FX landscape where each currency pair tells a different story, shaped by interest rate differentials, commodity price swings, and political undercurrents.

In the analysis that follows, we delve into the day’s action and outlook for the British pound vs. U.S. dollar, U.S. dollar vs. Japanese yen, and U.S. dollar vs. Canadian dollar. We’ll examine 5-minute price charts for technical cues, identify key support and resistance levels, highlight notable candlestick patterns, and discuss the latest economic and political news influencing each pair.

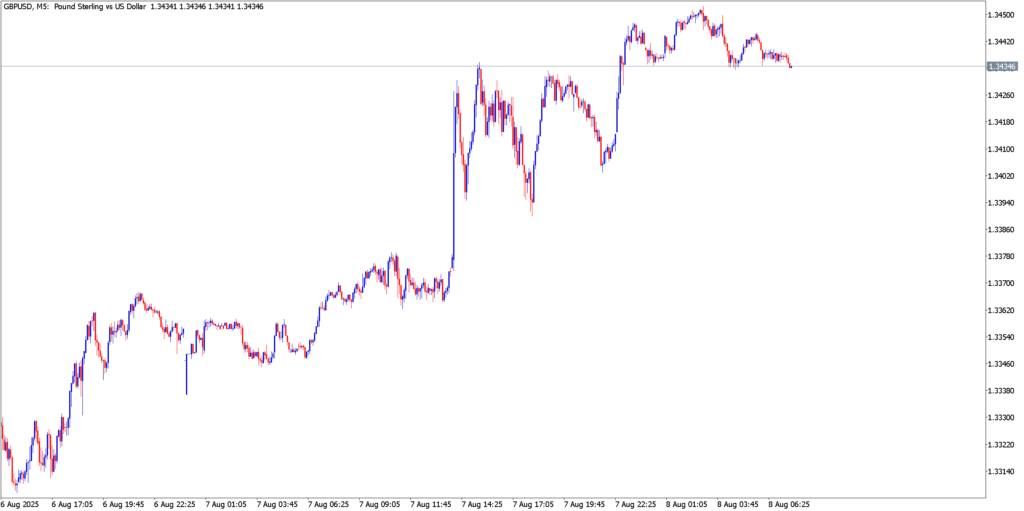

GBP/USD

The British pound is on the offensive, with GBP/USD jumping to its highest levels of the week after an eventful Bank of England meeting. The pair’s performance in recent sessions has been impressive – sterling surged as high as the mid-1.34s, defying what was broadly a short-term bearish trend earlier. This bounce comes in the wake of the BoE’s interest rate decision on August 7, where the central bank cut rates from 4.25% to 4.00%, its first-rate reduction in years, but struck a surprisingly hawkish tone. The Monetary Policy Committee’s vote was split (5–4 in favor of the cut), with four members pushing to keep rates unchanged, a signal that inflation fears linger. This dissenting hawkish minority caught traders off guard – instead of sinking, the pound rocketed higher as markets interpreted the close vote as an indication that further easing will be cautious. Essentially, the BoE delivered the expected rate cut but with a warning that it’s not eager to embark on a dovish spiral, providing a boost to GBP sentiment. On the U.S. side, no major data releases hit on the 8th, but the shadow of last week’s robust U.S. jobs report and the Fed’s July meeting outcome (a hold with a watchful eye on data) kept the dollar in check. With the Fed in wait-and-see mode and the BoE signaling it hasn’t turned fully dovish, the policy gap perception favored the pound in the short term.

The 5-minute chart illustrates the pound’s sharp rally following the BoE decision. A large bullish candlestick can be seen on Aug 7 around mid-day (UK time), corresponding to the rate announcement, as buyers piled in. This surge broke above the previous resistance in the 1.3370–1.3390 zone, which has now turned into immediate support. The pair is currently trading around 1.343–1.345, with bullish momentum evident in the series of higher lows on the intra-day chart. Notably, prices have been climbing within what appears to be a short-term bullish correction inside a broader downward channel (visible as the channel boundaries on the chart). The moving averages on this timeframe have flipped upward after the news, reflecting the short-term uptrend. We can spot a mini double-bottom pattern that formed near 1.3330 prior to the BoE event, which provided the launchpad for the rally. Now, key technical levels are in play: Upside resistance is seen around 1.3485–1.3500, which was the peak from late July and aligns with the upper edge of the channel and a cluster of prior highs. A strong push above 1.3505 would break the bearish channel’s upper bound and invalidate the downtrend scenario, signaling potential for an extended climb toward the next target around 1.3775. On the downside, initial support lies at the 1.3370 breakout area, with further firm support in the mid-1.32s – specifically, around 1.3255, which marks the lower boundary of the recent corrective upswing. A slide back below 1.3255 would be a bearish warning that the pound’s recovery has run out of steam, potentially opening the door to a deeper decline toward the 1.3200 and 1.3195 region. For now, candlesticks show sustained bullish pressure (multiple consecutive green bars post-BoE), though some small dojis near 1.3440 hint at buying fatigue as we approach resistance.

Fundamental Drivers

The Bank of England’s policy twist is unquestionably the top driver for GBP/USD right now. By delivering a “dovish” rate cut but pairing it with hawkish rhetoric (close voting and emphasis on still-high inflation), the BoE engineered something of a positive surprise for the pound. Traders who had positioned for a more unequivocal dovish turn were forced to unwind short-GBP bets, fueling the rally. Additionally, UK political developments provide a supportive backdrop: the UK’s general election earlier this year resulted in a stable government that has avoided any market-rattling policy shocks, allowing the BoE’s actions to take center stage. Economic data this week from the UK was mixed – for instance, July PMI surveys hinted at slowing growth, but inflation readings have been gradually cooling, giving the BoE cover to cut rates. Across the Atlantic, U.S. developments are exerting a subtle influence: yesterday’s U.S. weekly jobless claims came in a bit higher than expected, and productivity data showed labor costs under control. This combination suggests the Fed has less reason to stay hawkish, which in turn put mild downward pressure on the dollar generally. Moreover, political news out of the U.S. is injecting volatility; President Trump’s trade policies are back in focus, with a recent tariff hike on India over oil trade with Russia. Such moves stoke global uncertainty but interestingly have not dented risk appetite severely yet – global stock indices are relatively steady, and safe-haven flows into the dollar have been limited. For the pound, there’s also an eye on European developments: the Eurozone economy showed further signs of slowdown this week (German industrial output disappointed), indirectly benefiting GBP as the UK looks comparatively resilient. In summary, a cautiously hawkish BoE versus a data-dependent Fed is the core fundamental narrative lifting GBP/USD, amplified by political undercurrents that thus far favor sterling’s risk profile.

Outlook & Trading Ideas

In the near term, bulls have the edge in GBP/USD, but the pair is heading into a critical test of overhead supply around 1.35. The prevailing bias is cautiously bullish – we could see another leg higher if momentum carries the pound through the 1.3485/1.3500 resistance barrier. A clear break and 5-minute close above 1.3500 would likely trigger follow-on buying, with quick scalping targets at 1.3575 and 1.3650, and a potential swing move toward the mid-1.37s if broader dollar weakness resumes. However, traders should be careful chasing too high; the BoE-inspired rally could fade if no new bullish catalyst emerges. Volatility is expected to stay elevated for now (the BoE surprise has increased 1-week implied vol on GBP). If GBP/USD struggles to breach 1.35 decisively, profit-taking could set in. Bears might look for short opportunities on any signs of a reversal pattern near 1.35 – for example, a double-top or bearish engulfing candle on the hourly/M5 chart. A dip back below 1.3370 would indicate the rally is stalling, possibly inviting a slide to 1.3300, and below that the focus returns to 1.3250 and lower. Overall, we anticipate range-bound-to-bullish trading today: buying on dips above support could be a viable strategy given the pound’s current momentum, with tight stops in case of a break under 1.33. The backdrop of a still-hawkish BoE means GBP/USD may retain a buy-on-dips character, as long as 1.3255 holds. But if that support cracks, all bullish bets are off, and the bias would swiftly shift bearish, targeting the low-1.32s and possibly 1.3195. Keep an eye on any fresh headlines (e.g. BoE members speaking or U.S. political surprises); those could be the wildcards that tip this pair out of its current upward correction.

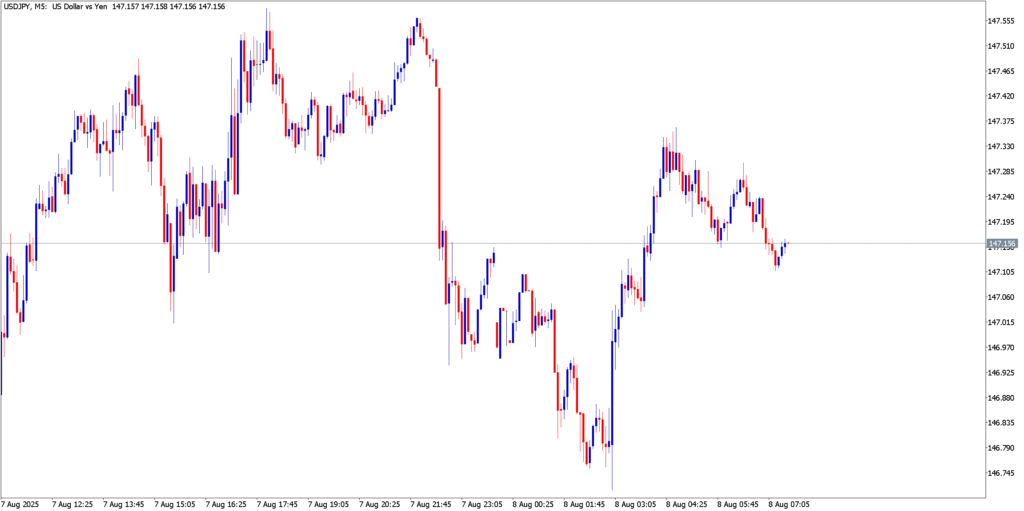

USD/JPY

USD/JPY finds itself hovering near multi-month highs as the yen remains under pressure and the dollar holds firm. In today’s session, the pair is trading in the mid-147s, not far from the psychologically critical 148.00 level that traders associate with previous intervention zones. Despite the dollar’s general struggles elsewhere, against the yen it has been bolstered by the enduring U.S.-Japan interest rate differential – the Fed’s policy rate (even if on hold) towers above the Bank of Japan’s, which remains in negative/near-zero territory. Over the past 24 hours, USD/JPY attempted to push above 147.50 but failed to sustain traction beyond that resistance. Risk sentiment has been relatively neutral to positive (with global equities steady and no major flight-to-safety), meaning the yen’s safe-haven appeal is dim at the moment. Additionally, rumors are swirling in Tokyo that the Ministry of Finance is growing uneasy with yen weakness as USD/JPY inches toward 150. This has injected a dose of caution among yen bears – traders vividly remember the 2022 FX intervention when Japanese authorities stepped in around ¥150 to prop up the yen. So while the path of least resistance has been upward for USD/JPY, markets are jittery about a potential official pushback if the yen slides too far, too fast. In summary, the dollar-yen is in an uptrend but approaching a make-or-break zone, caught between bullish momentum and the specter of intervention.

The M5 chart shows USD/JPY trading within a rising channel, reflecting a short-term bullish trend. The pair has been posting higher lows and higher highs since the start of the week, with buyers consistently stepping in on dips. However, we can see that around the 147.50 – 147.80 area, upward price action has stalled repeatedly – evident from the cluster of candle wicks and sideways movement near that zone. This corresponds to a known resistance ceiling. The bulls’ inability so far to secure a foothold above 148.00 underscores the importance of that barrier: USD/JPY needs to break and hold above ~148.0 to unleash another leg of sustainable upside. Until then, the risk of a pullback persists. On the downside, immediate support can be identified around 146.4 – 146.5, which is roughly where the lower bound of the channel lies and where the pair last bounced earlier today. In fact, the technical forecast for today anticipated an initial dip toward 146.45 support followed by a bounce, and this scenario has been playing out with intraday oscillations. A drop below that level would test the integrity of the channel – notably, a break beneath 145.55 (yesterday’s low and a minor support) could invalidate the bullish setup and signal a deeper correction. If 145.5 gives way, the next significant support is around 143.6 (a level mentioned as a potential target on a breakdown), which coincides with late July lows. Candlestick patterns on the M5 chart show some indecision at the top: small-bodied candles and upper wicks near 147.7 hint at buying momentum waning. Yet, there’s no dramatic bearish reversal pattern visible – more a consolidation. A noteworthy pattern is the tight consolidation (a miniature triangle flag) forming just under 147.5, which could precede a breakout one way or the other. The Relative Strength Index on short-term charts has cooled from overbought levels, potentially giving bulls a bit more room to run if they choose another assault on 148.

Fundamental Drivers

The dynamics driving USD/JPY are a mix of monetary policy divergence and growing intervention risk. On one side, we have the Bank of Japan, which remains the lone major dove. Thus far in 2025, the BoJ under Governor Ueda has only made very timid steps toward normalization – it has maintained its negative interest rate and only tweaked its yield curve control policy at the margins. With Japanese inflation still moderate and growth tepid, the BoJ has signaled no rush to hike rates meaningfully. This keeps Japanese bond yields ultra-low, and in turn, encourages Japanese and global investors to seek higher yields abroad (selling yen for dollars to buy U.S. assets, for example). The Fed, although likely at or near its peak rate, is not expected to cut aggressively anytime soon due to the U.S. economy’s resilience and still above-target inflation. U.S. 10-year yields remain significantly higher than equivalent Japanese yields, fueling the carry trade that supports USD/JPY’s uptrend. Economic news in the U.S. over the past day – such as the rise in jobless claims – might ordinarily weaken the dollar, but in this case it also eased fears of Fed tightening, which perversely supported risk sentiment and kept USD/JPY buoyant (as a “risk-on” indicator). Over in Japan, there was some data on consumer spending that came out soft this week (household spending continued to decline year-on-year), underlining the fragility of Japan’s recovery. This kind of data gives cover for the BoJ to stay dovish. However, a big fundamental wildcard is political intervention: with USD/JPY above 147, officials in Tokyo have been verbalizing their concern. There are reports that the Ministry of Finance has been checking rates with banks – a traditional verbal intervention tactic. The memory of last year’s intervention (when Japan spent billions to strengthen the yen) hangs over the market; any sign that USD/JPY is approaching 150 could trigger fear of actual yen-buying intervention. International politics also weigh in: the U.S.-China trade tensions initiated by Trump’s tariffs create a complex environment. If global trade worries escalate, it might spur a risk-off move that could ironically strengthen the yen (as investors flock to it as a haven). So far though, the Chinese trade news – strong export numbers – has kept Asian market sentiment fairly positive, limiting the yen’s haven demand. In essence, USD/JPY is torn between the bullish pull of yield spreads and the bearish potential of policy action (either BoJ surprise or FX intervention).

Outlook & Trading Ideas

The short-term outlook for USD/JPY remains constructive for bulls, but with important caveats. As long as the pair holds above its support levels (particularly the mid-146s), the path of least resistance is upward. Traders may adopt a strategy of buying on dips – for instance, accumulating longs in the 146.5–147.0 area, aiming for a break above 148. A successful breach of 148.00, especially on a daily closing basis, could ignite fresh momentum buying. The next upside level to watch would be around 149.35 (a technical target from the bullish channel projection), and beyond that, the 150.00 threshold looms large. It’s plausible that stop-loss orders are building above 148, which could fuel a quick jump if triggered. Volatility expectations are moderate but could spike if any official comments cross the wires. On the flip side, given the intervention risk, upside bets should be nimble. The government could step in, or even a sharp speculative flush could occur near 149–150. For bears or those looking to play a yen rebound, a clear signal would be a break below 145.5. A drop under 145.5 would break the rising trendline and likely usher in a deeper pullback toward 144 or even 143.65. In that scenario, short positions could target those levels, with stops just above 147 for a favorable risk/reward. Also, any concrete news (e.g., an emergency BoJ policy meeting or actual yen-buying intervention) would cause a violent reversal downward – scenario planning for such an event (perhaps via options or stop orders) might be wise given how close we are to historical intervention territory. Overall, bias: cautiously bullish – we expect the pair to grind higher on fundamentals, but we remain vigilant. Traders should monitor headlines from Tokyo and watch U.S. Treasury yields; sudden drops in the 10-year yield or strong risk-off waves could be the canary in the coal mine foreshadowing a USD/JPY pullback. For now, the trend is your friend, but don’t fall asleep on this one – it can change on a dime if the Finance Ministry decides to make a statement (literally or figuratively).

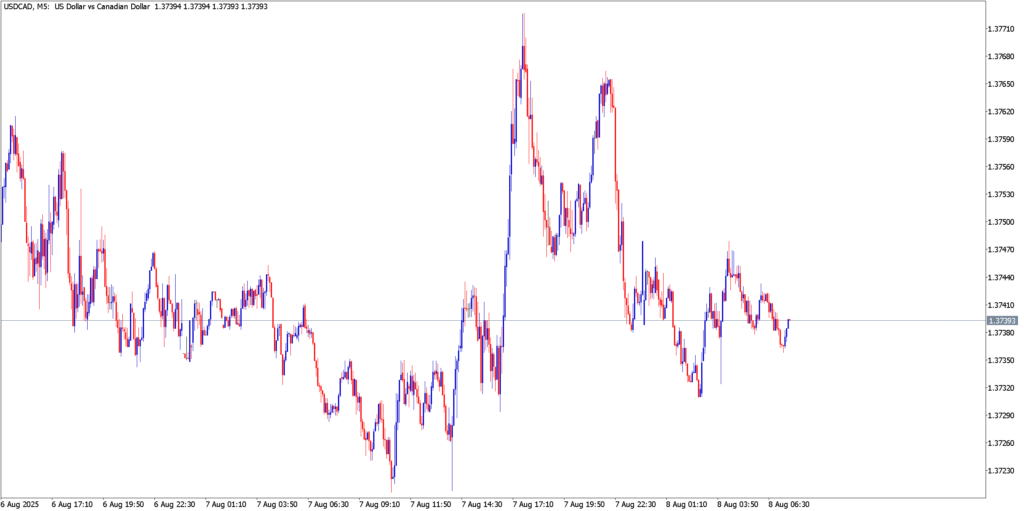

USD/CAD

The U.S. dollar vs. Canadian dollar pair has been tilting upward, with USD/CAD threatening to break higher as commodity headwinds hit the Canadian dollar. In recent sessions, the pair has drifted into the 1.37+ area, putting it not far from its highs of the year. The Canadian dollar (aka “loonie”) is facing a double whammy: softer domestic economic signals and a downturn in crude oil prices, one of Canada’s key exports. On August 8, USD/CAD is trading around 1.3740–1.3760, a level that reflects a moderate upward bias. Notably, other commodity currencies (like the AUD and NZD) saw a bit of relief rally earlier in the week after upbeat Chinese trade data, but the loonie hasn’t benefited much. Part of the reason is that Canada-specific factors – such as the outlook for the Bank of Canada’s interest rates and the price of oil – have been less favorable. The BoC, which was one of the earlier hawkish central banks in 2022–2023, has shifted to a more cautious stance as Canada’s economy shows signs of cooling (for example, Canada’s June GDP came in flat and housing market activity is slowing). Markets suspect the BoC is at or very near its rate peak and might even cut before the Fed does if Canada’s growth falters. This contrasts with a still relatively robust U.S. economy, putting the policy momentum in the USD’s favor. Meanwhile, oil – the lifeblood of the Canadian economy – has been weak. U.S. WTI crude fell to the mid-$60s per barrel this week, partly due to excess supply and global growth concerns, which directly undercuts the petro-linked CAD. All in all, USD/CAD’s upward creep reflects U.S. strength and Canadian softness, placing the pair at the cusp of a possible breakout from its recent consolidation pattern.

The technical picture for USD/CAD reveals a market in consolidation with a slight bullish tilt. On the 5-minute chart, the pair has been coiling into what looks like the beginning of a triangle pattern. This is evidenced by a series of lower highs juxtaposed against higher lows since yesterday – the range is tightening around 1.3740–1.3760. Such price action often precedes a sharper move once a breakout occurs. As of now, short-term moving averages are modestly upward-sloping, indicating buyers have the upper hand in the very near term. The pair found a solid floor around 1.3735 earlier in the day, rebounding each time it dipped to that area. This pinpoint support aligns with the triangle’s lower bound and has been highlighted as an important level to watch. If USD/CAD were to decisively break below 1.3735, it could signal a bearish fake-out from the triangle, with the next support zone around 1.3655 (a level identified as critical; a fall under 1.3655 would cancel the bullish scenario on the charts). On the flip side, immediate resistance is in the 1.3780–1.3800 region – just above the current market, where the triangle’s upper trendline lies. Beyond that, technical resistance from prior highs kicks in around 1.3845–1.386, which also corresponds to the 50-day MA on a higher timeframe and was cited as a target if momentum resumes. A break and hourly close above ~1.3855 would likely confirm an upside breakout, suggesting the pair could then extend toward 1.3895 (the forecasted bullish target from the triangle pattern). Notably, the chart shows some small bullish candlestick formations – for instance, a morning-star-like trio and a few hammer candles near support – reflecting that dips are being bought. Volatility on USD/CAD has been relatively muted compared to GBP or JPY pairs, but that could change if oil prices swing or if tomorrow’s Canadian employment report surprises. For now, the pair remains range-bound between roughly 1.3730 and 1.3780, waiting for a catalyst to tip the scales.

Fundamental Drivers

Several forces are at play for USD/CAD, and most have been USD-positive or CAD-negative lately. First, oil prices: Canada’s economy and its currency are highly sensitive to oil. This week’s U.S. EIA petroleum status report showed a larger-than-expected draw in crude inventories, yet crude oil barely caught a bid and instead tested $66 a barrel. The fact that oil is struggling to rally on ostensibly bullish inventory news indicates underlying demand worries. Indeed, global growth concerns – partly stemming from China’s manufacturing slowdown (despite strong export numbers, Chinese PMIs are weak) – are weighing on the oil market. The slump in oil to 2025 lows has directly hurt the Canadian dollar, since cheaper oil means lower export revenues for Canada and generally a weaker terms of trade. Second, the Bank of Canada vs. Federal Reserve expectations: The BoC did not meet in early August (its last decision was in July when it raised rates modestly then signaled a conditional pause). Since then, Canadian data like retail sales and housing figures have been underwhelming. The BoC has communicated readiness to hold rates if inflation continues easing. In contrast, while the Fed is also pausing, U.S. data (jobs, GDP, etc.) has been coming in stronger than Canada’s. This divergent trajectory – the U.S. economy outpacing Canada’s – suggests the Fed may end up keeping rates higher for longer than the BoC, a recipe for capital flows favoring the U.S. dollar. Third, macroeconomic news: today (Aug 8) there aren’t major Canadian releases, but traders are looking ahead to tomorrow’s Canadian employment report. If last week’s pattern is any guide, Canada’s labor market might be starting to sputter (July’s numbers are expected to show only modest job gains). Meanwhile, last week the U.S. delivered a solid Non-Farm Payrolls report and this week’s U.S. data (productivity, jobless claims) painted a Goldilocks scenario – decent growth, easing inflation pressure. This favors the USD. Additionally, political factors cast a shadow: Canada is quietly dealing with its own U.S. trade irritant – the re-emergence of U.S. protectionism means Canada must stay vigilant about its exports (be it lumber, dairy, or auto). Any hint of the U.S. imposing new trade barriers (in line with Trump’s tariff stance) could spook the CAD. However, on the plus side for Canada, we did see some “risk-on” appetite from investors on news that China’s imports rose and stimulus hopes in China, which can boost commodities and resource currencies. That gave brief support to the loonie and other commodity currencies, but the effect was blunted by oil’s slide. In summary, fundamentals currently favor USD/CAD upside: soft oil prices, a cautious BoC, and a relatively robust USA. Traders are justifiably wary of one thing – if oil finds a bottom (say OPEC steps in or inventories fall further) or if the Fed sounds more dovish suddenly, the tide could turn. But as of now, the Canadian dollar lacks a bullish catalyst of its own.

Outlook & Trading Ideas

The stage appears set for potential upside continuation in USD/CAD, barring a sudden oil price spike or surprisingly strong Canadian data. The near-term bias is bullish. A convincing break above 1.3800 would likely unleash the pair from its consolidation, targeting 1.3890 (the top of a projected range and year-to-date high). Traders could position for this by going long on a break of 1.3800 or on dips to support (around 1.3735), with stops just below 1.3700 or 1.3655 to guard against false breakouts. The risk-reward favors upside as long as that key support at 1.3655 remains intact. In terms of volatility, USD/CAD might see an uptick with the upcoming economic releases (like the Canadian jobs report and any Fed speak). Also, keep an eye on oil inventory data or OPEC rumors – any sharp move in oil can translate quickly to the CAD. For those inclined to see a CAD comeback, the argument would hinge on oil and risk sentiment. A strategy for CAD bulls could be to wait for a clear failure at the 1.3850 resistance zone. If USD/CAD prints a double top near 1.3840 and slides back below 1.3730, that could be a cue to short the pair, aiming for a retracement to 1.3650 and then possibly 1.3500 if momentum builds. However, until such a reversal pattern emerges, catching a falling knife (or in this case a rising dollar) is hazardous. We expect choppy trade within the triangle for now, but with a slight upward drift. Overall, it’s a “buy the rumor” situation on USD strength, and possibly later “sell the fact” if Canada’s data or oil prices show improvement. For today, focus on the breakout markers: above 1.3855 for bullish acceleration, below 1.3655 for bearish turn. In the absence of those triggers, range strategies (buying near 1.3735, selling near 1.3800) can prevail, mindful that the coil will eventually spring loose.

Conclusion

In summary, August 8, 2025 finds the forex market at an intriguing inflection point. Divergent central bank policies are the dominant theme: the Bank of England’s quasi-hawkish rate cut has put wind in the pound’s sails, the Bank of Japan’s dovish stance leaves the yen vulnerable (even as officials eye intervention), and the Bank of Canada’s caution amid low oil prices is undermining the loonie. Meanwhile, the U.S. dollar is trading mixed – strong against low-yield and commodity-tied currencies, but softer against the more hawkish-policy currencies. This reflects a nuanced sentiment: traders are discerning which currencies have room to gain on the dollar and which do not. Overall market sentiment leans cautiously optimistic (stocks are not in panic mode, and there’s no rush into safe havens yet), aided by encouraging news like China’s export surge and improving productivity in the US. However, under the surface there are plenty of reasons to stay on guard. Political risks – from Washington’s trade saber-rattling to global election uncertainties – could quickly sour risk appetite. If that happens, we might see abrupt moves: the yen could catch a bid on safe-haven flows, or the dollar could reverse course if U.S. policy concerns mount.

For now, traders should keep a close eye on key technical levels discussed above: they will act as early warning signals for sentiment shifts. Whether it’s GBP/USD holding above support to extend its rebound, USD/JPY testing the resolve of Japan’s Ministry of Finance near 148–150, or USD/CAD breaking out of its consolidation as oil gyrates, each pair has critical tripwires to monitor. Volatility is likely to remain event-driven. Upcoming economic data (like tomorrow’s North American jobs figures) and any surprise central bank communications will be prime catalysts. Also, any change in tone from major players – say, a BoE member hinting at policy pause, or Fed officials pushing back on rate cut bets, or OPEC commenting on oil prices could tilt the scales.