The forex market on December 23, 2025 was marked by broad U.S. dollar weakness, fueling impressive rallies in major currencies. The dollar index slid to a 2½-month low around 97.77, putting the greenback on track for its steepest annual drop since 2017. Investors remained convinced that the Federal Reserve’s easing cycle still had room to run, even after a solid U.S. GDP reading failed to alter expectations of further rate cuts in 2026. In contrast, other central banks appeared largely done with loosening policy – with the ECB and BoE holding a cautious stance and even considering future hikes – which helped propel the euro and pound to fresh multi-month highs. Meanwhile, the Japanese yen drew intense focus: after sliding to 11-month lows against the dollar, it got a brief reprieve from aggressive verbal intervention by Tokyo, though traders stayed wary of actual intervention amid the yen’s weakness. All this unfolded in the final days before Christmas, with many market participants already away – thin liquidity conditions that potentially magnified volatility.

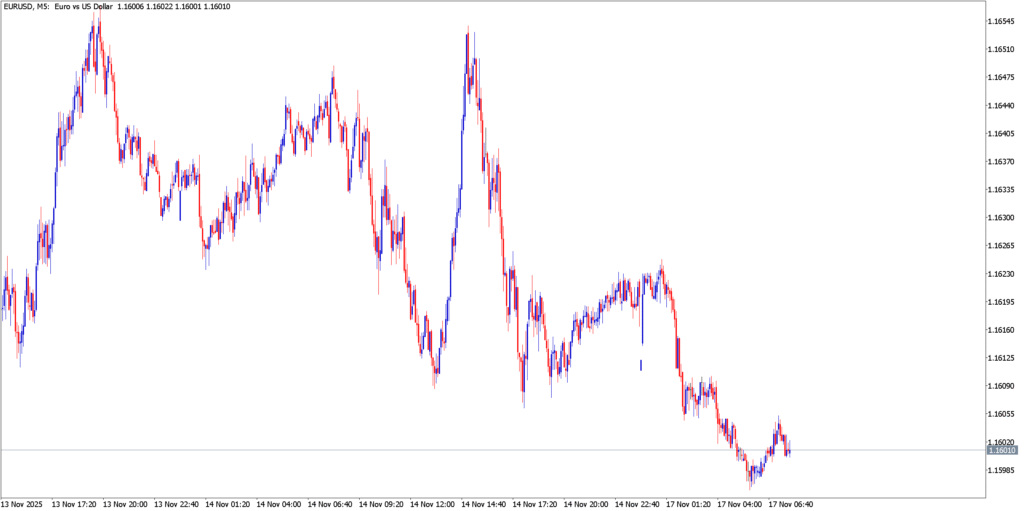

EUR/USD

Fundamental Analysis

The euro–dollar pair surged higher, with EUR/USD climbing toward the mid-1.17s, primarily driven by a broadly softer U.S. dollar. On the U.S. side, recent data signaled easing inflation pressures and mixed labor indicators, reinforcing bets that the Federal Reserve can shift to a more dovish stance. Last week’s cooler inflation print and uneven jobs data dented the dollar, and upcoming releases – like the next day’s Q3 GDP revision – were seen as unlikely to change the narrative in light of data disruptions from a prior government shutdown. In fact, an upbeat third-quarter GDP number on Dec 23 did little to sway investors from pricing in roughly two more Fed rate cuts in 2026. This backdrop of Fed easing expectations kept the dollar on the defensive, boosting EUR/USD.

Meanwhile in Europe, the European Central Bank (ECB) had recently delivered a cautiously optimistic message. At its mid-December meeting, the ECB held rates steady and raised its growth and inflation forecasts for the coming years. These upgraded projections – including inflation hovering near 2% through 2027 and growth proving stronger than expected – signaled that no further rate cuts are likely in the near term. In fact, some investors even began pricing in a slim chance of a rate hike by late 2026, given the ECB’s “higher for longer” guidance. This hawkish tilt in the euro zone’s outlook, combined with the Fed’s easing bias, provided fundamental support for the euro. The ECB’s stance effectively “closed the door to further easing” while the Fed was seen with “room to cut rates further next year,” a stark policy divergence bullish for EUR/USD. Additionally, Europe’s resilience amid global trade headwinds and an absence of new geopolitical shocks have helped the euro recover from its mid-year lows. In summary, a confluence of factors – dovish U.S. monetary outlook vs. steady-to-hawkish ECB signals – drove EUR/USD’s strength on Dec 23, with the pair enjoying its highest levels in three months.

Technical Analysis

From a technical perspective, EUR/USD’s bias was firmly bullish heading into the year-end. The pair was trading above all major moving averages on the daily chart, reflecting a well-established uptrend. Momentum indicators confirmed the strength: the 14-day Relative Strength Index (RSI) hovered in the high 60s (around 67.5) – elevated but still below overbought thresholds, suggesting room for further upside before buyers might tire. Price action on Dec 22–23 showed a decisive bullish reversal off support. Notably, EUR/USD had rebounded strongly from the ~$1.1710 support level, posting a bullish daily candlestick that engulfed the prior four days’ range. This pattern signaled a robust shift in short-term momentum upward. The rally extended on Dec 23, with the pair approaching an initial resistance around 1.1800–1.1820 – a zone corresponding to intraday highs and a technical barrier cited by analysts. A clear breakout above 1.1820 could pave the way for an extension toward the next resistance near 1.1870, which marks the top of a medium-term range.

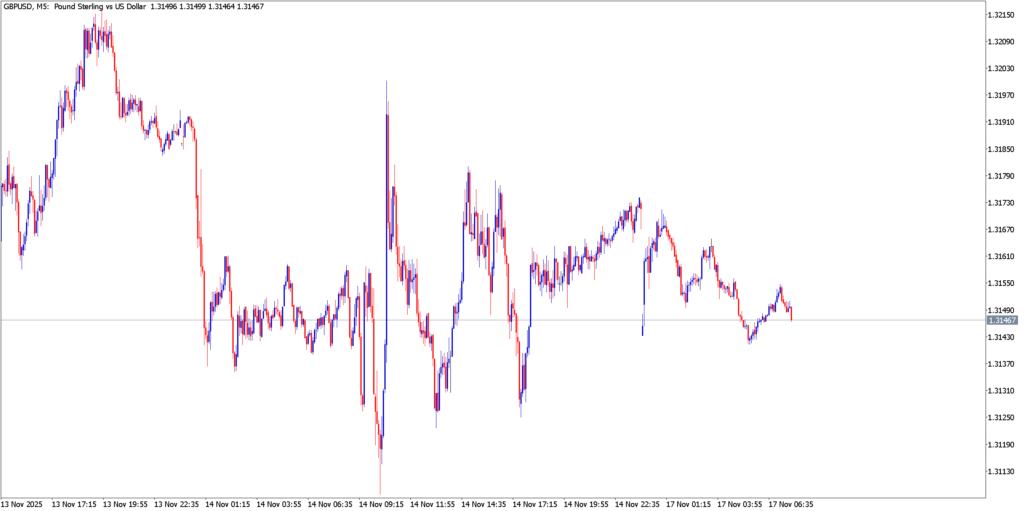

GBP/USD

Fundamental Analysis

GBP/USD was another major beneficiary of the dollar’s swoon, with the British pound climbing to 3-month highs against the greenback. On Dec 23, GBP/USD rallied through the 1.3450 level, underpinned by a combination of UK fundamentals and U.S. dollar weakness. In the UK, recent economic data and central bank signals have turned mildly supportive for the pound. The third estimate of UK Q3 GDP, released earlier in the week, showed modest growth of +0.1%, indicating the British economy is still expanding (if sluggishly). More importantly, UK inflation has been cooling – dipping to 3.2% as of the latest reading – which, while above the Bank of England’s 2% target, represents a dramatic comedown from the sky-high inflation of the prior year. Easing price pressure gives the Bank of England (BoE) room to start trimming interest rates, and indeed the BoE cut rates last week (likely a 25 bps cut) in a close decision. However, the crucial nuance is that BoE policymakers signaled a very cautious approach to further easing. In the December meeting minutes and Governor Andrew Bailey’s comments, the BoE indicated that the already gradual pace of rate cuts “might slow further,” surprising markets that had expected a more aggressive cutting cycle. Essentially, the BoE has telegraphed that it will not rush to slash rates, even as inflation falls – a stance that contrasts with the more rapid easing path anticipated from the Fed.

Technical Analysis

On the charts, GBP/USD showed a strong bullish breakout and continuation pattern. The pair’s decisive move above $1.3450 – a level that had capped it for weeks – signaled a short-term breakout, flipping that resistance into support. The technical momentum was clearly on the upside: on Dec 22, cable (GBP/USD) posted a strong bullish daily close, and the momentum carried into Dec 23 with price pushing further into new highs. At ~1.3470–1.3500, the pair was trading well above its short-term moving averages. In fact, analysis from Sucden Financial noted that GBP/USD was above even its shorter-term MAs (with one key support identified around 1.3360 corresponding to a 20-day or 50-day MA) and that its RSI had just hit ~70, near overbought territory. An RSI around 70 suggests the rally is strong but may be entering a zone where pullbacks can occur. Nonetheless, as long as price holds above support, overbought readings can simply indicate an uptrend in force.

Immediate focus is on whether the pair can sustain above 1.3450. That area, which was a breakout zone, now forms the first support on any dips. Thus far, bulls have defended it, keeping the bias upward. Should the uptrend continue unabated, the next upside target comes in around 1.3600 – a nice round number and a level highlighted by technical analysts as an upside objective. There is minor interim resistance on the way, such as the recent peak near 1.3533 (achieved early on Dec 24), but beyond that, not much significant resistance is seen until the mid-1.36s. Notably, some analysts see the potential for the pound to eventually gravitate toward 1.38, which are the highs of the year 2025, if the uptrend persists in early 2026.

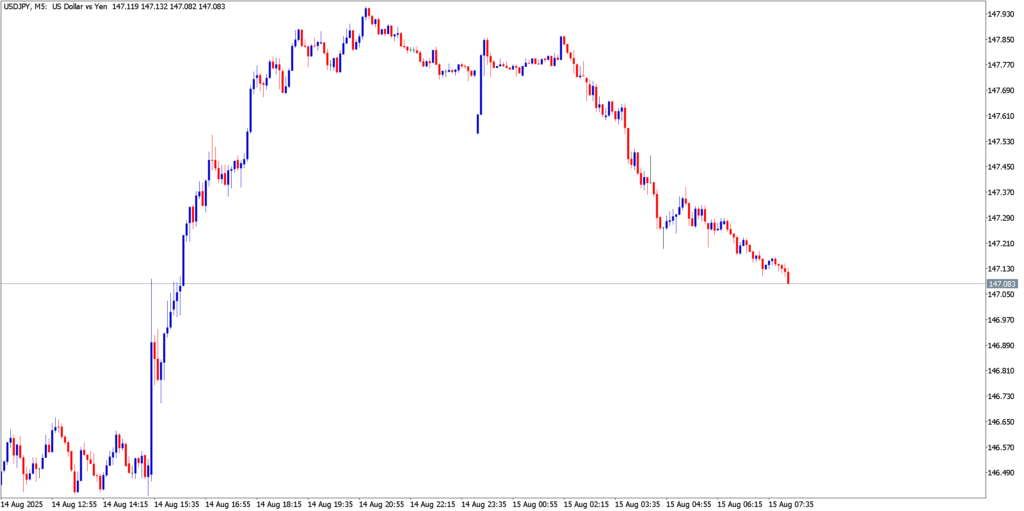

USD/JPY

Fundamental Analysis

The U.S. dollar/Japanese yen pair (USD/JPY) traded at historically high levels for the yen, holding near ¥156–157 on Dec 23 despite some yen recovery in the past two sessions. This currency pair’s trend in late 2025 has been defined by a tug-of-war between Japan’s efforts to tighten monetary policy and the market’s skepticism due to Japan’s fiscal and intervention concerns. In a landmark move, the Bank of Japan (BoJ) raised interest rates on Dec 19 by 25 bps, taking the policy rate to 0.75% – the highest in 30 years (since 1995). One might expect a rate hike to strengthen the yen, but the immediate reaction was the opposite: the yen weakened and USD/JPY spiked above ¥157. The reason was Governor Kazuo Ueda’s dovish tone – in his press conference, Ueda offered few hints of accelerating tightening and emphasized a slow, data-dependent approach to any further hikes. This disappointed some market participants who had hoped the BoJ might turn more aggressive on inflation. As a result, traders concluded the BoJ will “take time raising rates,” which actually undercut the yen, since U.S.–Japan rate differentials could still favor the dollar for a while. Indeed, the dollar jumped to a one-month high above ¥157 right after the BoJ meeting.

Compounding the yen’s difficulties is Japan’s fiscal situation. Prime Minister Sanae Takaichi’s government has embarked on an expansionary fiscal program – including a massive ¥21.3 trillion spending package – at a time when government debt is already about 263% of GDP, an eye-watering level. Investors fear that this fiscal profligacy will worsen Japan’s debt sustainability and ultimately limit the BoJ’s ability to normalize policy. In fact, former BoJ officials have noted that yen weakness persisted even as the Fed-BoJ interest rate gap narrowed, because traders demand a premium for Japan’s fiscal risk. This is evident in the bond market: Japanese 10-year government bond yields have surged above 2.0%, a multi-decade high, not purely due to economic optimism but due to investors’ concerns about inflation and debt. In essence, the market is viewing the yen as fundamentally weak because monetary tightening is being offset by fiscal expansion and associated risks.

However, the yen’s rapid slide has raised the specter of direct intervention. Japanese authorities, wary of a too-weak yen, have been increasingly vocal. On Dec 22–23, Finance Minister Satsuki Katayama issued the strongest warning yet, stating that recent yen declines “absolutely do not reflect fundamentals” and vowing that the government has a “free hand” to deal with excessive moves. She explicitly referenced an agreement with the U.S. that allows Japan to step into markets if moves are disorderly. These comments – effectively jawboning the market – had an immediate (if modest) effect: the yen bounced from roughly ¥157.7 per dollar to about ¥155.8 on Dec 23 as traders pared back short positions in case Tokyo might intervene. Officials also hinted that if the dollar were to climb past the post-BoJ high (around ¥158) and toward ¥160, intervention would become highly likely. Notably, Japan last intervened in the FX market in July 2024 (buying yen) when USD/JPY hit ~162, so markets are keenly aware that somewhere in the upper-150s lies a red line. In summary, USD/JPY’s fundamentals are a mix of opposing forces: the U.S. dollar is somewhat softer globally (which ordinarily would help pull USD/JPY down), but Japan’s own factors – a still-dovish BoJ relative to inflation, huge fiscal spending, and the threat of intervention – are creating volatility. As of Dec 23, the pair remained elevated, reflecting the market’s broader skepticism about the yen despite the BoJ’s tightening. Yet the constant intervention warnings have introduced a two-way risk: traders are reluctant to push USD/JPY much higher in fear of a sudden government action, keeping the pair in a bit of a holding pattern just below recent highs.

Technical Analysis

USD/JPY’s technical picture shows a currency pair that is pausing after a strong uptrend, but still biased to the upside overall. Prior to this week, the pair had been in a steady uptrend, reaching a peak around ¥157.78 (an 11-month high) on Dec 19. The subsequent pullback brought it down into the mid-155s, but this move appears to be largely corrective in nature. On the daily chart, USD/JPY is still trading above key moving averages – the 50-day MA lies well below in the low-150s and the 200-day around mid-140s, underscoring how far the yen had depreciated. Shorter-term, the pair has been consolidating between roughly 154 and 157, digesting the BoJ and MOF developments. Support can be identified around the ¥155.00 level (a round number and recent reaction low), with stronger support at ¥153.00 and ¥151.00 below that. Importantly, traders have cited the area near ¥154.40 as a pivot – that was the low from early December before the last leg of the rally, and a level that bullish traders are using for stop-loss placement. If USD/JPY were to break decisively below ~154.4, it would constitute a violation of the recent higher-low pattern, potentially signaling a trend shift to bearish in the short term. So far, that hasn’t happened: dips into the mid-155s have been bought, and the pair was last seen rebounding off ¥155.83.

On the upside, resistance is clearly the recent high zone around ¥157.7–158.0. The market has treated the upper-157s as a line it is tentative to cross, likely due to the looming intervention risk. If a catalyst (e.g. a surge in U.S. yields or a surprise BoJ dovish remark) did propel USD/JPY above 158 convincingly, one could see momentum carry it to the ¥160.00 level next – a psychologically important figure, and near the highs last seen in 2022. Technical indicators show mixed signals in the very near term: the daily RSI has cooled from overbought levels (back toward the mid-50s), reflecting the recent consolidation. The MACD on daily timeframe has been narrowing, hinting that bullish momentum has slowed, but it has not produced a clear bearish crossover yet. In essence, the uptrend’s momentum has paused, but not definitively reversed. The overall structure remains bullish unless we get a break below the aforementioned supports. Traders holding long USD/JPY positions are likely maintaining them with stops below ¥154.40 to protect profits, given that level would mark a break in trend. In terms of trading strategy, many are in “wait-and-see” mode: range-bound trading could persist into the New Year, with roughly 155 as support and 158 as resistance, unless an intervention or policy surprise jolts the pair out of this range. Should the Ministry of Finance step in (or convincingly threaten to), USD/JPY could quickly drop by several yen; thus, managing risk is paramount for anyone long the pair at these heights. Conversely, absent any intervention, the fundamental bias (higher U.S. yields vs. Japan, etc.) favors USD/JPY bulls, so the path of least resistance is still upwards – albeit a path capped by the clear “intervention ceiling” in the high-150s. All told, the technicals for USD/JPY show an uptrend that is intact but stretched, with traders treading carefully near the top of the range for now.

Market Outlook

As we head into the final week of 2025, forex traders are navigating a landscape where U.S. dollar weakness is the dominant theme, and central bank divergences are set to shape early 2026. The dollar’s nearly 10% drop this year – its worst annual performance in 8 years – reflects a significant shift in expectations around U.S. monetary policy. With the Fed widely anticipated to continue cutting rates in 2026 (and even facing questions about its independence amid political influencer), the dollar’s downside bias may persist into the new year. This bodes well for currencies like the euro and pound, which ended 2025 on a strong note. EUR/USD and GBP/USD are entering 2026 with bullish momentum, each up over 8–14% for the year. The euro, in particular, had its best year since 2003, thanks in part to the ECB’s stance that no more easing is needed – a stark contrast to the Fed. The pound too has benefited from the BoE’s cautious approach to rate cuts, and if the BoE holds off on aggressive easing, sterling could remain supported relative to the dollar. However, both EUR and GBP traders will be watchful for any growth slowdowns or geopolitical risks in Europe that could temper their rallies. Key upcoming events include the January PMI readings and inflation prints; any sign that the Eurozone or UK economies are faltering could revive talk of rate cuts and weigh on those currencies. Barring that, the macro bias into early 2026 favors euro and pound strength against the U.S. dollar.

The Japanese yen, on the other hand, presents a more nuanced outlook. Structurally, the yen is undervalued and Japan’s inflation is finally above target – factors that normally argue for a stronger JPY over time. The BoJ’s step toward policy normalization supports this view. Yet, as 2025 showed, yen exchange rates are highly sensitive to yield differentials and now to fiscal concerns. If U.S. yields drift lower with Fed cuts while Japanese yields remain capped around 2%, the narrowing spread could gradually ease upward pressure on USD/JPY. Indeed, we might have seen the peak in USD/JPY for this cycle if the Fed continues to ease. However, any relief for the yen may unfold slowly and could be offset if investors remain fixated on Japan’s debt trajectory. In the near term, intervention risk will be a key theme – the Japanese authorities have made it clear that they won’t tolerate another rapid yen selloff. This means USD/JPY’s upside into year-end and early January is likely limited to the high-150s. Traders should be prepared for possibly volatile moves in thin holiday liquidity, as low volumes can exaggerate price swings. The period between Christmas and New Year’s can see sudden jumps if any news hits an illiquid market.

In conclusion, forex traders closing out 2025 face a mix of continued trends and potential turning points. The dollar’s downturn has been the story of the year, and as of Dec 23, that story remains intact – a dollar “on the back foot” with more downside possible if the Fed delivers on easing bets. The euro and pound are riding that wave, bolstered by their central banks’ comparatively steadier hands and improved economic outlooks. The yen, while fundamentally poised to strengthen with BoJ tightening, is weighed by unique factors, making it a wildcard entering 2026. Going into the new year, traders should watch for any policy communication from central banks (e.g. the Fed’s January minutes or ECB speakers) that could recalibrate rate expectations. Additionally, early January’s U.S. nonfarm payrolls report will be a crucial data point – a significantly weak or strong jobs number could either reinforce the dollar bearish narrative or spark a short-term reversal if it surprises markets.