Forex markets kick off October amid swirling risks. A looming U.S. government shutdown on Oct 1 and mixed global data have traders on edge. The U.S. dollar is under pressure after disappointing ADP jobs (52K vs 54K expected), while the Fed’s outlook remains murky. At the same time, Sterling and the Euro face their own headwinds from weak PMI surveys. Overall, expect choppy trading as GBP, EUR and AUD react to local releases (UK PMI, Euro inflation) and ongoing U.S. data.

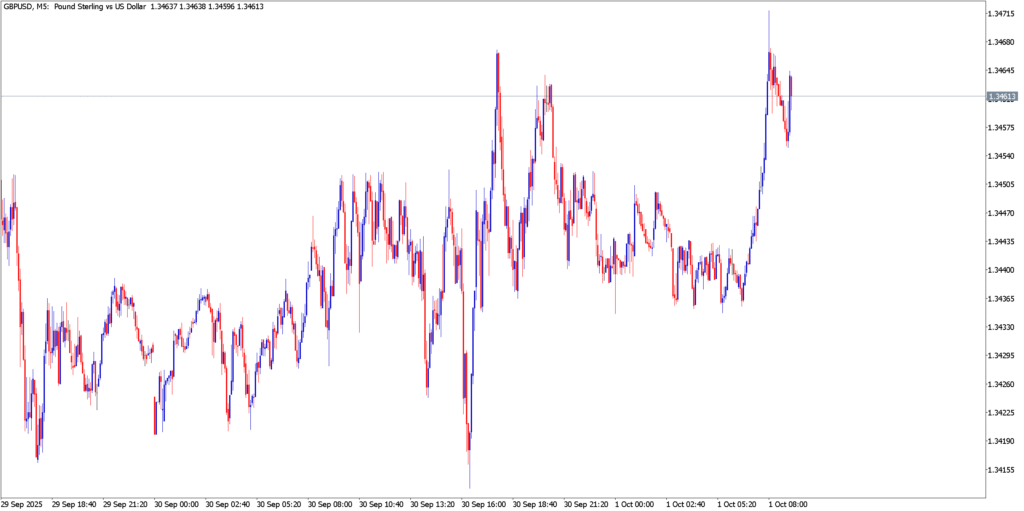

GBP/USD

Fundamental

UK data have disappointed recently. The S&P Global UK Manufacturing PMI fell to a weak 46.2 in September (contraction), reflecting softness in factories (even Jaguar Land Rover shutdown weighed on orders). This reinforces BoE caution despite 4% official rates. In the U.S., private payrolls (ADP) showed only 52K jobs added for Sep (below forecasts), while ISM/PMI data were mixed. Together, tepid jobs data and Fed “wait-and-see” rhetoric have dented the dollar. Still, any outperformance in forthcoming U.S. nonfarm jobs could quickly swing USD strength back.

Technical

On the chart, GBP/USD has broken below its ascending channel and sits just above 1.3300. It opened ~1.3445 and closed 1.3441 on Oct 1, slipping under recent support. Key levels: immediate support is near 1.333 (the pivot/100h-MA) and then the 1.3200 area. Resistance lies around 1.347–1.350 (recent swing highs and channel floor). RSI is rebounding from sub-40 (oversold) levels, hinting at a possible bounce, but the bias remains bearish below the broken trendline.

- Support ≈ 1.3330 (recent low)

- Resistance ≈ 1.3500 (recent high)

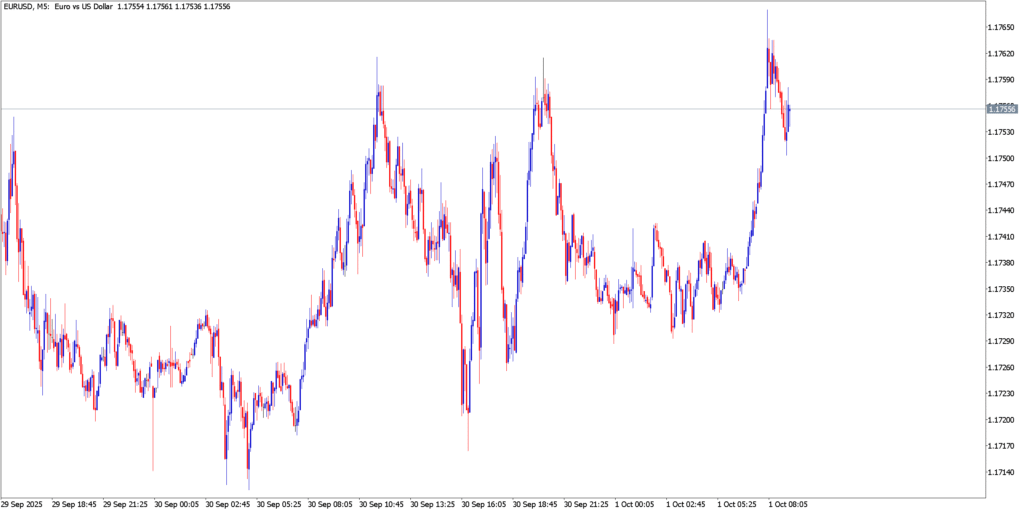

EUR/USD

Fundamental

Eurozone indicators are mixed. Headline inflation is roughly at the ECB’s 2% target (flash CPI around 2.2–2.3% expected) and retail sales remain modest. On the U.S. side, the weak ADP and U.S. ISM data have eased some upside in the dollar, but broader Fed caution limits EUR gains. With both economies relatively steady, macro drivers are thin; traders are focused on technical breakouts and Fed clues.

Technical

EUR/USD is consolidating near 1.173. It opened 1.1734 on Oct 1 and closed 1.1737, just above last week’s lows. Analysts note a possible head-and-shoulders reversal forming here. The pair is testing resistance ~1.1735–1.1740; a turn down from that zone would confirm further decline toward 1.1695 and the swing lows. Above 1.1795, that bearish scenario is invalidated (target then ~1.1985). In sum, EUR/USD is range-bound around 1.17 with bearish bias.

- Support ≈ 1.1695 (recent low)

- Resistance ≈ 1.1735–1.1795 (short-term caps)

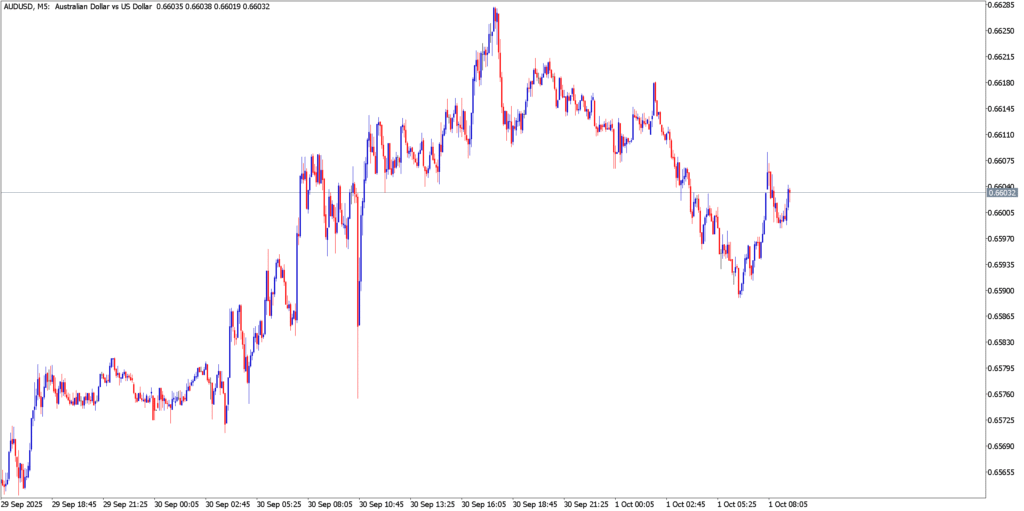

AUD/USD

Fundamental

The Aussie dollar got a boost from the RBA’s Sep 30 meeting. As expected, the RBA held rates at 3.60%, signaling inflation concerns. The Australian dollar climbed to a one-week high (~0.6615) after the decision, aided by dovish Fed bets and higher commodity prices. Locally, private sector credit was steady and PMI surveys mixed, so U.S. labor data (jobs on Fri) and China data (PMI) will be key next. Overall, AUD is buoyant on rate-divergence play and should remain supported unless USD surges.

Technical

AUD/USD has formed a bullish “megaphone” pattern on the 12h chart. The pair rebounded from ~0.6520 (late Sept low) up to ~0.6615 on Oct 1, clearing its 50-hour MA. RSI has moved above 50, reinforcing upside momentum. As a result, the pair looks set to test resistance around 0.6700–0.6710 in the near term.

- Support ≈ 0.6520 (recent pivot)

- Resistance ≈ 0.6700–0.6710 (weekly highs)

Market Outlook

Today’s tone is cautiously bearish for the USD, benefitting GBP, EUR and AUD overall. GBP/USD may drift lower unless UK data surprises, eyeing the 1.3330 support level. EUR/USD remains stuck in its 1.1700s range – a break of 1.1695 could kick off a sharper decline. AUD/USD is the most constructive, with momentum building toward 0.6700 if U.S. data stay weak. In all cases, traders will watch U.S. payrolls and Fed comments for cues. In summary, expect subdued, data-driven moves: the Dollar is vulnerable and all three pairs could edge higher if U.S. labor slackens, but upside caps around their noted resistance zones suggest gains may be limited.