Tuesday’s forex session reflected a more nuanced and mixed performance from the US dollar, as markets digested a combination of economic indicators, geopolitical developments, and policy narratives. Despite Monday’s strong data-driven dollar rebound, Tuesday lacked a standout catalyst, leading to range-bound behavior in many major USD pairs and a more cautious market tone overall.

Investor sentiment remained cautiously optimistic, but tempered by emerging uncertainties around geopolitical tension and macro data interpretation. Commodity-linked currencies showed pockets of strength, while the dollar’s mixed movements highlighted that traders were balancing between growth optimism and lingering risk aversion.

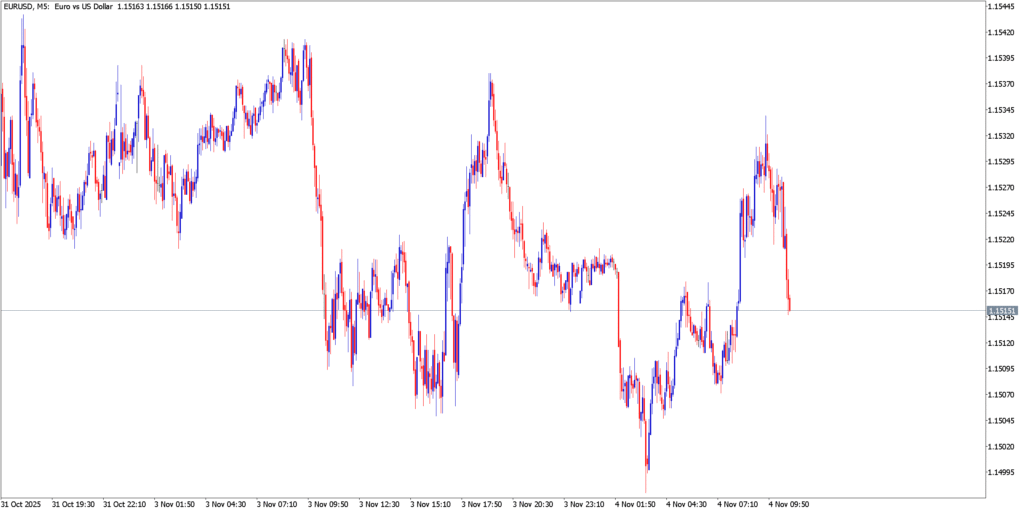

EUR/USD

Technical Analysis

EUR/USD consolidated on Tuesday, trading near the upper end of its recent range after Monday’s dollar-led pullback. Technical indicators showed the pair oscillating in a tighter band, suggesting a lack of compelling directional momentum. Support around earlier lows remained intact, and resistance capped upside advances, reinforcing the market’s holding pattern.

Fundamental Analysis

The euro’s consolidation came as markets weighed broader macro influences against the backdrop of ongoing weakness in the dollar and relative stability in European inflation expectations. Some longer-term forecasts suggest a continued backdrop of dollar softness into February, with seasonality potentially favoring euro resilience, though real-time price action remained cautious.

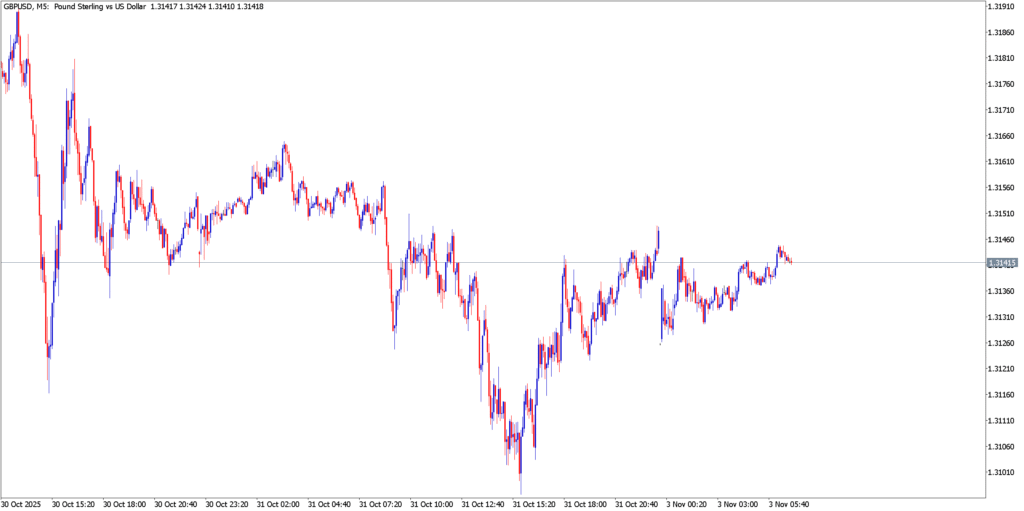

GBP/USD

Technical Analysis

GBP/USD traded in a narrow range, stabilizing after recent gyrations. The pair spent much of Tuesday near short-term support levels, with price action marked by overlapping candles and low volatility. This technical behavior reflected the broader market’s indecision and willingness to await fresh directional cues.

Fundamental Analysis

Sterling’s stability against the dollar was partly supported by anticipation ahead of the Bank of England’s upcoming decision, which markets expect to hold rates steady. Despite strong UK inflation and economic data, traders remained cautious about positioning too aggressively ahead of the formal policy announcement.

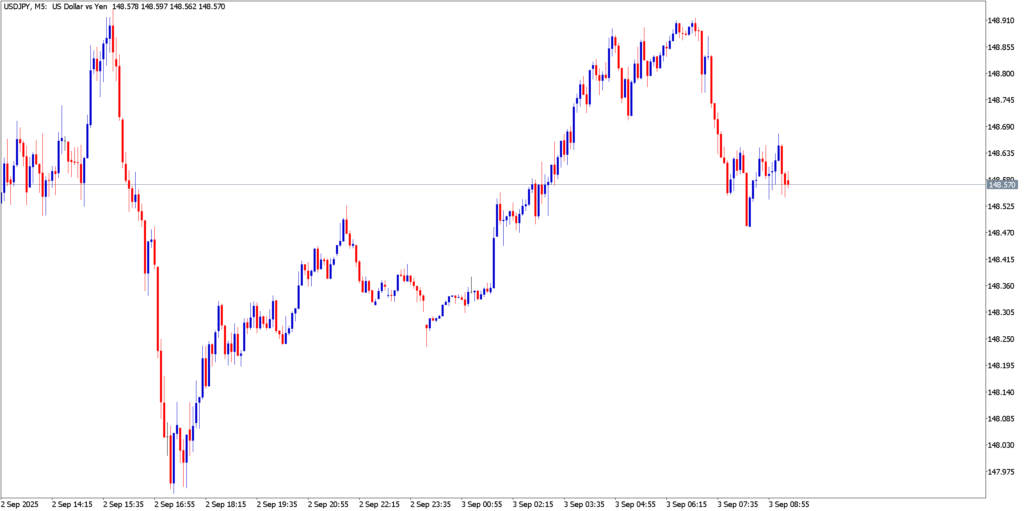

USD/JPY

Technical Analysis

USD/JPY remained supported near recent levels, trading above the mid-150s despite broader USD volatility. The pair’s technical profile suggested a range-bound but bullish-leaning bias, with buyers stepping in on shallow dips and key support holding firm. Any break above short-term resistance could re-energize trend momentum.

Fundamental Analysis

The yen continued to underperform against the dollar, influenced by ongoing political expectations in Japan as well as broad risk flows. Softening geopolitical tensions and continued market confidence in U.S. economic data kept pressure on the yen, though the strength was not unilateral. This contributed to a mixed dollar landscape where USD/JPY remained resilient but not dramatically directional.

Market Outlook

Looking ahead, traders will likely wait for policy cues, labour data, and clearer macro drivers before committing to sizable directional trades. The dollar’s mixed movements reflect a market transitioning from reaction to consolidation, where strong data prompts confidence but is met with cautious positioning. As new catalysts emerge later in the week, pairs such as EUR/USD, GBP/USD, and USD/JPY could break out of recent ranges with renewed conviction.