The FX market opened like a powder keg on Nov 4: the U.S. dollar exploded higher while the euro, pound and Aussie all plunged. Investors cheered renewed Fed hawkishness – Fed Chair Powell’s remark that this could be the last cut of the year sent USD buying into overdrive – and dumped the “weak money” trades. EUR/USD cracked through key support around 1.1550 to hit ~$1.15, GBP/USD slid below the 1.31 floor on jitters over UK fiscal policy, and AUD/USD tumbled after Australia’s central bank left rates on hold but sounded surprisingly hawkish on inflation. The lead was so sharp that major trendlines and moving averages were torn apart in minutes. With ultra-cautious comments from Tokyo (yen) and Venezuelan oil-war jitters adding to the drama, traders are scrambling to reposition for tomorrow’s BoE meeting and key U.S. jobs data.

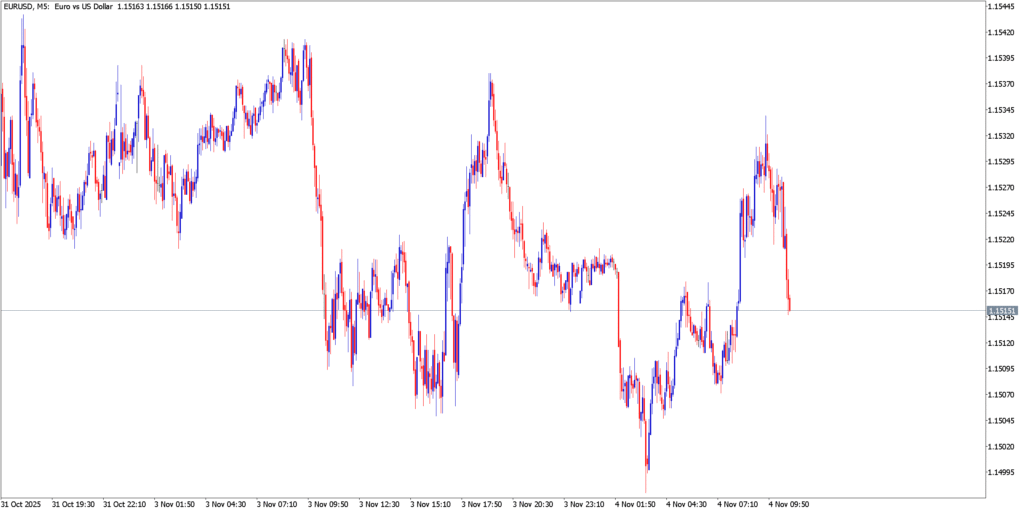

EUR/USD

Technical

EUR/USD gapped and slid right through the 1.1550 region, breaking a rising trendline from the summer and dragging into the 1.1500 area. On the minute/5‑min chart, the pair is firmly below its 50-period moving average (EMA50) and hugging a descending trend line. Short-term momentum is deeply bearish: stochastics and RSI are oversold, and sellers have seized the chart. Today’s sharp selloff has left EUR/USD at three-month lows (around $1.1498), with support eyed near 1.1400 if the slide continues. Any intraday bounce has repeatedly run into resistance at ~1.1550 and the 1.1600 zone.

Fundamentals

The euro’s troubles were fundamentally driven by U.S. strength and lackluster euro-zone data. A Reuters report noted the dollar surged to a three-month high against the euro on Monday, as Powell’s dovish tilt gave way to hawkish skepticism. Investors are now bracing for the Fed’s next meeting with cuts priced out. Meanwhile, October inflation in the euro area came in softer (only easing a bit), igniting talk of a possible ECB rate cut in December. In other words, the ECB’s “hold” stance looks shaky – markets have lifted the odds of a 25bp ECB cut from ~10% to 25% in December. Against this backdrop, the US dollar has been treated as a safe haven: “investors favored the dollar as the best available investment” amid Fed uncertainty. With official U.S. releases stalled by the government shutdown, markets even lean on ADP and other private data for cues. In sum, USD momentum met waning euro support – a toxic combo for EUR/USD.

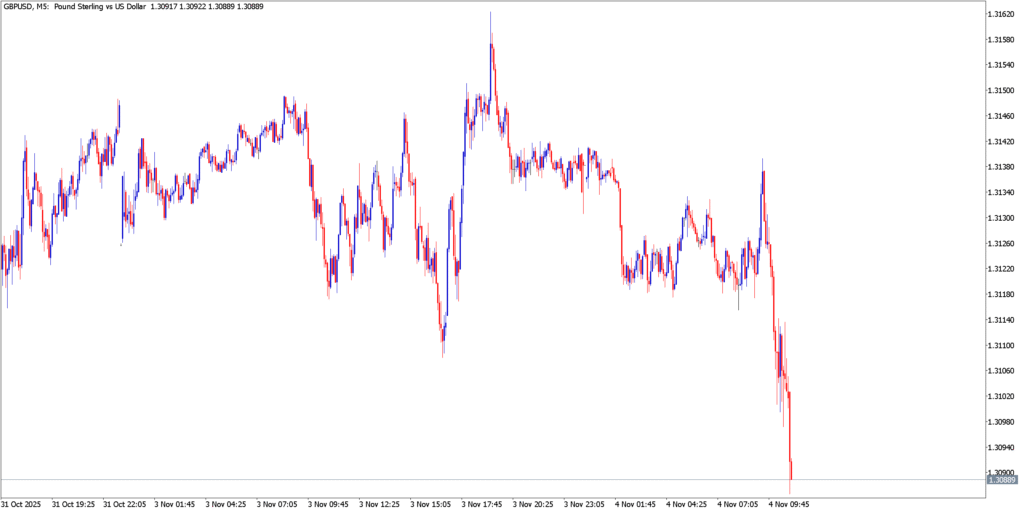

GBP/USD

Technical

Cable followed a similar plummet. GBP/USD cracked its short-term floor near 1.3110 and is now trading at ~1.3090 – its lowest in months. The chart shows a clear break below the 5‑min EMA50 (red line) and a descending channel forming. Oscillators have turned down, reflecting “full dominance” of the bearish trend. Intraday, every attempt to rally toward 1.3150/60 has been sold; the pair now eyes confluence support around 1.3000-1.3050 next. Overall, GBP/USD’s technical setup is ominous: trendlines from October are broken and momentum is squarely to the downside.

Fundamentals

Sterling’s weakness reflects UK domestic worries. In a rare pre-budget speech on Tuesday, Finance Minister Rachel Reeves reiterated an “iron-clad” commitment to fiscal discipline – implying tax hikes despite slowdown. The reaction was swift: Reuters reports “sterling fell 0.34% to $1.3092… undermined by lower gilt yields” after the hawkish talk. In fact, 10-year UK yields briefly dipped, signaling fear of slower growth. Inflation in Britain is stubbornly above target, but growth is now fragil – leaving the BoE torn. Money markets have flipped from no cuts expected to about a 50/50 chance of a rate cut at the next BoE meeting. In short, pound bulls got spooked by fiscal hawkishness and a softer tone on U.K. GDP, while the Fed’s strength added downward pressure. Together, these forces have pushed GBP/USD sharply lower on the day.

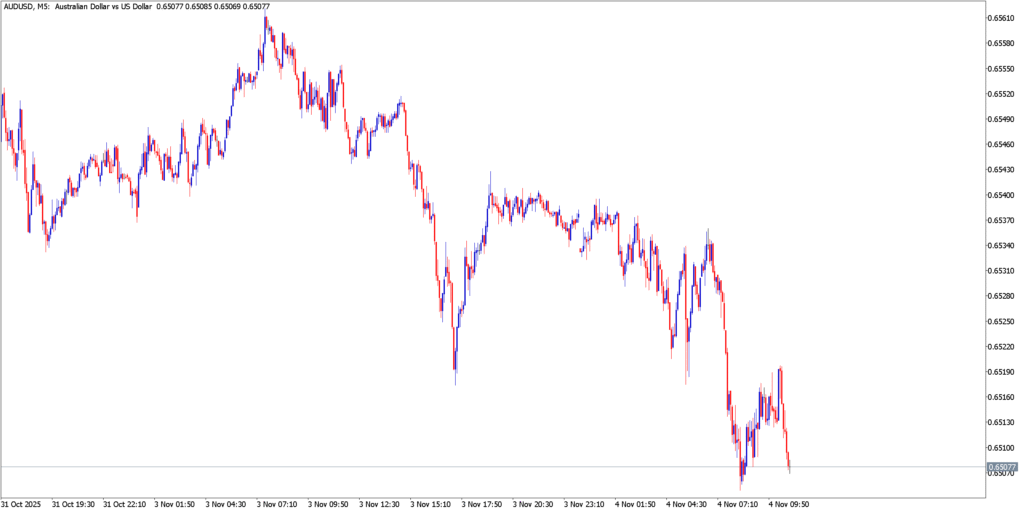

AUD/USD

Technical

AUD/USD has likewise been under intense pressure. The pair punched down through 0.6530 and hit a two-week trough around 0.6515. On the charts, AUD/USD broke below a short-term bullish correction line and is now squarely below its EMA50. There are no signs of a bounce yet: momentum indicators have flipped negative, reinforcing that the decline is more than just a one-off shock. Support may come near the Oct 24 low ~0.6500, but for now the bias is firmly lower as trend breaks stack up.

Fundamentals

The Aussie slump was largely set off by the RBA meeting early Tuesday. As widely expected, the RBA held its cash rate at 3.60%, but the language was hawkish. Governor Bullock’s statement noted that core inflation remains “persistent” and projected it above 3% for the coming quarters. Bullock even said “we did not consider an immediate rate cut” and suggested the tightening cycle may already be done, or at least delayed. This set markets to pricing out RBA easing: after the announcement, the chances of a December cut fell sharply (from 65% to 35%). Meanwhile, Australian data has not been helping – recent PMI and jobs numbers are soft, and China’s weak demand (a key Australian export market) is a headwind. The net effect: traders dumped AUD on both the dovish hold and lackluster fundamentals, driving AUD/USD down over 0.65. With the US dollar rally in the background, Aussie vulnerability was mercilessly exposed.

Market Outlook

All told, USD strength and central bank policy are the common thread. A strong greenback is setting the tone: it’s lifted the USD index to ~100 (3-month high) and is the main culprit behind EUR, GBP and AUD pressures. Tomorrow’s BoE policy decision (Nov 5 London, likely no change but watch tone) is front and center for sterling. U.S. data are the other key: ADP employment and ISM reports mid-week will test the Fed narrative (and are running on backup feeds due to the shutdown). By Friday, NFP and Fed’s preferred CPI gauge loom – a big test if the shutdown persists. Oil and risk sentiment are also watchpoints given Venezuela tensions (oil spiked on US-Caribbean moves).