Global currency markets ignited on Monday, 3 November 2025, as a surge in dollar strength collided with faltering growth signs from the UK and Australia. Risk appetite took a hit when U.S. Treasury yields rose sharply and commodity prices plummeted, dragging the Aussie lower and inspiring a broad flight to the greenback. Meanwhile, investor veterans whispered of a possible pivot in the Bank of England’s reaction functions as UK borrowing concerns ballooned – a perfect storm for volatility in EUR/USD, GBP/USD and AUD/USD. With central bank calendars looming and global data more muted than expected, the opening salvo of November may be just the start.

AUD/USD

Technical Analysis

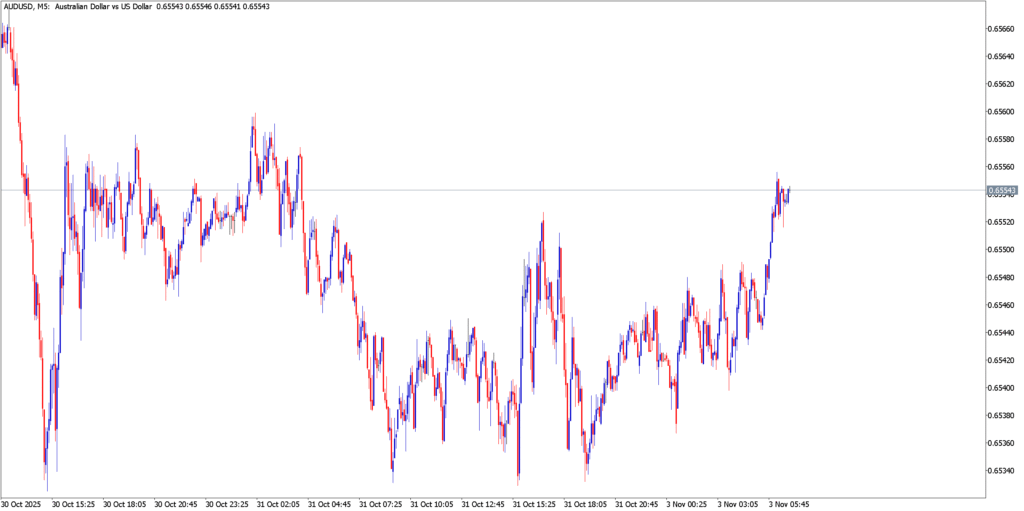

On Monday the AUD/USD chart showed a shallow rebound after testing short-term support. The pair found buying interest near its 50‑day moving average, and short-term momentum indicators (RSI) began to recover from oversold levels. Price action remained in a sideways range (roughly 0.6460–0.6630); the 9‑day EMA (~0.6544) acted as near-term support while the top of this rectangle (around 0.6600–0.6630) capped any rallies. The chart’s overall bias is still bearish: bulls would need a clear break above the 0.6630 resistance (the September 17 high was 0.6707) to turn things around, whereas a drop below 0.6544/0.6460 would expose deeper targets towards 0.6414.

Fundamental Analysis

Fundamentally, AUD/USD traded cautiously. Risk appetite (bolstered by renewed optimism over U.S.-China trade talks) provided some support, and Australia’s unexpectedly hot Q3 inflation report drove the pair briefly higher late last week. However, Fed Chair Powell’s hint that a December rate cut was “not a foregone conclusion” rekindled a dollar rally and limited AUD gains. Headline data on Monday were mixed: Australia’s TD-MI inflation gauge rose 0.3% MoM in October (annual 3.1%) and building permits jumped 12%, but ANZ job ads fell further. China’s manufacturing PMI cooled slightly to 50.6. In sum, traders remained focused on the upcoming RBA meeting (Nov 4), where a 3.60% rate hold was widely expected, and held positions cautiously in the absence of fresh catalysts.

EUR/USD

Technical Analysis

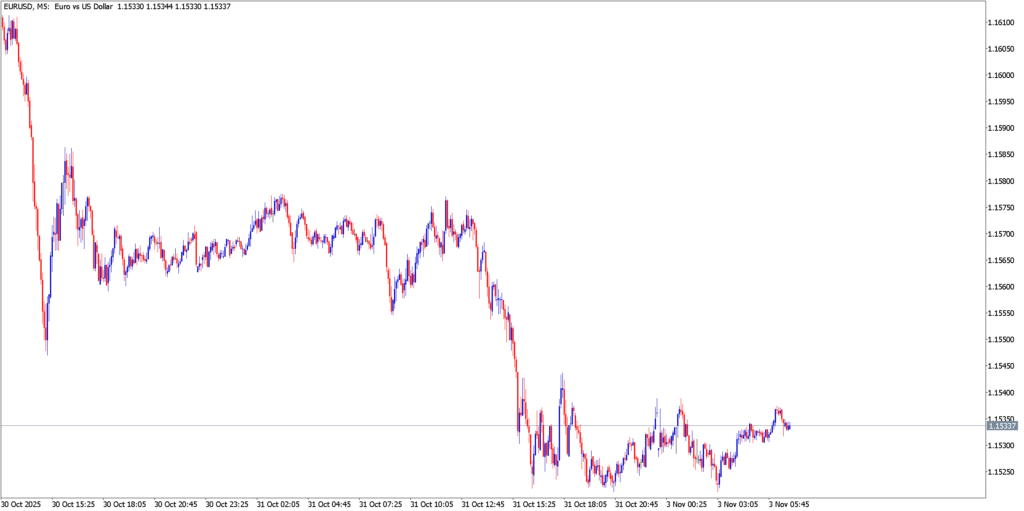

The EUR/USD chart illustrates a clear downtrend. The pair decisively broke below the 1.1530 support level early Monday, completing a bearish triangle breakout. Successive red candles drove the price toward the 1.1500 area and below, confirming the negative bias. Momentum indicators (4h RSI and MACD) remain in bearish territory. Immediate resistance is now seen near the recent lows (1.1530 and 1.1550 from Oct. 30–31), which were mentioned as key supports. A failure to regain those levels leaves the way open for targets around 1.1440 (the measured triangle projection) and potentially the old August trough near 1.1390.

Fundamental Analysis

Eurozone data offered little relief. October’s eurozone manufacturing PMI held essentially steady at 50.0, up slightly from 49.8, but this did not strengthen the euro. FXStreet noted that the PMI “failed to provide any significant support” to EUR/USD. The ECB’s sentiments were also neutral: Bundesbank President Nagel said current data were in line with projections and that “all options remain open” for policy, a comment that suggested no imminent easing or tightening. In contrast, U.S. cues drove the dollar higher. Fed Chair Powell’s dovish-cut expectations were curbed – he explicitly played down the odds of a December cut – which fueled a broad USD rally. In this context EUR/USD slid to fresh multi-month lows, and markets turned to upcoming U.S. data (ISM manufacturing) and Fed speakers for any fresh impulses.

GBP/USD

Technical Analysis

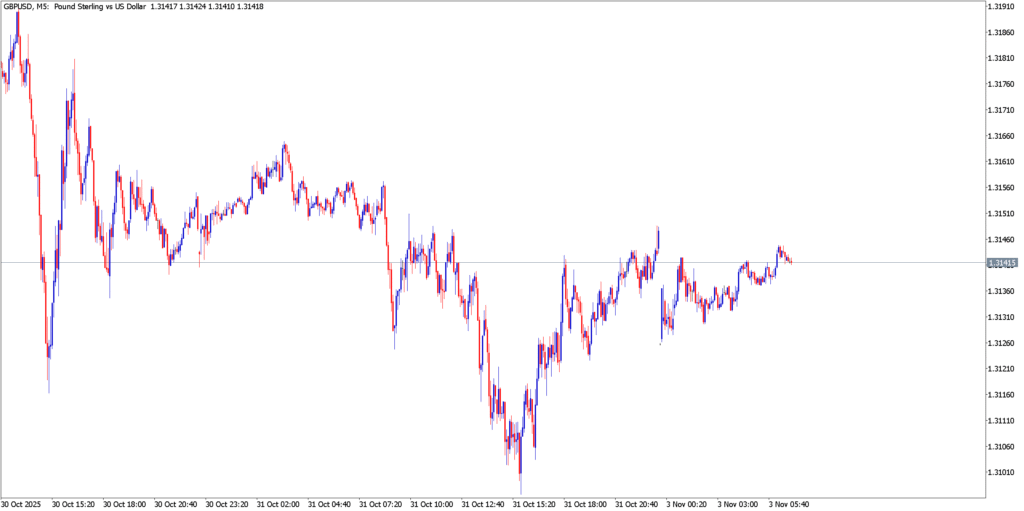

GBP/USD remained under pressure, trading around the mid-1.3100s. Technically, the pair has broken key support and looks set to extend its downtrend. An overnight close below the 1.3300 round number (Friday’s high) was cited as a bearish trigger. On the daily chart, oscillators (e.g. RSI) sit deep in negative territory, confirming the bearish outlook. Attempts to rally are stalling under strong resistance: the 1.3245–1.3250 zone has repeatedly capped advances, and a move above 1.3300 would be required to challenge that bias. On the downside, the next technical target is the August low around 1.3140. If that gives way, pair may test the 1.30 area. In the shorter run, the candlestick action showed short-lived bounces that were quickly sold into, underscoring the dominance of the bearish trendline.

Fundamental Analysis

Fundamental factors continued to favor the dollar and kept GBP/USD soft. Fed-related news dominated: U.S. rate cut expectations were scaled back after Fed officials (including Powell) signaled caution, keeping the dollar firm. As a result, sterling extended Friday’s losses – by Monday it was trading just above $1.31 – its weakest since mid-October. On the UK side, negative news piled up. Reports that the Office for Budget Responsibility will revise down productivity forecasts (widening the fiscal gap by ~£20bn) have stoked concerns ahead of the November budget. Softer inflation readings also weighed: recent data showed food and shop prices falling, reinforcing expectations that the BoE may be forced toward rate cuts. In combination, these UK-specific headwinds (fiscal strain and easing inflation) – together with renewed dollar strength – left pound bulls with little support on Monday.

Market Outlook

By day’s end, one theme stands clear: “Dollar dominance until further notice.” With the Fed still on hold but U.S. economic signals holding up better than expected, the greenback remains the go‑to safe‑haven. For the euro and pound, that spells pressure – unless surprise hawkish commentary or upside data emerges in the next 24 hours. The Aussie remains hostage to commodity swings and risk sentiment; with oil and metals sliding, AUD/USD may test deeper support (near ~0.6500) before finding a floor.